SimonSkafar

Welcome to the November 2022 cobalt miners news.

The past month saw a very busy month of cobalt news and some positive news regarding Trafigura and EVelution Energy signing an MOU on a U.S. cobalt processing facility. We also saw plenty of great progress from the leading cobalt juniors, notably Jervois Global and Electra Battery Materials.

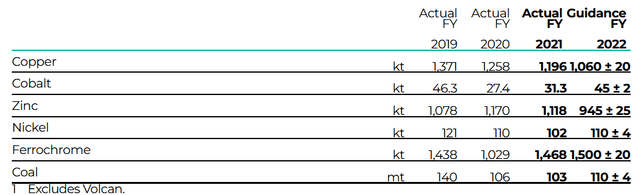

Cobalt price news

As of November 22, the cobalt spot price was flat at US$23.25/lb, from US$23.25/lb last month. The LME cobalt price is US$50,995/tonne. LME Cobalt inventory is 165 tonnes, about the same as the 168 level from last month. More details on cobalt pricing (in particular the more relevant cobalt sulphate), can be found here at Benchmark Mineral Intelligence or Fast Markets MB.

Cobalt spot prices – 5-year chart – USD 23.25 (source)

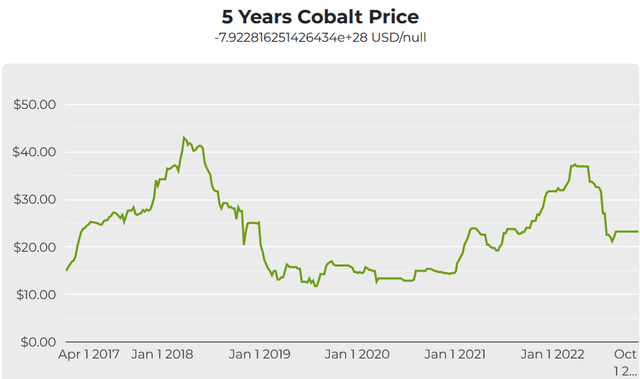

Cobalt demand v supply forecasts

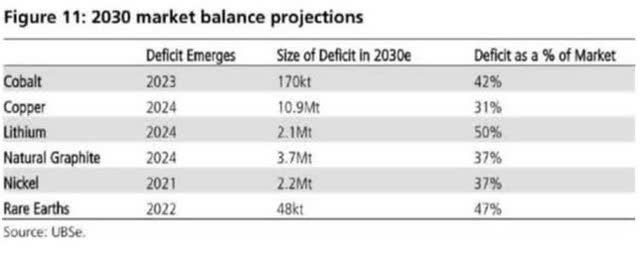

UBS cobalt supply and demand forecast (as of 2021) – Growing deficits from 2023

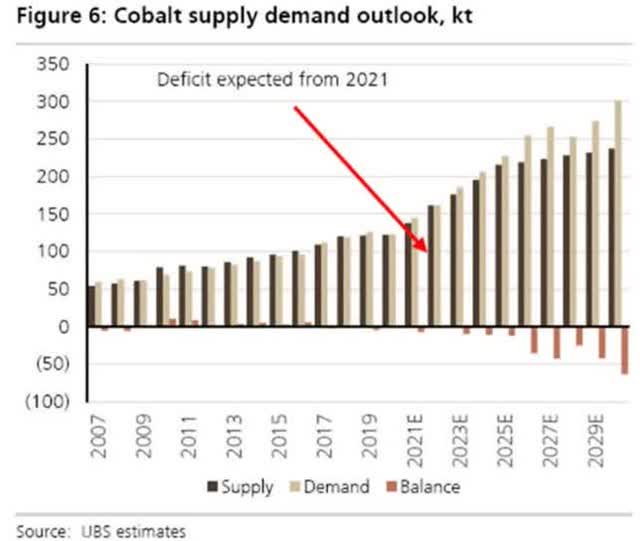

UBS’s EV metals demand forecast (from Nov. 2020)

UBS forecasts Year battery metals go into deficit – Source: UBS courtesy Carlos Vincens LinkedIn

