Michael Vi/iStock Editorial via Getty Images

While we remain optimistic on Palantir’s (NYSE:PLTR) long-term fundamentals, markets have admittedly been unforgiving to the company’s valuation – and reasonably so. The stock has at its worst point lost close to three quarters of its value since peaking in November due to broad-based market turmoil this year that has been compounded by investors’ distaste against multi-period deceleration at Palantir’s core government segment, and the company’s ultimate decision to pause its multi-year annual growth target of at least 30%, citing near-term macro uncertainties.

Amid tightening macroeconomic conditions that have shifted investors’ preference from high duration equities like Palantir to low duration equities “tied to large near-future cash flows and pay-outs,” the stock remains highly prone to further downward valuation adjustments in the near term. The following analysis will revisit the factors supporting Palantir’s long-term growth trajectory and discuss immediate macro-driven risks facing its near-term fundamental performance that could potentially subject the stock to a further downtrend over coming months. Looking ahead, anticipated weakness in Palantir’s 2H22 fundamental performance – which management has cautioned upon their decision to pause the 30% annual growth target for 2022 during the second quarter – due to mounting macro headwinds beyond the company’s control is becoming increasingly prominent, putting a bear-case valuation of as low as $5 apiece in sight.

Understanding the Long-Term Opportunities and Near-Term Risks to Palantir

Government Segment

Palantir’s government segment is a core driver of the company’s fundamentals, representing more than half of the company’s quarterly sales. Elevated double-digit year-over-year growth in the segment during Palantir’s first 12 months as a publicly-listed company was a key driver to its bullish run. Yet, rapid deceleration in the segment, which began in 2H21 when pandemic-related contracts diminished, caused investors to think twice about the sustainability of Palantir’s forward growth trajectory. Paired with worsening macro conditions in 2022, the stock has been on a steady decline with no immediate respite in sight.

Revisiting Opportunities in the Government Segment

Although Palantir’s government revenues have demonstrated a decelerating trend in recent quarters, it has continued to make favourable progress on its “acquire, expand, and scale” business model. As discussed in our previous coverage, Palantir has not only demonstrated a consistent track record in renewing government contracts, but also successfully leveraging said existing government contracts to cross sell its offerings, which is corroborated by a high volume of deal extensions that often expand beyond the initially-contracted services.

Aside from the slowdown in pandemic-related contracts, the company has yet to experience significant churn in its government segment, which also provides validation to the effectiveness of its data management, storage and analytics solutions. In fact, Palantir has effectively leveraged its pandemic-era deal wins to showcase its capacity in addressing data management and analytics requirements in healthcare, which has translated into long-term partnerships that it continues to hold with the HHS and NHS today.

Although some may view Palantir Alex Karp’s recent commentary on the effectiveness of the company’s product offerings as arrogant, he’s got a point – Palantir’s continued demonstration of favorable progress in expanding its existing government deal portfolio serves as validation to the effectiveness of its product offerings, while also building forward visibility on the segment’s long-term fundamental prospects by driving sustained growth:

By the way, on this point, one of the most important things driving our software, but especially in commercial, is that people have tried and tried and tried to build our product. We have a number of customers that we’ve been able to bring on board this year that, quite frankly, didn’t like us. And it’s like – but the product brought them back… And why did the product bring them back? Because the product is actually delivering value that is otherwise not available. And in the U.S. government especially, the U.S. government has tried everything not to buy our product. We had to sue the U.S. government twice. Just imagine how popular I am. They still are buying the product. It’s not a love relationship always. It’s – we bring you back. Our products bring you back.

