iQoncept

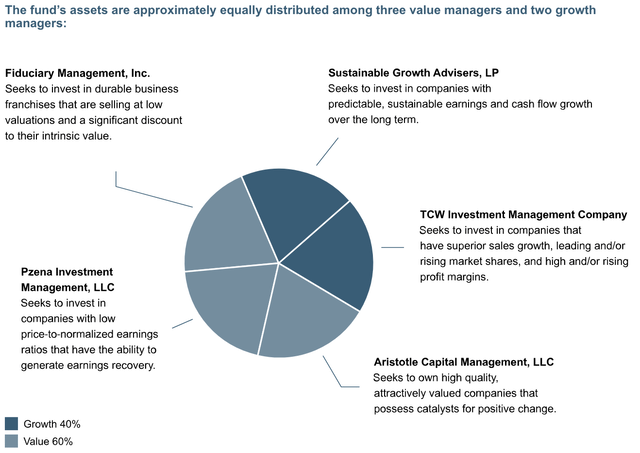

We’ve covered many closed end funds, CEF’s, and other high yield vehicles through the years in our articles. Liberty All-Star Equity, (NYSE:USA) and its sister fund, the Liberty All-Star Growth Fund, (NYSE:ASG), are 2 CEF’s which utilize multiple managers to focus on a variety of styles. USA takes a multi-pronged approach to its investments, using 3 value portfolio managers and 2 growth managers with expertise in different slices of the market:

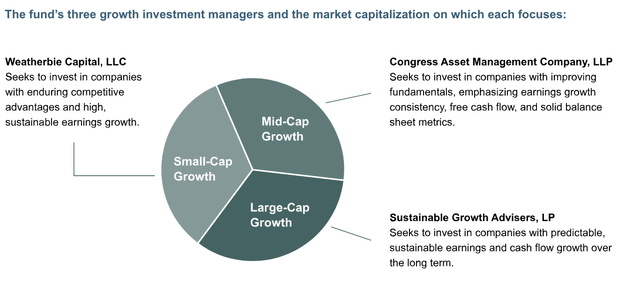

USA’s sister closed end fund, ASG, specializes in growth equities, utilizing 3 managers, each focusing on different market cap sizes:

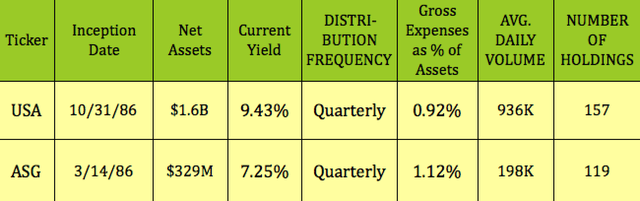

Both funds were established in 1986. USA is a much larger fund, with $1.6B in Net Assets, vs. $329M for ASG. USA also has much higher average volume, at 936K, vs. 198K for ASG, in addition to more holdings, 157 vs. ASG’s 119. They both pay quarterly distributions.

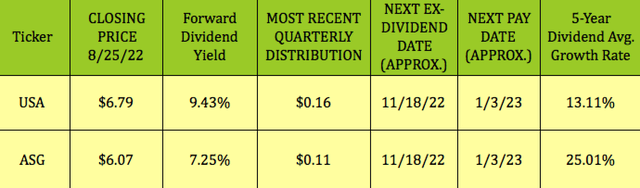

Dividends:

The dividend policy is variable for both funds. USA’s dividends are based upon 10% of its net asset value per year, payable in four quarterly installments of 2.5% of the Fund’s net asset value at the close of the NYSE on the Friday prior to each quarterly declaration date. ASG’s are based upon 8% of its net asset value per year, payable in four quarterly installments of 2%.

Through 2021, both funds had strong average 5-year dividend growth, with ASG on top, with 25%, and USA with 13%. However, since both of their dividends are based upon %’s of NAV, the quarterly payouts tend to shrink in down markets, and to increase in rising markets.