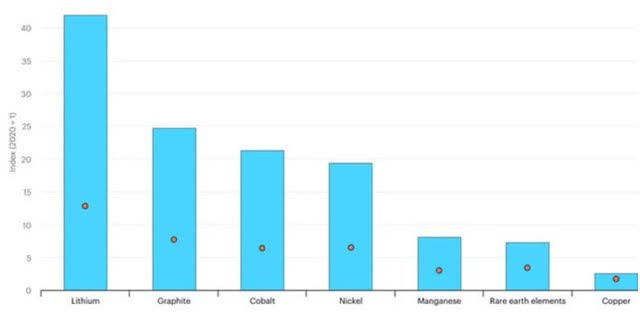

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

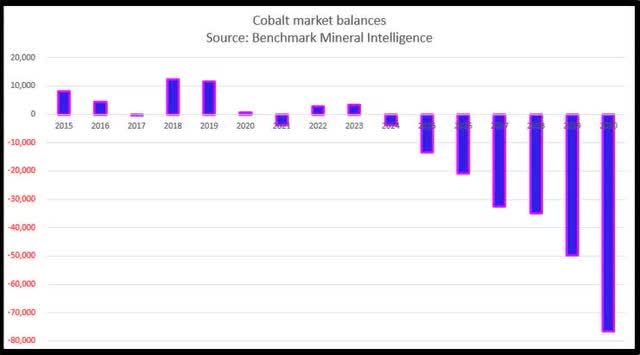

BMI 2022 forecast for cobalt – Deficits building starting from 2024

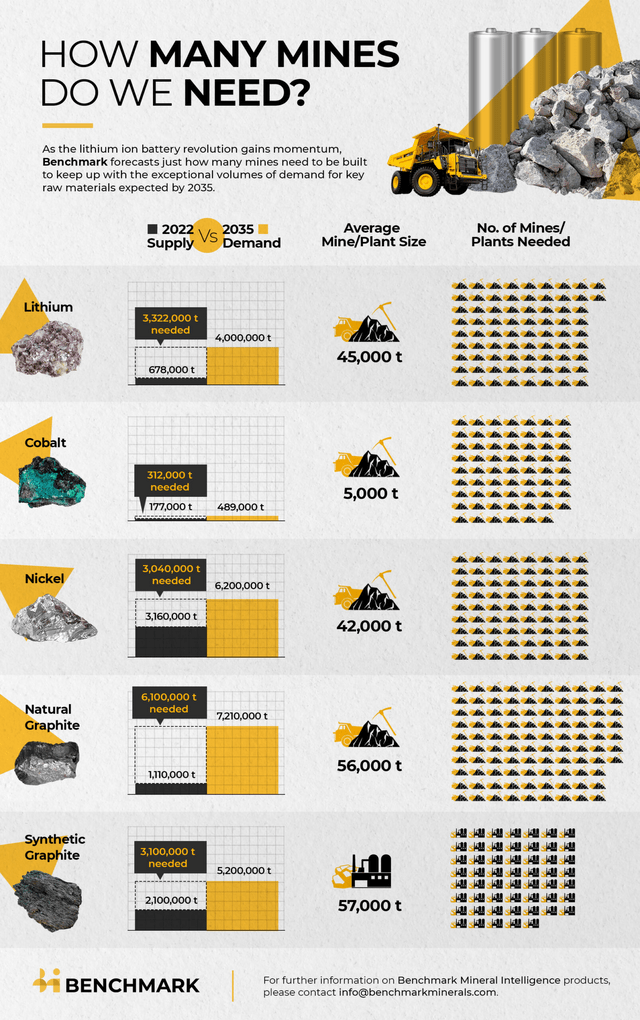

2022 – BMI forecasts we need 330+ new EV metal mines from 2022 to 2035 to meet surging demand – 62 new 5,000tpa cobalt mines (drops to 38 if include recycling)

Cobalt market news

On October 24, Trafigura announced:

Trafigura and EVelution Energy sign Memorandum of Understanding on U.S. cobalt processing facility. Trafigura, one of the world’s largest physical commodity traders, and EVelution Energy, a U.S. EV battery materials processing company, have signed a Memorandum of Understanding [MOU] to support the development of a battery-grade cobalt sulphate processing facility in the State of Arizona, USA. With an expected annual capacity of 7,000 tonnes of cobalt…

On October 25, The Northern Miner reported:

As Ontario joins clean energy talks, federal minister Wilkinson looks to streamline project approvals… The natural resources ministry plans to update its $3.8-billion critical minerals strategy by year’s end with categories for funding, Wilkinson said in an interview. The fine tuning will help future talks in the tables initiative with Ontario about its Ring of Fire zone of critical minerals, he said.

On October 27, Benchmark Mineral Intelligence reported:

Indonesia cobalt supply to push market into surplus this decade. Indonesia’s cobalt production could increase more than thirty-fold this decade, making it the second-largest producer after the Democratic Republic of the Congo and helping to ease concerns about a shortfall of the battery metal. Supply from the South-East Asian country is expected to reach 76,345 tonnes a year by the end of 2030, from just 2,367 tonnes last year, according to Benchmark’s latest Cobalt Forecast.

On October 31, The Financial Times reported:

Indonesia considers Opec-style cartel for battery metals. World’s largest nickel producer exploring governance structure similar to that used by oil group… Indonesia is studying the establishment of an Opec-like cartel for nickel and other key battery metals… “Indonesia is studying the possibility to form a similar governance structure with regard to the minerals we have, including nickel, cobalt and manganese.”… Indonesia is the world’s largest nickel producer, generating 38 per cent of global refined supply.

On November 1, Reuters reported:

EV battery production faces supply chain, geopolitical headwinds – report… original equipment manufacturers’ battery-electric and hybrid vehicle sales aspirations will face strong headwinds as they scramble for raw materials, with annual market demand for lithium-ion batteries pegged at about 3.4 Terawatt hours (TWh) by 2030… “Elements such as lithium, nickel, and cobalt do not just magically appear and transform into EV batteries and other components,”… The intermediate steps between excavation of elements and final assembly are a particular choke point, he added…

On November 1, The Business Times reported:

South Korea launches government-backed battery alliance to source key metals… The country, home to major battery makers LG Energy Solution, Samsung SDI, and SK Innovation’s SK On, is seeking to bolster supply chain stability and metals to become a major player in the field, which is dominated by China…

On November 3, Reuters reported:

Canada orders three Chinese firms to… divest their investments in Canadian critical minerals, citing national security… Sinomine was asked to sell its investment in Power Metals Corp (PWM.V), Chengze Lithium was asked to divest its investment in Lithium Chile Inc (LITH.V) and Zangge Mining required to exit Ultra Lithium Inc (ULT.V).

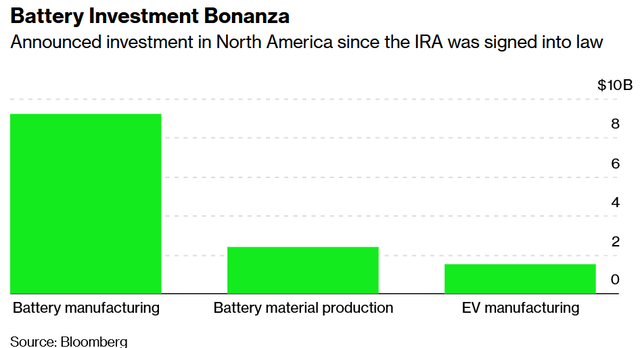

On November 8, Bloomberg reported:

Democrats supercharged EV investment while they had the chance… More than $13 billion of investment in battery raw material production and battery and EV manufacturing has been announced in the less than three months since Biden signed the IRA into law on Aug. 16. Volkswagen and Mercedes-Benz almost immediately sealed agreements to secure mining and refining resources from America’s neighbor to the north. Honda and Toyota earmarked almost $7 billion worth of EV battery plant investments within two days of one another. An Australian development company started up the first US cobalt mine in three decades. BMW said it would spend $1.7 billion expanding its South Carolina SUV factory, and that its battery supplier would build a new plant nearby.

