Alexey_Lesik

Golden Ocean Group Limited (NASDAQ:GOGL) stock price has dropped by 38% in the past six months as bulk carrier freight rates decreased. Due to the hiked inflation, increased interest rates, supply chain disruptions, and global economic recession, the demand outlook for iron ore is not strong. However, the negative effect of low iron ore demand on the dry bulk carriers market is partially offset by the increased coal demand as a result of the energy crisis in Europe. The stock is a hold.

Financial and operational results

In its September presentation, GOGL announced that 56% of 2H 2022 vessel days are covered at highly attractive rates. For 82% of its fleet available days, GOGL announced a TCE per day of $27700 in 3Q 2022. Also, for 25% of its fleet available days, the company announced a TCE per day of $26900 in 4Q 2022. In the second quarter of 2022, the company reported a TCE rate for the total fleet of $29,431 per day. Thus, GOGL’s total fleet TCE rate in the second half of 2022 will not be as strong as in 1H 2022. In its 2Q 2022 financial result, GOGL reported total operating revenues of $317 million, compared with 2Q 2021 total operating revenues of $276 million, up 15%, driven by increased time charter revenues. As TCE rates decreased in the past few months, I expect the company’s revenues to be below $300 million in 3Q 2022. The company’s total operating expenses decreased from $181 million in 2Q 2021 to $170 million in 2Q 2022, driven by significantly lower charter higher expenses. Golden Ocean reported a 2Q 2022 net income of $164 million, or $0.81 per diluted share, compared with a 2Q 2021 net income of $105 million, or $0.52 per diluted share.