With the S&P down nearly -13% in 2022, both funds decreased their quarterly dividends this year – USA went from $.18 to $.16 for its most recent payout, which went ex-dividend in late July. ASG went from $.14 to $.11 for the same period.

With its price down ~20% in 2022 to $6.79, USA yields 9.43%, while ASG yields 7.25%. They should both go ex-dividend next on ~11/18/22, with a ~1/3/23 pay date.

Holdings:

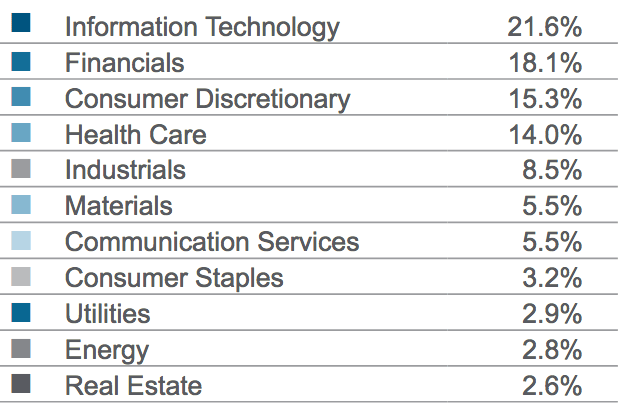

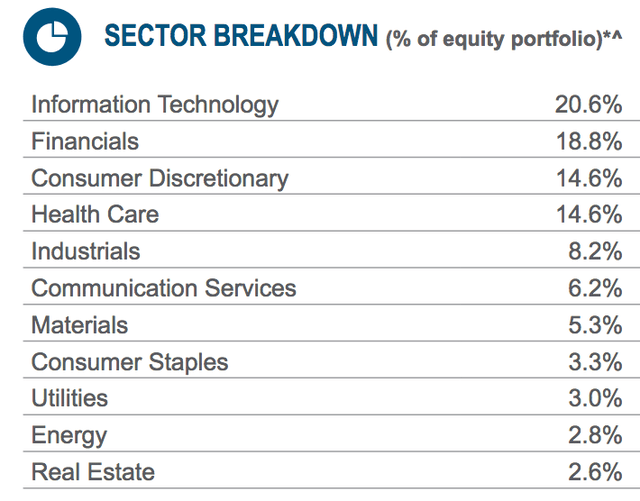

The funds have very similar sector breakdowns, with Tech, Financials, Consumer Discretionary and Healthcare being the top 4 sectors for both funds.

USA sectors:

ASG sectors:

ASG site

USA’s top 10 holdings comprised ~18% of its portfolio, as of 6/30/22, and consisted of well-known, large cap names. Management added new positions in Merck and Starbuck’s recently, while dropping Chubb, Disney, and Textron.

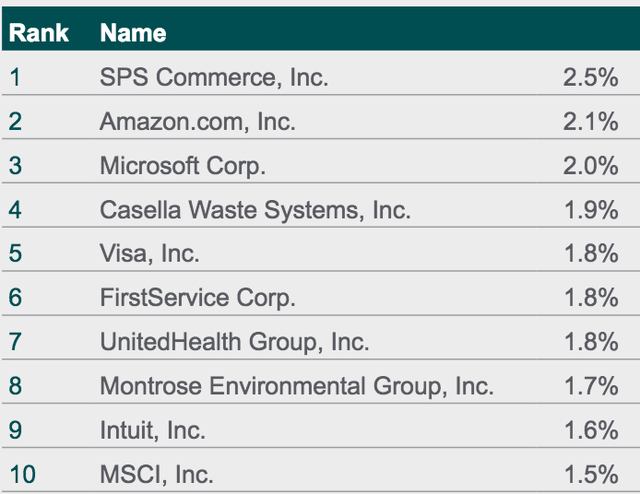

ASG’s top 10 holdings are much more varied, and includes other names, such as SPS Commerce, a cloud-based supply chain management software company. Casella Waste Systems operates in the northeastern US; while FirstService is a residential property management company. Other top 10 holdings not found in USA’s top 10 are Montrose Environmental, Intuit, and MSCI.