And while market concerns over recession risks are rising, Palantir has continued to do what it does best – extending and expanding its existing government partnerships:

- U.S. Army Research Laboratory: Palantir was recently awarded a second deal extension with the U.S. Army Research Laboratory (“ARL”) to facilitate the build-out of AI/ML capabilities to be used across the Department of Defense (“DOD”). Valued at up to $229 million over a one-year period, the latest extension builds on earlier work commissioned by the ARL under a $100 million two-year project on the implementation of AI/ML capabilities, which stemmed from Palantir’s initial partnership with the agency dating back to 2018. The expansive undertaking, which is expected to cover all AI/ML capabilities across the DOD, will not only add to Palantir’s government top-line growth, but also play a critical role toward realizing its mission to assist critical decision-making processes “from outer space to the sea floor, and everything in between.”

- Department of Homeland Security: Palantir has secured a five-year deal extension valued at $95.9 million with the Department of Homeland Security to continue its provision of support to the Homeland Security Investigations unit (“HSI”) on the “Investigative Case Management” software. Palantir’s decade-plus partnership with the HSI is, again, a validation to the effectiveness of its data solutions – the HSI has pointed to advantages such as “speed of delivery as well as leading edge access control and data protections to enforce critical security and privacy standards” enabled by Palantir’s offering for the partnership extension. The Investigative Case Management software run by Palantir has played a critical role in supporting the HSI’s mission in “combating human trafficking and child exploitation, dismantling international drug trafficking organizations, disrupting cyber criminals, preventing identity and benefit fraud, and the investigation of international war crimes.” A key example of which includes the use of Investigative Case Management in enforcing recent sanctions levied on Russian oligarchs and other key personnel tied to Russia’s invasion of Ukraine. The surge in global urgency to counter rising cybersecurity threats also underscore the critical role that the Investigative Case Management software will continue to play within, and potentially beyond, the HSI over the longer-term, building further on Palantir’s land-and-expand strategy.

While Palantir has shown favorable progress in cementing its brand as a staple service provider to some of the public sector’s largest procurement centers – primarily pertaining to the U.S. Army and homeland security – it has also ramped up efforts in expanding its presence across non-defense public agencies, including healthcare (HHS), utilities (DOE), finance and economics (TREAS), and legislature (DOJ). The company has acquired at least $342 million in contract obligations from the U.S. government alone this year, the highest on record, underscoring continued growth to its government segment especially as Palantir steps up on share gains in allied regions overseas.

Understanding Near-Term Risks in the Government Segment

While the government segment’s long-term growth outlook remains well intact based on public contract data, the choppy nature of revenue recognition on said deal wins, as well as recent deceleration makes a sore spot for the spot, especially as investors shun high growth tech stocks with lofty valuations and negative bottom lines amid weakening economic conditions.

Although Palantir’s name has been a consistent showing across major government deal wins valued in the lofty range of hundreds of millions of dollars, the realization timeline on said contracts are often uncertain, with some even subjected to an “up to” clause with no minimum guarantee. Recall that GAAP-based accounting does not permit the recognition of revenue until the contracted services are rendered, and the prescribed transaction value has either been paid for or acknowledged by the receiving party as an obligation for services performed. In other words, a hypothetical two-year contract valued at “up to” $100 million awarded today may not even hit Palantir’s PnL until two years later; worse off, the “up to” might not even come with a minimum deal value guarantee, and end up being a nil-value contract upon expiry. But the bulk of said risks is likely driven by timing, rather than termination – meaning the uncertainties over the revenue recognition timeline on Palantir’s long-term government contracts are the primary drag on the segment’s immediate performance, instead of contracts that end in zero value. This is further corroborated by the consistent flow of government deal extensions awarded to Palantir.

I personally remain very optimistic that the next three years will look a lot like the last three years, again, where we took a money-losing business and made a business that throws off free cash flow, where we ended up as of today with $2.4 billion in the bank and no debt, and that the large and chunky nature of our contracts will continue to be in large part an advantage because these contracts do not disappear.

Sometimes, they are put off. Sometimes, they take too long for us to get them. But at the $1 billion range of the contracts that we are working on, they have the bug of sometimes taking too long and the feature of a highly difficult, tumultuous and politically uncertain world that you actually get paid and you actually make free cash flow…

While the timing of large contracts in government can be frustrating, the underlying requirements and needs are enduring.

