ipopba

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on October 15th, 2022.

Higher interest rates are here, and the financial sector is benefiting. Unfortunately, it has only meant lower share prices due to the fact of the aggressive pace of interest rate increases could push the economy into a deep recession. On the other hand, we have now seen several banks post their results and see the benefit of higher rates on net interest income. Their earnings have come down from a year ago, though, too.

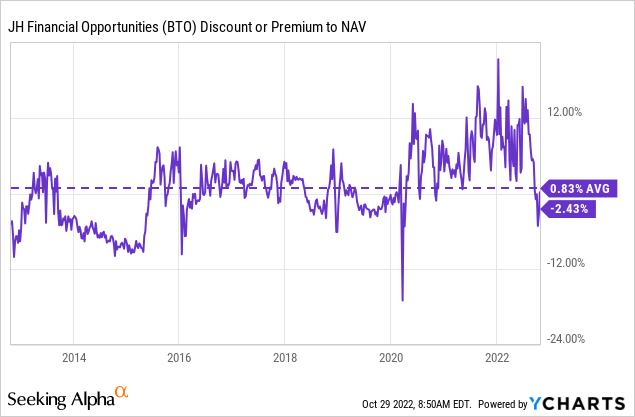

John Hancock Financial Opportunities (NYSE:BTO) is one closed-end fund that invests specifically in equity positions of the financial sector space. This fund has traded at a premium for several years, a fairly high premium at that. However, the fund has recently slipped into an attractive discount.

It has been quite some time since I’ve written on BTO specifically, going back to over a year ago. That being said, I have added to my position several times in 2022. Now, the valuation on BTO is right, along with the valuation of some of the underlying holdings.

The Basics

- 1-Year Z-score: -2.01

- Discount: -2.43%

- Distribution Yield: 7.58%

- Expense Ratio: 1.45%

- Leverage: 16.56%

- Managed Assets: $755 million

- Structure: Perpetual

BTO’s investment objective is “capital appreciation and current income.” To achieve this, they simply “invest at least 80% of assets in equity securities of U.S. and foreign financial services companies.” While they mention foreign financials, they are nearly 96% invested in U.S. institutions.

The fund’s expense ratio is quite high, considering the fairly standard approach of their portfolio to invest in easily accessible publicly traded securities. When including the leverage expense, the fund’s expense ratio comes to 1.67%.

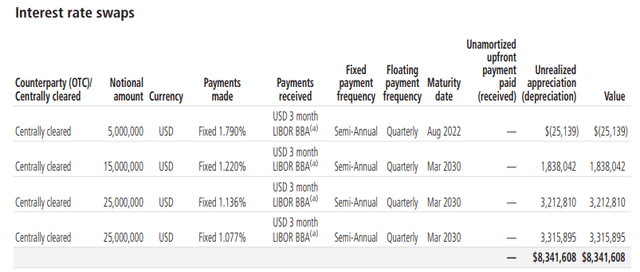

They utilize a moderate amount of leverage. Interest charged is one month LIBOR plus 0.60%. Given that LIBOR is discontinued, it will be changed in the future, but that is what the last report provided. The average interest rate came to 1.23%. However, it finished up on June 30th, 2022, at 2.39%. That provides some context on just how rapidly rates are rising.

That being said, they have been employing interest rate swaps to hedge against the rising rates we’ve been experiencing. This is something we’ve seen across other John Hancock funds, which seems like a smart move. With maturity dates out to 2030 on a large portion of the contracts, these hedges are likely to benefit BTO until this latest rate hiking cycle is over.

BTO Interest Rate Swaps (John Hancock)

