4kodiak

It’s been just under five months since I suggested investors continue to avoid Boyd Gaming Corporation (NYSE:BYD) in spite of the excellent financial results the company had just posted. The shares have fallen another 7% or so since then against a loss of about 7.3% for the S&P 500, so I thought I’d check back to see if it makes sense to buy. After all, a stock trading at $52.50 is definitionally less risky than the same stock when it’s trading at $56.50. Since the company has reported financial results recently, I’ll comment on those, and I’ll also comment on the current valuation. Finally, in the previous missive, I droned on about the deep out of the money puts that I had written about previously, and I’m absolutely champing at the bit to write about that again.

It’s that time again, dear readers. We’ve reached that part of the article where I give you a little bit more than I just gave you with the bullet points above, and a great deal less than you’ll find in the article if you choose to continue to subject yourselves to it. I think Boyd Gaming is now a reasonably good buy, so I’ll be picking up some shares today in spite of the fact that I’m still short 10 deep out of the money January puts. You may have come across the old quip, “buy low.” It sounds easy enough, but the only way that we can manage to do that is if someone sells to us at a low price for what they deem to be very sound reasons. The only time that happens is when it seems like an absolutely terrible time to buy stocks. This is one significant reason why stock investing is “simple, but not easy” in my estimation. Stepping back down from my soapbox, I think Boyd is a buy here because they are one of the few stocks I’ve seen recently that seems to have fully recovered from the pandemic. Revenue and net income are both up nicely, the dividend has been reinstated, and there’s room to grow on that front in my view. Additionally, the capital structure is much cleaner now, which reduces the risk present. In spite of all of that, the stock is trading at what I consider to be reasonable valuations. Additionally, it’s sometimes good when Wall Street agrees with you. Finally, the value of the January puts has eroded nicely since May, reminding investors that sooner or later “King Theta” reasserts himself. While I generally like the risk reducing, yield enhancing potential of short puts, I think the stock itself represents better value here.

Financial Snapshot

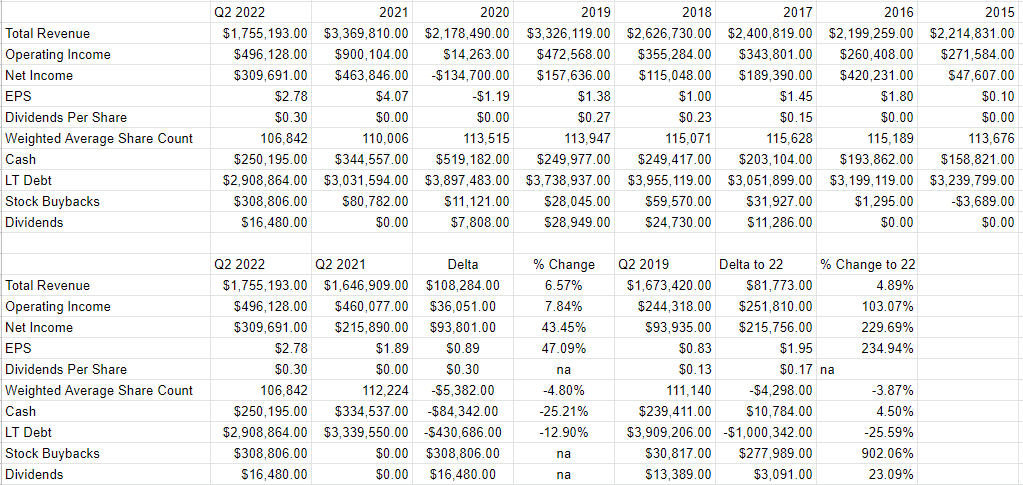

I think the company has posted some excellent financial results recently. Specifically, relative to last year, revenue and net income are about 6.5% and 43.5% higher, which I think is a very good result. At the same time, it also seems that the company has more than recovered from the pre-pandemic period, which isn’t something I can write for every company. Specifically, revenue and net income were 4.9% and just under 230% greater for the first six months of 2022 relative to that glorious time before the world had heard of “Covid.” If you’re worried that the most recent net income has been goosed by a one-off item of some kind, fret no further. Total operating costs were about 6% higher in 2022 than they were in 2021. Food and beverage, room, and maintenance costs, for instance were up by 29.9%, 26.3%, and 13.5% respectively. This financial improvement was driven entirely by topline growth.

At the same time, the capital structure has been cleaned up massively. Specifically, long term debt is down just under 13% relative to the same time last year. This lowers the risk here dramatically, in my view.

Management has rewarded shareholders with this improvement in the business by reinstating the dividend. The only point worth making on that front is the relative thinness of the payout ratio in my view. The fact that the company is only paying out about 5.3% of net income in the form of dividends suggests to me that there’s room for an increase here.

Given the above, I’d be very happy to buy this stock at the right price.

Boyd Gaming Financials (Boyd Gaming investor relations)

Boyd Gaming Stock

If you subject yourself to my stuff regularly, you know that I think the stock is distinct from the business in many ways. A business buys a number of inputs, adds value to them, and then sells the results for a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company, and it’s buffeted by a number of forces that may have little to do with the underlying business. For instance, a fashionable analyst may offer an opinion about a significant customer, and that drives the stock up or down. Very weirdly, in my estimation, the stock of a given company may be affected by narratives about currencies or investors may be mesmerized by the pronouncements of Fed officials, who drive stock prices up or down massively because of a 75 basis point difference in the overnight rate.

