HuyNguyenSG/iStock Editorial via Getty Images

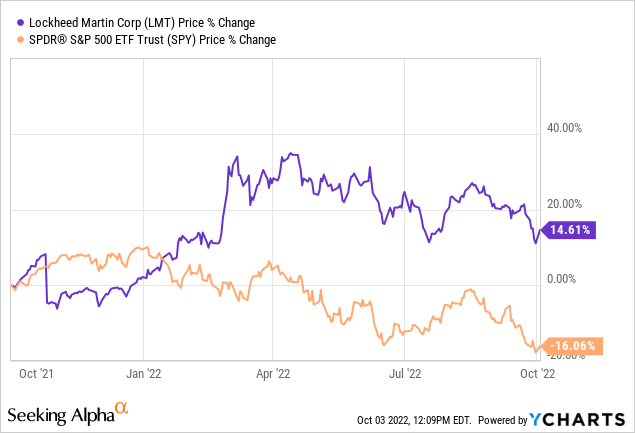

Lockheed Martin (NYSE:NYSE:LMT) has been an outlier in 2022’s bear market. The stock’s outperformed the S&P 500 comprehensively due to various exogenous and endogenous reasons. However, many investors might be coy about the stock given the bear market’s persistence and Lockheed’s second-quarter earnings miss.

Even though Lockheed has a few challenges to deal with, we believe the stock’s well-placed to outperform the broader market until the end of the year and possibly beyond; here’s why.

Operational Review

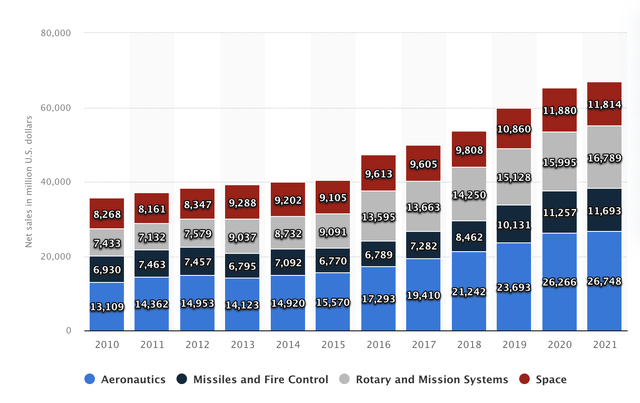

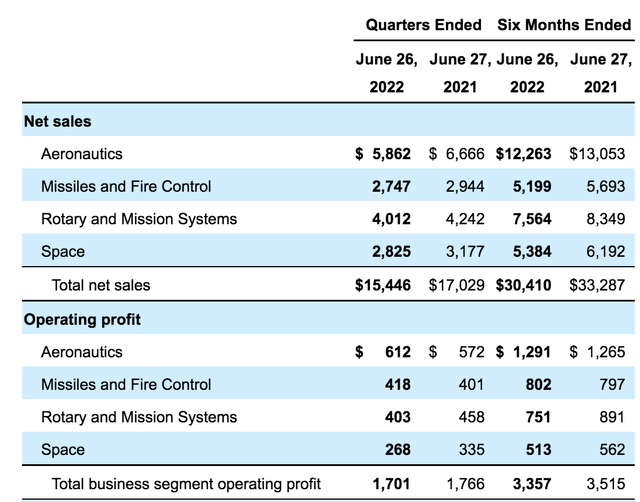

Although it’s a well-diversified company, Aeronautics is Lockheed’s cash cow. The company’s F-35 fighter jets are clearly popular, and its latest $6 billion supply contract with the Swiss government proves the point. Furthermore, the company’s Missiles and Fire Control operating margins widened by 4.2% (year-over-year) in its second financial quarter, which is impressive considering the past year’s rising inflation.

Cumulatively Lockheed’s growing at a compound annual growth rate of 5.51%, which is beyond solid for a company that operates in a mature industry.