But it’s exactly this that puts investors off, especially under the risk-off environment for equities as borrowing costs surge and growth slows. As long as government revenues continue to decelerate, the stock will be punished as investors take-off at the first hint of weakness – a consistent trend observed across markets this year.

And considering management’s bold decision to pause its multi-year 30% y/y growth target for 2022, Palantir’s third quarter government segment performance has likely remained muted compared to 1H22, which is consistent with the decline in U.S. government contract obligations from more than $115 million in 2Q22 to just over $100 million in 3Q22. With the stock currently trading at 7x forward EV/sales, which exceeds the high growth SaaS peer group average of about 6x, there’s likely still room for a downtrend over coming months if Palantir’s government segment deceleration persists while market sentiment continues to soften in the face of an unravelling economy.

Commercial Segment

While Palantir’s government segment performance remains a key near-term focus area, it’s worth noting that its commercial segment has remained resilient despite the sector’s higher exposure to rising recession risks. Commercial revenues, though showing some deceleration in 1H22, remains robust, maintaining an average 45% of Palantir’s consolidated sales mix over the past four quarters, up from the low-40% range in the previous year.

Revisiting Opportunities in the Commercial Segment

We believe Palantir’s adoption of a “modularization” strategy over the past year helped it better penetrate the private sector by pinpointing end-users needs and improving understanding of its innovative software structures:

As mentioned in our previous coverage, Palantir has been leveraging its core Foundry operating system designed for the private sector in the development of new, industry-focused modularized solutions (e.g. Carbon Emissions Management and Anti-Money Laundry / Know Your Client solutions targeting the crypto sector) to better cater to end users’ needs. The strategy has also helped the company break the barrier of IT resistance to new software structures like Foundry, and improve acceptance of the cutting-edge data analytics and management solutions that Palantir has to offer.

Source: “Palantir: Land And Expand is Working”

Following Palantir’s consecutive collaborations with key industry-leading partners across various end-markets earlier in the year, spanning industrial machinery manufacturing, water infrastructure consulting, and commodity trading, the company has recently set foot in private healthcare as well as consumer goods:

- Concordance Healthcare Solutions: Palantir has recently partnered with Concordance Healthcare Solutions to “power a fully integrated medical supply chain ecosystem.” Although the specific software underpinning the ecosystem was not disclosed, the partnership likely leverages Palantir’s Foundry – its flagship platform built to enable integration of disparate data sources across the commercial sector. The jointly-built integrated medical supply chain ecosystem is effectively a real-time data one-stop-shop hub that compiles “inventory and supply chain data from manufacturers, suppliers, distributors, and providers,” and can be accessible by all licensed healthcare personnel and/or OEM “regardless of compatibility.” Similar to Palantir’s partnership with Hyundai Heavy on the joint development of data integration software targeting the industrial sector, the latest collaboration with Concordance Healthcare Solutions involves the co-development of an industry-specific tool aimed at better addressing end-market needs. The modularized offering is expected to improve Palantir’s presence in the private healthcare sector over the longer-term, which is expected to grow into a $900 billion TAM by the end of the decade:

With technology being one of the top three items identified by frontline healthcare workers in the U.S. that can “help reduce their stress and become more effective,” the sector’s demand for related cloud-computing solutions is expanding rapidly. The addressable market for healthcare-focused cloud-computing solutions is expected to expand at a compounded annual growth rate (“CAGR”) of close to 11% from $383 billion in 2020 towards $900 billion by the end of the decade.

