Timing the Market Beats Time in the Market

Dilok Klaisataporn

Introduction

Hut 8 Mining’s (NASDAQ:HUT) main investment value proposition is derived from its commitment to HODL 100% of its Bitcoins (BTC-USD) mined:

Keeping with our longstanding HODL strategy, 100% of the self-mined Bitcoin in September were deposited into custody

In our previous coverage, we determined that the benefit of such a commitment is to provide shareholder value through asset value appreciation when Bitcoin rebounds. However, the side effect of such commitment is HUT’s severe shareholder dilution.

Conventional wisdom suggests time in the market beats timing the market. However, this study aims to argue that investors should time their investments into HUT.

Reason 1: Another Round Of 75% Dilution On The Cards In Coming Quarters

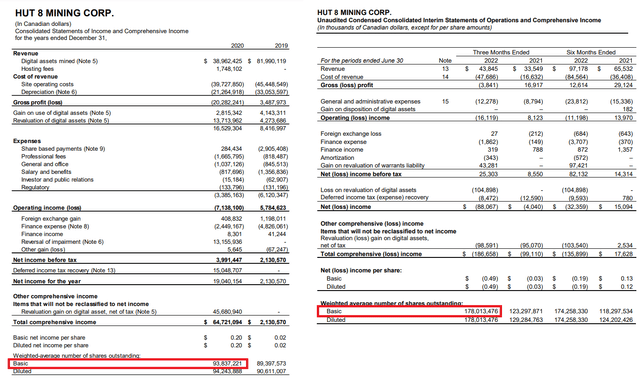

Since the beginning of 2021, HUT has increased its outstanding shares by 89% from 94.244mil (End of 2020) to 178mil in 2022Q2. What we noticed was large-scale equity offerings were carried out when HUT’s cash on the balance sheet approaches a certain threshold. That threshold is about $30mil.

Hut 8 mining common shares outstanding (HUT)

There are 3 observations that led us to suggest that a 20% dilution is on the cards for Q3.

- The first supporting evidence is the timing. in 2021Q1 when HUT’s cash reaches $30.8mil (discrepancy derived from exchange rate). In the following 2 quarters, HUT’s cash on the balance sheet spiked up together with the number of shares outstanding. What was the resulting dilution? 70% (from 97mil to 164mil shares outstanding).

- The second supporting evidence is HUT’s quarterly cash burn rate. HUT’s quarterly cash burn rate is about $20mil to $30mil on average (Table 1). Therefore, it is critical for HUT to raise cash before its cash on the balance sheet drop below $30mil.

- The third supporting evidence is what was announced. HUT announced a $65mil at-the-market (ATM) equity offering in 2022Q1, which itself will result in an 18.5% increase in shares outstanding at the current market cap. In August 2022, HUT announced another round of ATM equity offering to raise $200mil, which is equivalent to a 57% increase in shares outstanding at the current market cap. Therefore, the total amount of shares increased would total 75%.

Table 1. HUT’s Changes in Cash On Balance Sheet Over Time.

Source: Author, HUT

The net shares outstanding increase could be worse than 75% as we’re still in a stock bear market and a Bitcoin bear market. What this implies is that shareholders of HUT since the end of 2020 have seen their ownership of the company drop to 53% (=1/1.89) in 2022Q2.

Based on the current market cap, the $265mil ATM equity offering will reduce existing shareholder ownership by another 43% (=1/1.75) which further decreases shareholder ownership from that number to 30% (=0.53*1/1.75).

These investors may only lose 35% based on share price (from $2.75 on 31st Dec 2020 to $1.81 on 29th Sept 2022). In reality, they’ve already lost 65% (= 1-(1-0.35)*1/1.89) of the value after considering dilution up to 2022Q2 and potentially 80% (=0.65/1.89/1.75) considering the $265mil ATM equity offering.

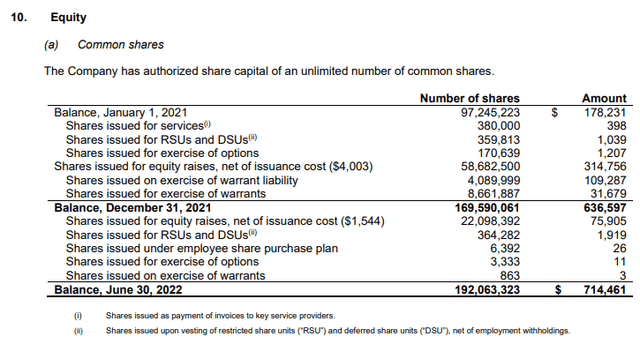

Unlimited Authorized Shares Indicates Indefinite Dilution

You might be thinking, “when will this dilution end?” We don’t expect it to as it can go on indefinitely. This is the side-effect of the 100% HODL strategy. The question investors should be asking is when will the degree of dilution be decreased.

In our previous coverage, we explained that HUT’s only source of cash is from selling Bitcoin (HUT’s high-performance computing (‘HPC’) revenue is still negligible). Since HUT HODLs and does not sell, HUT has to continuously revert to equity or liability for cash.

This is the fundamental side of its business model. Analysts looking for more concrete evidence for indefinite shareholder dilution can look no further than the balance sheet. HUT’s balance sheet indicates that the company is an unlimited number of authorized shares. This aligns with our analysis of HUT’s business model.

The Company has authorized share capital of an unlimited number of common shares.

HUT has an unlimited number of authorized shares (HUT)

Therefore, investors should re-consider becoming long-term shareholders of HUT, more so in a bear market. The degree of dilution will be greater during a stock bear market because more equity has to be offered to raise the same amount of cash.

