Ruslan Lytvyn/iStock via Getty Images

Intro

When it comes to stock picking, to find companies capable of outperforming the market it is certainly useful to start with dominant companies that have a moat able to protect them from the competition. The next step is to see if this competitive advantage is reflected in the company’s operating results, particularly in terms of ROIC/ROC and cash generation. As a last step (but not least) comes the valuation. The price at which the shares of the company are traded must be at least equal to their intrinsic value (although it is always better to have a margin of safety). I realized that Dolby (NYSE:DLB) meets only one of these three criteria. With this article I want to explain the reasons that led me to think that although Dolby is an excellent company, most likely its performance will be in line with the market.

Business Overview

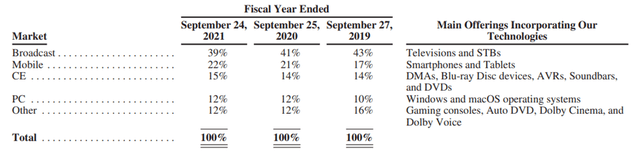

Dolby’s business is based on developing audio visual technologies to improve the experience of using digital content such as songs, films or video games. Almost all of the revenue generated by Dolby comes from royalties obtained from the licenses granted to customers for the use of proprietary patents. In 2021, the revenue not generated by Licensing was only 5% of the total.

To fully understand Dolby’s business, you need to know the customers it targets and the various licensing models:

- Two-Tier Licensing model: as can be understood in this model there are two types of licenses referring to two different subjects. The first phase concerns semiconductor manufacturers called “Implementation Licensees” who use Dolby technologies in ICs which they then sell to OEMs of consumer entertainment products, called “System Licensees”. System Licensees separately obtain the license to manufacture and sell finished products containing ICs containing Dolby technologies. Implementation Licensees pay a nominal initial fee on contract execution. For the use of technologies, System Licensees pay an initial fee and then royalties.

- Integrated Licensing model: this type of license applies to software operating system vendors and some OEMs acting as Implementation and System Licensees. In this case Dolby asks for an initial fee together with royalties.

- Patent Licensing model: they license their patents through patent pools which are nothing more than agreements between multiple patent holders. This is convenient for granting licensees a set of patents jointly, reducing transaction costs. Dolby also generates fees to manage patent pools through a subsidiary (Via Licensing Corporation).

- Collaborations Arrangements: we can divide this category into Dolby Cinema and Dolby Voice. With Dolby Cinema they collaborate with exhibitors to offer a premium experience thanks to Dolby Atmos and Dolby Vision and the company receives a percentage of box office receipts.

A minor part of Dolby’s business is represented by the “Product and Services” segment, which in FY 2021 represented 5% of the company’s turnover.

We design and manufacture audio and imaging products for the cinema, television, broadcast, and entertainment industries. Distributed in approximately 90 countries, these products are used in content creation, distribution, and playback to enhance image and sound quality, and improve transmission and playback.

They recently launched a developer platform called Dolby.io, which allows developers to access Dolby technologies through APIs. The offer currently includes multimedia processing APIs for analyzing and improving recorded audio files. Dolby.io is a project that management wants to work on, to expand its functionality over time.

The fact that many of the Dolby technologies have become the industry standard gives the company a nice competitive advantage. Once many producers, both of multimedia contents and of devices for their reproduction, use these technologies it becomes difficult to completely change standards. This is a significant competitive advantage that must certainly be taken into consideration when evaluating the company.

Always taking into account Dolby’s dominant position, however, we must remember the way in which the company generates turnover, that is, mainly through royalties. This means that Dolby’s revenue actually depends on the products its customers sell.

Financial Performance

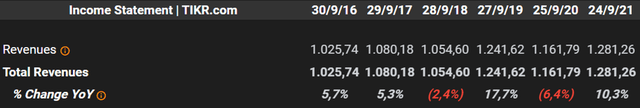

The progress made by Dolby in recent years in terms of revenue has not been very exciting, an increase of around 28% in 5 years. For FY 2022 the expected revenue growth is 0%, for 2023 and 2024 analysts estimate growth of 6.5% and 9.2% respectively, thus bringing revenues to around $ 1.49 billion. I certainly do not have the information and the skills to say that the analysts who calculated these estimates are wrong, but considering that the real effect of the rate hike probably usually occurs after 6-12 months and that, at the moment, the demand seems to be still standing by the savings accumulated by families during the pandemic, I think these estimates are optimistic. I will still take this into account in the valuation, but personally I think it is more prudent to use less aggressive growth rates.

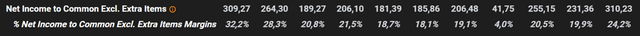

As for the net profit Dolby in 2016 obtained around $ 186 million, therefore equal to a net income margin of 18.1%. In 2021 the profits generated were $ 310 million with a margin of 24.2%. In the image below you can see the trend in net profit and the net margin from 2011 to 2021.

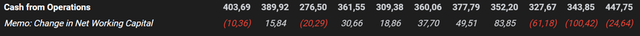

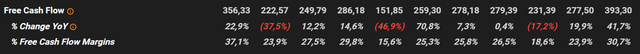

You can confidently see that 2021 earnings are on par with 10 years earlier. A net margin that could be considered fair for valuation could be in the range of 18% to 22%. If we look at the cash flows, we observe that the company has had no problems in generating liquidity from its business. Always considering the time frame from 2011 to 2021, we can say that Cash from Operations has in fact remained stable, the same is true for Free Cash Flow.

