Sundry Photography

Arista Networks (NYSE:ANET) reported a better-than-expected Q3, with revenue coming in around 10% above expectations and operating margin expanding nicely, despite ongoing pressure on gross margin. Q4 guidance was also stronger than expected, which was encouraging given the ongoing difficult macroeconomic environment. See how it performed in Q2 here – Arista Networks: Another Strong Quarter, Remaining Bullish Here

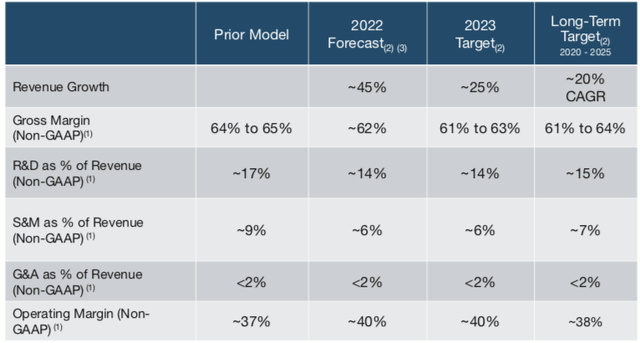

Shortly after reporting earnings, the company hosted an analyst day where they talked about their competitive differentiation and their long-term financial targets. With revenue growth expected to be ~25% CAGR over the long term, they are clearly taking market share.

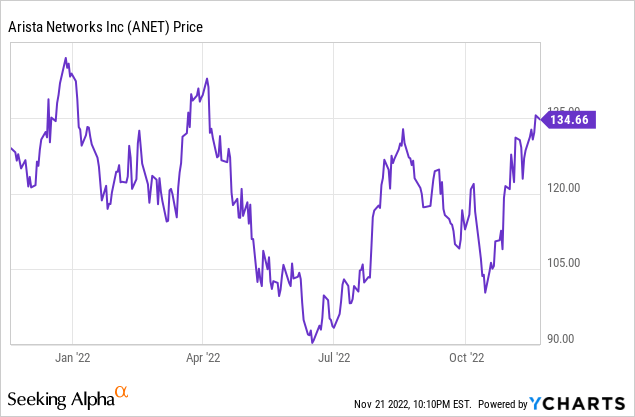

While the stock has remained pretty resilient so far this year, down only ~10%, I continue to believe there is a lot of long-term upside remaining.

Yes, ANET already trades at a premium valuation with the stock currently ~25x 2023 EPS, but the company’s superior revenue growth and margin profile demand a premium valuation. Over the long-term, as the company continues to execute beat-and-raise quarters, I believe ANET’s valuation gap could widen against competition.

Financial Review and Guidance

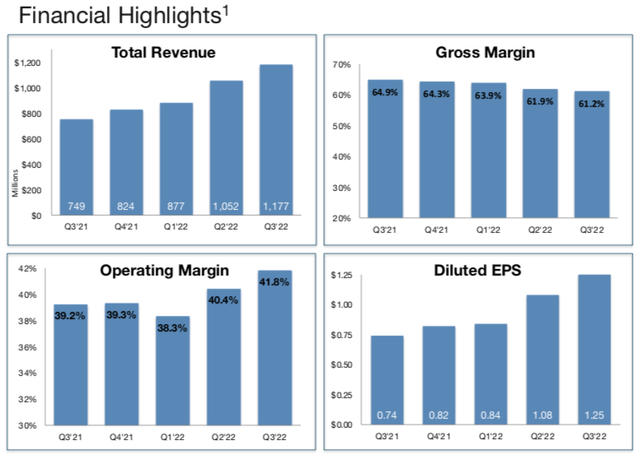

Revenue during Q3 grew an impressive 57% yoy to $1.177 billion, which came in well above consensus expectations of $1.065 billion. Further breaking down revenue, product revenue grew 67% yoy to $1.01 billion, and represented over 85% of total revenue. Services revenue grew 16% yoy to $168 million.

On one hand, gross margins continued to decline, with Q3 coming in at 61.2%, down from 61.9% last quarter and down from 64.9% in the year-ago quarter. Gross margin continues to be pressured from higher costs related to their supply chain, which will likely continue into 2023.

However, ANET continues to do a great job with their expense controls, delivering non-GAAP operating income margin of 41.8%, up from 39.2% in the year-ago period. In addition, as the company continues to scale, they will experience greater operating leverage, thus further benefiting their margin profile.