The market outlook

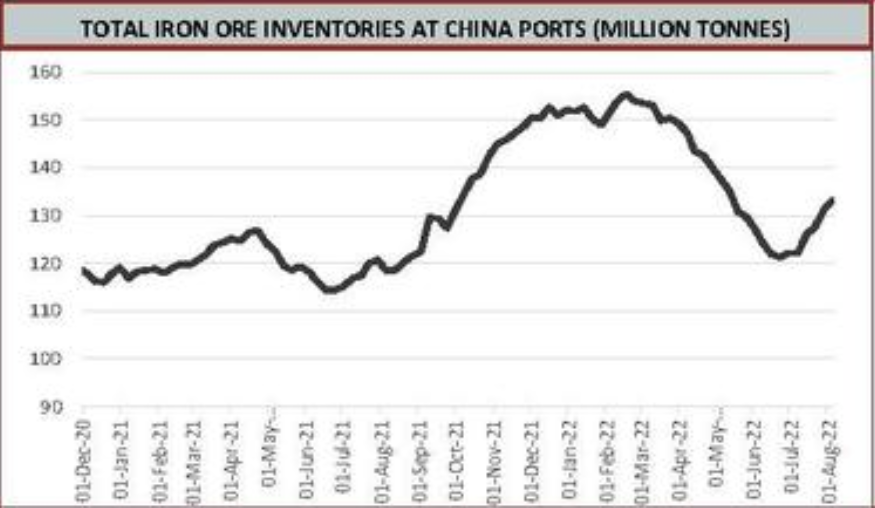

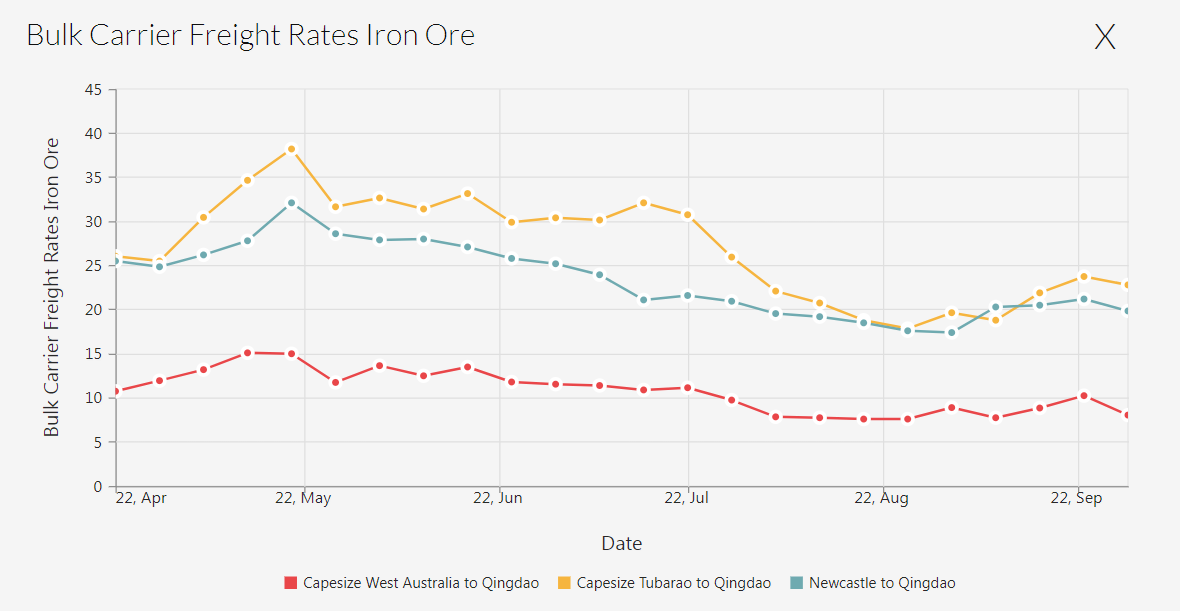

According to the MMI daily iron ore index report, published on 13 October 2022, total iron ore inventories at China ports decreased from more than 135 million tonnes to below 130 million tonnes in recent weeks (see Figure 1). Moreover, Chinese rebar and hot-rolled coil production decreased in September 2022 (see Figure 2). However, we can see that Chinese rebar consumption in September increased to more than its levels in previous months. Furthermore, increased interest rates in western countries caused their iron ore import to decrease, and with current fiscal and monetary policies to combat inflation, I do not expect the United States and European countries’ iron ore demand to increase in the following months. The result is that bulk carrier freight rates (iron ore) are now lower than in 2Q 2022 (see Figure 3).