Management added Decker’s Outdoor, Ulta Beauty, Starbuck’s, and National Vision recently, while dropping Disney, Etsy, Burlington Stores, and NeoGenomics.

Pricing:

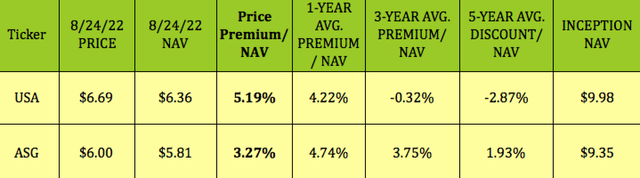

A useful strategy when buying CEF’s is to try to buy them at deeper discounts or lower premiums than their historical averages.

Currently, USA has a higher premium to NAV than its average 1-year, 3-year, and 5-year pricing. ASG’s 3.27% premium to NAV is lower than its 1- and 3-year average premiums, and more expensive than its 5-year 1.93% premium.

Performance:

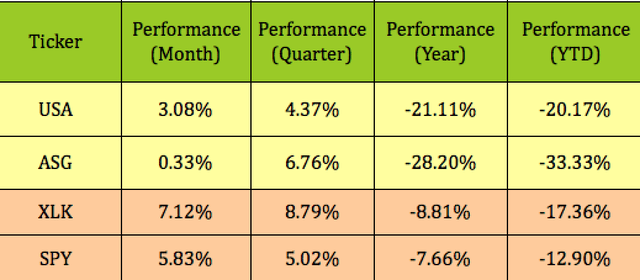

Both funds have lagged the Tech sector and the S&P 500 over the past month, year, and so far in 2022, while ASG outperformed the S&P over the past quarter. USA has held up better than ASG over the past year, and so far in 2022.

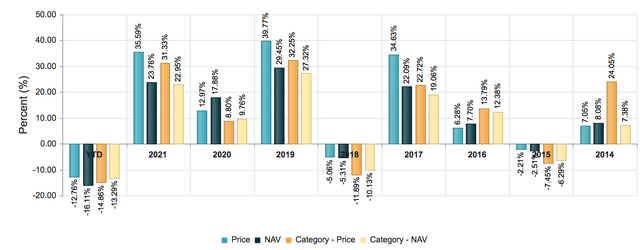

Looking back over the past several years, USA outperformed the Morningstar US CEF US Equity category in 2017-2021 and 2015.

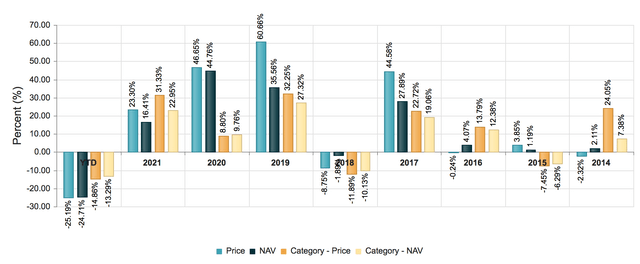

ASG lagged in 2021, while outperforming in 2017 – 2021:

Parting Thoughts:

With both funds basing their dividends on a % of NAV, a down market leads to lower dividends. No one knows when the Fed will stop its rate hikes, inflation will pull back, and/or the market will bounce back, but when the bull market resumes, USA and ASG could be good bets for income investors.

Look for deeper discounts to NAV than at present, and a price near 52-week lows – right now both funds are 16 to 20% above their 52-week lows, and their NAV pricing is mostly more expensive than historic averages.

If you’re interested in other high yield vehicles, we cover them every Friday and Sunday in our articles.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment