Dan Kitwood/Getty Images News

Company Description

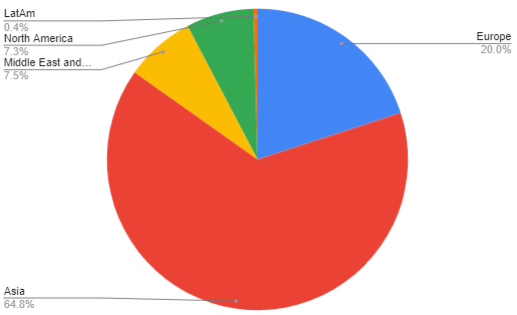

HSBC (NYSE:HSBC) (OTCPK:HBCYF) is a British multinational bank, providing several financial services including, commercial banking, lending services, wealth management and investment banking. HSBC operates across most of the world, earning the majority of its income from Asia.

See HSBC’s Profit before tax by country/territory.

HSBC’s profit before tax, by territory (HSBC Annual Accounts 2021)

HSBC stands for The Hongkong and Shanghai Banking Corporation and is the largest bank in Hong Kong. It was set up in 1866 in order to benefit from the opium trade between The British Empire and China. HSBC currently has a dual primary listing in the UK (FTSE 100) and Hong Kong (Hang Seng).

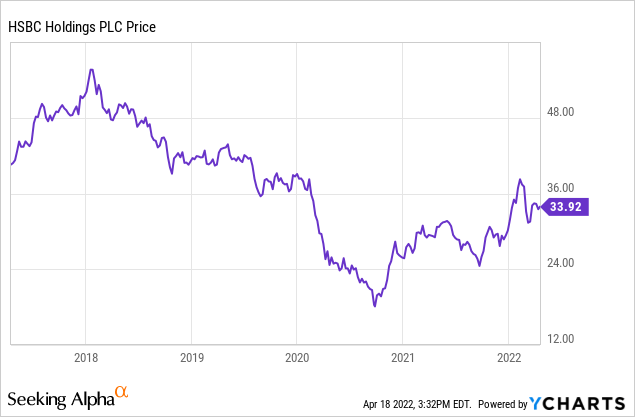

HSBC, like many European banks, has languished in the most-crisis period. This has been driven by greater regulation, record low interest rates and structural changes.

Investment Thesis

HSBC posted record profits in 2021, driven predominately by a reversal of expected credit losses. Due to the COVID-19 pandemic, many banks recognized large impairments against their loan books which subsequently were not needed and so reversed. With the slate wiped clean, we think HSBC is well positioned going forward.

We are seeing inflationary pressure globally, driven by a host of factors including, pent-up demand and greater liquidity from government support schemes. The expectation is for interest rates to increase further, as governments look to fend off a cost of living crisis. HSBC is primed to benefit from such an environment.

HSBC has been in a long period of internal improvement. It is a mammoth bank which has been trying to cut poor performing departments, and invest in better performing ones. Unfortunately, it has spent much of the last decade taking one step forward and two steps back. We believe many of the efforts of management are finally coming to fruition, and should mean improved performance in the coming decade.

Finally, HSBC is trading incredibly cheaply for the position it is now in. When we consider HSBC against its peers, we see it trading at an unjustifiable discount. This is while paying a strong dividend, which we believe should now continue uninterrupted.

Therefore, we consider HSBC a buy. Let us now consider the reasons in further detail.

Recent Update

Russia invaded the country of Ukraine in late February 2022. Governments were quick to sanction the Kremlin, and target those businesses operating within Russia. HSBC had no retail presence within Russia, with only a small team, which it is now winding down. Furthermore, they are avoiding providing new services to Russian individuals as a precaution going forward. This is important as many of HSBC’s competitors are currently struggling to untether themselves from their Russian businesses, and are paying the price for it. Citi’s (C) share price is down 16% since the invasion, compared to the S&P 500, which is up 2.4%.

Furthermore, In December 2021, HSBC was fined by UK regulators for failures in its money laundering procedures. This follows a previous fine from US regulators for the same infringement. This continued to add to the reputation HSBC held in many circles of being a criminal’s bank. It should however be said that these fines were for past infringements. In recent years, HSBC has invested heavily in improving its internal procedures to ensure this does not happen again.