Democrats supercharged EV investment. Battery manufacturing being the main winner so far (Source)

On November 10, Korea JoongAng Daily reported:

Posco Chemical finishes largest cathode plant in world. Posco Chemical finished construction of the world’s largest cathode plant in Gwangyang, South Jeolla, to become a major player in the fast-growing electric vehicle (EV) battery industry. The 165,203-square-meter plant has 90,000 tons of annual capacity, which is enough to make batteries for 1 million EVs. That is the world’s largest facility in terms of cathode production, Posco Chemical said. Made of lithium, nickel, cobalt and manganese, cathode materials account for 40 percent of the production cost of an EV battery.

On November 11, Bloomberg BNN reported:

Ford, GM in talks with Posco on investing in battery metal hubs. Ford Motor Co., General Motors Co., and Stellantis NV are in talks with South Korea’s Posco Chemical Co. about potentially investing in plants producing electric-vehicle battery materials in North America, according to people familiar with the matter. The factories would make cathode-active or anode materials…

On November 13, CBS News reported:

U.S. military weighs funding mining projects in Canada amid rivalry with China. Canadian companies told they qualify under Defense Production Act… The United States military has been quietly soliciting applications for Canadian mining projects that want American public funding through a major national security initiative.

On November 16, Benchmark Mineral Intelligence reported:

How can the world meet Elon Musk’s 300 TWh battery capacity target? The world will need to increase battery production thirty-fold from today’s levels… Production of lithium ion batteries will need to increase from 0.6 TWh a year to 20 TWh by 2050… That would require a twenty-fold increase in lithium supply to 12 million tonnes of lithium LCE and a similar increase in nickel sulphate to 8 million tonnes. Cobalt supply would have to increase by five times to 1 million tonnes of cobalt sulphate, and manganese by over twenty-fold to 2.5 million tonnes of manganese sulphate, according to Moores.

Note: Bold emphasis by the author.

Cobalt company news

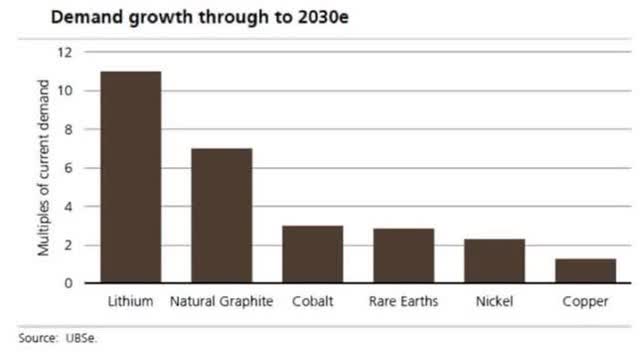

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

On October 28, Glencore announced: “Third quarter 2022 production report.” Highlights include:

“… Other matters

- Following the exceptionally strong marketing performance in the first half of the year, we currently expect a significantly reduced, but still above-average second-half contribution, likely exceeding $1.6 billion, being the top end of the pro-rated long-term EBIT guidance range of $2.2 to $3.2 billion p.a.”

Glencore production figures and 2022 guidance (source)

Glencore Q3 2022 production report

On November 3, Glencore announced:

Glencore Energy resolves investigations by UK. £280,965,092.95 financial penalty and costs is part of previously announced coordinated resolutions with authorities in the US, UK and Brazil. Aggregate amounts of the resolutions are materially consistent with the provision recorded in Glencore’s FY 2021 results.

CMOC Group Limited [HKSE:3993] [SHE:603993] (OTCPK:CMCLF) (formerly China Molybdenum)

On October 24, CMOC Group Limited announced:

CMOC reports RMB5.3bn net profit for the first three quarters of 2022, up 49% YoY. In the first three quarters of 2022, the company reported a revenue of RMB132.47bn, up 5% YoY; EBITDA of RMB14.64bn, up 41% YoY; net profit attributable to shareholders of the parent company of RMB5.31bn, up 49% YoY; net profit attributable to shareholders of the parent company after extraordinary gains and losses of RMB4.7bn, up 146% YoY; and EPS of RMB0.248, up 50% YoY.

On November 1, Reuters reported:

China’s CATL to take near 25% stake in CMOC… CATL’s Sichuan unit will indirectly own a 24.68% stake in CMOC via a capital boost and stake transfer, according to a company filing on the Shenzhen Stock Exchange.

Zhejiang Huayou Cobalt [SHA:603799]

On October 28, Zhejiang Huayou Cobalt announced:

The sum of 4.25 million US dollars is used to the Public Welfare Cause within five years! CDM Company of Democratic Republic of the Congo signs the Social Responsibility Letter with Peripheral Communities…

On November 9, Metso Oututec reported: “Huayou Cobalt awards tailings filtration equipment order to Metso Outotec… “

Jinchuan Group International Resources [HK:2362]

On November 13, Jinchuan Group announced:

Operational update for the nine months ended 30 September 2022; and profit warning… During the Period, the Group’s mining operations sold 46,922 tonnes of copper (nine months ended 30 September 2021: 47,376 tonnes), representing a decrease of approximately 1% year-on-year compared to the corresponding period in 2021, and 3,194 tonnes of cobalt (nine months ended 30 September 2021: 1,660 tonnes), representing an increase of approximately 92% year-on-year compared to the corresponding period in 2021… Out of the sales of copper and cobalt, the Group’s mining operations generated revenue of approximately US$356.4 million and US$129.1 million in the Period, respectively (nine months ended 30 September 2021: approximately US$430.8 million and US$70.2 million, respectively), representing approximately 17% year-on-year decrease and 84% year-on-year increase respectively compared to the corresponding period in 2021.

Chemaf (subsidiary of Shalina Resources)

No news for the month.

GEM Co Ltd [SHE:002340]

On November 17, GEM Co Ltd. announced:

GEM signs MoU with UID to establish GEM-UID International Green Technology Research and Development Institute…

Investors can read more about GEM Co in the Trend Investing article: “A Look At GEM Co Ltd – The World’s Largest Battery Recycling Company” when GEM Co was trading at CNY 5.08.

Eurasian Resources Group (“ERG”) – private

ERG own the Metalkol facility in the DRC where ERG processes cobalt and copper tailings with a capacity of up to 24,000 tonnes of cobalt pa.

On October 26, ERG announced: “Eurasian Resources Group publishes its Sustainable Development Report 2021.”

Umicore SA [Brussels:UMI] (OTCPK:UMICY)

No significant news for the month.

Sumitomo Metal Mining Co. (TYO:5713) (OTCPK:STMNF)

On November 8, Sumitomo Metal Mining Co. announced: “FY2022 capital expenditure and total investment plan.”

On November 8, Sumitomo Metal Mining Co. announced: “Consolidated financial results for the second quarter ended September 30, 2022.”

On November 15, Sumitomo Metal Mining Co. announced:

Sumitomo Metal Mining published integrated report 2022‐Explaining initiatives aimed at the achievement of our long-term vision with the Theme of Change…

On November 17, Sumitomo Metal Mining Co. announced: “FY2022 2nd quarter progress of Business Strategy.” A great report but focuses on nickel and copper. It does also mention “consideration of the possibility of LFP business”.

MMC Norilsk Nickel [LSX:MNOD] [GR:NNIC] (OTC:NILSY) (ADRs to remain in circulation until April 28, 2023)

On October 24, MMC Norilsk Nickel announced: “Nornickel announces consolidated production results for 9m 2022… “

On October 31, MMC Norilsk Nickel announced: “Commercial local treatment plants launched in Norilsk… “

On November 1, MMC Norilsk Nickel announced: “Nornickel provides update in relation to loan participation notes due 2025.”

OZ Minerals [ASX:OZL] (OTCPK:OZMLF)

On October 24, OZ Minerals announced: “Third quarter report 2022 for the three months ending 30 September 2022… “

On November 18, OZ Minerals announced: “OZ Minerals receives revised proposal at $28.25 per share from BHP and provides access to due diligence.” Highlights include:

The Revised Proposal of A$28.25 per share represents:

- “An enterprise value for OZ Minerals of A$9.6 billion1.

- A 49.3% premium to OZ Minerals’ undisturbed closing share price of A$18.92 per share on 5 August 2022.

- A 59.8% premium to OZ Minerals’ undisturbed 30-day volume weighted average price of A$17.67 per share as at 5 August 2022.

- A 13.0% increase compared to the Initial Proposal of A$25.00 per share.”

Sherritt International [TSX:S] (OTCPK:SHERF)

On November 2, Sherritt International announced: “Sherritt reports strong third quarter results and provides details of its Moa JV expansion program.” Highlights include:

Selected Q3 2022 Developments

- “Sherritt had earnings from operations and joint venture for the quarter of $21.3 million, compared to a loss of $10.8 million in the same period in the prior year driven by higher nickel and fertilizer sales volume and realized prices and by the timing of maintenance between the two periods…

- Adjusted EBITDA(1) in the quarter was $37.4 million compared to $17.6 million in Q3 2021…

- Sherritt’s share of finished nickel and cobalt production at the Moa Joint Venture (Moa JV) was 4,443 tonnes and 419 tonnes, respectively… “

On November 2, Sherritt International announced:

Sherritt announces second modified Dutch auction to purchase secured notes and fixed price tender offer to purchase junior notes in 2022 for aggregate $50 million…

On November 14, Sherritt International announced:

Sherritt amends and extends its previously announced offers on receipt of support from significant noteholders to tender $30 million of secured notes…

Nickel 28 [TSXV:NKL] [GR:3JC] (OTCPK:CONXF)

On October 25, Nickel 28 announced: “Nickel 28 releases Ramu Q3 2022 operating performance.” Highlights include:

- “Ramu Q3 2022 production of 759 tonnes of contained cobalt in MHP, compared to 841 tonnes in Q3 2021…”

Investors can view the company presentations here.

Possible mid-term producers (after 2022)

Jervois Global Limited [ASX:JRV] [TSXV: JRV] (OTCQX:JRVMF) [FRA: IHS] (formerly Jervois Mining)

On October 24, Jervois Global Limited announced: “Jervois approves 2035 Net Zero Target for Finland Operations.”

On November 10, Jervois Global Limited announced: “Jervois to restart São Miguel Paulista refinery, Brazil – Final investment decision and equity capital raising.” Highlights include:

- “Jervois approves Final Investment Decision (“FID”) on São Miguel Paulista (“SMP”) refinery restart,1 focused on delivering Stage 1 forecast of 10,000 mtpa nickel and 2,000 mtpa cobalt metal cathode2.

- First production at SMP expected in Q1 2024.

- Commissioning underway at Idaho Cobalt Operations (“ICO”); expected commercial concentrate production in Q4 2022, and nameplate capacity production end of Q1 2023.

- Jervois announces fully underwritten A$231 million (US$1503 million) equity capital raising (“Equity Raising”).

- Proceeds will fully fund SMP restart, ICO ramp up and mine sustaining capital expenditure, and Jervois Finland expansion BFS.

