ArtistGNDphotography/E+ via Getty Images

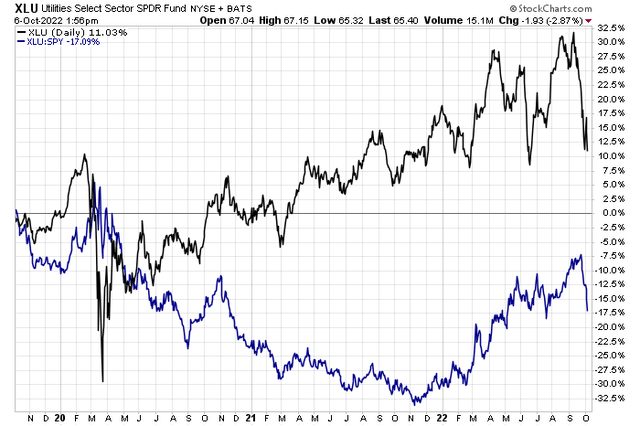

The Utilities sector had been a great spot in which to hide out during much of 2022. Recently, though, the Utilities Select Sector SPDR ETF (XLU) has given back most of its YTD gains. On a relative basis to the S&P 500 ETF (SPY), it looks to be breaking its uptrend since late November. One Oklahoma electric utility firm has struggled lately on its own. But is it time to buy the dip?

Utilities Sector Drops Big, Relative Strength Uptrend in Jeopardy

According to Fidelity Investments, OGE Energy Corp. (NYSE:OGE), together with its subsidiaries, operates as an energy and energy services provider that offers physical delivery and related services for electricity, natural gas, crude oil, and natural gas liquids in the United States. The company generates, transmits, distributes, and sells electric energy.

The Oklahoma-based $7.5 billion market cap Electric Utilities industry company within the Utilities sector trades at a low 7.9 trailing 12-month GAAP price-to-earnings ratio and pays a high 4.6% dividend yield, according to The Wall Street Journal.

OGE has a favorable outlook in terms of its cost and rate revenue dynamic. Higher fuel costs are not a major issue since cost recovery is seen as being relatively fast. Moreover, positive rate case settlement news earlier this year sets up the company for better profits in the coming years, according to Bank of America Global Research. Also, any improvements to Energy Transfer’s (ET) value could be accretive to OGE. Further regulator developments in Oklahoma could be an upside catalyst along with improved capex opportunities. Downside risks are numerous, though, as there is the chance that further rate increases do not go through, while higher interest rates would pressure margins.

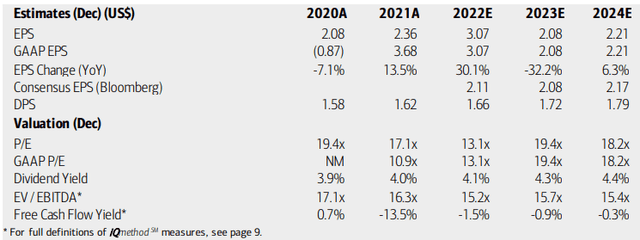

On valuation, analysts at BofA see earnings rising sharply in 2022 following its ET exit – earnings are seen as falling by a commensurate amount in 2023 before stabilizing at a +6% EPS growth rate in 2024.

The Bloomberg consensus forecast for 2023 and 2024 per-share profits are comparable to BofA’s outlook. Dividends are expected to be more stable, though. The normalized P/E is likely in the mid-teens right now, which is a bit of a discount to the broader sector, but its EV/EBITDA multiple is high while the free cash flow yield is seen as negative through 2024. The valuation is lukewarm right now, but I question the growth case.

OGE Earnings, Valuation, And Dividend Forecasts

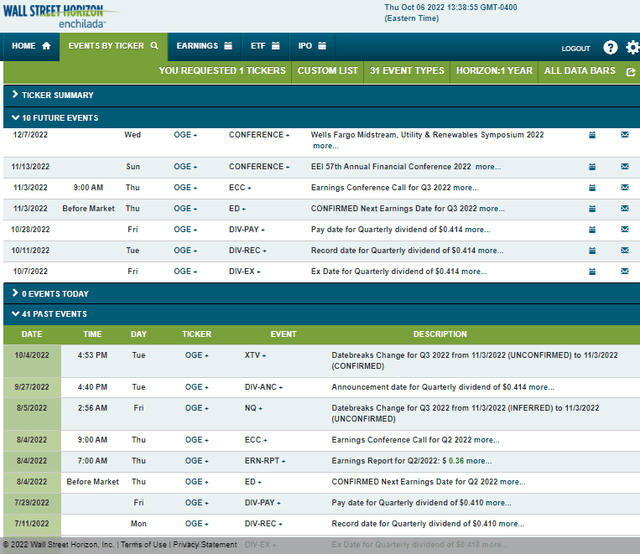

Looking ahead, corporate event data provided by Wall Street Horizon show a busy calendar through the next two months. First, there’s a dividend ex-date on Friday, October 7 before the November 3 Q3 earnings date (before market open). An earnings call follows the report – you can listen live at ogeenergy.com.

Then come two industry conferences that investors should pay close attention to as often news and business updates are given at these gatherings.

Corporate Event Calendar

The Technical Take

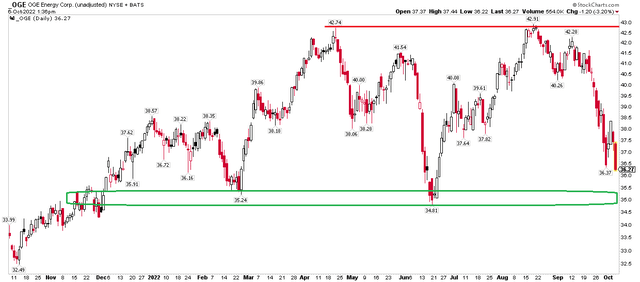

As the sector pulls back hard, and with an eventful next few months for OGE, what does the chart say? I see bearish risks.

Notice in the chart below that the stock put in a bearish double top pattern near $43, and shares appear to have a date with the key $35 support level. While $35 has held twice, there’s the risk that a move below it would trigger a further downside move to $27 based on the measured move off the double-top pattern and range since last December.

Going long near $35 with a tight stop could be a trade, but I see a bit more downside from here.

OGE: Bearish Double Leads to a Swift Move to Support. Watch $35.

The Bottom Line

OGE is a reasonably valued Utilities sector company, but its growth outlook looks muted. Moreover, the technical chart is a sideways chop with key support about to be in play. Overall, it’s a hold for me but would be a sell if the stock falls much below $35.

Be the first to comment