Although it’s tedious to see your favorite investment get buffeted around for reasons having little to do with the health of the business, within this tedium lies opportunity. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. This is why I’m relatively excited about stocks at the moment. The mood among investors is quite sour at this time in my view, and that creates opportunities. Written another way, we’re told repeatedly to “buy low.” How do we do that exactly? We only ever manage that when crowds of people are willing to sell to us at low prices for what they deem to be very rational reasons. Thus, buy when the mood turns sour.

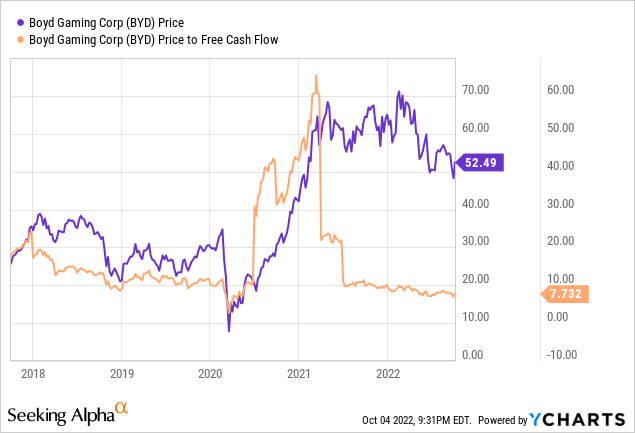

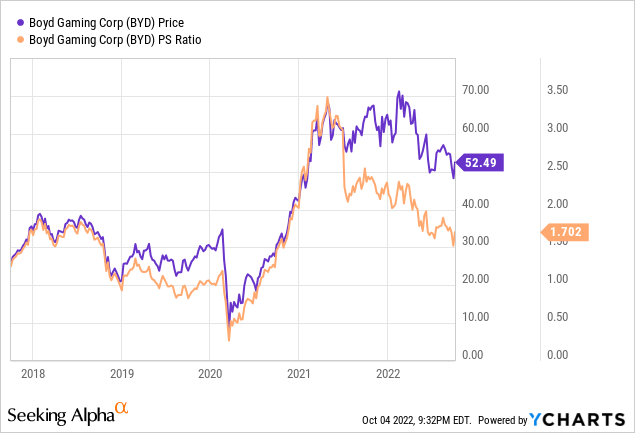

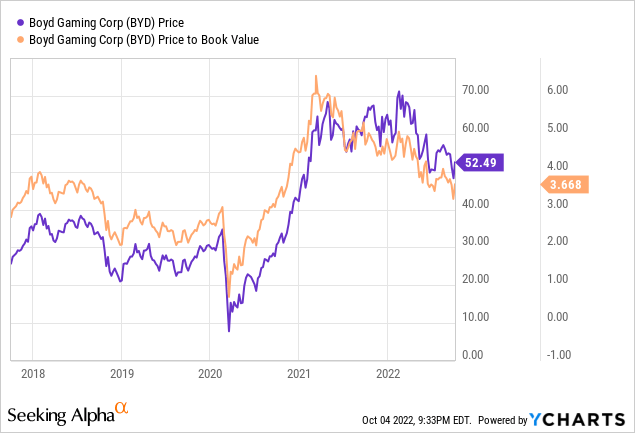

As my regulars know, when judging the cheapness (or not) of a stock, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Because I think “cheaper wins”, I want to see a company trading at a discount to both the overall market, and the company’s own history. When I last reviewed Boyd Gaming, I avoided these shares because they were trading at a price to free cash flow of about 7.67, a price to sales of 1.8, and a price to book of 3.89. Fast forward to the present and the shares are slightly more expensive on a price to free cash flow basis, but are 5.5% cheaper on a price to sales basis and about 6% cheaper on a price to book basis per the following:

Source: YCharts

Source: YCharts

Source: YCharts

If you know I like cheap stocks, you also know that I want to try to understand what the market is currently “assuming” about the future of a given company. If you read me regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to Boyd Gaming at the moment suggests the market is assuming that this company will grow earnings at a rate of ~1% in perpetuity, which I think is nicely pessimistic. Given the above, I’ll be buying a few shares of Boyd Gaming this morning.

Options Update

Those who are paying attention know that I decided to sell put options on Boyd Gaming rather than buy the stock. I specifically sold 10 January 2023 Boyd puts with a strike of $42. I received $1 of premium for each of these, and they were at the time that I wrote them about 31% out of the money. I recommended investors sell these same options in my previous missive, because the premia had jumped to $2.60 as the price dropped. In spite of the continued drop in stock price, these last traded hands at $2.07. It seems the options market is less optimistic that the strike price will be reached in spite of a recent drop in the price of the stock. An options trader once said to me that “time crushes all”, meaning that theta rears its ugly head eventually.

Anyway, I’d be happy to be exercised at a net price of $41 ($42 strike – $1 premium), so I’ll take no action on these. While I’m normally a fan of selling puts, obviously, I think the stock itself represents better relative value at the moment. For that reason, I’m no longer recommending people sell puts and simply suggesting they buy this stock.

Be the first to comment