JazzIRT

The pandemic highlighted our need and reliance on expert healthcare. Thus it’s no surprise that in 2020, US national health spending was worth a staggering $4.1 trillion in 2020 or $12,530 per person. This industry is expected to grow at a 5.4% CAGR (compounded annual growth rate) and reach $6.2 trillion by 2028.

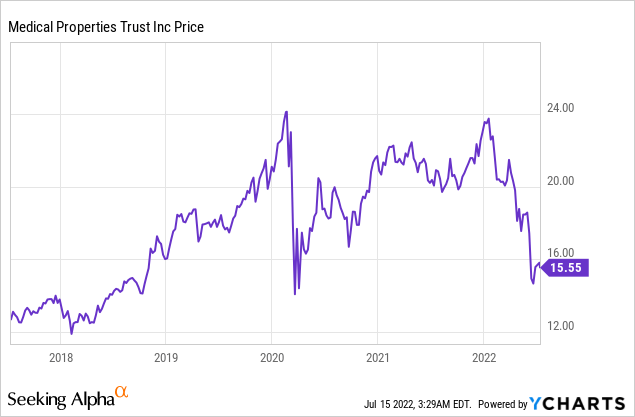

At the Berkshire Hathaway Meeting in 2022, Warren Buffett spoke widely about investing into solid assets which “produce something” and used the analogy of owning “1% of all the apartments in the US”. In this case, why not own a percentage of all the Hospitals and Healthcare facilities in the US and globally? That is something you can do with Medical Properties Trust (NYSE:MPW). A diversified and growing REIT with a prescriptive 7.46% Dividend Yield. The stock price has plummeted by ~33% since January 2022 on market volatility and now trades at an undervalued valuation, similar to the pandemic levels of 2020. So put your scrubs on and let’s dive into the Business model, Financials and Valuation for the juicy details.

Healthy Business Model

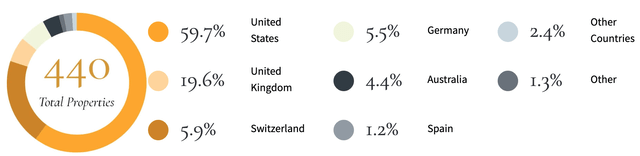

Medical Properties Trust is a real estate investment trust which has a $22.2 billion portfolio of 440 medical facilities globally.

Medical Properties (Investor Presentation 2022)

The REIT’s portfolio is widely diversified across 10 countries, with the lion’s share (59.7%) coming from the United States, one of the most valuable healthcare systems in the world. The second highest share of properties comes from the United Kingdom (19.6%), which is also an extremely valuable healthcare market thanks to the National Health Service (NHS).

Medical Properties (Investor Presentation 2022)

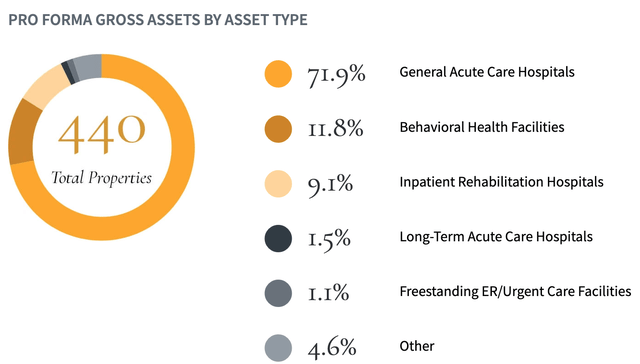

71.9% of its properties are General Acute Care Hospitals. However, MPW is increasing its diversification across Behavioral Health Facilities (11.8%). Behavioral Health is another word for Mental health, which is a growing industry. It’s not that people are getting “crazier” (hopefully); it’s that less stigma is being attached to mental health disorders and it’s now widely discussed openly on social media and by celebrities. Thus, the global mental health market was valued at $383.31 billion in 2020, and is forecasted to reach over half a trillion dollars by 2030, growing at a steady CAGR of 3.5% over the period.

Medical Properties (Investor Presentation 2022)

A prime example of the company’s expansion into mental health facilities was with the $800 million acquisition of the 35 facility Priory portfolio. The Priory has the largest market share (26%) of behavioral facilities in the UK, versus a 17% share for the 2nd place operator.

This was an attractive investment, given the facilities get 90% of their revenue from the NHS in the UK, which is the second largest single payor system in the world. The NHS funds close to all of the mental healthcare in the UK and thus offers an extremely stable customer base.

Inflation Hedge Leases

MPW rents its properties on “Triple Net Leases”. This means the tenant rents the entire commercial building and is liable for all property expenses. This includes Property Taxes, Insurance and even maintenance expenses. These type of leases generally offer lower rates to the tenant but are much lower risk for the landlord as unexpected surprises are generally mitigated. In addition, it has a master lease agreement which allows them to recoup and re-rent the property should the operator default. MPW has a strong 99% occupancy rate with 437 properties rented out of the 440 total. The three that are vacant have a value of $9 million.

