Jeff T. Green/Getty Images News

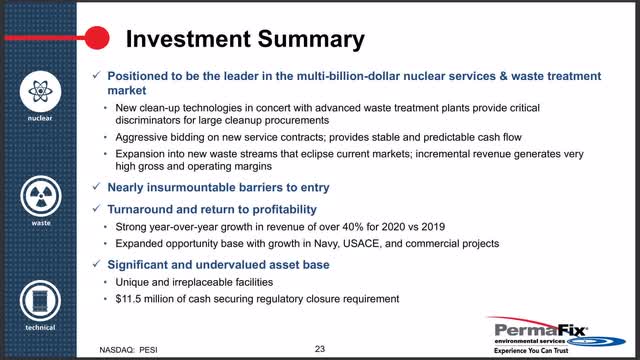

Perma-Fix Environmental Services (NASDAQ:PESI) is a company specializing in nuclear and mixed waste management treatment and services. While the company was stymied for two years by the Covid-19 pandemic, the future has never looked brighter. As Covid-19 has moved from pandemic to endemic, we are seeing a “return to normal” in most of society, including government agencies that have been some of the slowest to make this transition.

But for PESI, it appears the “return to normal” will be disproportionately bullish. I will highlight below several key indications provided by management on its recent 4Q21 conference call, which align with publicly available data on these matters. For those who wish for a brief background on the company, I recommend my previous introductory article on the company. For those who might prefer less detail than this article, or to hear my thesis via audio, you can tune in to my recent 10-Minute Podcast with Breakout Investors.

In short, I believe PESI remains on track to achieve the financial targets I outlined in that prior article. If PESI is able to do that, I believe the company’s shares could potentially triple from the current $5.50/share range within a relatively short period (i.e. the next 12-18 months).

PESI’s Recent Past

As noted, Covid-19 complications significantly and negatively impacted PESI over the past two years. Because PESI’s work relies on waste being created, the company was hit hardest by the pandemic in 2021. Throughout 2020, the company was able to work through prior backlog of waste, but since not as much waste was created in 2020 as during a normal year, business momentum slowed in 2021. Fortunately for the company and its investors, the worst of this situation seems to be in the rearview mirror. In fact, based upon multiple data points I will discuss in this article, I believe PESI will not only “return to normal,” but will far exceed its pre-2020 operational and financial performance levels.

Return to Normal – And Beyond

On the recent 4Q21 call I linked in the introduction, CEO Mark Duff noted he was “highly encouraged” by the pent-up demand PESI is seeing in its Treatment Segment. While noting some projects were delayed in 4Q21, he commented “they have all been mobilized now to full operation towards the end of this (i.e. 1Q22) quarter.”

The CEO continued by sharing some key metrics on bidding activity, which he indicated has a direct impact on the company’s revenue. According to Duff, the company was bidding on around 15 contracts per month in December 2021. However, in March 2022, the company bid on 28 projects—almost 100% more than just three months ago! Prior to this large increase, Duff said 20 bids a month was “pretty good,” while also noting that Q1, and March in particular, are “always our slowest” in terms of waste receipts and sales. So, given this significant uptick during what is normally the slowest quarter, Duff expressed he is “very encouraged” by the progress on the Treatment side of the business.

The Services Segment is also seeing abnormally high demand, with project backlog standing at approximately $66M. In response to a question I asked Duff on the 4Q call, he clarified that backlog is defined for the Services Segment as work that is (1) under contract and for (2) funded contracts. In other words, as he noted, backlog is only for projects with which the company has “a very high degree of confidence.” Further, Duff noted that revenue is normally recognized from backlog within 6-18 months of the contract being awarded. He concluded by stating “the majority of that [backlog] will be [recognized as revenue] this year. There may be $5-10M that would bump into the next year.”

To put this backlog of $66M in perspective, in FY21, PESI recognized $39.2M of Services Segment revenue. Deducting out even $10M from the backlog and moving it into 2023 revenue, we still see that the backlog alone represents 43% topline growth! Any new business won during the year will only make that number higher.

The final macro tailwind worth mentioning here is the approval of the 2022 federal budget. That budget allocates $900M in an incremental funding increase over last year within the Department of Energy’s (DOE) Office of Environmental Management. Duff “believe[s] this additional funding will support increased waste treatment and other projects through 2022.”

Related to that, Duff highlighted that PESI has been actively bidding on a number of new management & operating (M&O) type nuclear services projects within the DOE that will likely be announced later this year. He noted: “Some of these projects are quite considerable in size and [would] represent a substantial increase in sustainable revenue for many years.” So on top of an already expected 40%+ increase in Services segment revenue from backlog alone, PESI has yet another considerable growth opportunity with these possible M&O nuclear services projects.

