cyano66/iStock via Getty Images

With a U.S. recession looming in 2023, investors hoping to find a safe place to park their capital should look for safe harbor in “boring companies.”

Companies that will survive no matter what the economy throws at them, thanks to the scale of the business, a balance sheet fortress, or the “stickiness” of its products and services.

We have already discussed at length how investors should be assessing every company’s balance sheet “recession readiness” (if you haven’t seen this series yet, I suggest starting here). Now, we’ll look to explore firms well-placed to ride out a recession with ease thanks to the nature of their goods or services.

One such company that stands out is H&R Block, Inc. (NYSE:HRB), a well-established player in the tax preparation industry in the U.S. While taxes may not be the most exciting topic, no matter what the economy does, accountants will always be there, plugging away solidly.

Today we’ll be comparing HRB to the rest of the U.S. market (using this U.S. Stocks Screener) to get a sense of the firm’s financial health in the context of the market to give us a base rating of the firm’s sustainability, give it a valuation attractiveness score, attempt to find a pricing mechanism for the firm, and finally discuss some of the major risks investors would need to consider.

(Data & prices in this article are correct as of pre-market 20th January 2023.)

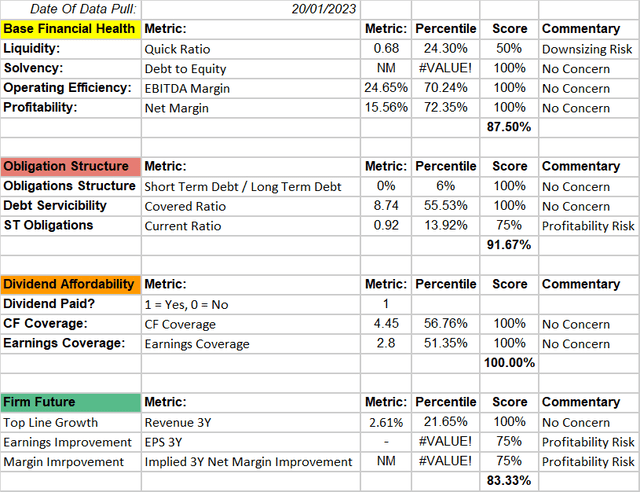

H&R Block, Inc.’s Base Financial Health

The Quick Ratio “acid test” of 0.68, indicates some level of risk associated with a worst-case scenario for the firm. The EBITDA Margin is relatively high at 24.65%, offering healthy profits, and this is alongside a relatively high Net Margin at 15.56%.

The Covered Ratio, which measures the company’s ability to meet its short-term debt obligations, is also healthy at 8.74, and the Current Ratio, which measures the company’s ability to meet its short-term obligations with short-term assets, is also good at 0.92. The Revenue 3Y growth outlook is relatively low at 2.61%.

Overall, H&R Block, Inc. has a good financial health, with a healthy liquidity ratio, high margins, and a good coverage ratio, indicating that the company may have the ability to meet its short-term obligations.

HRB’s financial health summary (Author)

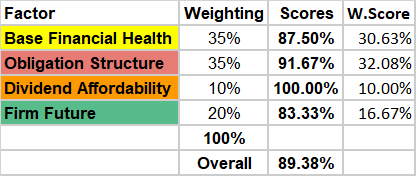

Overall, the company’s financial health score of 89% suggests that it is a relatively stable and financially sound company.

HRB’s overall financial health score (Author)

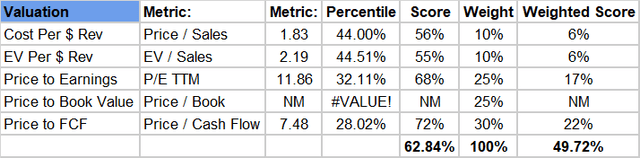

Assessing H&R Block, Inc.’s Pricing Attractiveness

When assessing the pricing attractiveness of H&R Block, Inc., the Price/Sales ratio of 1.83 and EV/Sales ratio of 2.19 suggests a relatively fair valuation. The P/E TTM of 11.86 is low, while the Price/Cash Flow ratio of 7.48 is the most attractive figure of the list, indicating that H&R Block, Inc. stock may be undervalued. Overall, we give the company a pricing attractiveness score of 49.72%, suggesting that the company may be fairly based on its valuation metrics.

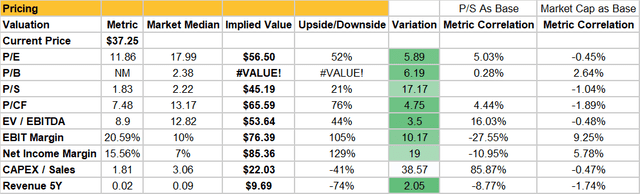

Finding An Appropriate Valuation Method For H&R Block, Inc.

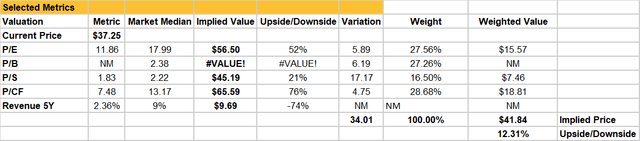

Using the peer group as our guide, we will consider a number of normal (and some non-standard) valuation methods for the firm, assess each metric’s “noisiness,” correlation with P/S and Market Cap, before settling on a few key metrics to lean on.

Having short-listed the metrics we want to use, we can see that investors have slightly undervalued H&R Block compared to the wider market, and this gives us an argument to see a slightly significant upside risk potential should the narrative for the firm improve.

Closing Remarks

As Benjamin Franklin once said, “Nothing is certain except death and taxes.” In light of the looming recession in 2023, investors seeking a relatively safe haven for their capital should consider investing in “boring companies” such as H&R Block, Inc. The tax preparation industry is one that is often considered as a “recession-resistant” industry, and it is clear to see why. Regardless of the economy, people will always need to file their taxes, and the services of accountants will always be in demand.

Based on our analysis of the firm’s financial health, we conclude that H&R Block, Inc. is a relatively stable and financially sound company, with a score of 89%. The firm’s pricing attractiveness also suggests that the company may be fairly valued, with a score of 49.72%. Our valuation method suggests that the company is slightly undervalued compared to the wider market, indicating a potential for upside risk of 12.31%, while enjoying a well-covered 3% dividend yield.

In conclusion, while nothing is certain in the world of investing, H&R Block, Inc. is a company that offers investors a sense of security and stability, especially in times of economic uncertainty. It is a company that stands out as well-positioned to weather a recession, thanks to the nature of its goods and services.

With that said, it would be irresponsible of me not to point out that this analysis is limited in its scope to just a quantitative peer analysis. While we do look at the firm’s financials, it does not go searching for detail and context that one might find reading earnings transcripts. Further, the analysis is of the market as a whole but does not consider the specific industry the firm operates in and does not break down a near-peer comparison. Investors should use this analysis as a baseline for their analysis, but spend time looking at the firm’s qualitative aspects to further inform their thinking.

Be the first to comment