- Funding further de-risks Jervois, allowing it to maintain 100% control of three cash generating assets, all expected to be online early 2024, and ensures commercial negotiations with downstream supply chain occurs from a strong position.

- Entities controlled by Australian Super, Jervois’ largest shareholder, have agreed to participate in up to ~24% of the Equity Raising (A$55.6 million or US$36.1 million) – including its full Institutional Offer entitlement, Placement pro-rata and additional Retail Entitlement Offer sub-underwriting.

- Mercuria, Jervois’ third largest shareholder and one of the world’s largest independent energy and commodity traders, commits to investing US$10.5 million (A$16.2 million).

- Jervois Directors and Senior Management will invest a further A$2.0 million4 (US$1.3 million).”

On November 11, Jervois Global Limited announced:

Jervois successfully completes placement and institutional entitlement offer… Approximately A$177 million (US$115 million) was raised across the Placement and Institutional Entitlement Offer at an offer price of A$0.42 per share. The Placement and Institutional Entitlement Offer were strongly supported by new and existing domestic and offshore institutional investors…

Upcoming catalysts include:

- End Q1, 2023 – Idaho Cobalt Operations to reach nameplate capacity production.

- Q1, 2024 – First production targeted from the São Miguel Paulista Refinery.

Electra Battery Materials [TSXV:ELBM] (ELBM)

On November 8, Electra Battery Materials announced:

Electra announces marketed offering of units for proceeds of up to approximately US$8 million to finance commissioning of cobalt refinery…

On November 9, Electra Battery Materials announced: “Electra reports Q3 results and provides update on cobalt refinery project and black mass recycling demonstration.” Highlights include:

Electra Q3 2022 Highlights and Developments

- “Held cash and marketable securities of $19.7 million as at September 30, 2022, down from $41.8 million as at June, 2022. Electra’s cash balance at the end of Q3 does not include the remaining $6.7 million of government investments expected to be received or $16.8 million of available funding from the Company’s At-the-Market (“ATM Program”) program.

- Total incurred costs for the refinery construction project for the quarter were $18.8 million…

- Signed a three-year agreement to supply 7,000 tonnes of battery grade cobalt to LG Energy Solution, a leading global manufacturer of lithium-ion batteries for electric vehicles, beginning in 2023.

- Made progress towards the launch of a black mass recycling demonstration plant at the Company’s Ontario refinery complex. Under the parameters of the demonstration, which is expected to be launched in the coming weeks, Electra plans to process up to 75 tonnes of material in a batch mode and anticipates the recovery of high-value elements found in lithium-ion batteries, including nickel, cobalt, lithium, copper, and graphite.

- Confirmed cobalt mineralization at its Ruby prospect, which is located 1.5 kilometres from Electra’s primary Iron Creek deposit, following receipt of assay results from the summer exploration program in the Idaho Cobalt Belt. Assay results and exploration work completed to date support the launch of a more extensive drill campaign to determine the full extent of Ruby’s mineralization.

- Released highlights of a scoping study prepared by a global engineering firm that supports the creation of an integrated electric vehicle battery materials park in Ontario consisting of nickel, cobalt, manganese refining, recycling of battery black mass material, and precursor cathode active material (pCAM) manufacturing. The scoping study assessed the economics and carbon footprint of various nickel feed options to develop an integrated facility producing 10,000 tonnes per annum of battery grade nickel sulfate and pCAM components essential to the production of EV batteries.

- Signed a benefits agreement with the Métis Nation of Ontario… “

Highlights Subsequent to Quarter End

- “… Issued a request for a proposal for the purposes of identifying an engineering firm to complete a prefeasibility study on the development of cobalt sulfate refinery in Bécancour, Quebec. Selection of the engineering firm is expected before end of year with completion of the study expected in the second half of 2023.

- Launched a marketed offering of units for total gross proceeds of up to US$5.5 million (~CAD$7.4 million) to be used to fund the commissioning of Electra’s cobalt sulfate refinery.”

Upcoming catalysts include:

Early 2023 – Target to have their Ontario cobalt refinery operational with ore feed from Glencore.

Investors can view the company presentations here and a recent Trend Investing article on Electra here.

Sunrise Energy Metals Limited [ASX:SRL](OTCQX:SREMF)(formerly Clean TeQ)

Sunrise Energy Metals has 132kt contained cobalt at their Sunrise project.

On October 31, Sunrise Energy Metals Limited announced: “Quarterly activities report.”

- “Sunrise continues to progress discussions with potential equity funding and offtake partners for the Sunrise Battery Materials Complex (‘Sunrise Project’)…

- Work streams to advance the fully integrated Sunrise Project continued with activities focussed on: Advancement of the long-lead electrical transmission line work scope. Test and process development work assessing opportunities for potential recycling of spent battery materials. Scandium alloy development programs to work with, and assist, industry players to investigate and develop new applications for scandium-aluminium alloys. Long-term leases of land agreed with councils for water pipeline.

- … Completion of the drilling program at the Hylea project with assays returning a number of encouraging cobalt, nickel and scandium intervals. Laboratory analysis of rock chip samples over uranium-thorium radiometric anomalies of trachytes at Minore Project returned significant rare earth elements (REE) anomalies.”

Upcoming catalysts include:

2022/23 – Possible off-take agreements and project funding/partnering.

Investors can also read the latest company presentation here.

Australian Mines [ASX:AUZ] (OTCPK:AMSLF)

On October 27, Australian Mines announced: “Quarterly activities report for period ended 30 September 2022.” Highlights include:

- “Sconi Project Studies – Subsequent to the reporting period and following a review of recent technical and financial studies, along with detailed discussions with potential financers and business partners, Australian Mines made the strategic decision to develop the Sconi Project to produce battery grade nickel sulphate, cobalt sulphate and scandium oxide, as described in the Feasibility Study announced in November 20181 and updated June 20192 , rather than a MHP project.

