Natal-is/iStock via Getty Images

Investment Thesis

Crocs (CROX) has been pummeled this year, down ~46% YTD and ~60% since its November, 2021 $180 high. I believe the selling is overdone and investors should get interested in the stock at current levels. The company recently acquired HEYDUDE for $2.5B, Crocs’ largest acquisition in its history. The acquisition makes sense from a brand standpoint, as HEYDUDE specializes in one product (their Wendy/Wally slip on shoe) which is similar to Crocs’ focus on its widely recognizable line of clogs. Not only do I think the market is underestimating how accretive the HEYDUDE brand is, but also the staggering growth Crocs has delivered over the past few years. 2021 revenues are up 88% since pre-pandemic (2019) levels, and 67% Y/Y. Free cash flow generation is strong, and the company is deleveraging after its massive acquisition. Crocs is in growth mode, but executing in a smart way. Based on my DCF model, Crocs is ~12% undervalued at current levels, and I assign a strong buy rating at current levels.

Background On The Company

Crocs designs, markets, distributes, and sells casual lifestyle footwear to customers in the Americas, Asia Pacific, and Africa. The company specializes in its clogs offerings which are widely recognizable across the world and utilize its proprietary Croslite™ material to maximize comfort and decrease its environmental footprint. The company operates through its wholesale and direct-to-consumer channels. Its wholesale segment distributes to brick and mortar retailers including sporting goods stores, independent footwear retailers, and national/regional retail chains. This segment made up 50.8% of revenue in 2021. Its direct-to-consumer channel made up the remaining 49.2% of revenue in 2021. Crocs operates a total 373 stores worldwide, adding 22 stores from its 2020 reported number of 351.

Staggering Growth And Profitability

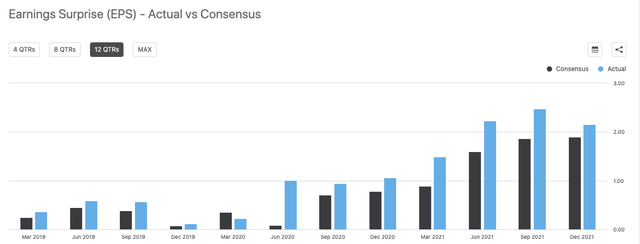

Crocs reported its strongest quarter in history in Q4-21, with revenues of $586.63M, beating the consensus numbers by $5.92M. Earnings were even more impressive, reporting Q4-21 EPS of $2.57, outpacing consensus by a high $0.76 margin. This isn’t the company’s first rodeo beating analyst estimates, however, reporting 11 EPS beats over the past 12 quarters.

Seeking Alpha EPS Surprise Premium Tool

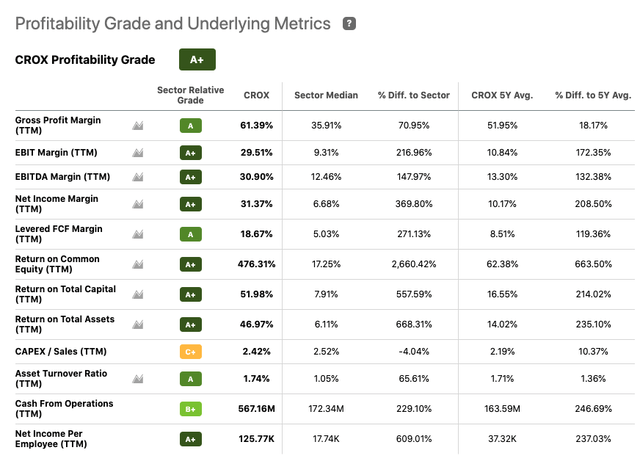

Crocs is also extremely profitable, as can be shown by its 61.39% gross profit margin, 31.37% net income margin, and 18.67% levered free cash flow margin. This has earned Crocs an “A+” for its profitability as shown below.

