gorodenkoff

Booz Allen Hamilton (NYSE:BAH) has functions that primarily center on various types of tech and engineering consulting, including a pretty important focus on cybersecurity, as well as some general management consulting, for various branches of government. The drivers of their business are twofold: greater emphasis on cybersecurity especially as geopolitical tensions mount, as well as greater expenditure by government secularly on government programs, because the US government just keeps getting larger. We are seeing some decline in the velocity of contract closes, but that’s just because contracts are getting larger and more complex. The business is resilient, but also very premium, so ultimately it’s not very compelling.

Puts and takes of Q1 2023

Briefly on the BAH business model, the following are their functional areas:

- Analytics: consulting and development of AI applications for customers.

- Digital Solutions: some more of the front end related to the applications in AI and ML that BAH maybe developing for clients, also interacting with concerns like the cloud and cloud access.

- Cyber: cyber risk management and other cybersecurity consulting.

- Engineering: technical consulting for physical systems.

- Consulting: management consulting and focuses on issues of strategy, human capital and whatever else.

You can see how these things interlink.

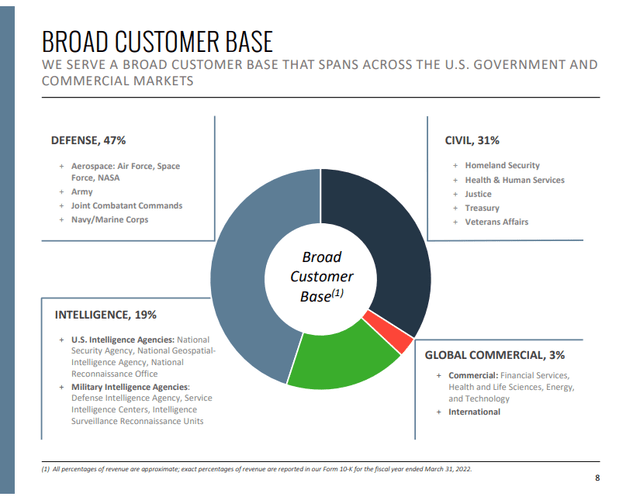

Critically, its customers are almost always government entities and therefore depend on things like government budget, size of the government, and strategic concerns related to cybersecurity, which are exacerbated by conflict including the Ukraine war where Russia commonly does attempt cyber attacks.

The most recent quarter came out some months ago and there are a few salient points that we want to point out to investors:

- Book to bill was 0.72x this quarter versus the 1.2x 12 months trailing, and this is because contract awards are slowing down a little bit. Apparently, this is mainly affecting timing, not dollar volume of contracts or interest from customers.

- However, end-markets remain resilient, with growing momentum in cyber concerns and the need for greater cybersecurity consulting.

- Moves to increase funding for the IRS and other spaces within government is driving greater budget for BAH services.

- Moreover, headcount grew about 2.6% year over year and there was likely some turnover as we’ve seen everywhere in the human capital space, so a greater proportion of this headcount is fresh and maybe only more recently capable of billing customers and being productive.

- There was some labor inflation costs, but favourable pricing and productivity kept organic growth rates of 12% ahead of rising costs, and EBITDA ended up still growing 6%, with some margin declines evident.

- There were some monopoly-based protests from the DoJ over some acquisitions they did, which they do to try stay technologically ahead of the curve, that may affect about 3% of their backlog, which we consider to be an irrelevant amount.

- Moreover, seasonality effects tend to kick in, so greater concerns around Russia and cyber threats may materialise in the coming quarter which is before the calendar year ends and is usually the deadline for government to issue contract awards.

Remarks

In other words, the next quarter, which will be for the latter part of the calendar year, should see some positive increments as major contracts become awarded and milestones continue to be reached. Also, considerations around the greater Russian hostility to the West and vice versa should create demand for cybersecurity services relating to lots of important government entities and missions. Management acknowledges that Cyber is likely to be the platform for the push that gets them well beyond the $1 billion in EBITDA mark by 2025, which is their current objective.

The problem is the price of the business. It is trading at a 16x multiple for EV/EBITDA, and it’s 24x for PE. That in our opinion is an objectively high multiple. While strategic markets do put it in a good position in terms of resilient fundamentals, and consulting is not capital intensive, there are other businesses out there that trade at substantially lower multiples while also being able to assure investors of high probability earnings stability or even growth. In BAH’s defense, it is better priced than Accenture (ACN), which does not have these strategic markets and is only marginally cheaper than BAH at a 13.6x EV/EBITDA multiple and a 23.7x PE. While it can also achieve growth thanks to its tech consulting markets, BAH is more of a solid play in our view. Nonetheless, bargains need to be struck in the current markets to outrun a growing risk free rate. BAH is effectively being valued as if it has no equity risk. We will take a pass on BAH.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment