ferrantraite

Investment Thesis

Huntsman Corporation (NYSE:HUN) is a strong company with a pandemic slowdown, but the trends in EPS, P/E Ratio, and Net Profit Margin provide good indications for stock price appreciation. I like the planned usage of cash from their $718M divestiture. Even if HUN’s stock price moves from $27.06 to $28.00 by May 19th, a 26.9% potential annualized return is possible, including covered call premiums and dividends.

Huntsman Corporation is a Strong Company

Here is what I gathered about Huntsman from their corporate website. Huntsman is a global leader in MDI-based polyurethanes, serving over 3,000 customers in more than 90 countries. They have world-scale production facilities in the US, the Netherlands, and China and a global network of more than 30 downstream formulation facilities close to customers, providing highly differentiated, tailored solutions. The Polyurethanes division accounts for $5.5B in annual sales or 59% of its total business.

Polyurethane is one of the most versatile polymers available and can be used to create rigid and flexible foams, thermoplastic urethanes, coatings, adhesives, sealants, and elastomers. As the most effective thermal insulant in the market, MDI-based polyurethane is widely used to deliver energy savings solutions in residential and commercial buildings. It is used throughout the cold chain, in refrigerators and cold stores, helping preserve food. It is made using recycled plastic waste like plastic bottles.

The Performance Products division accounts for $1.8B in annual sales, or 19% of its total business. This division handles amines, maleic anhydride, and carbonates, enabling them to serve diverse consumer and industrial end markets, including energy, automotive and transportation, coatings and adhesives, building & construction, electronics, and industrial manufacturing. With manufacturing facilities in North America, Europe, the Middle East, and Asia, they produce and sell over 800 products to over 1,000 global customers and provide extensive pre-and post-sales technical service support.

The Advanced Materials division accounts for $1.3B in annual sales or 14% of its total business. Their portfolio of adhesives, composites, and formulation products meet demanding engineering specifications and address customer-specific needs. Serving more than 2,000 customers in over 30 countries, Huntsman has expertise in complex chemistry, long-standing relationships with customers, and their ability to develop and adapt technology and applications know-how for new markets.

They are 90.2% owned by institutions. I consider institutional investors such as hedge funds, pension funds, mutual funds, and endowments smart money because they have more resources available for research than retail traders. They control much more buying and selling than retail investors, which determines the stock price. According to Reuters, retail investors currently account for roughly 10% of the daily trading volume on the Russell 3000.

HUN has annual sales above $9B with 9K employees. Their return on equity is 30.9%, and they have a 21.6% return on invested capital. Free cash flow yield per share is 16.9%, and their buyback yield per share is 12.7%.

Their second quarter EPS was $1.28 versus $0.86 during Q2 of 2021 due to their value over-volume strategy, improved pricing, and solid cost control. This was accomplished despite an increasingly challenging economic environment from extremely high European natural gas prices, headwinds in China associated with government-mandated shutdowns, and monetary tightening in the United States.

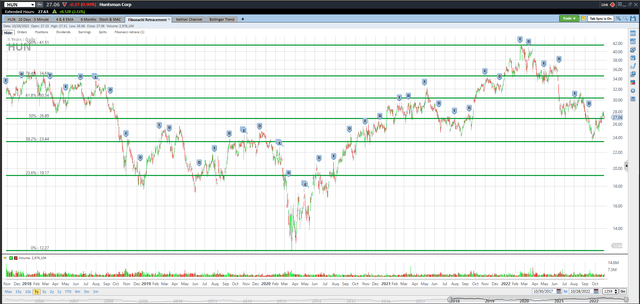

Good Technical Entry Point

I’ve added the green Fibonacci lines using the high and low of the past five years for HUN. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where HUN may be going. HUN is currently at the 50% Fibonacci retracement level, which could go lower if the overall market pulls back. However, I believe that HUN will trade above $28.00 by May for the reasons in this article.

The eleven most accurate analysts have an average one-year price target of $32.90, indicating a 21.5% potential upside from the October 28th closing price of $27.06 if they are correct. Their ratings are mixed with six buys, four holds, and one sell. Analysts are just one of my indicators, and they are not perfect, but they are usually in the ballpark with estimates. They often seem a bit optimistic, so I suspect prices may end up lower than their one-year targets to be on the safe side.

