da-kuk

Thesis

Eaton Vance Tax-Managed Buy-Write Opportunities Fund (NYSE:ETV) is an equity buy write fund from the Eaton Vance suite. As per the fund’s literature:

The Fund invests in a diversified portfolio of common stocks and writes call options on one or more U.S. indices on a substantial portion of the value of its common stock portfolio to seek to generate current earnings from the option premium. The Fund’s portfolio managers use the adviser’s and sub-adviser’s internal research and proprietary modeling techniques in making investment decisions. The Fund evaluates returns on an after tax basis and seeks to minimize and defer federal income taxes incurred by shareholders in connection with their investment in the Fund.

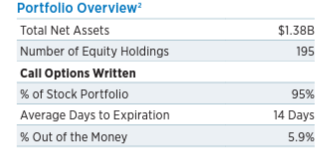

The fund currently writes options for most of its portfolio:

Portfolio Characteristics (Fund Fact Sheet)

We can see the vehicle goes for the short end of the skew curve, with an average expiration period for the written options of only 14 days. By writing out of the money calls the fund retains some of the upside during furious bear market rallies, such as the one we are currently experiencing.

Investors looking to hold exposures to the equity asset class but fearful of recessions are better served to allocate capital to funds such as ETV. The vehicle has significantly outperformed the S&P 500 this year (down only -10% now versus -17.6% for the index) and has suffered a much shallower drawdown as well (-15% for the CEF versus -25% for the index). The reason behind this outperformance is represented by the premium received on the written calls, premium which has served as a stream of income for the total return profile for the fund. Selling calls is equivalent to giving up the upside in a significant market rally. By virtue of being an options seller the fund pockets the premiums when the options are not triggered. Underwriting this strategy in a systematic way can be very profitable, and can result in substantial index outperformance in a year with elevated volatility such as 2022.

ETV represents an emblematic way to trade recessions or range bound markets because it is able to offer investors exposure to the equity asset class, but with a buffered downside profile. The safest way for a retail investor to position a portfolio during a recession is cash. Cash however can generate FOMO (fear of missing out) hence it is not ideal for a portfolio to be 100% in short-dated instruments. We are of the opinion that for portfolio construction purposes, when an investor is fearful of a recession, but still wants to retain exposure to equities, said investor should switch to a robust equity buy-write fund such as ETV.

The fund has delivered outstanding value and returns historically, and it is the proper way to trade recessions. The CEF however is currently overpriced, with a premium to NAV of over 15%. For the current market cycle the fund is already embedding in its premium the pricing benefit achieved via short vol positioning, but retail investors looking for an appropriate instrument to trade the next macro cycle should keep this fund on their watchlist.

Performance

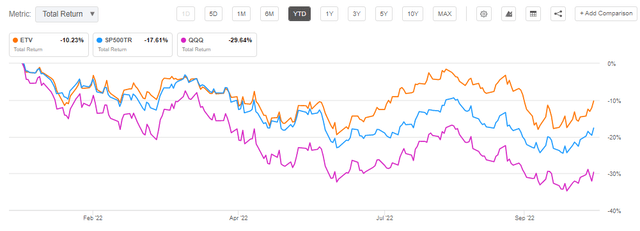

The fund is down this year, buy only modestly so when compared to the S&P 500 or the Nasdaq:

YTD Total Return (Seeking Alpha)

We can see the CEF being now down only -10% this year, versus -17.6% for the S&P 500 and -29.6% for the Nasdaq. We are including the tech index here because historically, ETV has had a technology overweight positioning when compared to the S&P 500:

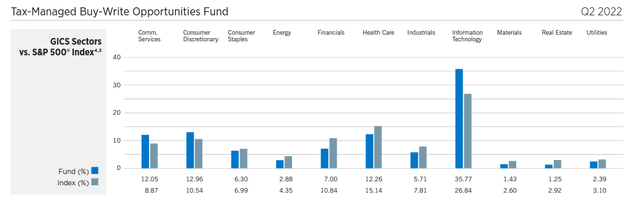

Sectoral Breakdown (Fund Fact Sheet)

We can see from the sectoral split that ETV has a 35% allocation to information technology, versus only 26.8% for the S&P 500. So while we cannot consider ETV a tech equity CEF, it is nonetheless tech oriented versus a pure S&P 500 buy-write CEF.