In recent weeks, China and Hong Kong have begun re-introducing COVID-19 restrictions as cases begin to rise again. Chinese policy is extremely strict, with curfews and almost zero social interaction. Consequently, consumption will inevitably fall, with the economic by-products following suit. In order to combat this, the Chinese government has cut reserve requirements of banks, in order to provide support for demand. We have yet to see the net impact of this, but it will most certainly materially impact HSBC in the short-term.

Recent macro conditions have not been favorable for HSBC. Although the Russian invasion was navigated well, bigger issues look to be materializing in China. Prudently, we would expect any expansion in the loan book to be unlikely, and HSBC may once again need to reassess its credit impairment.

Economic Deep Dive

HSBC is a global bank, but the vast majority of its profits (67.5%) are derived from the UK, HK and China. Due to this, we must consider the economic outlook of these countries and how this will impact HSBC.

UK:

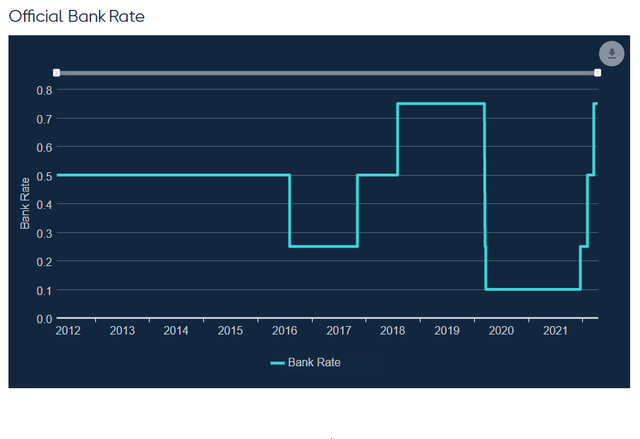

The British Chambers of Commerce is predicting steady growth within the UK, with GDP growing 3.6% in 2022, 1.3% in 2023 and 1.2% in 2024. This is far from impressive but we must consider this alongside interest rate hikes. The Bank of England has already increased rates to 0.75%, with three hikes in the last four months.

BoE bank rate (Bank of England)

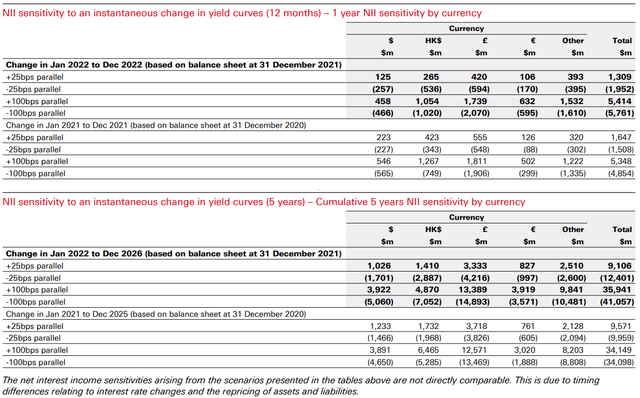

Further increases are expected in the near future as inflation continues increasing. This will benefit HSBC highly as the vast majority of its income is generated from its lending business. If we look at the table below, we can see HSBC’s sensitivity to a change in rates. Markets are currently expecting rates to rise to around 1.5% within the UK, this would be a 1.25% increase since fiscal year end. This suggests a strong tailwind for HSBC.

HSBC’s NII sensitivity to rate changes (HSBC’s Annual Accounts 2021)

Finally, consumer spending is expected to grow 4.4% in 2022. This underpins the steady GDP growth and suggests HSBC could expand its loan book as consumers look to finance these transactions.

Therefore, the UK economy is expected to remain robust, with some scope for growth. Irrespective of this, rate hikes should mean tailwinds are ahead in the medium term.

HK & China

Similar to the UK, Hong Kong’s growth is not expected to be high. The reason however is linked to COVID-19, with further restrictions in place due to outbreaks. This will act as a drag on spending and means an expansion in loans is unlikely in the short-term. We are expecting this to also be the case for China. This said, growth is expected to be much higher, at 5.1%.