The better-than-expected operating margin led to EPS of $1.25, above expectations of $1.05.

During Q3, management commented about their strong cloud titan growth and customer momentum.

We are experiencing one of our best ever cloud titan growth and revenue this year since IPO. Therefore, we expect north of 45% contribution in 2022 from this category with a diversified product portfolio and use cases

As I mentioned previously, our customer momentum continues. Our $1 million logos have doubled in the last 3 years and Arista’s market share in 100, 200 and 400-gig ports climbs placing us at a number market leader position according to many industry analysts.

Arista Network

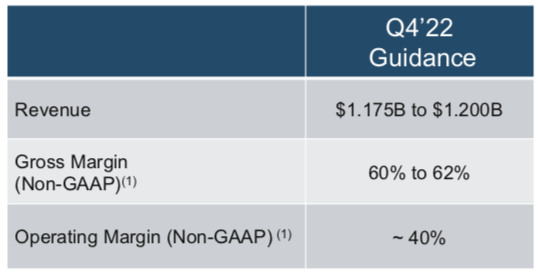

For Q4, the company expects revenue of $1.175-1.2 billion, which was above expectations for $1.09 billion. Non-GAAP gross margin is expected to be 60-62% (similar to Q3 of 61.2%) and non-GAAP operating margin of ~40%.

In early November, shortly after the company’s earnings, they hosted an analyst day where they provided long-term financial targets.

Impressively, the company is expecting 2020-2025 revenue growth of ~20% CAGR, which includes ~25% revenue growth in 2023. Part of this revenue strength is being driven by enterprise strength as well as cloud customer demand remaining consistently strong. Given ANET’s consistent customer base and impressive cloud titan growth, it’s no surprise revenue growth is expected to remain healthy over the coming years.

And despite the ongoing macro headwinds, gross margins are expected to reach 61-64% over the long-term, which compares to 2022 gross margin ~62%. Moving further down the financial statement, operating income margin is expected to reach ~38%, which is a slight contraction from ~40% in 2022. While there is some considerable variability within gross margin, ANET is also expected to moderately increase their R&D and S&M expenses as they continue to build out their competitive advantage.

Over the longer-term, I do believe there are additional operating levers the company may have to expand margins, which leads me to believe there could be some upside to operating margin targets.

Valuation

Despite the challenging macro environment, ANET has held in pretty well, with their stock only down ~5% so far this year. And since the company reported earnings on October 31, the stock has been up over 10%.

As the company continues to execute on the top line and demonstrate their ability to move up market to larger enterprises, investors have gained more confidence in the long-term growth potential.

Additionally, the company hosted a positive investor day, providing strong long-term financial targets that seem quite achievable, and possibly beatable.

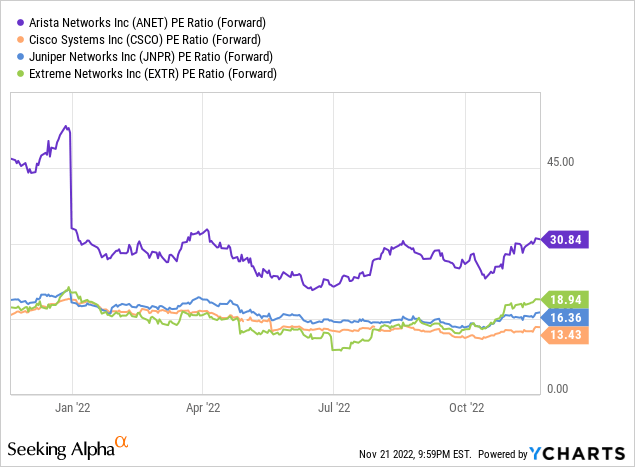

ANET has historically traded at a premium to their competition, driven by their superior revenue growth and margin profile. However, this also makes valuation a little more challenging to gauge since ANET already trades at quite a premium valuation.

Currently, consensus expects 2023 EPS of $5.40 (per Yahoo Finance), which implies the stock is currently trading at ~25x 2023 P/E and this remains well above the peer group range of 13-19x.

Given the challenging macro backdrop, it seems a little challenging for the stock to reach 30x P/E in the near-term, however, if the company continues to put up beat-and-raise quarters, the higher EPS growth figure could lead to some multiple expansion.

For now, I continue to remain bullish on the long-term growth trajectory for the company and given their continued push in enterprise territory, I believe revenue growth could surprise to the upside over time.

Be the first to comment