Further analysis of Lockheed’s income statement conveys the company’s resilience during a trying macroeconomic climate. Lockheed’s 8.6x DOL (Degree of Operating Leverage) means the company’s operating earnings aren’t overly sensitive to its top-line sales. Therefore, Lockheed stock can definitely be viewed as a recession-resistant asset.

Source: Seeking Alpha

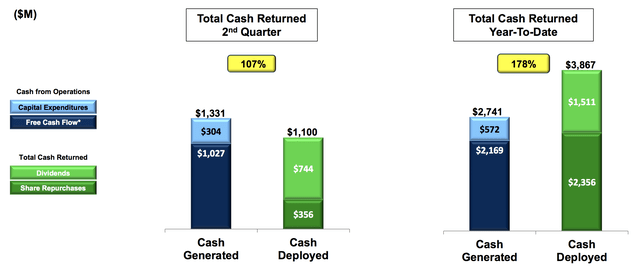

Lastly, Lockheed’s cash flow statement communicates two factors that investors should be bullish about. First is the company’s year-over-year surge in shareholder compensation (see the diagram below). In isolation, the company’s aggressive share repurchases support a higher valuation, providing investors with potential capital gains support.

The second feature I’d like to outline is Lockheed’s aggressive CapEx, which could add to the company’s broad-based growth.

Geopolitical Frictions

I’m sure you’ve heard that the era of moderation is coming to an end. But what does this mean exactly?

Economic growth over the past 40 years has been moderate and accommodated by tame inflation. This period of moderation surfaced after the post-World War II growth period, in which the economy went into overdrive.

What has caused moderation to wane?

Factors such as divergence between global powers, rising inflation in exporting nations, and slowing labor productivity in developed nations have caused global economic growth to slow significantly in recent years. Moreover, artificial economic stimulus and supply-chain concerns during the COVID-19 pandemic acted as catalysts to what could be the end of moderation.

Why is all of this important to Lockheed Martin?

The end of moderation plays a key hand in Lockheed’s prospective sales. Global leaders aren’t unaware of post-moderation symptoms, which are typically characterized by global conflict. Evidence suggests that conflict is brewing with the war in Ukraine, rising right-wing populism in Europe & North America, surreal civil conflict in emerging nations such as Sri Lanka, and rising tensions in the South China Sea. Therefore, it’s likely that governments will start stocking up on defense systems, as we recently saw with Germany’s $107 billion defense spending boost.

Lockheed is a key supplier to various governments (including the U.S.) and supplies various private markets around the globe. In essence, various systemic tailwinds could assist Lockheed in the coming years.

High-Yield Attributes

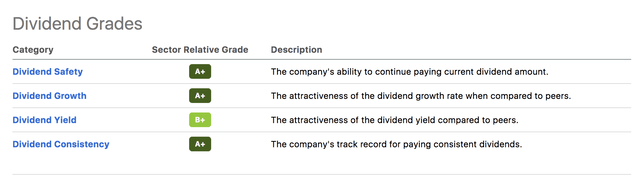

Lockheed’s dividend yields impressively at 2.90% and is well covered by $8.95 billion in cash from operations. The stock has recorded 19 consecutive years of dividend growth, in the process developing a loyal investor base as conveyed by its low Beta coefficient (0.66x), which labels the stock as a low-volatility investment.

| D.Yield (fwd) | 2.90% |

| Dividend Coverage | 2.36x |

| Cash From Operations | $8.95 billion |

Source: Seeking Alpha

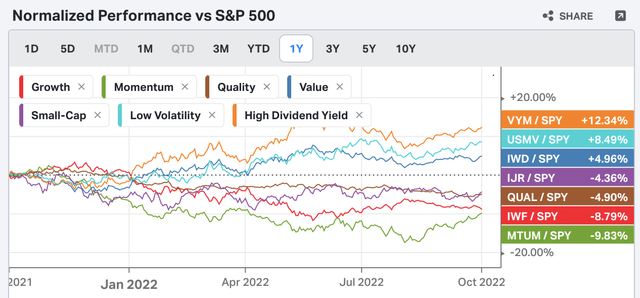

Lockheed’s high dividend yield doesn’t just provide investors with excellent income-generating prospects but also places the stock in a popular market segment. I say this because high dividend stocks have outperformed the S&P 500 over the past year due to risk aversion (among many reasons).