MPW also structures its leases with “Rent Escalators” which allow the rent to be raised with inflation based upon the Consumer Price index. This means the REIT has an “Inflation Hedge” built into its business model. Clauses such as these result in increasing Cash Yield.

Growing and Stable Financials

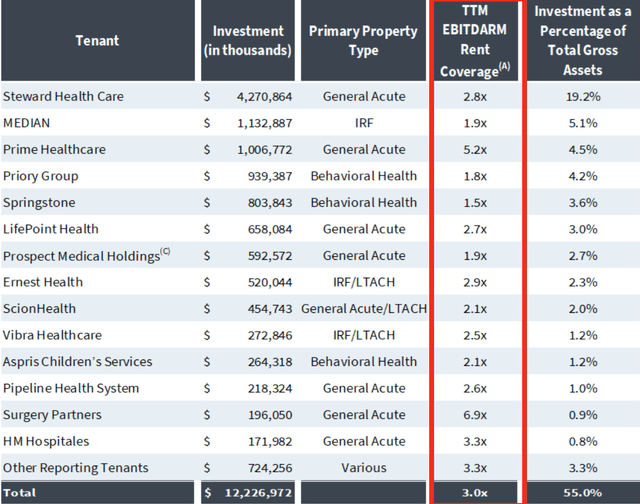

MPW’s operators/tenants include a variety of for-profit and not-for-profit organisations with the largest being Steward Health Care, which makes up 19.2% of assets. Column four (highlighted in red) on the table below shows the EBITDARM (Earnings Before Interest, Taxes, Depreciation, Amortization, Rent and Management fees) to Rent Coverage Ratio. This is a ratio which is used to help determine how well debt obligations can be serviced. A ratio greater than one indicates that the company has enough interest coverage to pay off its interest expenses; in this case, the average is close to 3 which is fantastic.

Rent Coverage Ratio (Q122 earnings)

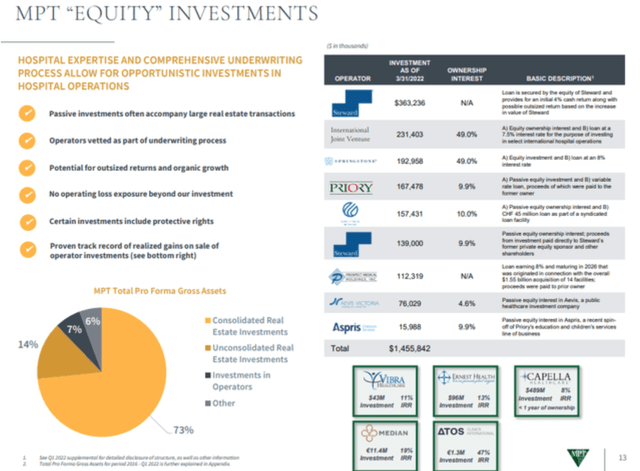

This REIT also has an equity investment portfolio which includes investments into its operators such as Steward Health Care and the Priory in the UK which helps to boost returns. The beautiful thing about this model is the underwriting process enables MPW to understand more about its operators and financial situation. Internationally, MPW has a ~50% ownership stake in eight hospitals in Italy and 45% stake in two hospitals in Spain, in addition to joint ventures with various hospitals in Switzerland. Its equity portfolio value was $1.46 billion as of the first quarter 2022.

MPT Equity Investments (Investor Relations)

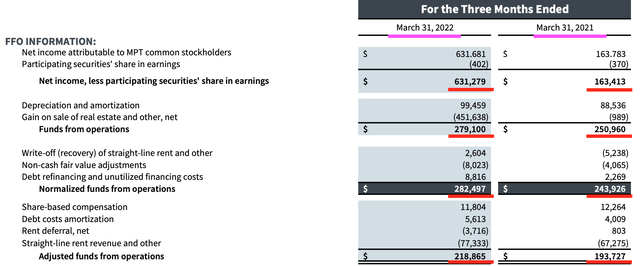

Medical Properties Trust has generated fantastic financials which have been growing year over year. Net Income was $631 million in Q122, up a blistering 281% from the $163 million achieved in same quarter last year.