Crocs Profitability Metrics (Seeking Alpha Profitability Grade For Crocs)

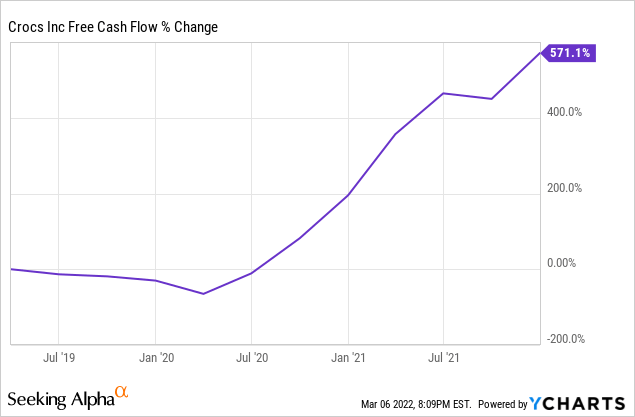

I have been most impressed with free cash flow for Crocs as the company has grown its free cash flow nearly 600% since the pandemic, all whilst navigating the headwinds of a global pandemic.

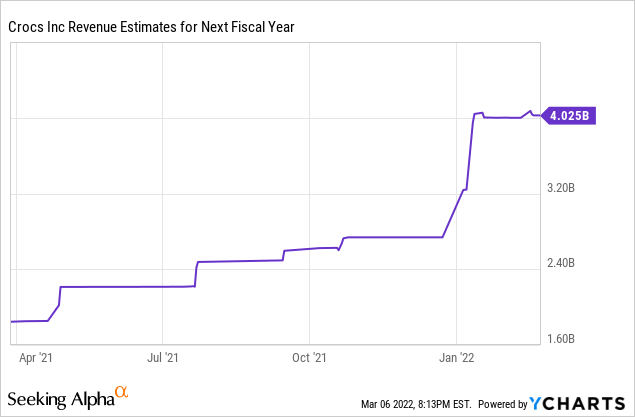

I anticipate free cash flow generation to grow with revenues, and analysts are very bullish on the company’s revenue outlook next year.

This free cash flow generation will help to lower Crocs’ debt burden which it took on as a result of its acquisition of HEYDUDE. The company stated in its Q4-21 earnings call that the company is committed to “deleveraging and expect the combined brand to generate significant cash flow, allowing us to quickly achieve 2x gross leverage by the end of 2023.” The company has suspended its share buyback program until it is able to deleverage, but $337.8M of its $1B share buyback program remains available once it is able to do so. This is ~8.5% of the company’s current market cap which should bolster earnings growth when management decides it’s the right time to continue share repurchases.

HEYDUDE Acquisition

Crocs announced that it acquired HEYDUDE for $2.5B at the end of last year, the company’s largest acquisition in its history. The HEYDUDE acquisition is expected to be immediately accretive to 2022 revenue growth, operating margins and earning. Put simply, this acquisition just makes sense for Crocs. CEO Andrew Rees commented in an interview on CNBC that there is a complimentary nature to HEYDUDE’s brand given its iconic Wally and Wendy shoes (pictured below). It makes sense, given the slip-on, casual feel that are reminiscent of Crocs’ own iconic clogs.

Wally Shoe – HEYDUDE

*Note: The Wally is the “men’s version”

Wendy Shoe – HEYDUDE

*Note: The Wendy is the “women’s version”

The addition of HEYDUDE’s iconic shoes to Crocs’ product line-up is a fantastic way for the company to diversify its revenues. Crocs also has specialized its marketing efforts to promote single products, such as its clogs, and promoting the Wally/Wendy slip on shoes will be no different. We will get more color on the financial results of this acquisition in the company’s Q1-22 earnings report, but I am optimistic.