While most of the United States is “returning to normal,” it appears PESI will be exceeding its own pre-pandemic “normal.” I will discuss in more detail some of the specific projects and areas that are likely to benefit PESI and its shareholders in the near future.

TBI – Hanford Site

By far the most lucrative possible future project that I hope to see in PESI’s near-future relates to the Test Bed Initiative (“TBI”) at the Hanford nuclear site. I wrote about some of the background details of this project in my previous article. In short, if PESI’s bidding conglomerate wins the business of the DOE at the Hanford site, PESI could more than double its pre-Covid annual revenue on that project alone.

According to a report from the National Academy of Sciences, PESI’s grouting and removal method of dealing with the waste at Hanford would save taxpayers $95B (yes, billion, not million!) over the multi-decade life of the project. Because of this, and because of the environmental benefits of PESI’s process, sources tell me that the Senators from Washington state (where Hanford is located) and the Representative from that district are supportive of PESI’s process to help clean up the Hanford site. In addition, there are local, influential business leaders publicly and vocally supporting PESI’s process because of the environmental and cost savings.

On the 4Q call, CEO Duff referred to two quotes from a March 25 Weapons Complex Monitor weekly publication: “In public comments, the DOE’s manager for the Hanford site recently stated, and I quote, ‘I would certainly like to execute the Test Bed Initiative as early as we feasibly can.’ He went on to state that funds are now available for both installation and removal of the needed equipment.” Duff continued: “In similar comments, [a regulator from] the Nuclear Waste Management for the Washington State Department of Ecology stated and, again, I quote, ‘We have TBI as a priority. Once an application is sent our way, if we have to pull resources from another program, we will in order to process that application.’ As you can see, TBI has certainly become a priority at both the federal and the state levels in Washington.”

As further proof of this project becoming a priority, Duff cited the recently enacted federal spending bill that includes an additional $7 million specifically allocated for the Test Bed Initiative in 2022. In that vein, he commented that the second phase of PESI’s demonstration will include extraction shipment and transportation of 2,000 gallons of tank waste to PESI’s facility in Richmond, Washington. He said DOE officials have stated the shipment of this waste to PESI’s facility should occur by late summer 2022. Following that, PESI expects the DOE to award the Hanford site more permanently in Q422. According to Duff: “They seem to be on track for that. They had orals earlier this month, and they’re on their way. So hopefully, they stick to that schedule. That will be important to us and all the other bidders as well.”

To be clear, an award for the Hanford site cleanup would be lucrative for PESI and its shareholders. But even if PESI never earns another dime from the Hanford site, their current core business is expected to grow significantly, based on several other projects I will now highlight below.

US Navy De-Commissioning

Another exciting growth opportunity for PESI results from the de-commissioning of submarines by the U.S. Navy. I detailed this in my prior article. But since that time, it appears the Navy is planning to de-commission two additional ships in the next 12 months, a fact highlighted by investor, Ross Taylor, in the 4Q21 conference call Q&A. In response to Taylor’s probing, CEO Duff noted there are nine ships coming, and one or two will be nuclear subs, on which PESI’s team will work.

Duff emphasized: “There’s not a lot of other commercial contractors on the ground [that can do what we do]. So we’re pretty confident we’ll have a good shot at the work.” Still, Duff cautioned: “It’s going to be difficult to predict [the amount of work] in the next two quarters. But certainly, by the end of Q2, we’ll have a better schedule of what’s coming up.”

To give a sense of the materiality of this work to PESI, I want to draw attention to Duff’s following comments: “[The first ship] is in the $40 million to $50 million range [and] is probably one of the smallest jobs. And I think there’s a lot of ships in between, between $50 million and $200 million each. It all depends on the level of contamination.” As you can see, even “one of the smallest jobs” is highly material to PESI, representing well over 50% of PESI’s FY21 revenue.

International

Yet another growth opportunity for PESI is in the international market, most specifically in Europe. To this end, in early March, PESI announced a joint venture with Westinghouse UK targeting waste treatment in Europe. While PESI is getting this operation up and running, they will be shipping and treating waste from Europe at their American facilities.

In response to my questions about European opportunities, CEO Duff mentioned on the Q4 call that PESI is receiving a second shipment from Germany right now. He further noted the company is receiving two other waste streams from two different countries in Europe (he was unwilling to provide further details on the specific countries involved).

Overall, Duff commented they are looking at 10-12 “very specific waste streams” that he believes they can treat “in the next 18 months.” He said the value of those is between $500,000 and $20M per project. And, of course, additional opportunities will open up once the joint venture facility opens with Westinghouse UK (likely in 18-24 months).

MATOC Opportunities

The final growth opportunity worth noting for PESI at this time relates to multi-award task order contracts (“MATOCs”). As detailed in my previous article, PESI has been named on several of these types of contracts for multiple different projects, with some budgeted to spend up to $95M. These MATOCs allow a small, select group of companies to bid on task orders with limited competition. In short, once a company has been named on a MATOC, it is quicker and easier for them to be awarded an order that falls under the MATOC’s purview.