Furthermore, I mentioned Lockheed’s Beta coefficient for a specific reason. The chart below shows that low-volatility stocks have also outperformed the broader market in the past year, which is typical during periods of economic turmoil.

Collectively, Lockheed is characterized as a high-yielding, low-volatility stock, which is precisely the type of asset to own in today’s risk-off market climate.

Potential Risks

Although I’m generally upbeat on Lockheed stock, there are a few concerns that investors should take note of.

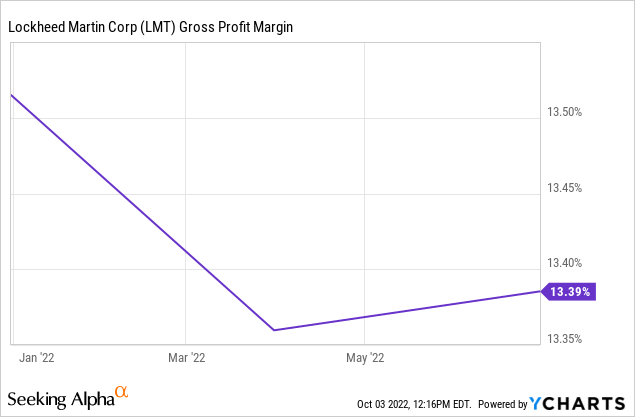

Firstly, Lockheed is clearly suffering from rising input costs as its gross profit margin of 13.39% is compressed. In addition, Lockheed’s second-quarter earnings miss included softening growth in key segments as its Aeronautics and Space segments slipped by 12% (year-over-year) and 11% (year-over-year), respectively. Even though I anticipate these segments to recover, it’s clear that potential softening in growth needs to be considered.

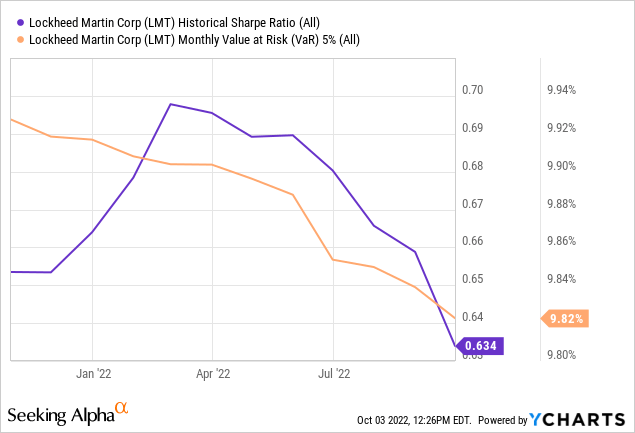

Furthermore, Lockheed’s Sharpe Ratio falls below 1; therefore, it needs to be considered that the stock exhibits poor risk/return prospects from a quantitative vantage point. Also, the stock’s monthly 5%VaR of 9.82% means it tends to draw down by more than 9.82% in at least 5% of its traded months, which isn’t ideal to see during a bear market.

Concluding Thoughts

Lockheed is classified as a low-volatility, high dividend yield stock, placing it in an ideal segment to outperform today’s shaky market. Moreover, Lockheed’s operational efficiency is admirable as it exhibits a high degree of operating leverage.

Lastly, Lockheed provides a compelling shareholder compensation package with share repurchases bolstering the stock’s valuation.

If you’re interested in more advanced analysis, be sure to keep an eye out for our marketplace program, “The Factor Investing Hub,” which launches soon. FIH is an AI-driven “smart beta/factor investing” portfolio management concept with the goal of balancing long-term portfolios relative to “factors.”

Be the first to comment