- Beckett Collectibles: Beckett Collectibles, a buy-and-sell marketplace specialized for “sports card and sports memorabilia,” has opted for the use of Palantir’s Foundry to integrate its disparate legacy data systems. The latest partnership draws from Beckett Collectible’s “digital transformation” efforts, which aims to “enable users (with) quick and easy access (to) data sets about cards, comics and other collectibles, as well as automating the process of grading and authenticating”. Palantir’s partnership with Beckett Collectibles is a prime example of how the company remains a key beneficiary to digital transformation trends ahead, a key driver to the stock’s long-term bullish thesis:

However, revenue growth from Palantir’s commercial segment remains robust and should not be overlooked. Businesses are becoming increasingly digital, generating vast troves of data that will need to be integrated, processed and analyzed to drive key decision-making processes. And this trend will continue to propel commercial demand for Palantir’s enterprise software solutions…Palantir’s software solutions remain a critical function to ensuring the seamless integration of data platforms and improving decision-making in the increasingly digital world… To date, only 4% of companies claim to have a “highly sophisticated approach to leveraging data.” This leaves a sizable addressable market within the private sector in which Palantir could penetrate. And the company has already deployed various strategic offerings to ensure adequate capitalization of said opportunities ahead.

Source: “Palantir: A Rebound May Be In Order With Potentially Stronger-than-Expected Earnings Ahead”

Understanding Near-Term Risks in the Commercial Segment

Potential impacts from looming recession risks come to the top of mind when thinking about the near-term outlook for Palantir’s commercial segment.

Industry-leading SaaS providers already are starting to sound alarms over early observations of a tougher sales environment, underscoring that the sector is not immune to near-term macro risks despite digital transformation tailwinds. This accordingly draws uncertainties over the near-term sustainability of the commercial segment’s growth at Palantir.

Based on analyst notes compiled from recent Investor Day presentations across SaaS leaders such as Salesforce.com (CRM) and Autodesk (ADSK), the broad theme is that the overall spending environment remains “solid, but (with) some near-term caution”:

While we remain bullish on the LT disruptive nature of software, the macro environment remains cloudy and recent software results have shown increased signs of macro pressures, which tended to impact different software sub-segments to varying degrees.

Source: RBC Monthly Software Valuation Recap; September 2022

Specifically, Palantir’s peer group continues to see “resilient spending intentions for digital transformation and front-office software” such as Foundry, but “upselling/cross-selling is becoming tougher in the current macro (environment)”, which spells potential challenges in the near-term for the company’s ongoing land-and-expand strategy employed for spurring growth across the commercial segment. As mentioned in our latest coverage on industry peer Datadog (DDOG), management has already observed a pickup in “noises” and “variability” on customer take-rates in the first half of the year.

As such, we expect Palantir’s ongoing efforts in penetrating mass market through initiatives such as “Foundry for Builders,” which targets start-ups and SMBs that are more recession-prone, will be temporarily stalled in the near-term due to the anticipated pullback in capital investments and back-office spending to brace for macro uncertainties ahead. But continued modularization of its flagship Foundry platform built for commercial use-cases are expected to bolster penetration across larger enterprise clients, which will likely be more resilient amid an economic downturn and inclined to continue spending on digital transformation efforts to remain both economically and operationally competitive.

Meanwhile, industry sentiment continues to favor “security spending trends, (which) remain durable and in reality, strong relative to other areas of IT spending as security remains top of mind and not as exposed to budget uncertainty.” This builds on similar trends observed across Palantir’s government business due to the increasing urgency to counter rising cybersecurity threats, which is favorable to Foundry adoption and potentially offset any softness in take-rates due to macro-driven pullbacks in digital transformation investments. While Foundry is widely known for its ability in integrating disparate data sources for customers to facilitate improved decision-making processes, the platform also enables customers to “strengthen their security posture” through its risk management capabilities. With information security being Palantir’s “lifeblood,” the function is largely built into its software offerings as an integral component, making protection of customers’ data a priority.