Figure 1 – Total iron ore inventories at China ports

MMI

Figure 2 – Chinese steel consumption and production

MMI

Figure 3 – Bulk carrier freight rates for iron ore

www.ssyonline.com

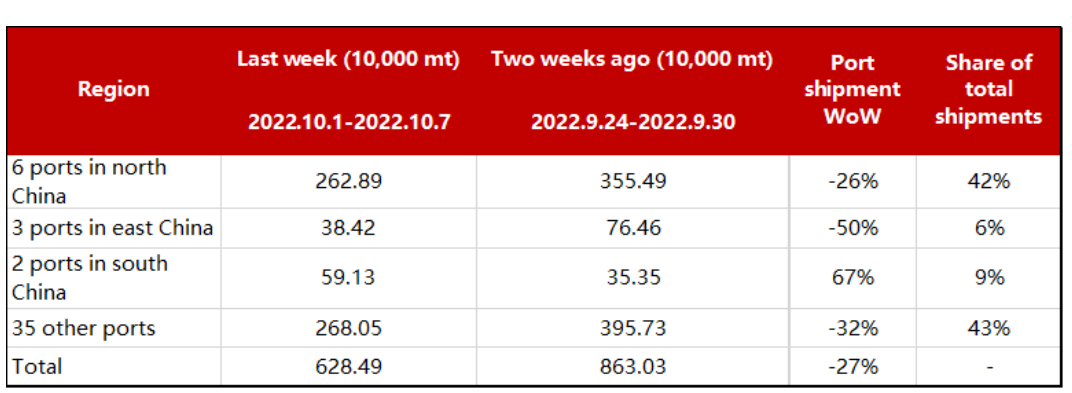

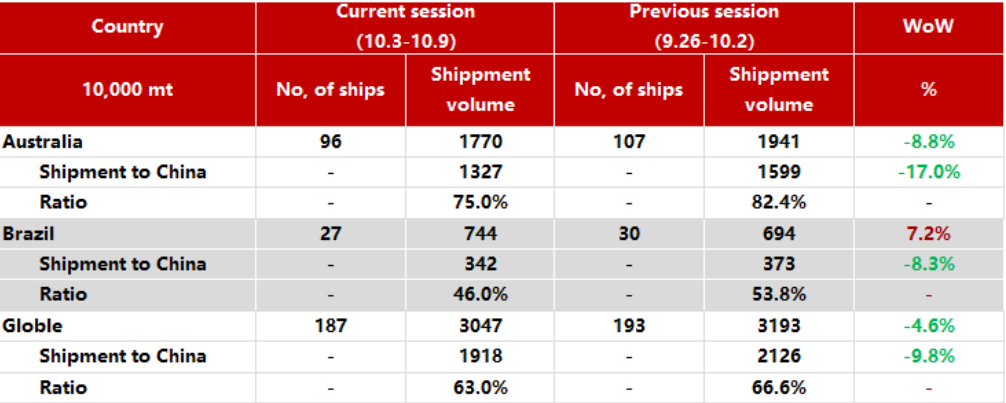

According to MMI, China’s steel port shipments by domestic trade decreased by 27% WoW to 6.28 million mt in the week ending 7 October 2022 (see Figure 4). Moreover, Chinese shipments by ports outside China decreased by 7% to 1.69 million mt in the week ending 7 October. According to Figure 5, global iron ore shipments decreased by 4.6% WoW to 30.47 million mt in the week ending 9 October 2022, driven by lower shipments from Australia to China (down 8.8% WoW).

Figure 4 – China steel port shipments under domestic trade

MMI

Figure 5 – Global iron ore shipments

MMI

However, there are positive signs for the dry bulk commodities market. On the other hand, China’s domestic stainless steel production increased by 21% MoM and 30% YoY to 2.76 million mt in September. In September 2022, the daily output of steel in China increased by 2.73% MoM to 3.87 million mt. According to Figure 6, the Baltic Dry Index increased from 965 on 31 August 2022 to 1838 on 14 October 2022. However, the current level of the Baltic Dry Index is significantly lower than in October 2021.

Also, the demand for coal remains high as natural gas prices in the European Union hiked as a result of the war in Ukraine. Figure 8 shows that coal prices skyrocketed in 2022 due to increased demand. The war in Ukraine is still going on. Due to hiked natural gas prices, the demand for coal will remain high. Recently, some European countries have announced plans to reactivate old coal power plants. Thus, the increased demand for coal will support the dry bulk shipping market.

