jetcityimage/iStock Editorial via Getty Images

As markets continue to focus on what Elon Musk plans to do with Twitter (TWTR), this week marks a more important point for the business he actually has control of. Electric vehicle maker Tesla (NASDAQ:TSLA) will report its Q1 results after the bell on Wednesday, and this will be a very interesting earnings report. With inflation fears and the Shanghai factory shutdown dominating the headlines, investors have a lot of business questions on their minds. Today, I’d like to examine the most important items to watch in this week’s report.

Tesla set a quarterly delivery record during the first quarter of this year, although the Shanghai factory shutdown meant production was slightly lower than Q4 2021 levels. As I discussed in my previous article linked above, there are a number of reasons to believe Tesla will report more revenues than the $17.72 billion it did for Q4. There were more Model S/X sales, which obviously helps selling prices, a lower mix of leased vehicles, and Tesla has continued to increase prices in recent quarters. The Street is currently looking for almost no sequential revenue growth, but as I continue to detail, a number of analysts have kept their estimates ridiculously low. There’s one estimate out there still calling for $14.33 billion, which either hasn’t been updated in quite a long time or is an intentional low number designed to help Tesla’s chances of beating.

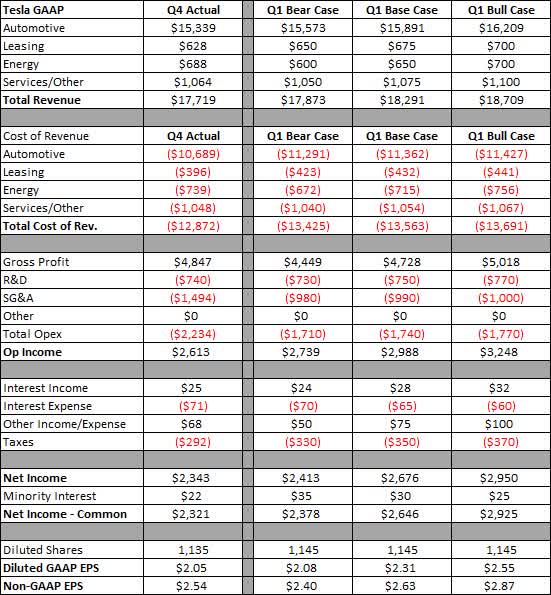

The more important item here for investors is the company’s margin profile. Average selling price tailwinds that I discussed above would normally boost margins, but we’ve also seen a lot of commodity inflation that could limit those gains. Tesla also was beginning to build vehicles in its Berlin and Austin factories during Q1, so those start-up costs will hurt in the near term. On the operating side, Elon Musk’s pay package and options expiration caused some large one-time expenses to be reported in a messy Q4, and those won’t be repeated in Q1. In the graphic below, I’ve provided my usual three cases for what Tesla could report for Q1, with dollar values in millions except for per share amounts.

Tesla Income Statement Cases (Author’s Estimates, Q4 Results)

As usual, I think analysts are even more bearish when it comes to the bottom line. Tesla has beaten on non-GAAP EPS in 9 of the past 10 quarters, with every quarter last year being at least a 15 cent beat. My $2.63 figure may look a bit high when you see the Street average at $2.26, but my base case would only be the 4th largest beat in this now 11-quarter period. I’m assuming a little more than 175 basis points of GAAP gross margin compression here, and of course, the actual number could vary a bit depending on Tesla’s credit sales for the period. With Elon Musk’s major pay package having mostly been accounted for, the spread between GAAP and non-GAAP EPS shouldn’t be as large as we’ve seen in recent quarters as overall stock-based compensation should be lower.

Perhaps the most important item investors want to hear about is Tesla’s current production status. The Shanghai factory has been shut down since late March, which is going to meaningfully impact the company’s Q2 results. Even when Shanghai opens up again, it’s expected to take some time to get back to full production, especially as the supply chain remains in limbo. This is also supposed to be the first quarter where the Berlin and Austin factories contribute more than just a token amount of vehicles. It will be interesting to see if management details any current production run rates for these factories, as they are a big part of Tesla’s growth story moving forward.

With many investors not too concerned with the near-term numbers, there will be plenty of questions asked about some of the major projects ongoing. Both consumers and investors are curious to hear how the 4680 battery ramp is coming along and what that will mean for the new Model Ys coming out of the Austin factory. I’ll be curious to see if Tesla provides any major updates this week on some of the delayed items such as the Cybertruck, Semi, and Roadster. Tesla is also expected to announce locations for new gigafactories this year, but I don’t know if we’ll get that information just yet.

As for Tesla shares, they closed Thursday at $985. Shares were pressured that day, and could see some more pressure in the near term if investors worry that Elon Musk may need to sell more Tesla shares to finance a potential Twitter purchase. While Tesla shares have certainly bounced around, the most recent close is fairly comparable to the average Street price target of $967 currently. I don’t think the Q1 headline results are going to do anything major to change the narrative in the long run. Investors will likely focus more on how the two new factories are ramping and what the Shanghai shutdown impacts are for Q2 and perhaps beyond.

In the end, Tesla will report Q1 results this Wednesday while everyone seems to be focusing on the Elon Musk and Twitter saga. Investors will be watching to see how commodity price inflation is impacting the bottom line, and how quickly the two new factories are ramping production. A Covid shutdown in China will certainly impact the company’s Q2 results, but the Street is more concerned with the long-term picture. With shares still trading near $1,000, the company will need to show that the overall growth story is still looking good and that new projects aren’t going to see further delays.

Be the first to comment