CROX Valuation

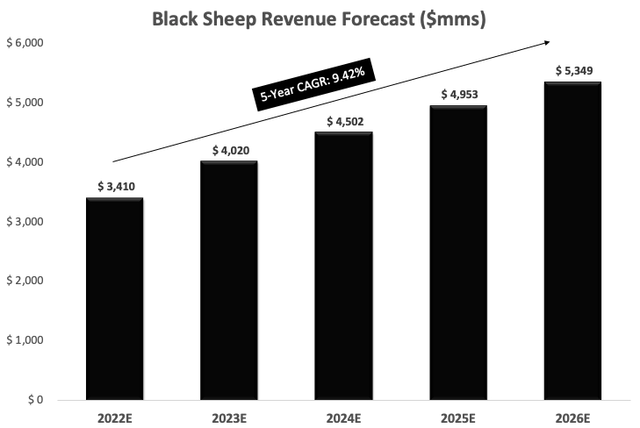

In terms of valuation, my DCF suggests that there is a 12% upside opportunity in Crocs shares from current levels. My DCF is primarily driven by my optimistic revenue outlook for the next five years which can be found below.

Crocs Revenue Forecast (Image made by author using own forecasts and assumptions)

My 2022 estimate is right in line with management’s outlook of “~$3.4B.” My 5-year revenue CAGR is 9.42%, driven by the company’s continued dominance in the footwear industry and recent acquisition of HEYDUDE (which should accelerate growth in the coming years). Keeping margins consistent with historical levels, my model can be found below.

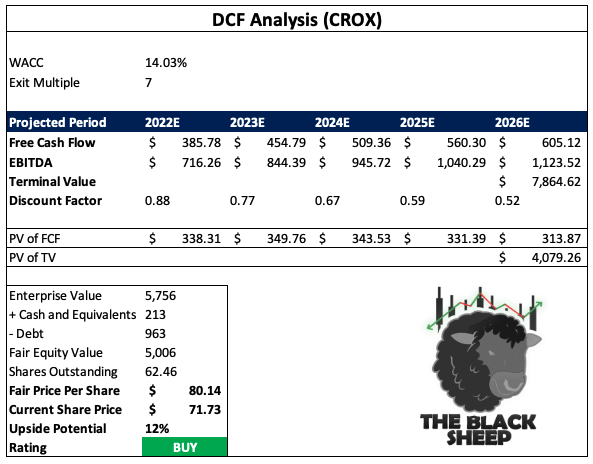

Crocs DCF Model (Made by author using own growth forecasts and assumptions )

Taking a walk-through of my model, I assume a WACC of 14.03% and exit multiple of 7x (below the company’s current EV/EBITDA of 7.17 and far below the 5-year median of 15.19). I assumed a low exit multiple to remain conservative in my analysis. Placing a 7x multiple on projected EBITDA of $1.123B, I arrived at a terminal value of $7.864B. After summing all free cash flow and discounting everything at the proper rate, I arrived at an enterprise value of $5.756B. After subtracting net debt and dividing by shares outstanding I arrived at a fair share price of $80.14. This represents 12% upside from current levels.

Summary Of Crocs’ Balance Sheet

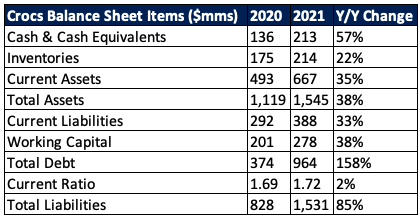

Below you can find a summary of the most important line items from Crocs’ balance sheet.

Crocs Important Balance Sheet Numbers (Image made by author using Crocs SEC 10-K Filings)

The most important standout on Crocs’ balance sheet is the 57% jump in cash & cash equivalents Y/Y. This coupled with a 22% boost in inventories allowed for current assets to improve by 35%, from $493M to $667M. This increase in liquidity for Crocs was offset, however, by a large increase of debt. Debt increased from $374M to $964M as a result of the company’s HEYDUDE acquisition. Management has committed to reducing this debt load, and I’m not worried considering the company generated $431.84M of levered free cash flow in 2021 (which will be the main source of repayment).

Peer Analysis

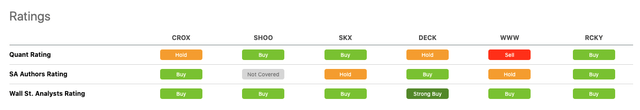

Taking a look at Crocs’ peers, it is hard to draw direct comparisons to a company with such an iconic brand name as Crocs. Regardless, here are the company’s peers along with their assigned ratings by Seeking Alpha.