Financial Analysis

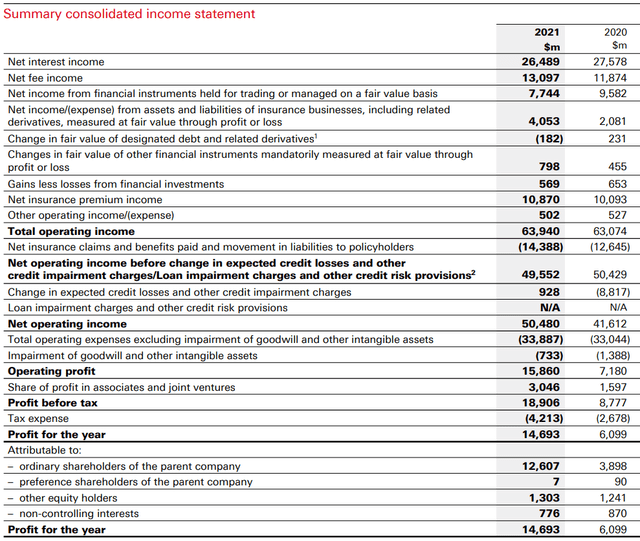

HSBC’s Consolidated Income Statement (HSBC’s Annual Accounts)

As we have noted already, the change in expected credit loss has wholly driven the record profits in the year. Compared to pre-COVID levels, HSBC remains flat. Given the economic and legislative environment in Europe, this is unsurprising. Most tier 1 European banks have been unable to grow beyond inflation.

The most impressive aspect of their performance is net fee income, which is up 10.3%. HSBC have been investing heavily in their wealth management operations and see this as an area of focus. It has a higher margin than retail banking, and has greater scope for growth.

These returns are in conjunction with a comfortable CET1 ratio of 15.8%. At this level, HSBC will be able to maintain its dividend payments and also execute its buy back program. Further, this gives sufficient liquidity, which protects against any downside risks.

ROTE however is a disappointing 8.3%. This indicates that the efforts to reshape the business are not yet successful. Given the size of HSBC, this is not going to happen overnight, especially when you consider that they do not have a tier 1 investment banking operation.

Relative performance to peers?

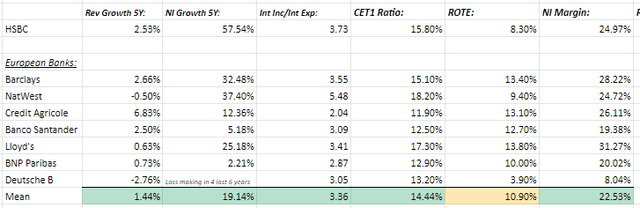

HSBC’s performance against its European peers (Tikr Terminal)

Generally, HSBC’s performance has been market leading. It is growing well and is slightly more profitable. This is while being the largest European bank by revenue, and having greater tier 1 assets on hand.

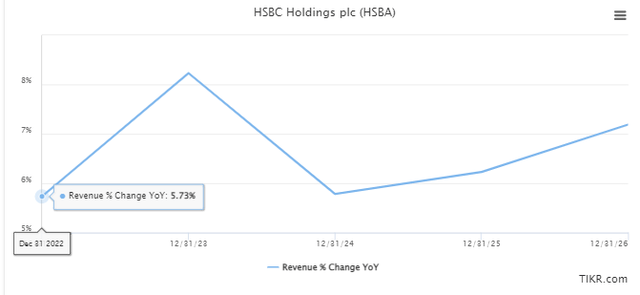

Analysts are guiding strong growth into 2022. This suggests a consensus belief that economic conditions will be net favorable for HSBC.

Analyst consensus revenue growth (Tikr Terminal)

Therefore, we believe HSBC is performing well. Its KPIs are above average compared to its peers, and is showing growth in higher margin areas. With fundamentals forecast to improve, we believe HSBC is a compelling proposition.

Expansion

As we mentioned above, HSBC is expanding its wealth management services in Asia. They have been hiring substantially and are committed to investing several billion dollars over the next few years, with the ambition to be the largest wealth manager by 2025. Given the level of growth we have already seen in the region, and the expected growth ahead, this will be substantially more fruitful than operations in Europe. The advantage here is HSBC’s brand value, it is one of the largest banks in the region and has a foothold in almost every large country.