Figure 6 – The Baltic Dry Index

tradingeconomics.com

Figure 7 – Coal price

tradingeconomics.com

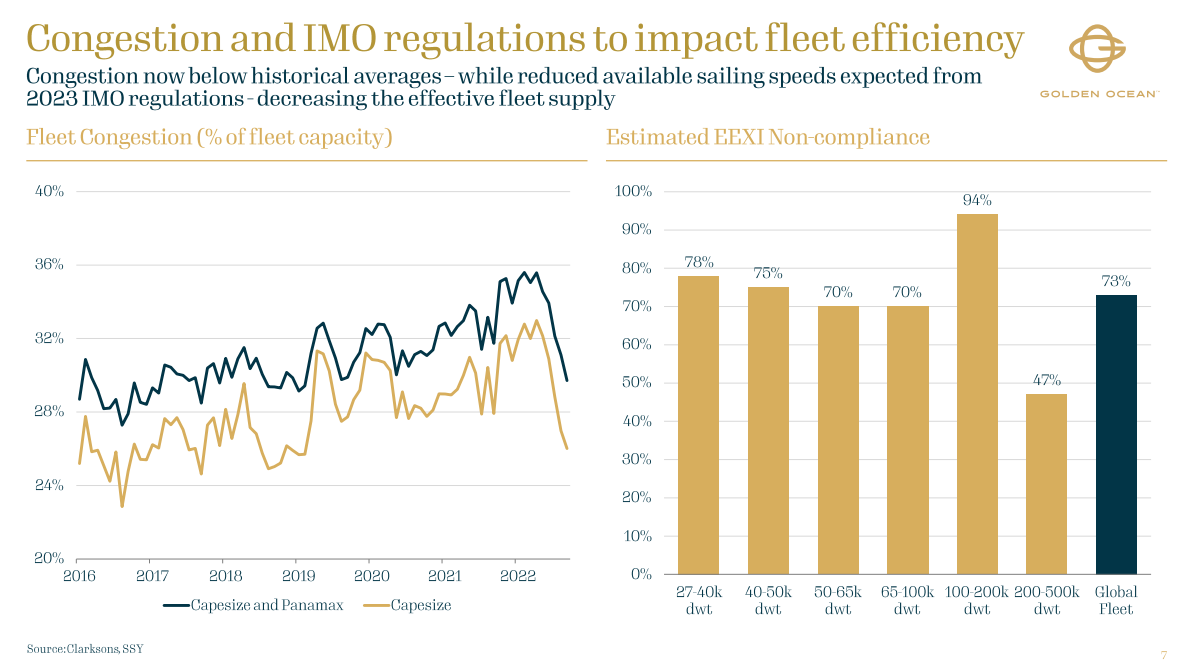

On the demand side, due to high commodity prices, high inflation, and global economic challenges, the dry bulk shipping market cannot reach its record highs soon. On the supply side, due to lower port congestion, the fry bulk shipping market in 2023 will not be promising for dry bulk shipping companies. However, the environmental regulations and the low fleet growth will support the TCE rates (see Figure 7).

Figure 8 – The effect of lower port congestion and environmental regulations on fleet efficiency

September 2022 presentation

GOGL stock performance outlook

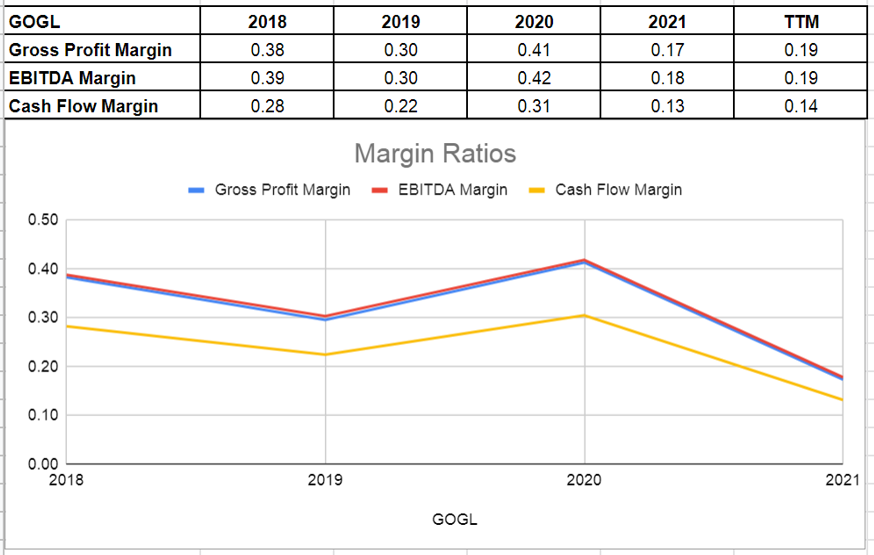

I looked at Golden Ocean’s profitability ratios in this thorough article to assess how well the company can turn a profit and use its assets to make money for its investors. I examined the profitability ratios across the board of margin and return ratios to provide insights into the financial health of the company. I calculated the ratios in comparison to previous years to be more helpful.