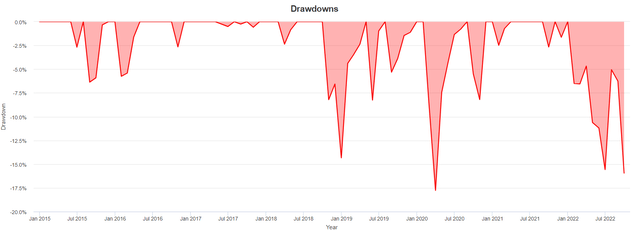

Not only has the CEF overperformed the index, but it has exposed a much shallower drawdown this year as well:

Drawdowns (PortfolioVisualizer)

We can see that so far this year the maximum drawdown (computed on a monthly basis), has been slightly above -15%, whereas the S&P 500 has seen a drawdown exceeding -25%. The reason behind this outperformance for the CEF is the buy-write strategy. Shorting volatility via calls is a profitable way to buffer a portfolio and monetize volatility.

Premium / Discount to NAV

The fund historically has traded at premiums to NAV:

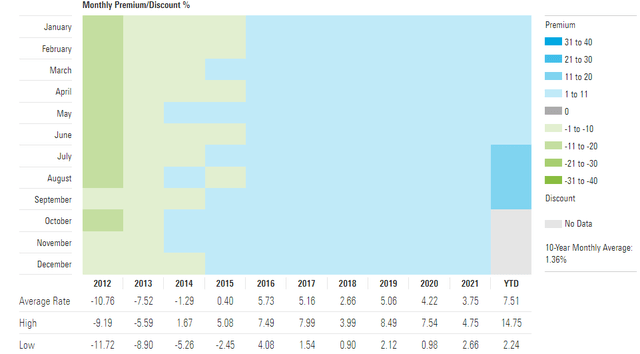

Historic Premium to NAV (Morningstar)

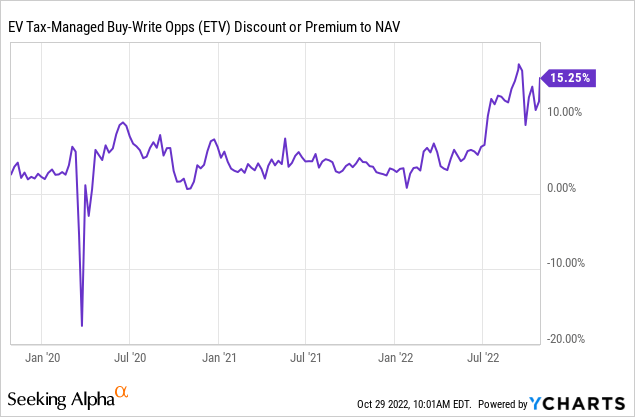

We can observe from the above table courtesy of Morningstar that the CEF has traded at average premiums to NAV of around 5%. This year has been a different story altogether:

We can observe how the premium has jumped to historic highs this year. The fund is now at an eye-popping 15% premium to net asset value. The market is basically pricing the high value of the systematic options, selling via the premium. We believe the premium is too high versus both historic levels and the value it offers.

Conclusion

ETV is a buy-write closed end fund. The vehicle has an overweight technology sectoral build, but has been able to outperform both the S&P 500 and Nasdaq indices in 2022. The CEF is down only -10% this year versus -17.6% for the S&P 500 and -29% for the Nasdaq. Furthermore, the CEF has exposed a very shallow drawdown as well when compared to the indices. While currently overpriced via a historic premium of over 15%, the fund is the proper way to trade recessions but still retain exposure to the equity asset class.

Be the first to comment