- Agreement for proposed settlement with ASIC – The Company and ASIC agreed, subject to approval by the Federal Court, to settle the Proceedings by the Company making certain admissions of contraventions of its continuous disclosure obligations. The joint submission will be heard in the Federal Court at the end of October.“

Investors can read the latest company presentation here.

Upcoming catalysts include:

- 2022 – PFS on alternative nickel-cobalt laterite ore processing.

Ardea Resources [ASX:ARL] (OTCPK:ARRRF)

In total, Ardea has 5.9mt of contained nickel and 380kt of contained cobalt at their KNP Project near Kalgoorlie in Western Australia. Ardea is also exploring for gold and nickel sulphide on their >5,100 km2 of 100% controlled tenements in the Eastern Goldfields region of Western Australia.

On October 28, Ardea Resources announced:

Quarterly operations report for the quarter ended 30 September 2022… Ardea remains debt free, with a tight capital structure and had $19M cash-at-bank, at the end of the September 2022 Quarter Strong cash position leaves the Company well-funded throughout FY23 to deliver the Kalgoorlie Nickel Project Preliminary Feasibility Study (PFS), continue Nickel Sulphide and Critical Mineral exploration within KNP tenure.

On November 22 Ardea Resources announced:

Eastern Goldfields projects exploration update… The Company tenement portfolio covers 4,200km2 and is one of the largest land holdings over nickel-hosting komatiite ultramafic stratigraphy in Australia. The significant land holding is also prospective for other economic mineralisation including Critical Minerals such as Lithium-Caesium-Tantalum (LCT) elements and Rare Earth Elements (REE). These compelling magmatic nickel sulphide and Critical Mineral opportunities are being evaluated for their exploration potential…

Upcoming catalysts include:

- 2022 – Possible off-take partner and funding for the GNCP Project. Further exploration results.

Investors can read the latest company presentation here.

Cobalt Blue Holdings [ASX:COB] (OTCPK:CBBHF)

Cobalt Blue has 81.1kt of contained cobalt at their 100% owned Broken Hill Cobalt Project [BHCP] (formerly Thackaringa Cobalt Project) in NSW, Australia. LG International is an equity strategic partner.

On October 26, Cobalt Blue Holdings announced:

BHCP demonstration plant – Ore processing update. As reported on the 6th October, the Concentrator Circuit completed the initial 500 t of ore in September. Over the next four weeks a further 1,500 t of ore has been processed, bringing the total tonnage to 2,000 t. A scavenger float circuit was brought online in October to target recovery of cobalt from the gravity circuit tails. The overall target recoveries of >90% are expected with the combination of gravity and flotation circuits. These expected recoveries and upgrades are in line with our earlier technical studies.

On October 31, Cobalt Blue Holdings announced: “September 2022 quarterly activities report.” Highlights include:

Broken Hill Cobalt Project

- “Feasibility Study update.

- Bulk Sample for Demonstration Plant works.

- Concentrator works.

- Demonstration Plant update.

- Critical Minerals Accelerator Initiative Grant.”

Cobalt in Waste Streams Project Update

- “Initial sample test work completed. Second sample test work underway shortly.”

On November 7, Cobalt Blue Holdings announced:

ASX announcement – Successful completion of placement and non-renounceable entitlement issue to raise up to $16 million in new shares. The Placement will involve 6.9 million New Shares being issued at an issue price of $0.58 per New Share to raise proceeds of $4 million (before costs). The issue price of $0.58 per share represents a 12% discount to the closing price on 2 November 2022 and a 14% discount to the 10-day VWAP up to and including 2 November 2022.

Upcoming catalysts include:

- 2022 – Possible off-take agreements. Feasibility Study & project approvals. Final Investment decision. Project Funding.

Investors can watch a CEO interview here and a recent presentation here.

Havilah Resources [ASX:HAV] [GR:FWL] (OTCPK:HAVRF)

Havilah 100% own the Mutooroo copper-cobalt project about 60km west of Broken Hill in South Australia. They also have the nearby Kalkaroo copper-gold-cobalt project (optioned to Oz Minerals), as well as a potentially large iron ore project at Grants. Havilah’s 100% owned Kalkaroo copper-gold-cobalt deposit contains JORC Mineral Resources of 1.1 million tonnes of copper, 3.1 million ounces of gold and 23,200 tonnes of cobalt.

On October 21, Havilah Resources announced: “Annual report 2022.”

On November 18, Havilah Resources announced:

Commencement of OZ Minerals-Havilah strategic alliance drilling. Up to 19,900 metre, $4 million reverse circulation (RC) exploration drilling program has commenced on a series of high priority copper prospects in proximity to the Kalkaroo copper-gold-cobalt deposit (Kalkaroo) under the Curnamona Province Strategic Alliance (Strategic Alliance) with OZ Minerals Limited.

Upcoming catalysts include:

- 2023 – Progress towards the OZ Minerals option to buy Kalkaroo.

Investors can learn more by reading the Trend Investing article “Havilah Resources Has Huge Potential and/or the update article. You can also view a CEO interview here, and the company presentation here.

Aeon Metals [ASX:AML](OTC:AEOMF)

Aeon Metals 100% own their Walford Creek copper-cobalt project in Queensland Australia.

On October 27, Aeon Metals announced: “AEM survey identifies new near surface targets at Walford.” Highlights include:

- “14 km long, near-surface, highly conductive structure identified.

- Similar conductive signature to the mineralised PY1 horizon adjacent to the Fish River Fault.

- Supported by earlier gravity and magnetic surveys over Walford Creek.

- Multiple conductive ‘linking’ structures noted.

- Mapping plus laterite and gravel (LAG) sampling underway to ground-truth the structure.”