In short, severe dilution should act as a major deterrent for long-term investors.

Reason 2: Lack Of Growth Visibility

Dilution might still be acceptable for investors, as the company could outgrow dilution. However, HUT stated that its $200mil ATM offering isn’t aimed at growth but to cover general corporate purposes.

The Company intends to use the net proceeds of the ATM Program, if any, principally for general corporate purposes (including funding ongoing operations and/or working capital requirements). The net proceeds of the ATM Program may also be used to repay indebtedness outstanding from time to time, discretionary capital programs, and potential acquisitions.

This statement is far-reaching: Decrease in profitability.

Doesn’t stagnation simply imply stagnating profits?

No. Bitcoin mining profitability relies on a miner’s capacity relative to all other miners combined. This is known as the share in the Bitcoin network. Simply put, if all miners grow at the same rate, they will simply maintain the probability of mining a Bitcoin.

Prior to Bitcoin’s decline from all-time highs (‘ATH’), HUT’s growth has already been lagging behind competitors. For instance, Bitfarms (BITF) grew from 1.2 EH/s in 2021Q1 to 4 EH/s in 2022Q3 (3.33x growth), CleanSpark (CLSK) grew from 0.315 EH/s in 2021Q1 to 4 EH/s in 2022Q3 (12.7x growth). HUT only grew from 1.37 EH/s in 2021Q2 to 2.98 EH/s in Aug 2022 (2.17x growth).

By simply growing slower than competitors, HUT is losing its share in the Bitcoin network, which reduces the probability of mining a Bitcoin. Since the $200mil isn’t aimed at growing capacity while competitors are aiming to multiply their capacity (e.g. CleanSpark (CLSK) is aiming for 22.4 EH/s by 2023 from 4 EH/s in 2022Q3).

In short, we believe that HUT lacks the business fundamentals to provide investors with a sufficient long-term investment value proposition. Hence, investors have to look at other aspects (such as assets) to derive value.

Reason 3: Volatility Dynamics

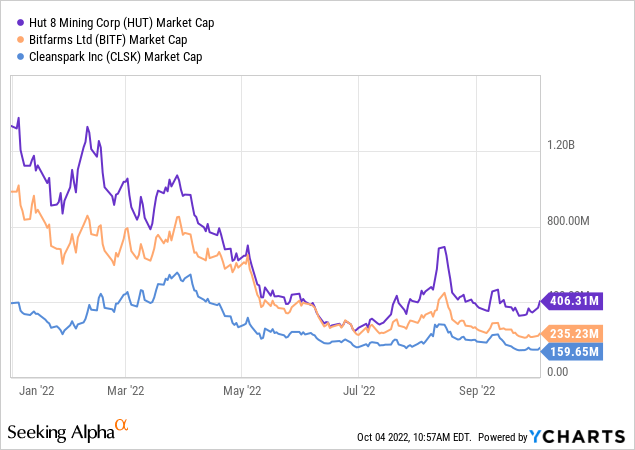

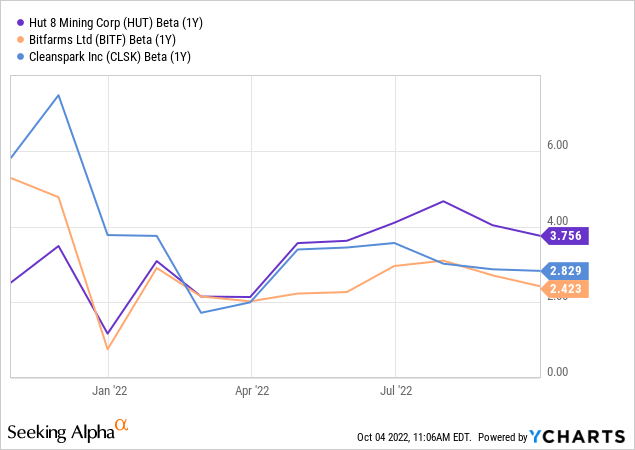

HUT’s lack of business fundamentals and huge Bitcoin reserves indicate that HUT should have elevated volatility toward the market index and Bitcoin compared to comps.

We use Bitfarms and CLSK as comps based on similar mining capacities. We can see that HUT is valued much higher than both BITF and CLSK even though HUT’s mining capacity is the lowest among them. This can be justified by the assets of their balance sheet, especially the value of their Bitcoin reserves (Latest September Update – HUT: 8,388; BITF: 2,065; CLSK: 594)

What this means is that HUT’s intrinsic value is mainly derived from its Bitcoin holdings such that fluctuations in the Bitcoin price will affect HUT more than BITF and CLSK. Hence, the elevated volatility (see figure below).

In our view, HUT will suffer the most decline but will enjoy the most upside. Therefore, timing the market is paramount.

HUT is valued higher than BITF and CLSK despite having lower capacity is because of its outsize Bitcoin reserve (YCharts)

Verdict

The main point of attraction for HUT is that HUT ($406mil market cap) is trading at its $405mil adjusted net asset value (= $47mil cash + $152mil PP&E + $88mil Deposits + 8,388 x $20,000 BTC – $50mil Total Liability).

However, this study argues that this point of attraction does not provide a sufficient long-term investment value proposition for the 3 key reasons presented.

Therefore, this study finds that timing the market beats time in the market. We are navigating the market by looking at the halving cycle. The halving cycle helped us predict the current bear market. Currently, Bitcoin has followed through with 4 out of the 5 predicted sequences of events based on the halving cycle and is carrying out the 5th sequence of events.

The 5th sequence of events will see Bitcoin hit below $10,000. That’s when we’ll start paying attention to HUT.

Be the first to comment