mattjeacock/iStock via Getty Images

On March 31, 2022, MSCI and SP Global announced that they are making substantial new changes in the GICS sector definitions, which will come into effect after the close of business on Friday, March 17, 2023. The details of those changes are discussed in this MSCI publication.

GICS is not an academic institution, nor is it an independent organization. GICS is a joint venture of Morgan Stanley Capital International (MSCI) and S&P Global (SPGI). Not so incidentally, S&P Global and MSCI are the companies that supply a great number of the indexes that all ETFs track.

GICS’s sector definitions are at times ludicrously arbitrary as they are assigned when stocks are young and often not changed when the issuing company’s business model changes. Thus, for years, Target (TGT) and Walmart (WMT) have been classified in entirely different sectors despite how similar their stores might be. But every so often GICS does change its sector definitions. The last time they did this was in 2018. Now they are going to be making major changes again.

The biggest changes to the GICS classification system that were just announced will affect the Information Technology sector. I have already discussed these changes and the ETFs they impact in this recent article: Tech Sector Investors Beware: The MSCI Tech Sector Is Losing Some Of Its Strongest Stocks. But GICS is also making big changes to the Consumer Discretionary sector and to a lesser extent to the Consumer Staples sector.

These changes, unlike those affecting the Information Technology sector, do not involve moving a large number of stocks completely out of the Consumer Discretionary sector, though several heavily followed stocks will be moved from the Consumer Discretionary to the Consumer Staples sector. Two other stocks will be moving to the Industrials Sector, and one stock will be moving to the Information Technology sector.

GICS Is Discontinuing The Internet & Direct Marketing Retail Subsector

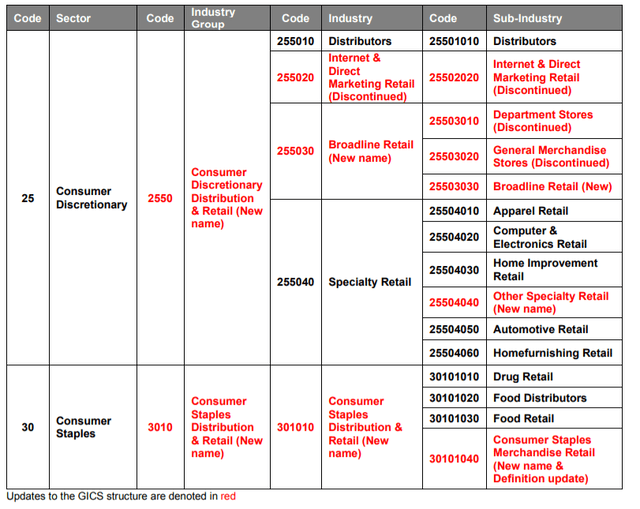

GICS’s changes to the Consumer Discretionary sector and Consumer Staples subsectors mainly consist of changes affecting their subsectors. As MSCI’s press release tells us,

S&P DJI and MSCI will discontinue Internet & Direct Marketing Retail and classify companies according to the nature of goods sold, merge General Merchandise Stores and Department Stores into a new Sub-Industry called Broadline Retail, shift consumable merchandise sellers to the Consumer Staples Sector, and update the GICS nomenclature for select Retail classifications by replacing the word “Stores” with “Retail

Here is the table they provided to clarify the changes they are going to be making to these sectors.

Changes to the Consumer Discretionary and Staples Sectors in 3/2023

What Stocks Will Be Affected?

On January 21, 2022, S&P Global published a document with links to a spreadsheet titled the SELECT LIST OF COMPANIES THAT MAY BE IMPACTED BY PROPOSED CONSULTATION ON GICS® STRUCTURE CHANGES IN S&P DJI INDICES.

The list includes the stocks with market caps greater than $2 billion that would possibly be reclassified if the changes which were being considered back in January were adopted. This list includes stocks traded across the globe. Not all stocks may have been listed as S&P tells us about this list that “certain companies are not included as they are subject to ongoing review by S&P DJII and MSCI.”

The March 31, 2022 press release tells us that not all the changes proposed in January were adopted. But those affecting the two consumer sectors have been.

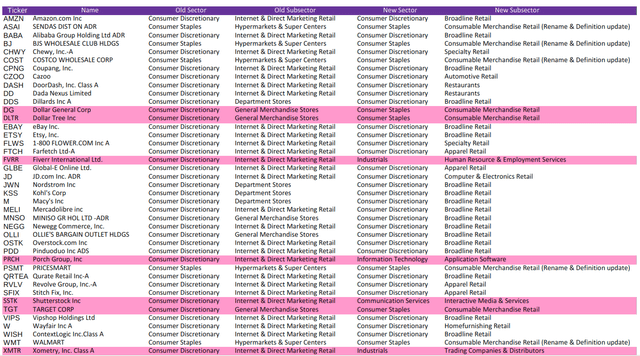

The chart below lists all stocks traded on US exchanges with market caps larger than $2 billion that may be affected, sorted by ticker. I have added in their tickers myself, as S&P Global and MSCI do not include ticker information.

Stocks highlighted in red are those that are being moved out of the Consumer Discretionary sector to a different sector. All other changes affect only subsector classifications.

Consumer Stocks Probably Affected by GICS Sector Changes

This may be especially significant information for owners of lesser followed stocks, Porch Group (PRCH), Shutterstock (SSTK), Fiverr International (FVRR) and Xometry (XMTR) because much of their trading may take place because they are held within sector ETFs and their sectors will be changing, possibly to ones less or more heavily traded.

The Timeline For These Changes

The press release informing investors of these changes tells us,

A select list of large market capitalization companies affected by the changes will be announced no later than June 30, 2022. The full list of companies affected by these changes will be made available to clients no later than December 15, 2022.