On October 31, Aeon Metals announced: “Quarterly activities report for the period ending 30 September 2022.” Highlights include:

- “Continued, successful exploration drilling at Walford Creek further extended known mineralisation along the Fish River Fault (FRF).

- Completion of the CEI grant funded airborne electromagnetic survey (AEM) highlighted extensive near surface structure to south of the FRF.

- Completion of CEI grant funded gravity survey at Sugarbag prospect.”

On November 9, Aeon Metals announced: “Amy West drilling delivers exceptional copper and cobalt results.” Highlights include:

- “Recently received assay results from drilling at Amy and Amy West include the best copper and cobalt intersections achieved at Walford Creek.

- Significant new results include: WFDH548 intersected: 98.0m at 2.56% recoverable CuEq* (1.54% Cu, 0.17% Co, 1.5% Pb, 0.38% Zn, 0.08% Ni, 37.5g/t Ag) in PY3 from 319.0m.

- Further assay results pending for additional step-out holes to the east; strong visual indications of mineralisation extension.“

On November 11, Aeon Metals announced: “R&D refund received. R&D refund of A$2.76 million received.”

On November 14, Aeon Metals announced: “Updated quarterly activities report… “

GME Resources [ASX:GME][GR:GM9] (OTC:GMRSF)

GME Resources own the NiWest Nickel-Cobalt Project located adjacent to Glencore’s Murrin Murrin Nickel operations in the North Eastern Goldfields of Western Australia. The NiWest Project which has an estimated 830,000 tonnes of nickel metal and 52,000 tonnes of cobalt.

On October 31, GME Resources announced: “Quarterly activities report September 2022.” Highlights include:

- “Updated PFS outcomes for NiWest deliver substantial increase to projected economic returns from the development of the Project.

- Strong results led the GME Board to seek to proceed with a Definitive Feasibility Study (“DFS”) for the Project.

- Signing of a non-binding MOU with Stellantis N.V. in relation to future offtake of battery grade nickel and cobalt sulphate products from NiWest.

- Completion of a Placement to raise $4.0 million (before costs) to be applied towards the NiWest DFS and provide general working capital.”

On November 1, GME Resources announced:

Engineering partnership with Ausenco for NiWest Nickel Project DFS… NiWest DFS team close to being finalised and will formally commence in November with a targeted completion date in late 2023.

On November 14, GME Resources announced: “Bulk sample collection underway for offtake partner testwork.”

Investors can read a company investor presentation here.

Global Energy Metals Corp. [TSXV:GEMC][GR:5GE1] (OTCQB:GBLEF)

On October 31, Global Energy Metals Corp. announced: “Global Energy Metals announces copper-cobalt grades continue at depth at Millennium with balance of RC and diamond drilling assays received from partner funded exploration.” Highlights include:

- “Remaining assays received from recently completed drilling at Millennium Cu-Co-Au. Diamond drill extension results include: 17m @ 0.43% Cu, 0.11% Co and 0.08g/t Au from 234m (MI22RD02)…

- Resource review and upgrade work in progress.”

On November 1, Global Energy Metals Corp. announced:

Global Energy Metals enters binding agreement to sell its majority interest in the Werner Lake Cobalt Project to High-Tech Metals Ltd… Mitchell Smith, President and CEO of GEMC comments:“We are pleased to increase value for our shareholders, without dilution, through the monetization of a non core asset as part of our ongoing strategy of building investment exposure to technology enabling metals essential to an electrified future. The Werner transaction with High-Tech is another demonstration of the realization of this business model. We look forward to becoming shareholders of High-Tech and participating in the exploration success of the project through the public entity upon its proposed listing on the ASX.”… The Mineral Property Purchase and Sale Agreement provides, among other things, that the aggregate purchase price shall be AUD $700,000 of which AUD $50,000 shall be paid to the Company on execution of the Mineral Property Purchase and Sale Agreement and the balance of which will be satisfied by the issuance of a total of 3,250,000 shares of HTM (the “Consideration Shares”) as to 2,500,000 Consideration Shares to Global Energy Metals and 750,000 Consideration Shares to Marquee.

Giga Metals Corp. [TSXV:GIGA][FSE: BRR2] (OTCQX:HNCKF) (Turnagain Nickel Deposit now held via Hard Creek Nickel Corporation [TSXV:HNC] (OTCQX:HNCKF)

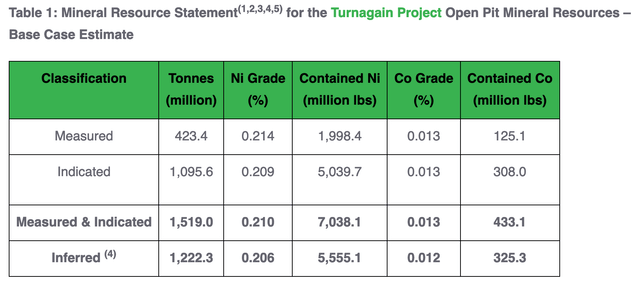

On October 27, Giga Metals Corp. announced:

Measured plus indicated resources at Turnagain increase by 42% to 1.52 billion tonnes. Contained nickel increases by 35% to 7.0 billion pounds.

The Metals Company (TMC)

On November 14, The Metals Company announced: “NORI and Allseas lift over 3,000 tonnes of polymetallic nodules to surface from planet’s largest deposit of battery metals, as leading scientists and marine experts continue gathering environmental data.” Highlights include:

- “During the historic deepsea trials, engineers drove the pilot collector vehicle across over 80 kilometers of the seafloor, collecting approximately 4,500 tonnes of nodules and bringing over 3,000 tonnes up a 4.3-km riser system to the surface production vessel, Hidden Gem.

