Michael Vi

Thesis

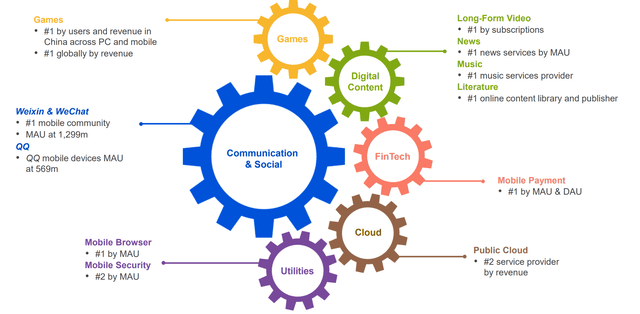

Tencent (OTCPK:TCEHY) stock is down about 44% since I have last covered the company and assigned a ‘Buy’ recommendation. Arguably, my positive assessment of the situation – especially the thesis of improving sentiment towards China-based equities – proved wrong. But as I have highlighted in the article, and as I continue to believe, ‘investors should focus on the long-term’, because Tencent’s ecosystem of leading digital services continues to offer a deep value opportunity.

Although I acknowledge that it is dangerous to keep adding to ‘loser’ positions, I believe the additional discount since I last covered Tencent makes the opportunity only more appealing.

For reference, Tencent stock is now down about 55.6% YTD, versus a loss of 18.5% for the S&P 500 (SPY). Lately, TCEHY also more and more seems to move opposite to the US markets (negative correlation).

Depressed Q3 Expectations…

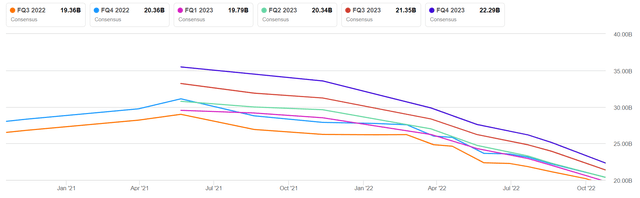

Tencent is expected to report earnings for the July-September period on 16 November pre-market, and analyst consensus estimates another ‘disappointing’ quarter.

Total sales are expected to be between $18.9 billion and $20.07 billion, with the average estimate being $19.36 billion. If an investor would assume the average as the anchor, Tencent’s Q3 sales are estimated to contract by about -13.1% as compared to the same quarter in 2021. EPS estimates are estimated at $0.47, which would imply a year-over-year growth of negative 7.9%.

Notably, according to analysts, Tencent’s total Q3 revenue would contract 2% quarter over quarter. But is such an assumption realistic? Investor should consider that Q2 was a very ‘bad’ period for the Chinese economy, and the situation should have improved by now – at least somewhat.

For reference, see below how sharply Tencent’s revenue outlook has deteriorated – according to analysts – since mid 2021. For Q3 2022, analysts cut sales expectations by about $10 billion, from close to $30 billion in 2021 to less than $20 billion as of October 2022. This is a greater than 30% cut within a 15 month period!

…Despite Improving Fundamentals

But I think analysts are too pessimistic here. In the press release commenting on Q2, Alibaba (BABA) management hinted that China might already be in an economic recovery: (emphasis added)

Following a relatively slow April and May, we saw signs of recovery across our businesses in June … We are confident in our growth opportunities in the long term.

And in the analyst call, Chief Financial Officer Toby Xu added, that Alibaba’s business sees…

… [a] positive trend of recovery continuing through July.

Similar statements have been made by Baidu and JD. And in the analyst call post-Q2, Tencent’s Martin Lau confirmed that (emphasis added):

our payment volume growth slowed to low single digits year-on-year in April and May when cities went through the COVID-19 shocks. And then accelerated to high-teens growth year-on-year in June and accelerated again in July.

Thus, with regards to sales, I believe that Q3 earnings season might bring some upside surprises for China’s big tech companies – including Tencent.

Moreover, regarding Tencent’s earnings, I would like to point out that the company has taken a few major ‘rationalization’ measures that to expand business profitability post-Q2. This should be clearly EPS accretive.