Crocs Peers (Seeking Alpha Premium Tool)

As you can see, Crocs falls in the middle of the pack in terms of its quant score at “hold.” Taking a deeper look at the financials, however, we can see the superiority of Crocs versus its peers.

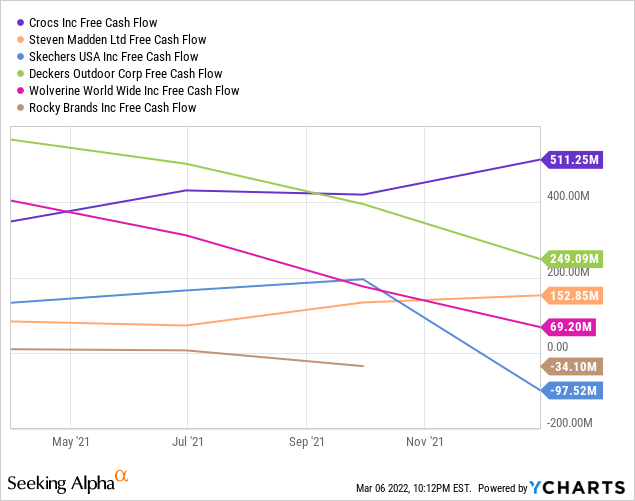

Crocs outproduces its peers in free cash flow by a healthy margin, generating over double as much cash as its nearest competitor.

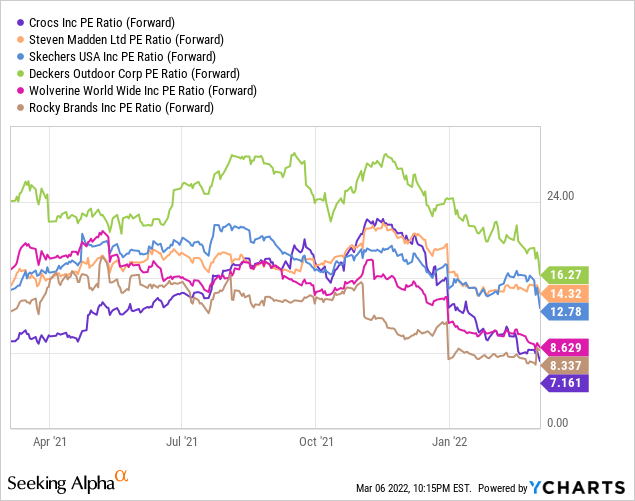

In terms of its forward P/E multiple, Crocs is cheap.

Crocs is currently trading at a modest 7.161x forward earnings estimates, which is the cheapest amongst the rest of its peers. Very rarely do I find a company with such fantastic profitability in growth mode that trades at such a low forward multiple. And never would I think it would be a retailer of clogs. Regardless, here we have it; Crocs!

Risks To Valuation

In terms of risks to my valuation, the biggest would be ongoing supply chain disruptions hindering inventory levels. In addition, Crocs outsources all of its production. ~62% of Crocs products were made in Vietnam in 2021, and the other ~38% were made in China. Escalating tensions between the United States and other countries could lead to issues within Crocs’ supply chain that investors should also be aware of. Crocs also relies on its Clogs heavily for revenue generation, but its acquisition of HEYDUDE should eliminate some of this concentrated product risk as its products are added to Crocs’ suite of footwear apparel. This is something investors should keep an eye on in case HEYDUDE’s products turn out to not be as accretive as management is suggesting.

Final Thoughts

Crocs is a fantastic company trading at a cheap valuation. The company is in growth mode, engaging in M&A, and is driving shareholder value through management’s strategic decisions. The HEYDUDE acquisition makes complete sense to me and should drive revenues in the coming years. On top of this, the company continues to expand its store base globally which should act as a catalyst for future growth. I am very optimistic about Crocs shares and advocate for investors to buy at current levels. The market moved Crocs shares too far too fast, down 60% from all-time-highs. I believe the totality of selling is over and suggest investors get interested given the 12% upside opportunity from current levels.

Be the first to comment