PhonlamaiPhoto

Thesis

We updated investors in our June article to use the rally from its May lows to cut exposure to CRISPR Therapeutics AG (NASDAQ:CRSP) stock. However, our sell thesis has not played out accordingly, as the market subsequently bottomed in July, helping stanch further bearish bias.

Furthermore, healthcare stocks could also have staged a long-term bottom, which lifted sentiments in speculative stocks like CRSP. Therefore, we posit that CRSP seems unlikely to re-test its May lows, given our conviction of its long-term bottom.

Notwithstanding, we observed that the market had used the surge in buying momentum in July to deny further upside in CRSP. The recent sell-off post Q2 update also led to further downside in CRSP, leading it to give back all its August gains.

However, we noted that buying support seems to have returned to CRSP, suggesting that further selling downside could be less intense.

Given the constructive price action developments over the past two months in CRSP, we are ready to re-rate CRSP as we posit that its price action looks more well-balanced.

Accordingly, we revise our rating on CRSP from Sell to Hold.

CRSP Has Given Back All Its August Gains

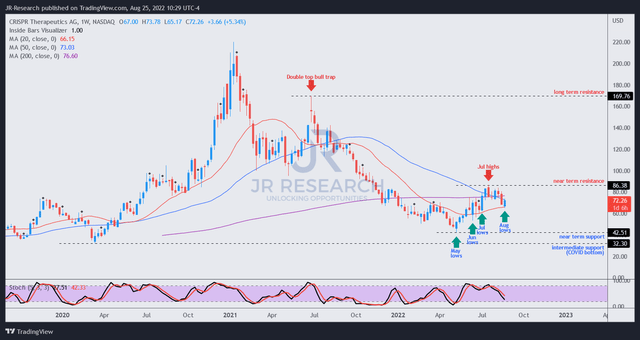

CRSP price chart (weekly) (TradingView)

As seen above, CRSP’s May bottom has been undergirded by a robust recovery in buying support, as it formed higher lows in June and July. Therefore, it appears that the market denied further selling pressure over the past three months.

Coupled with our conviction of a sustained broad market bottom, we are increasingly confident that CRSP’s May lows should hold robustly. Notwithstanding, we also observed that CRSP had faced significant selling pressure at its July highs. Therefore, investors are encouraged not to chase the rally in CRSP to add exposure. Instead, they should patiently wait for a deep pullback for a potential bottoming process before assessing the opportunity to add to their positions.

We noted that buying support seems to have returned this week to CRSP after its steep sell-off at the release of its Q2 update. Barclays also downgraded CRSP, suggesting that a “lack of other significant data catalysts” could weigh on the stock’s momentum. However, the market seems to have other ideas, given the robustness of the buying support this week. Therefore, we posit that the current price action remains constructive for a potential re-rating in CRSP.

But, Valuing CRSP With Confidence Is A Significant Challenge

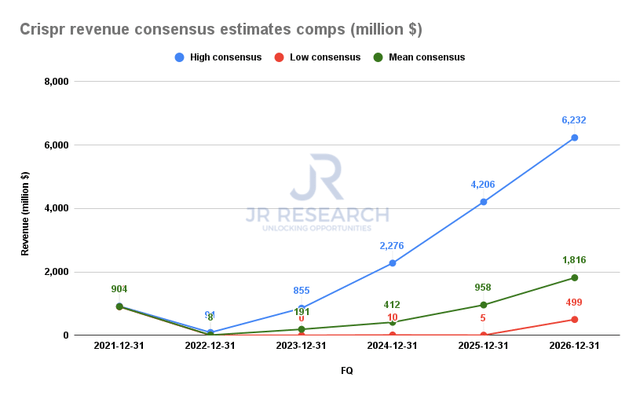

Crispr revenue consensus estimates comps (S&P Cap IQ)

As seen above, even the Street (bullish) deviates significantly from the growth trajectory of Crispr’s revenue. Moreover, despite the promise of its gene editing programs, investors need to consider the multitudinous challenges of commercialization for an early-stage company. Therefore, we find the reliability of Crispr’s revenue estimates highly uncertain.

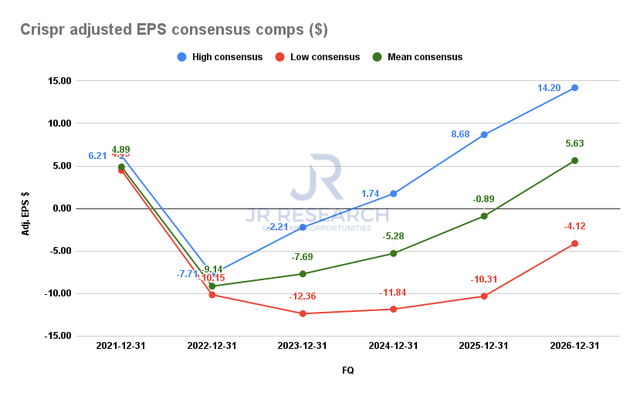

Crispr adjusted EPS consensus estimates comps (S&P Cap IQ)

Furthermore, the bifurcation seen in Crispr’s adjusted EPS estimates is even starker. For instance, the mean consensus estimates suggest that Crispr could deliver an adjusted EPS of $5.67 by FY26. However, the most pessimistic estimates indicate a significant loss of -$4.12, while the most optimistic estimates indicate $14.20. As a result, the standard deviation between the range of forecasts for FY26’s adjusted EPS is $6.36, even higher than Crispr’s mean consensus number.

Therefore, we posit that valuing CRSP with a high confidence level is challenging. Given such complexities, investors are urged to demand a significant margin of safety when deciding to add CRSP.

Is CRSP Stock A Buy, Sell, Or Hold?

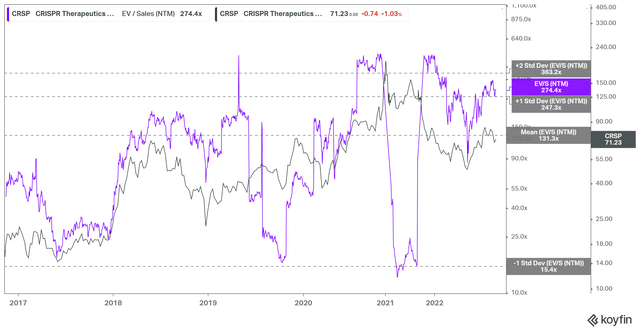

CRSP EV/NTM Revenue valuation trend (koyfin)

Note that CRSP has consistently found robust buying support when its NTM revenue multiples fell below the one standard deviation zone below its all-time mean, as seen above.

However, CRSP last traded well above its all-time mean. Therefore, we urge investors to wait patiently for another opportunity to add CRSP when its valuation is more constructive.

Nevertheless, CRSP’s price action has improved over the past couple of months. Therefore, we are convinced that its May lows should be underpinned.

As such, we revise our rating on CRSP from Sell to Hold.

Be the first to comment