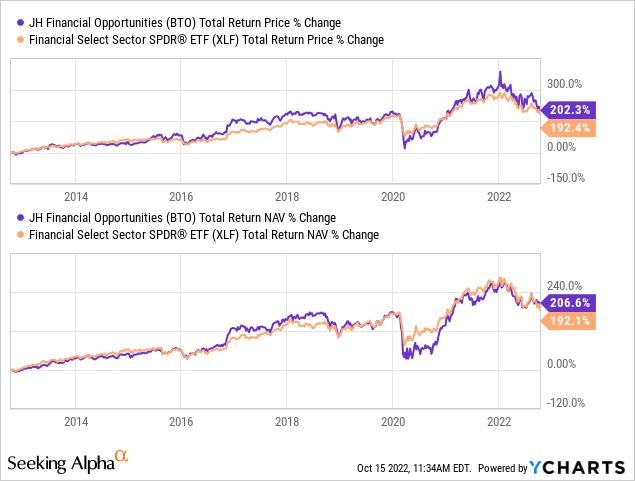

Performance – Beating Its ETF Counterpart

It’s fairly rare that income-focused investments can contend against passively managed ETFs. BTO is one example where over the last decade, this fund has outperformed the Financial Select Sector SPDR (XLF). Of course, that depends on what period you are looking at. If it was during the COVID crash, we could see that BTO underperformed.

YCharts

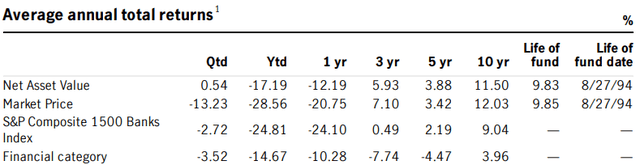

Against the benchmark that they use of the S&P Composite 1500 Banks Index, we can see that the fund has performed even better based on average annual total returns.

BTO Annualized Returns (John Hancock)

Given the fund has come to a discount more recently, I believe this is attractive given the historical average in the last decade. Over the last decade, the fund’s share price has essentially averaged parity with its NAV. That’s another rare occurrence in the CEF space. However, we can also clearly see that at any given time, the fund was at a discount or premium. It was hardly ever trading at its NAV for any considerable period of time.

Even more recently, the fund was pushing into double-digit premiums. That’s why the 1-year z-score of 3+ is seemingly so extreme. I think that the premium was mostly unjustified. When I was buying, I was doing so when the premiums were spiking lower. The volatility of 2022 has provided plenty of opportunities to shake up this fund’s valuation.

Even now, the fund is discounted, but its share price overall has dropped too. This reflects the poor performance in the financial space and the broader market YTD. Just because something has been reduced in price, it doesn’t automatically make it a worthwhile investment or cheap necessarily.

However, higher interest rates could help support the earnings of the financial sector. We can see that earnings on several of the largest banks so far have been supported by this. Earnings are down from a year ago but not plunging as the share prices should suggest. Most of the declines seem to be in anticipation of the Fed being too aggressive and pushing us into a deep recession in 2023.

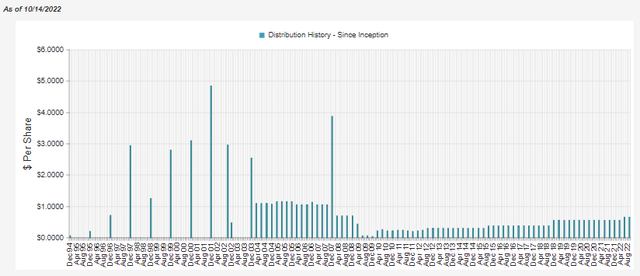

Distribution – Appealing ~7.5% Yield

The fund’s distribution rate becomes more appealing as the price comes down on the fund. Additionally, now that the fund is at a discount, the underlying portfolio can earn less and payout more to investors. The distribution rate comes to 7.58%; the NAV rate comes to 7.60%. Earlier this year, they bumped up their quarterly distribution too. Since 2008/09, the fund has raised its distribution several times.

BTO Distribution History (CEFConnect)

The net investment income of the fund has increased in the latest report. Net investment income for a closed-end fund shouldn’t be confused with the net interest income of the financial companies – both being abbreviated as NII can be confusing.

Net investment income for CEFs is the dividends and interest payments collected in the underlying holdings minus the fund’s expenses. Net interest income for banks is the earnings that a bank generates from interest-bearing and expenses of interest-bearing liabilities. Simply put, it is the amount banks earn from loans minus the expenses they pay on deposits.