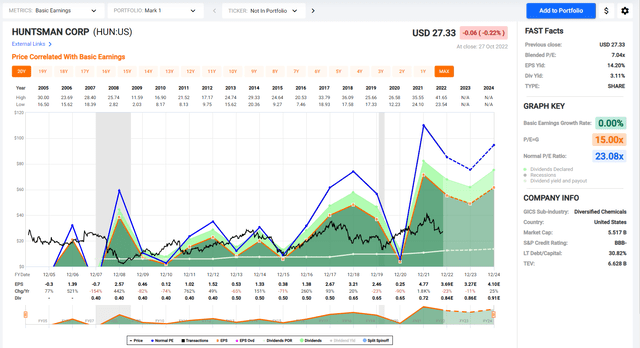

Trend in Earnings per Share, P/E Ratio, and Net Profit Margin

The black line shows HUN’s stock price for the past eighteen years. Look at the chart of numbers below the graph to see that HUN had trough earnings in 2020 during the pandemic. They bounced from $0.25 in 2020 to $4.77 in 2021, and they are projected to earn $3.69 in 2022 and $3.27 in 2023.

The P/E ratio for HUN is currently at seven, but the average ratio over the past ten years is 15. I don’t think the P/E will rally back to 15 anytime soon. If HUN earns $3.27 in 2023, the stock could trade at $32.70 if the market assigns only a 10 P/E ratio.

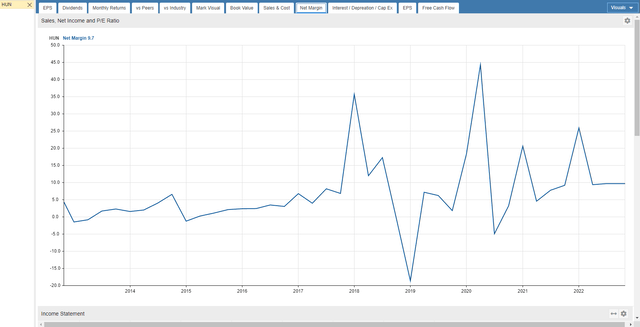

The net profit margin trend has improved since 2014, when it was less than 5%, to almost 10%. This metric is not at all-time highs, but it is off the lows.

Divestiture of Textile Effects Division

Huntsman announced on August 9th that it has entered into a definitive agreement to sell its Textile Effects division to Archroma, a portfolio company of SK Capital Partners. The total enterprise value of the transaction is approximately $718 million. Over the last twelve months ending June 30, 2022, the Textile Effects division reported sales of $772 million which is 8% of total sales and adjusted EBITDA of $94 million. Huntsman anticipates cash taxes on the transaction of approximately $50 million. The transaction is subject to regulatory approvals and other customary closing conditions and is expected to close in the first half of 2023.

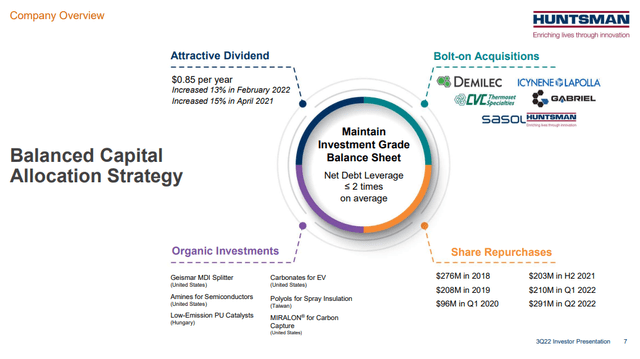

Balanced Capital Allocation Strategy

They expect the cash proceeds from the Textile Effects divestiture to be deployed in line with their current balanced capital allocation program. This includes strategic investments and acquisitions to strengthen the core businesses further and return cash to shareholders through the dividend and share repurchase program.

Their dividend is 3.1%. They have a $1B stock repurchase target for 2022 and have already repurchased $501M during the first two quarters. Their repurchase target adds up to about 16.5% of the outstanding 216M shares, depending on the purchase price.

Sell Covered Calls

My answer to uncertainty is to sell covered calls on HUN seven months out. HUN closed at $27.06 on October 28th, and May’s $28.00 covered calls are at or near $2.65. One covered call requires 100 shares of stock to be purchased. Selling a May covered call will allow the investor to collect dividends in December and March at $0.21 each. The stock will be called away if it trades above $28.00 on May 19th. It may even be called away sooner if the price is above $28.00, but that’s fine with me since I will have my capital returned sooner.

The investor can earn $265 from call premium, $42 from dividends, and $94 from stock price appreciation. This totals $401 in estimated profit on a $2,706 investment which is a 26.9% annualized return since the period is 201 days.

If the stock is below $28.00 on May 19th, investors will still make a profit on this trade down to the net stock price of $23.99. Selling covered calls and collecting dividends reduces your risk.

Takeaway

Huntsman Corporation is a strong company with a pandemic slowdown, but the trends in EPS, P/E Ratio, and Net Profit Margin provide good indications for stock price appreciation. HUN will put the $718M from their Textile Effects divestiture to good use. Even if HUN’s stock price moves from $27.06 to $28.00 by May 19th, a 26.9% potential annualized return is possible, including covered call premiums and dividends.

Be the first to comment