- Closed down certain non-core businesses – online education, eCommerce, game live streaming

- Rationalised underperforming businesses – loss-making digital content services, sub-scale social media products

- Tightened control on marketing programs – reduced selling and marketing expenses by 21% YoY

- Migrated all domestic in-house services to Tencent Cloud – enhanced cost efficiency

- Optimised workforce and controlled staff costs – total headcount down by ~5,000 QoQ

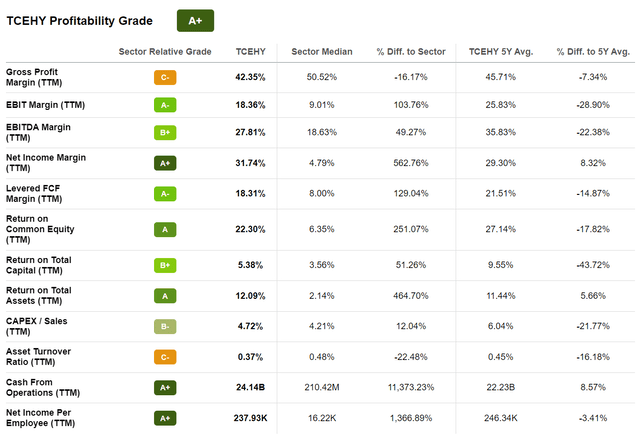

In any case, despite the economic headwinds, Tencent continues to operate a very profitable business – as highlighted below. And accordingly, any top-line expansion should materialize also in the bottom-line.

A Few Thoughts On Sentiment / Risk

The risk connected to investing in Tencent is arguably closely related to the risk from investing in China. Here are a few thoughts that I have written in my article on the Hang Seng index (HSI):

ADR delisting: The China Securities Regulatory Commission and U.S. Public Company Accounting Oversight Board have argued about on-premise audit inspections for multiple years. But the discussion heated up in late 2020/early 2021, and ADR investors got spooked. Although a preliminary agreement has been reached, the good news has failed to calm sentiment.

Taiwan tension: After Russia’s invasion of Ukraine, investors started to be concerned that China would invade Taiwan. The negative implication for China’s equity markets would be obvious.

Trade tensions/Semi-export restrictions: The trade tensions and the tech war has expanded to semiconductors, as the US government has imposed hard export restrictions on US chip technology. Investors now fear that such a move will cripple China’s AI emotions.

Internet/tech sector crackdown: From late 2020 and early 2022, China’s internet/tech companies such as Alibaba, Tencent and Meituan (OTCPK:MPNGF) have suffered from strong regulatory tightening. While the worst seems to be behind – given that no major action against tech/internet giants has been taken since months – investors remain spooked.

Especially relating to the internet/tech sector crackdown risk, Tencent management remains confident, that the headwind is turning to become a tailwind. As management highlighted in the Q2 analyst conference call:

… the recent regulatory direction is actually trending towards more positive tone for platform economy and the key message is like one to promote well-regulated, healthy and sustainable development, two, to complete the ratification, and three, to carry out regular supervision. And that’s reiterated in both the state council meetings as well as the politburo meetings in late July.

Valuation Even More Attractive

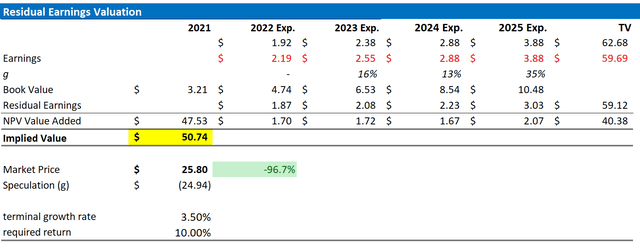

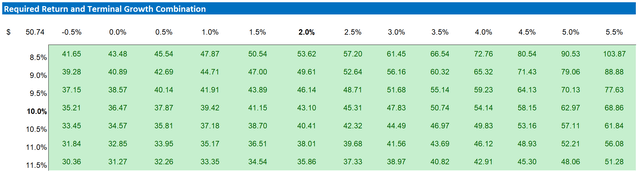

I liked Tencent’s valuation at $48/share. And I like the stock even more so at $25.8/share. But to reflect new information, I update my residual earnings model for TCEHY to account for preliminary consensus EPS adjustments, as well as for a material increase in ‘required equity risk premia’ for China-based investments, from 8.3% up to 10%. However, I continue to anchor on an 3.5% terminal growth rate (one percentage point higher than estimated nominal global GDP growth).

Given the assumption updates as highlighted below, I now calculate a fair implied share price of $50.47, versus $58.51 prior.

Analyst Consensus Estimates; Author’s Calculation

Below is also the updated sensitivity table.

Analyst Consensus Estimates; Author’s Calculation

Conclusion

Tencent stock is down about 44% since I have last covered the company and assigned a ‘Buy’ recommendation. But I continue to believe that investors should ‘Buy’ Tencent and ‘focus on the long-term’. As I argue in this article, Tencent’s fundamentals should already be improving versus Q2 2022, and although I acknowledge the paramount risk connected to a TCEHY investment, I believe valuation benefits outweigh risk concerns. To reflect new information, I update my residual earnings model for TCEHY now calculate a fair implied share price of $50.47, versus $58.51 prior.

Be the first to comment