Funds from Operations (Q122 report)

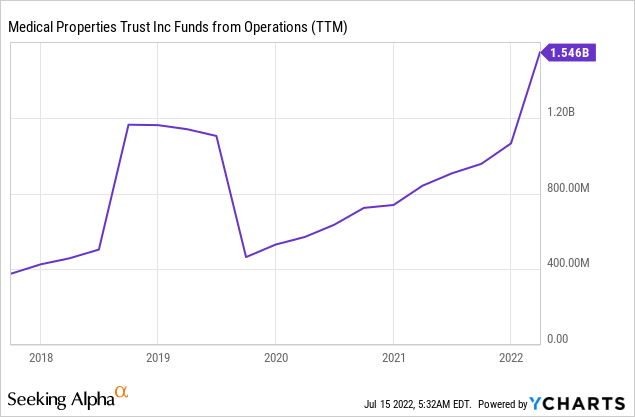

Funds From Operations (FFO), which is the main measure of REIT quality, increased from $251 million in Q121 to $279 million by Q122, up 11% year over year. If we “Normalize” the funds from operations, this jumps to 16% YoY and Adjusted FFO was up ~13% to $218.9 million.

The company’s general and administrative costs of gross assets show a reduction from 1.1% in 2013 to less than 0.8% by the end of 2021. This demonstrates economies of scale and increasing efficiency of its operation.

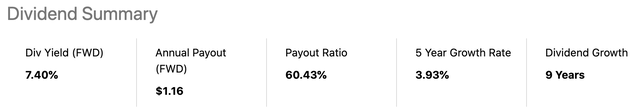

Delicious Dividend

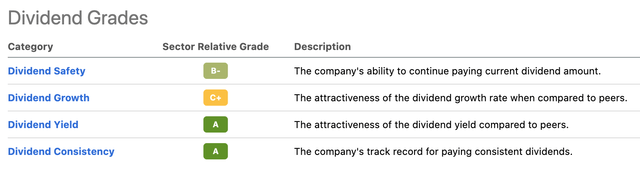

MPW pays a delicious 7.5% dividend yield with a 60% payout ratio and a 5-year growth rate of 3.93%. It has an “A” rating for its high yield and “A” for consistency.

Dividend graph (Seeking Alpha)

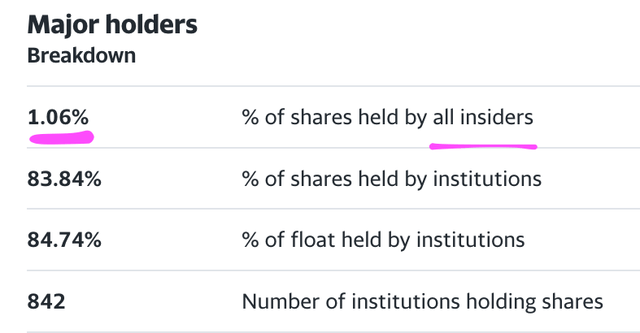

Large Insider Holding

When investing into any company I look for “Skin in the Game” from the management team. As in the words of Charlie Munger, “Show me the incentives and I will show you the outcome.” In this case, I was pleasantly surprised to see 1.06% of its shares held by insiders. This may not seem very high, but it is much higher than other REITs in the sector such as Healthpeak Properties, Inc. (PEAK), which has an insider holding of just 0.3%. In addition, Healthcare Trust of America, Inc. (HTA) has an insider holding of just 0.36%. Both these comparisons also have a similar market cap between $6 billion and $13 billion.

Medical Properties Trust (Yahoo Finance Insider Holding)

Valuation

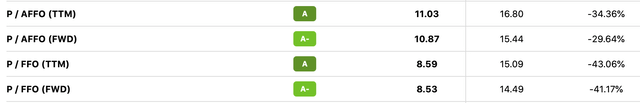

In order to value Medical Properties Trust, I will analyse its Price to Adjusted Funds from Operations (P/AFFO). In this case, MPW has a P/AFFO (forward) = 10.87, which is 29% lower than the real estate sector median of P/AFFO = 15.

Valuation Medical Properties Trust (Seeking Alpha)

The company also has a five-year average P/AFFO = 15.5 which means at the P/AFFO = 10.87 the stock trades at the time of writing, it is significantly undervalued. The Price to Funds From Operations (P/FFO) ratio also shows the stock is undervalued relative to the sector median on both forward and trailing 12-month estimates.

Risks

Not a perfect Credit Rating

Medical Properties Trust has a BB+ credit rating which is good but not investment grade. REITs tend to have high debt levels in general and low cash on hand, as they are legally required to pay out 90% of their profits. In this case, MPW has $10 billion in total debt and $248 million in cash and equivalents.

The company has been hit with a lot of controversy regarding loans issued to Steward Health Care and overpaying for properties to help pay off loans to Cerberus Capital Management. Although I don’t think this is a major issue, it’s just something to be aware of.

Final Thoughts

Medical Properties Trust is a tremendous REIT which owns a $22 billion portfolio of 440 properties globally. The company is poised to benefit from the large and increasing healthcare spending in many countries and growth/stability in mental health facilities. Its 7.5% dividend is exceptional and management’s relatively large insider holding is a bonus. The stock is also undervalued relative to historic multiples and the sector median. Thus, this looks like a great long-term investment in the future of healthcare.

Be the first to comment