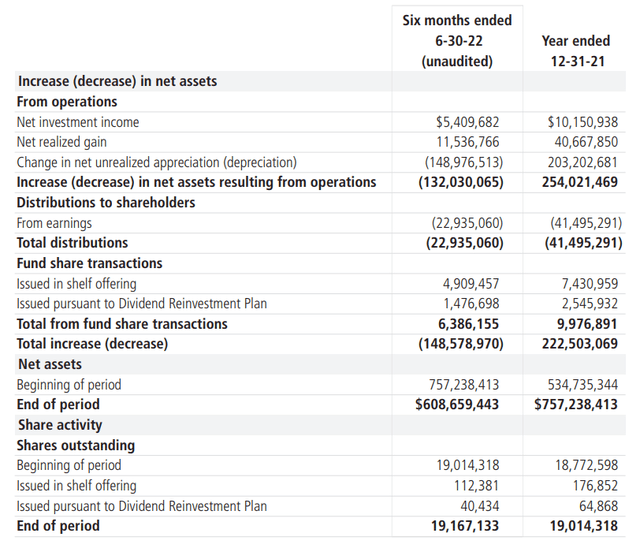

BTO Semi-Annual Report (John Hancock)

Annualizing the latest figure would put the NII increase for BTO at around 6.6%. It is a small increase, but it can help to support their distribution. With several banks raising their dividends, this should continue to rise, too.

The remainder of the shortfall for BTO between NII and the distributions paid out would have to be generated from realized gains. That includes gains from the swap contracts and portfolio holdings.

We can also see that the fund’s premium helped the fund grow AUM due to the dividend reinvestment and the at-the-market offerings. Since it was done at a premium, it is accretive to the NAV.

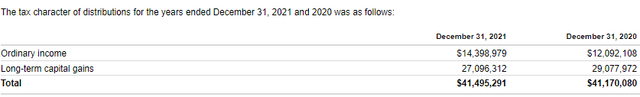

For tax purposes, the fund’s earnings mostly mirror the classifications. The tax classifications reflect both ordinary income and long-term capital gains. Here are the classifications from 2021 and 2020. All of the ordinary income was considered qualified dividend income for both years.

BTO Tax Character of Distribution (John Hancock)

BTO’s Portfolio

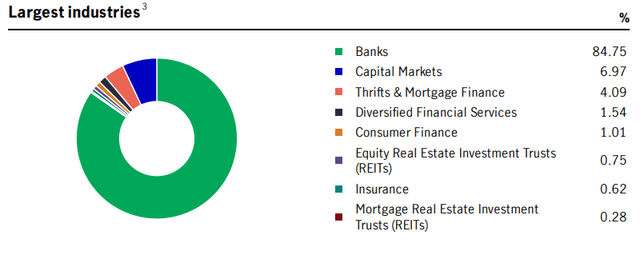

With little surprise, BTO’s largest industry exposure is to banks. Capital markets, thrift & mortgage finance, diversified financial services and consumer finance all makeup rather small portions of the portfolio.

BTO Sector Exposure (John Hancock)

Even with over a year being in between this update and the last, this is consistent with what we’ve seen previously. BTO’s turnover is rather low, so this isn’t completely unexpected. Turnover was last reported at 5%. For all of fiscal 2021, it was 14%. That was the highest in the last five years.

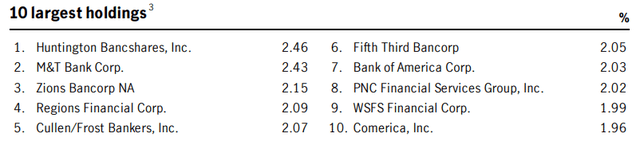

One of the changes since a year ago is that Citigroup (C) and JPMorgan (JPM) are no longer listed in the top ten. Bank of America (BAC) was the second largest holding but has moved down dramatically.

BTO Top Ten Holdings (John Hancock)

Instead, we now have these smaller regional banks rather than global banks. I suspect the idea behind this is that regional banks have more interest rate sensitivity. They are less reliant on capital markets to generate earnings than the largest banks focus on.

That being said, JPM and C are still holdings in the fund. They are just smaller weightings, with JPM at around 1.87% and C at 0.48%. JPM and C are two of the big banks that have announced earnings at the time of writing.

JPM had topped their earnings expectation and noted that they see buybacks resuming in 2023. They also boosted NII guidance after seeing a strong uptick in NII income in the latest quarter.