According to Duff, PESI anticipates awards from these contracts to begin in 2Q22 or 3Q22. These MATOCs provide yet further upside for PESI.

Risks

By far the biggest risk to PESI relates to the highly-regulated and sensitive environment in which they work. If PESI were to make a major environmental mistake, the company could be materially fined. Overall, the company maintains a strong record of safety and security, but this is always a risk in PESI’s type of business.

The second risk worth mentioning is that any resurgence of the Covid-19 virus could delay PESI’s progress. While this risk seems relatively low right now, I do not believe we can completely discount the risk until we get through what is normally referred to as “the flu season” without Covid becoming a big problem.

The third risk worth noting is that PESI operates under several fixed-rate structure contracts. Mistakes made in calculating their rates versus what it actually ends up costing PESI could materially alter PESI’s margins and, thus, bottom line.

Valuation

In my introductory article to PESI (linked in the introduction) I provided a detailed model for the company for 2022-2024. My valuation for the company has not materially changed, so I will simply reiterate some of my key assumptions here, as well as my revenue and EPS estimates from my model. If you want to see all the details that helped me arrive at these numbers, I recommend you refer back to that article.

2022 Assumptions & Estimates

I believe PESI will return to pre-Covid revenue and margin numbers on its core business. In addition to that, I estimate the company will add around $10M in new international work; $20M for MATOCs; and $20M from submarines. The Hanford site, I predict, will be relatively immaterial to PESI’s 2022 numbers, although I think the stock might very well rally if the company’s bidding conglomerate wins the Hanford contract that could be announced late in 2022. In fact, if that happens, it would not surprise me to see PESI acquired by a much larger company for a hefty premium to market prices at that time.

In any case, based on these assumptions, I show PESI earning $155M in revenue with EPS of $1.22/share. EBITDA is estimated to be $20.4M. My fair valuation for these expectations would lead to me valuing PESI at $15.20-18.35/share. This represents roughly 200% upside from current prices.

While I am not “predicting” that PESI will triple within the next twelve months, I believe that even if my model is overly optimistic, you can see plenty of upside from the $5.50/share price at which shares have recently been trading. To that end, I see PESI being able to earn around $0.75/share if they are merely able to return to their 2020 revenue numbers (roughly $100M in revenue).

2023 Assumptions & Estimates

I expect 2023 will be the year when PESI really begins to take off from a revenue and EPS standpoint. However, as I noted in the subsection above, the stock price might move materially before that if PESI wins the Hanford site contract. The reason for that is that if PESI wins that contract, they will almost certainly treat at least 300,000 gallons of waste from Hanford, at roughly $70/gallon revenue, in 2023.

In addition to Hanford picking up, I would expect the international business to begin increasing and for the submarine work to move higher as well. You can see those respective sections above to learn why I think this is a reasonable assumption.

With all these factors taken into account, I estimate FY 2023 revenue for PESI of $220M, EPS of $2.00/share, and EBITDA of $31M. The midpoint of my fair valuation calculations is around $26.85/share, nearly 400% returns from current prices.

2024 Assumptions & Estimates

My estimates for 2024 are nearly unbelievable if one does not run the math and do the research. If PESI wins Hanford, they expect to be able to treat at least 1M gallons of waste per year (likely eventually more) once the project is fully operational. My 2024 estimates take that into account, as well as assuming modest increases in international and submarine business.

All of these assumptions lead me to estimate PESI’s 2024 numbers as $285M of revenue, EPS of over $3.00/share, and EBITDA of $46M. These numbers would lead me to valuing PESI at around $40/share, well over 600% higher than today’s prices.

Conclusion

I understand it seems impossible, at first glance, to envision a waste management and services company going from FY21 revenue of $72M to FY24 revenue of $285M. However, my assumptions and estimates are clearly explained and based on publicly available data that supports them. There are obviously many ways PESI and its investors can succeed that is somewhere between $5.50/share and the $40/share possibility I mention by 2024.

But one thing is clear to me: PESI is worth a core position in my portfolio, most especially at this $5.50/share level. The company is coming out of a once-in-a-lifetime headwind (a global pandemic), with multiple tailwinds to help them sail forward. The company’s current Services backlog alone indicates at least 40%+ revenue growth from that segment, before factoring in possible new contracts. In addition, they appear to have material opportunities for new business related to international expansion, MATOCs, and the de-commissioning of U.S. Navy submarines. On those prospects alone, the stock is likely a buy at $5.50/share. But add to that the Hanford site possibility, and I believe PESI is a no-brainer to be in a small-cap portfolio.

Be the first to comment