Understanding Palantir’s Near-Term Valuation Risks

Palantir’s battered valuation this year has been primarily driven by investors’ distaste for its deceleration in recent quarters – as mentioned in our previous coverages, investors exiting positions at the first sign of weakness has been a consistent theme this year under the volatile market climate. With mounting macro uncertainties still – spanning the extent of the Fed’s monetary tightening trajectory, where inflation is headed, and whether a recession is imminent – we expect the risk-off trend to continue. And given the near-term macro-driven risks to Palantir’s fundamental performance in 2H22 discussed in the foregoing analysis, the stock could potentially be exposed to a further selloff, especially considering its higher-than-peer-average valuation premium today still on a relative basis (PLTR: approximately 7x forward EV/sales on consensus average NTM growth of 23%; high growth peer average: approximately 6x forward EV/sales on consensus average NTM growth of 22%), even after the violent declines observed in 1H22.

Although Palantir continues to expand its generous FCF margins, investors also remain focused on its path to positive GAAP-based profits, which will likely remain negative in the near term due to still-elevated stock-based compensation expenses, implying further bleakness to sustaining its premium valuation under the risk-off environment for equities. The anticipated continuation of topline deceleration, which is largely anticipated considering management’s decision to walk back on its 30% growth target for the year and near-term macro weakness discussed in earlier sections, also counters investors’ heightened focus on profitable growth under the current market climate. While we remain optimistic on Palantir’s long-term bullishness as it seeks to capitalize on digital transformation tailwinds with its disruptive software offerings, its shares are likely headed for a further decline as long as monetary tightening and macro deterioration continues, before any signs of a structural rebound happens.

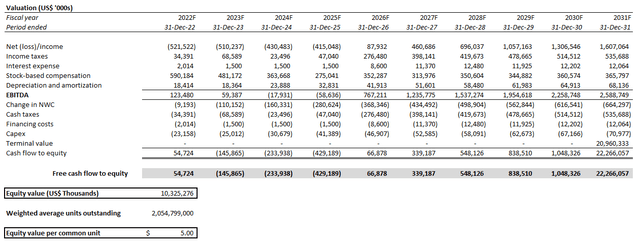

To gauge the extent of which the Palantir stock could fall, we have attempted to compute the company’s steady-state value, which strips it of any arbitrary growth premium to reflect the value of its projected cash flows that can be sustained “indefinitely” regardless of whether incremental capital investments are made. We have employed the Gordon Growth model, and applied a perpetual terminal growth rate of 3.6% Palantir’s projected cash flows based on our latest forecast, which aligns with long-term economic expansion across the company’s core operating regions – namely, the U.S. and its allied regions.

Palantir Valuation Analysis (Author)

Palantir_-_Financial_Forecast.pdf

This accordingly yields a terminal value of about $21 billion, which applied to our discounted cash flow analysis results in an implied intrinsic value of about $5 apiece. We view the $5 PT as a viable bear case scenario over coming months if Palantir’s third quarter results continue to reflect 1) deceleration and 2) distance from profitable growth – two sore spots for investors – which we consider to be likely in the near-term given adverse implications of management’s earlier decision to cancel its growth target for the year, as well as ongoing macro headwinds.

Final Thoughts

The Palantir stock has been subjected to significant volatility this year, having lost a substantial portion of its value amid the broader market selloff. Its upcoming earnings report will be a key near-term catalyst to determining whether the stock is in for another steep decline. Given Palantir’s valuation premium to peers still, we expect that there is still some room for a multiple contraction which could bring the stock lower if fundamental weakness persists in the near term.

Considering we remain optimistic on Palantir’s long-term growth prospects, we view the anticipated near-term stock decline in response to mounting macro uncertainties a favorable entry opportunity for sustained upsides once uncertainties over the broader market climate subsides. But in the meantime, investors should prepare for further volatility in the stock in the near-term as Palantir’s elevated valuation still exposes it to significant risks of a downward adjustment stemming from external factors influencing market-wide valuation multiples over coming months.

Be the first to comment