To complement this, HSBC has acquired AXA’s Insurance arm in Singapore. The deal will allow HSBC to further support wealthy individuals in all aspects of their financial needs and ensures HSBC can provide a compelling service to clients. This shows management are clearly extremely committed to this strategy. European banks are limited somewhat in their ability to expand beyond the continent due to brand awareness, HSBC does not have this restriction.

Furthermore, HSBC has now taken a majority stake in its Chinese brokerage firm. Like many firms, HSBC received a license to trade via a JV, but now has regulatory approval to own a majority. This is significant as it gives HSBC the ability to expand more wholly into China, where previously it was not on a level playing field with domestic banks. Further, it quashes the long held belief that the Chinese government wishes to rein in HSBC.

Unlike most banks, we are seeing real investment into growing out their operations. If successful, this will drive real growth in the bank.

Valuation

We are thus bullish on HSBC, but must now consider if the bank can be acquired at a reasonable price.

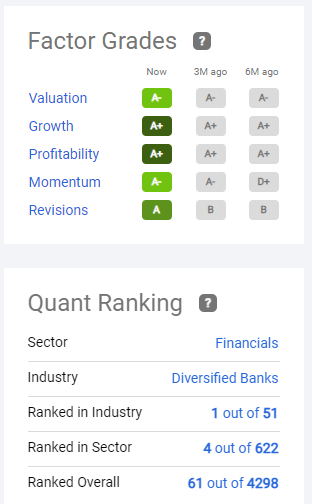

Luckily, Seeking Alpha has done the work for us. As we can see below, the bank currently has a valuation rating of A-, and is ranked no.1 in the industry.

Seeking Alpha’s assessment of HSBC (Seeking Alpha)

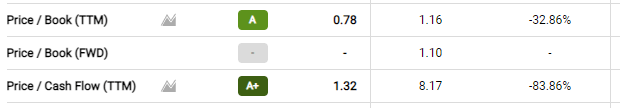

This is driven by 3 key metrics which HSBC significantly outperforms in, those being P/B, P/Cash flows and PEG ratio. A Price-to-book discount is expected given the poor ROTE relative to their peers, but the P/CF discount is substantial. Given that HSBC plans to maintain a strong dividend and buy back shares, this cash flow will directly translate to shareholder gains.

HSBC’s Valuation (Seeking Alpha)

Furthermore, their PEG ratio is below the industry average. This suggests markets either do not believe HSBC can meet its growth targets, or considers HSBC an inferior bank. We do not believe either.

HSBC’s Valuation (Seeking Alpha)

As a result, it is clear markets are not pricing HSBC correctly. We are comfortable that HSBC can stand toe-to-toe with its peers, yet is not valued as such.

We have also considered HSBC’s own valuation over the post-crisis period. What we see is that it trades at a discount to its mean by some 0.13x. Given the tough time it has had, especially in those early years, the book is as healthy as it has ever been.

HSBC’s historic P/B ratio (Tikr Terminal)

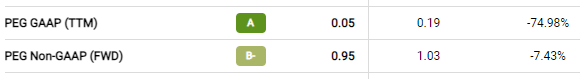

Further, the dividend yield is reasonable. We would be lying if we said it was good, but given that we are expecting returns via an appreciation in share price, we are not unhappy with this.

HSBC’s dividend relative to its peers (Tikr Terminal)

To conclude, we believe HSBC’s valuation to be very attractive. It is priced as if it is a weaker market participants.

Investment Risks

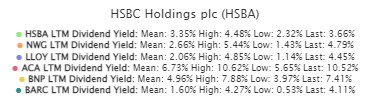

Downside risk comes from adverse macroeconomic conditions. There is growing fear that we may enter a period of stagflation, with growth falling and inflation remaining high. As of today, the yield curve has not inverted, with the two year gilt yield at 1.565% and the ten year at 2.118%.

UK Yield Curve (MarketWatch)

Final Thoughts

HSBC is arguably too big for its own good. It has gone through a long period of re-organization, trying to focus on successful areas of the business. The European retail arm will do anything revolutionary but should see an uptick in the short-term due to interest rate hikes. Our medium-term view is also bullish however, due to the investment in wealth management, which has the potential to be incredibly bountiful. We therefore rate HSBC a buy.

Be the first to comment