The high FCF margin is undoubtedly a point in favor of Dolby but now we come to the point that I consider most critical, profitability. The Return on Capital and the Return on Equity have worsened considerably since 2014, the average of the last 5 years of the ROC is in fact 10.8%. The 10.8% at first glance may not seem bad but considering that we are talking about a company that operates almost as a monopolist in its sector and the multiples at which it is traded, I believe it is very low. It turns out even lower if we compare it to the WACC around 9%-10%. In fact, Dolby has created little value for shareholders in recent years and I believe this is reflected in the price of its shares which have not come a long way in 5 years. The forward P/E calculated using the EPS at FY23 forecast by analysts of $ 2.58 is around 26 (using the price at the time of writing the article). A P/E of 26 in this macroeconomic situation and with rates that will continue to rise is not low. It can certainly be “justified” in some way considering the great competitive advantage that Dolby has, but it still means an earnings return of 3.8% to be compared with the 10-year Treasury yield which could even reach 5% if the Fed continues to raise interest rates as it has promised.

Having said that, with regard to the Balance Sheet, there is little to say except that it is exceptional. Dolby has total cash and short term investments of $1 billion and total liabilities of $460 million. The likelihood of Dolby default is certainly close to zero.

Valuation

I already hinted in the previous section that in my opinion Dolby is overvalued, or that in any case at these prices it cannot guarantee satisfactory returns to those who invest in it. However, I will proceed to evaluate the company. I will use various cases with different growth and margin assumptions and a discount rate of 10%. For 2022, 2023, and 2024 I’ll take analyst revenue estimates of $ 1.28, $ 1.365, $ 1.49 billion, respectively.

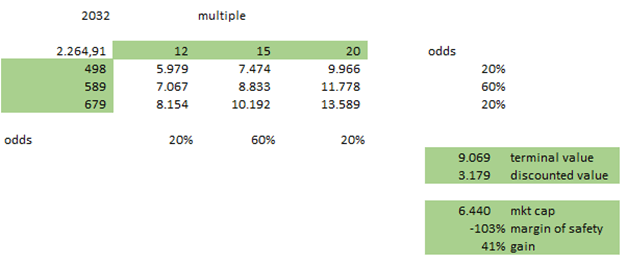

- Normal case: CAGR 6% from 2024 to 2027, 5% until 2032

Author’s estimate

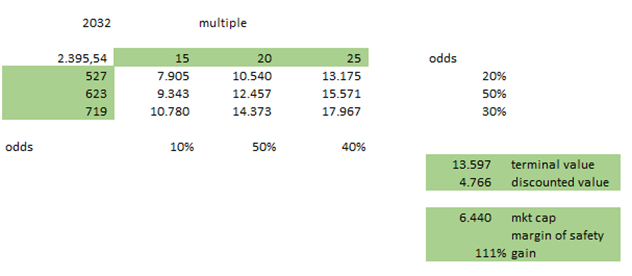

- Best case: CAGR 8% from 2024 to 2027, 5% until 2031

Author’s estimate

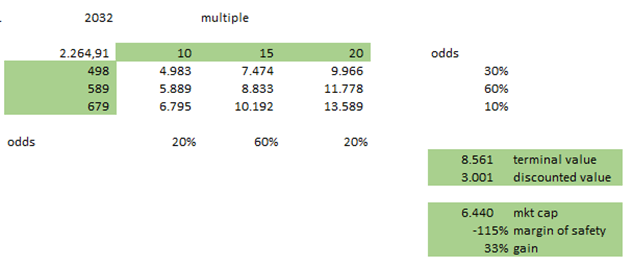

- Worst case: CAGR 5% from 2024 to 2027, 2% until 2032

Author’s estimate

As you can see from the images, the discounted value of Dolby fluctuates between a low of $ 3 billion and a high of around $ 4.8 billion. Even in the best case of growth, profitability and multiples I have supposed, Dolby doesn’t seem to be a good deal at current valuation.

I believe that at the current valuation Dolby can offer a return of around 7% per annum for the next 10 years, as in fact it has been in the past 10 years. A risk that should not be underestimated is certainly the possible contraction of margins. The return that Dolby shareholders have achieved over the past 10 years has been largely due to an expansion of multiples as the profits and FCF of the business have not increased that much. I do not think it is very likely that Dolby will be able to achieve double-digit growth in terms of revenue and profit as it was in 2021. 7% annual return could be obtained if Dolby were able to maintain these FCF levels and use a large part of this to buy back own shares. I therefore do not consider it convenient to invest in Dolby at these prices, regardless of the moat it has.

Risks

What could negatively affect Dolby’s revenue and earnings performance is the performance of the reference markets for the products that contain its technologies. I find it very unlikely that Dolby will lose its status and therefore market share, but given its business model, even if it continues to be the market leader, its revenues depend heavily on the success of its customers.

I also consider the current valuation a risk. I do not believe that the performance of the business in terms of growth and return on capital can justify these multiples. If we consider the EV the situation improves, but even in this case I believe that Dolby in the next 10 years will return to its shareholders performances very similar to those of the market.

Conclusion

I personally wouldn’t invest in Dolby at these prices. When I am looking for new companies to invest in, two qualities that I give a lot of weight to are the ROIC/ROC and the ability to reinvest a large part of the profits in the business at acceptable returns. As I have repeated several times, despite having Dolby a very strong moat, I don’t like the low return on capital and the performance of earnings and the FCF. If we also add a rich valuation to this, it is quite easy for me to say no and move on. If the company were to comply with analysts’ forecasts and continue to grow and raise margins, the returns that could be obtained in my opinion are modest, but on the other hand we have the case in which Dolby fails to meet expectations, the FCF of these two years could be unrepeatable and if it were to re-stabilize on the average levels of the last few years, the returns that could be obtained are absolutely not satisfactory.

Be the first to comment