Generally, margin ratios evaluate the company’s ability to turn revenues into profits. It is clear that this dry bulk shipping company has had higher gross profit, EBITDA, and cash flow margins in TTM compared with the end of 2021. In detail, GOGL’s profit margin increased to 0.19 in TTM compared with its level of 0.17 in 2021. Also, after a severe decline to 0.18 in 2021 from its level of 0.42 in 2020, its EBITDA margin improved slightly to 0.19 in TTM. Examining the EBITDA margin has the advantage of excluding fluctuating costs and providing a clear view of the company’s performance. Finally, the company’s cash flow margin has improved and sat at 0.14 in TTM. The cash flow margin indicates the relation between operating cash flow and the company’s total revenue. In summary, Golden Ocean’s profitability metrics across the board of margin ratios indicate that the company is in solid condition and the management is able to balance its financial statements. Thus, not only can they minimize expenses, but also take advantage of growth opportunities (see Figure 9).

Figure 9 – GOGL’s margin ratios

Author (based on SA data)

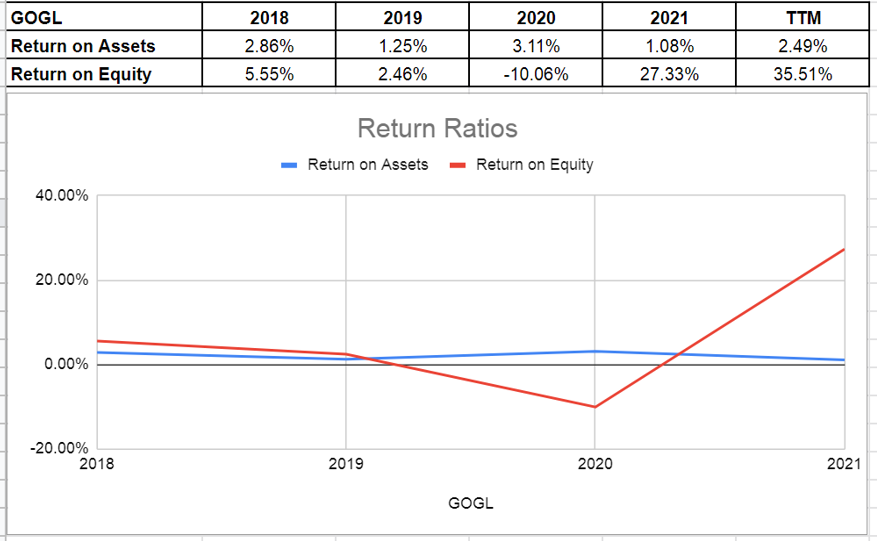

Also, I looked into GOGL’s return on equity and return on assets ratios to show how well the company can tailor returns to its shareholders. The ROA ratio illustrates the amount of profit an organization may produce for each dollar of its assets. The ROA ratio for Golden Ocean has increased in TTM, which is a witness to its ability to recover. The return on assets for Golden Ocean experienced a drop to 1.08% in 2021 versus its previous level of 3.11%. Currently, the ROA of GOGL increased back to around 2.5% in TTM. Additionally, its return on equity in TTM has improved impressively to 35.5% compared with its amounts of 27.3% and (10.96)% in 2021 and 2020, respectively. This ratio shows the net income of the company in relation to shareholders’ equity. Also, it calculates the rate of return on the capital invested in the business. It means Golden Ocean’s return ratios could indicate that the company has improved its return circumstances and will provide stable benefits for its shareholders (see Figure 10).

Figure 10 – GOGL’s return ratios

Author (based on SA data)

Summary

Golden Ocean will not benefit from the market condition as it did in the previous quarters. However, the company can still stay profitable in the current market condition as the dry bulk carriers market is supported by increased demand for coal. Golden Ocean’s profitability metrics across the board of margin ratios indicate that the company is financially healthy. The stock is a hold.

Be the first to comment