Furthermore, these changes,

…will be implemented as detailed below in GICS Direct and S&P DJI’s indices after the close of business (ET) on Friday, March 17, 2023.

Removing 6% or more of a market cap weighted ETFs holdings on a single day would be disruptive, which is what will happen to the Consumer Discretionary Select Sector SPDR Fund (NYSEARCA:XLY) when it loses the stocks currently in the General Merchandise Stores sector. To avoid this disruption index providers that use the GICS classification system may provide a “transition index” for ETFs that track the affected index. The ETFs will follow this index during a period of several months before the official change in the sectors takes place in March of 2023.

This is what happened in 2018 when the GICS sector definitions last changed. A footnote on the ETF’s profile page tells us that The Vanguard Consumer Discretionary ETF (VCR) went from following the MSCI US Investable Market Consumer Discretionary 25/50 Index until May 2, 2018. Then it started tracking the MSCI US Investable Market Consumer Discretionary 25/50 Transition Index through December 2, 2018. It has returned to tracking the MSCI US Investable Market Consumer Discretionary 25/50 Index since then.

Consumer Discretionary ETFs And Funds That Track The Entire Sector Affected By These Changes

The largest ETF affected by these changes will be the Consumer Discretionary Select Sector SPDR Fund. That is because Target, Dollar General (DG), and Dollar Tree (DLTR) are being moved to the Consumer Staples Sector. Together these stocks make up 6.14% of the total value of the XLY ETF. The other stocks moving out of the Consumer Discretionary sector are not currently held by XLY.

The Vanguard Consumer Discretionary ETF and its mutual fund share class, Vanguard Consumer Discretionary Index Fund Admiral Shares (VCDAX), will also be affected but to a lesser extent as the stocks listed as moving out of the sector makeup only 3.64% of its total value.

iShares sector ETFs are not affected as they do not use the GICS definitions to define the sectors they track.

Smaller ETFs that will also be losing holdings include the Fidelity MSCI Consumer Discretionary Index ETF (FDIS), the Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RCD), and possibly the Invesco S&P SmallCap Consumer Discretionary ETF (PSCD), though, since the list of affected stocks excluded small-cap stocks, holders will have to wait to see the final list of all stocks affected which will be published in December to know exactly what to expect.

The Invesco S&P 500 Equal Weighted Consumer Discretionary ETF may be the most heavily impacted of all these ETFs as each stock it will be losing will represent a holding of the same size as Amazon or Tesla.

Popular Consumer Discretionary ETFs that Track Affected Subsectors Are Probably Not Affected

The most popular of the ETFs that track online retailers is the Proshares Online Retail ETF (ONLN). It does not follow an S&P Global or Dow Jones index. The methodology document describing how the index it follows chooses stocks tells us only that,

The Index is designed to track the price movements of companies listed on a U.S. securities exchange that are deemed to be “Online Retailers”. In order to be eligible to be included in the Index, a company must be classified as doing business as an online retailer, an e-commerce retailer, or an internet and direct marketing retailer according to standard industry classification systems. Online travel companies are excluded. [emphasis mine]

This plural wording of “classification systems” doesn’t make it clear to what extent this ETF could be at all affected by the GICS sector changes.

The Amplify Online Retail ETF (IBUY) follows an index provided by the same index company that provides ONLN’s index, Solactive. It does not provide a methodology document online. What little information it gives us about IBUY’s index does not suggest that it would be affected by GICS sector changes.

As noted earlier iShares sector ETFs do not use the GICS sector classifications.

ETFs That Track The GICS Consumer Staples Sector

Several popular ETFs will be significantly affected by these changes, too. That’s because they will be adding the General Merchandise Stores stocks leaving the Consumer Discretionary Sector.

Those ETFs include the Consumer Staples Select Sector SPDR Fund (NYSEARCA:XLP), Vanguard Consumer Staples ETF (VDC), Fidelity Covington Trust MSCI Consumer Staples Index ETF (FSTA), and the Invesco S&P 500® Equal Weight Consumer Staples ETF (RHS).

How big an impact will be made on these ETFs by the addition of Target, Dollar General, Dollar Tree and any smaller companies can only be known after they are added to these ETFs, with the exception of Invesco S&P 500® Equal Weight Consumer Staples ETF which may be the most heavily impacted given that it will be adding at least three new stocks each making up as much of the ETF as all its other holdings.

A Few Closing Observations

The GICS classifications continue to be arbitrary. For example, Amazon is still classified as a retailer though a case could be made that its AWS cloud division and its sales of a variety of electronic devices should cause it to be considered an Information Technology company. Walmart and Target are now both in the same category in Consumer Staples, at last, after decades of being separated. But that change occurs just as Walmart has expanded into the same online marketplace that qualified Amazon to be considered a Consumer Discretionary company so many years ago.

Investors who buy sector ETFs and funds should be very aware of the arbitrary nature of the GICS classification system and its tendency to move stocks around to achieve “balance.” This balance is all too often achieved by weakening successful sectors by moving their top stocks to sleepier sectors, as happened when Alphabet (GOOG) (GOOGL) and Meta (FB) were moved from the Information Technology sector to the Communications Services sector in 2018.

The GICS’s tendency to change its sector definitions may also be a good reason to be careful with equal-weighted sector ETFs going forward as they can lose significant amounts of holdings when the GICS sector definitions are changed.

As the specific stock changes aren’t yet set in stone, keep an eye out for announcements of the large-cap stocks affected on June 30, 2022. If Amazon should actually move sectors, which could happen at some time in the future, it would have a very big impact on investors.

Be the first to comment