Abstract Aerial Art/DigitalVision via Getty Images

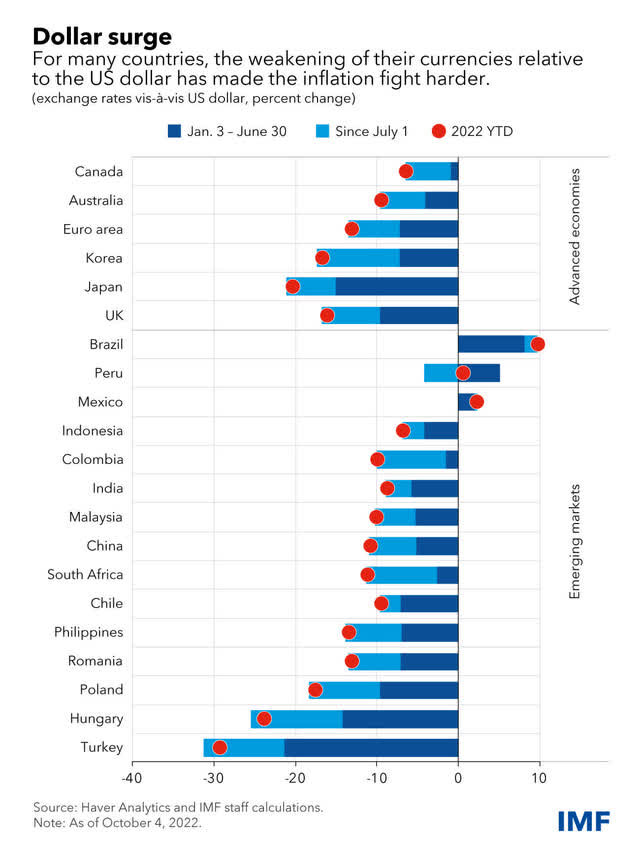

The U.S dollar has seen impressive gains versus other major currencies year-to-date, most notably against the JPY (+27%) and the GBP (17%). Driven mainly by the Federal Reserve’s aggressive monetary tightening and a widening yield gap between the U.S and other developed nations, dollar strength has played an important role in alleviating inflationary pressures from imported goods and services.

Given our core view that inflation has peaked and that Fed tightening will end in Q1 2023, we see scope for dollar weakness as future rate hikes have mostly been priced into current bond yields. We initiate our coverage of Invesco DB US Dollar Index Bearish Fund (NYSEARCA:UDN) with a neutral “Hold” rating for now, with the view to upgrade our rating by the end of the year.

We See Value In Enhancing Returns Through UDN

For investment portfolios that are mostly concentrated in dollar-denominated assets, investors tend to view fluctuations in exchange rates as more of a distraction than a potential source of returns. However, we note that a depreciation in the dollar against other major currencies will nonetheless undermine the purchasing power of investors.

More importantly, we see value in enhancing portfolio performance by hedging against the scenario of a US dollar peak. Especially given how far ahead the dollar has appreciated against major currencies, we think the potential returns (or protection) far outweigh the risk and cost associated with establishing a hedge.

There are few reliable options available to investors looking to hedge against dollar depreciation. Understandably, investors may be discouraged by the high cost and sophistication that comes with currency derivatives. For these reasons, the Invesco DB US Dollar Index Bearish Fund (UDN) seems an ideal choice for hedging against a U.S dollar peak.

Invesco DB US Dollar Index Bearish Fund

According to fund information provided by Invesco, UDN seeks to track changes in the level of the Deutsche Bank Short USD Currency Portfolio Index Excess Return, plus the interest income from the Fund’s holdings of primarily US Treasury securities and money market income less the Fund’s expenses.

UDN provides an effective way for investors to track the value of the U.S. dollar relative to and inversely to a basket of six major currencies – the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc. The rules-based index essentially holds short positions on U.S Dollar Index futures contracts traded on the ICE futures exchange.

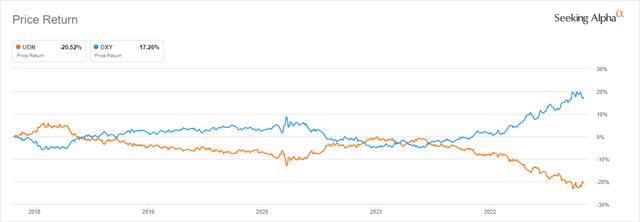

Below is a chart comparing the performance of UDN against the U.S Dollar Index (DXY) for the past 5 years. UDN generates returns or losses that are inverse to the performance of the DXY. There is usually some minor deviation in the form of excess returns, and this is largely attributed to returns generated from interest income from the fund’s holdings of US Treasury securities and money market funds. As futures are leveraged margin instruments, the fund is only required to put up margins that are a fraction of the nominal size of the futures contracts. Thus, the fund’s remaining cash balances are then invested in short-term US treasuries and money market funds to earn interest.

Relatively High Expense Ratio

We also prefer UDN’s indexed strategy, which we view as a more reliable and direct way to establish a hedge on the DXY, versus having to worry about the performance and cost of a more actively managed strategy. Nonetheless, given that UDN’s indexed strategy still requires some degree of management with its futures positions and excess cash, UDN’s expense ratio is somewhat costly at 0.77%.

Usually, a high expense ratio for an indexed ETF would be a major deterrence for us when considering an investment. However, for investors who are uncomfortable taking direct positions in currency derivatives, UDN would be the optimal choice for executing our tactical view of shorting peak U.S dollar.

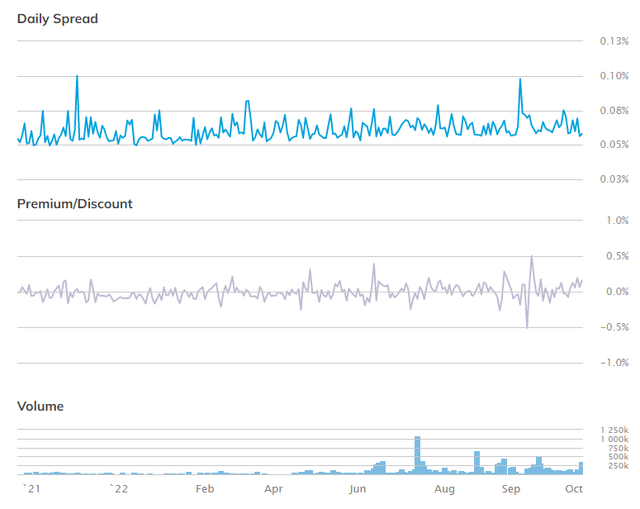

Trading metrics for UDN are also healthy with low and stable spreads, healthy volumes, and the fund trading close to NAV.

In Conclusion

We see value in enhancing portfolio performance by hedging against the scenario of a US dollar peak. UDN allows investors to conveniently and effectively hedge against risks of U.S dollar weakness against major currencies.

Especially given how far ahead the dollar has appreciated against major currencies, we think the potential returns (or protection) far outweigh the risk and cost associated with establishing a hedge.

We initiate coverage of UDN with a neutral “Hold” rating for now, with the view to upgrade our rating by the end of the year.

Be the first to comment