ktsimage/iStock via Getty Images

The hits keep on coming for Nvidia (NASDAQ:NVDA), with the latest dagger coming from the US government. Unable to get out of a financial mudslide caused by macroeconomic forces, as noted by its disappointing quarter and guide, Nvidia is now tasked with offsetting direct trade war mandates from the government. But this isn’t Nvidia’s battle alone. While AMD (NASDAQ:AMD) appears to be in the clear from a product perspective for the moment, the market is now calculating Trade War 2.0 ripple effects across the semiconductor industry and, in some cases, beyond. The problem is the market is viewing the action by the government as the beginning of the next trade war, a war where finished products are in the crosshairs, not just the equipment to make them.

Trade War 2.0

WFE (wafer fab equipment) companies are rolling out the welcome mat as chip manufacturers are welcomed to the trade war club. WFE companies were dealing with the brunt of the technology trade war with China not long ago. That was under a different administration, though. Now, the current administration is taking it to another level; don’t stop just the ability to produce chips but stop the altogether sale of advanced chip products.

From Nvidia’s perspective, things can’t get too much worse. Macroeconomic factors are putting extreme pressure on its retail-facing gaming division as guidance for a continued weak gaming market is clear. Notice I’m not blaming crypto mining, which isn’t the primary factor in Nvidia’s struggles, but I’ll attend to this subject in another article.

Nvidia’s Immediate Woes

For Nvidia, the government’s trade restriction explicitly calling out its products isn’t the problem – though this level of specificity is concerning – but rather, the products being called out belong to its strongest division – data center. The Data Center division has been the heavy lifter keeping Nvidia’s financial chaos somewhat contained. While Gaming and retail-facing revenue plummets, Data Center revenue has continued to grow even sequentially. But with the US department calling out the A100 and upcoming H100 – its workhorse AI accelerators – the company’s product performance and financials have been targeted.

This leaves the company in some pretty dire straits as it claims some $400M is in jeopardy due to the products’ final destination of China.

Now, the news isn’t as bad as it appears on the surface.

Nvidia also states the government has given it a window of sales by allowing it to continue selling its products until March 1, 2023, while other carve-outs will enable it to ship through its Hong Kong distribution until September 2023.

The U.S. government has authorized exports, reexports, and in-country transfers needed to continue Nvidia Corporation’s, or the Company’s, development of H100 integrated circuits after the Company filed its Current Report on Form 8-K with the U.S. Securities and Exchange Commission on August 31, 2022. The authorization also allows the Company to perform exports needed to provide support for U.S. customers of A100 through March 1, 2023. Additionally, the U.S. government authorized A100 and H100 order fulfillment and logistics through the Company’s Hong Kong facility through September 1, 2023.

– Nvidia company 8-K filing

There’s also the possibility of being granted licenses to continue selling these products in China. The trade restriction’s supposed purpose is to prevent these accelerators used for AI from getting into the hands of our adversary’s military.

The problem is these products are already in their hands – at least the older A100. Moreover, China and Russia are undoubtedly already reverse engineering and stealing product designs and likely secrets (remember, Nvidia had a supposed breach of its designs and source code). Put the pieces together, and it begins to form the picture on the puzzle box.

This is why the original Trade War intended to prevent China from creating the chips necessary to make these finished accelerator products.

But I’m digressing a bit from the discussion of how much trouble Nvidia, AMD, and others are in.

The bottom line for Nvidia is this is an additional wrinkle in its growth trajectory. Even if the $400M in the current quarter isn’t impacted, the situation needs to eventually clear out or be spread out enough so as not to significantly impact any one or two quarters.

The bigger problem is the uncertainty overhang. And as my readers know, I talk about market uncertainty a lot because it drives volatility.

Which brings us to AMD.

AMD’s Non-immediate Woes, But Immediate Realization

So far, the company is saying there isn’t a material impact from this directive; its MI100 accelerator product isn’t affected, according to management. Yet, the company’s stock has been on a slide, only accelerating after the filings. So even though the company finds no material impact, the market isn’t letting it off the hook.

Why is that?

The short of it is: The uncertainty factor; will there be something soon that will impact AMD’s sales?

But more to the point, this has brought to light an important competitive debate. Though the government has directed both companies to restrict products to China, only Nvidia sees a material impact. This means AMD’s data center accelerator product is either not competitive enough to be used for military AI work (as in not in demand for China), or it has worked its customer sales chain enough that these products aren’t directly sold into China.

If it’s the latter, then AMD should be commended for its efficient execution over the last few years to reduce dependence on direct Chinese sales. In this case, AMD has the competitive advantage from an end market sales chain perspective. If it’s the former, it confirms what most already knew: AMD is not competitive in the data center in terms of AI. That’s not to say its server CPUs aren’t competitive and taking share – I contend they are – but Nvidia’s superiority continues to reign supreme for AI acceleration – where big dollars and fat margins reside.

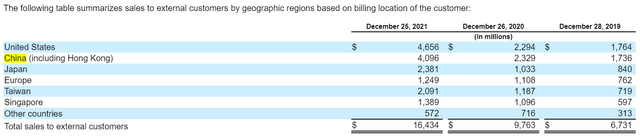

But AMD’s sales to China made up the second largest region, second only to the US in FY21. AMD’s Chinese revenue comprised 25% of overall revenue, growing 76% over 2020. This shows AMD isn’t in the clear in terms of being insulated from Chinese revenue. Granted, the portion related to AI processing is not determined, but the initial look is enough for more research and, at the very least, concern.

AMD Sales By Region (Company 10-K Filing)

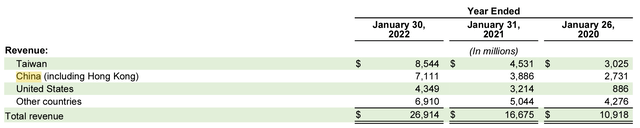

For comparison, Nvidia’s Chinese revenue made up 26% in FY22, growing 83%. Both companies are nearly identical in sales to China and grew at comparable rates between the last two fiscal years.

Nvidia Sales By Region (Company 10-K Filing)

This either means AMD doesn’t sell many data center products to China, or its data center accelerators are under the performance threshold to be considered a threat militarily. The conclusion is AMD is not competitive in this category, at least on the surface.

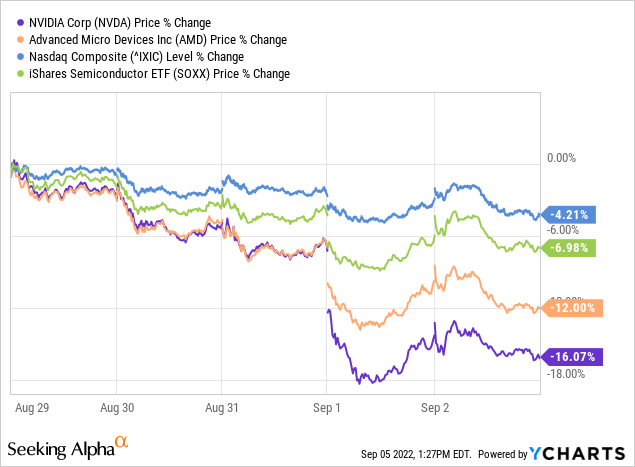

But even if Nvidia has the competitive advantage for advanced AI accelerators, the problem now is no matter how superior its product is, it can’t be sold in China, a region currently of material sales. This is at least the market perspective and the cause for the material underperformance over the last week.

And it’s how the two companies are ranked in terms of risk for Trade War 2.0; the market has spelled it out this past week.

Summarizing The Gist Of It

Nvidia has a near-term problem: Its AI products are above the threshold set by the US government to be sold to China (at least without proof it’s not being diverted to military R&D). A threshold seemingly set by its own A100 performance. According to the company, this means there’s $400M per quarter at risk of being evaporated – not just the current quarter (that’s just the company’s current focus in the filing).

AMD’s issue is not that it has revenue on the chopping block for the current quarter, but its AI accelerators’ performance is not desired and not competitive. But even more concerning is its ability to get to the performance threshold where it would engage the ban on sales to China and Russia has been capped. The silver lining is it can work toward and beyond the performance threshold while working to sell the products in another manner to avoid the ban preemptively (not necessarily circumventing it directly, but managing its sales chain in a way not to trip any alarms). This is an advantage AMD has over Nvidia.

But the bottom line is the current administration has taken the first material step in provoking Trade War 2.0, sending markets into uncertainty mode, not knowing what’s next to be knee-capped for US companies. Once the markets digest the current implications, each of these stocks may stabilize, but the volatility will not resolve anytime soon.

This means capitalizing on overreactions to the downside; dollar cost averaging into shares. For me, this means building my AMD position as the company has the most stable revenue among the two and really among all chip producers, including Micron (MU), Western Digital (WDC), and Intel (INTC). While it’s disheartening to realize AMD’s AI products are subpar, knowing its financials are more secure is the real victory in this market environment.

Be the first to comment