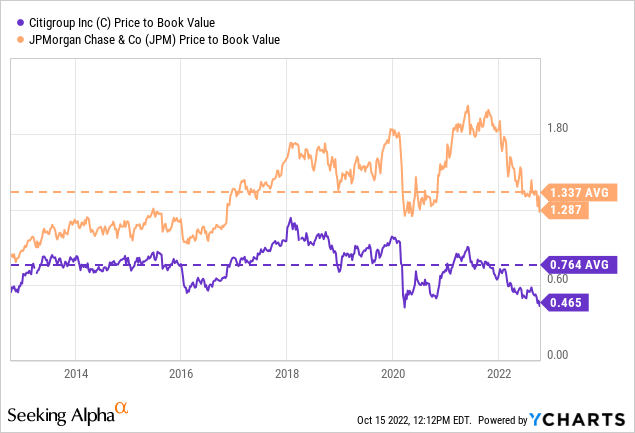

C also topped expectations. This company is also trading far below book value, which is quite interesting. It’s trading well below where it has averaged over the last decade. JPM, on this basis, could also be considered fairly attractively valued, but relative to C isn’t nearly as discounted.

YCharts

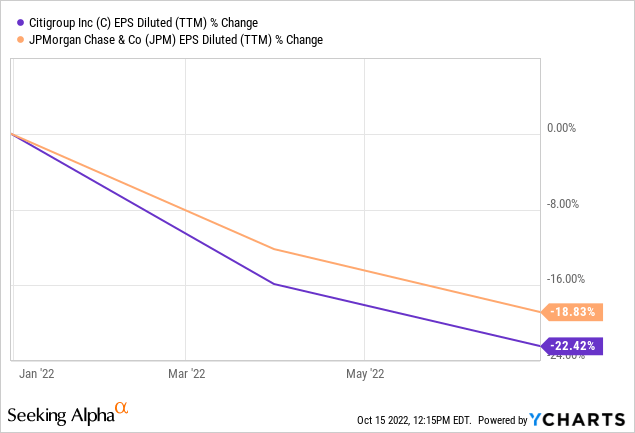

At the same time, earnings for both C and JPM have been coming down over the last year. That is despite the interest rate boosts that have contributed to higher NII as earnings in other operations come down. They also are contending with higher expenses, and loan loss provisions were also increased.

YCharts

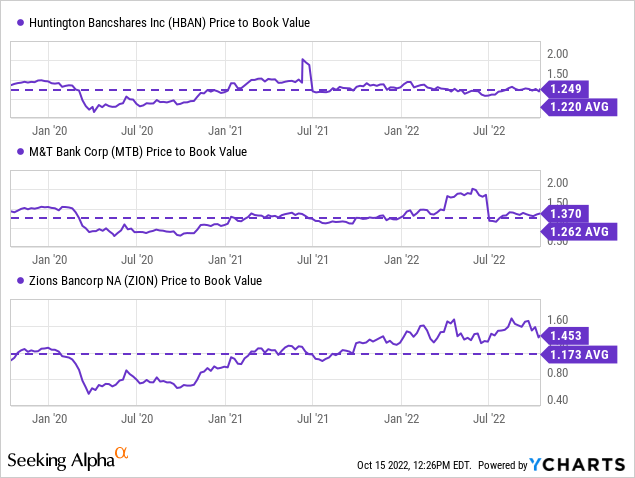

On the other hand, Huntington Bancshares (HBAN), M&T Bank (MTB) and Zions Bancorp (ZION) are holding much closer and even above the price-to-book value of the last several years. This would seem to be the case due to the benefits of higher interest rates, at least partially. Share repurchases can also slow the growth of book value.

For ZION, Sheen Bay Research had also noted in an article previously that unrealized losses accumulated in the securities portfolio contributed to a sharp drop in the book value.

However, they could be more susceptible to a downturn in the economy. So I think that should be considered too.

YCharts

Conclusion

BTO is an attractive fund that is focused almost entirely on equities in the financial sector. That makes it a unique closed-end fund. The financial sector is positioned to be able to take advantage of higher interest rates. On the other hand, the capital markets have been slow. That has meant that some of the larger banks take a hit to their corporate and investment banking earnings. BTO at a discount makes it a compelling option to invest in this specific area of the market.

Be the first to comment