- The Allseas-designed pilot nodule collection system — which will be scaled to include additional collector heads and a wider diameter riser pipe in preparation for NORI’s Project Zero – achieved all pilot production milestones and reached a sustained production rate of 86.4 tonnes per hour.

- Conducted across a small test area in NORI-D, collection system trials and ongoing environmental impact monitoring are part of the International Seabed Authority’s regulatory and permitting process and the extensive amount of data gathered will inform TMC subsidiary NORI’s application to the ISA for an exploitation contract.”

On November 14, The Metals Company announced: “The Metals Company provides Q3 corporate update.” Highlights include:

Financial Highlights

- “Net loss of $27.9 million and loss per share of $0.12 for the quarter ended September 30, 2022.

- Total cash on hand of approximately $66.9 million at September 30, 2022.

- The Company believes that existing cash will be sufficient to fund operations for at least the next twelve months, past the July 2023 date targeted by the International Seabed Authority (ISA) as the date for the final adoption of the exploitation regulations for the industry…”

Other juniors and miners with cobalt

Happy to hear any news updates from commentators. Tickers of cobalt juniors we will also be following include:

21st Century Metals (CSE: BULL) (OTCQB:DCNNF), African Battery Metals [AIM:ABM], Alloy Resources [ASX:AYR], Artemis Resources Ltd [ASX:ARV] (OTCQB:ARTTF), Aston Minerals [ASX:ASO] (formerly European Cobalt), Auroch [ASX:AOU] [GR:T59], Azure Minerals [ASX:AZS] (OTCPK:AZRMF), Bankers Cobalt [TSXV:BANC] [GR:BC2] (NDENF), Battery Mineral Resources [TSXV:BMR], BHP Group Limited (BHP), Blackstone Minerals [ASX:BSX], Brixton Metals Corporation [TSXV:BBB], (OTCQB:BBBXF), Canada Nickel [TSXV:CNC], Canada Silver Cobalt Works Inc [TSXV:CCW] (OTCQB:CCWOF), Canadian International Minerals [TSXV:CIN], Carnaby Resources [ASX:CNB], Castillo Copper [ASX:CCZ], Celsius Resources [ASX:CLA] [GR:FX8], Centaurus Metals [ASX:CTM], CBLT Inc. [TSXV:KBLT] (OTCPK:CBBLF), Cobalt Power Group [TSX:CPO], Cohiba Minerals [ASX:CHK], Corazon Mining Ltd [ASX:CZN], Cruz Battery Metals Corp. [CSE:CRUZ][FSE: A2DMG8] (OTCPK:BKTPF), Cudeco Ltd [ASX:CDU] [GR:AMR], DLE Resources [TSXV:DLP], Dragon Energy [ASX:DLE], Edison Battery Metals [TSXV:EDDY], Electric Royalties [TSXV:ELEC], First Quantum Minerals Ltd. (OTCPK:FQVLF), Fortune Minerals [TSX:FT] (OTCQB:FTMDF), Fuse Cobalt Inc [CVE:FUSE] (WCTXF), Galileo [ASX:GAL], GME Resources [ASX:GME] (OTC:GMRSF), Stillwater Critical Minerals Corp. [TSXV:PGE] (OTCQB:PGEZF), Hinterland Metals Inc. (OTCPK:HNLMF), Hylea Metals [ASX:HCO], IGO Limited [ASX:IGO] (OTCPK:IIDDY), King’s Bay Res (OTCPK:KBGCF) [TSXV:KBG], Latin American Resources, M2 Cobalt Corp. (TSXV: MC) (OTCPK:MCCBF), MetalsTech [ASE:MTC], Meteoric Resources [ASX:MEI], Mincor Resources (OTCPK:MCRZF) [ASX:MCR], Namibia Critical Metals [TSXV:NMI] (OTCPK:NMREF), Pacific Rim Cobalt [BOLT:CSE], PolyMet Mining [TSXV:POM] (PLM), OreCorp [ASX:ORR], Power Americas Minerals [TSXV:PAM], Panoramic Resources (OTCPK:PANRF) [ASX:PAN], Pioneer Resources Limited [ASX:PIO], Platina Resources (OTCPK:PTNUF) [ASX:PGM], Quantum Cobalt Corp [CSE:QBOT] GR:23BA] (OTCPK:BRVVF), Queensland Pacific Metals [ASX:QPM] (OTCPK:QPMLF), Regal Resources (OTC:RGARF), Resolution Minerals Ltd [ASX:RML], Sienna Resources [TSXV:SIE], (OTCPK:SNNAF), and Victory Mines [ASX:VIC].

Conclusion

November saw cobalt spot prices flat and LME inventory was generally flat.

Highlights for the month were:

- Trafigura and EVelution Energy sign Memorandum of Understanding on U.S. cobalt processing facility.

- Canadian federal minister Wilkinson looks to streamline project approvals.

- BMI: Indonesia cobalt supply to push market into surplus this decade.

- Indonesia considers Opec-style cartel for battery metals.

- South Korea launches government-backed battery alliance to source key metals.

- Canada orders three Chinese firms to divest their investments in Canadian critical minerals.

- Democrats supercharged USA EV investment with US$13b of investments announced so far, led by battery manufacturing.

- Posco Chemical finishes largest cathode plant in world. Ford, GM in talks with Posco on investing in battery metal hubs.

- U.S. military weighs funding mining projects in Canada, rivalry with China.

- Glencore cobalt production guidance remains at 45,000t in FY 2022.

- CMOC reports RMB 5.3bn net profit for the first three quarters of 2022, up 49% YoY. CATL Sichuan unit to take near 25% stake in CMOC Group.

- OZ Minerals receives revised proposal at $28.25 per share from BHP and provides access to due diligence.

- Jervois Global approves restart of São Miguel Paulista refinery in Brazil, first production expected in Q1 2024, raises A$177m.

- Australian Mines made the strategic decision to develop the Sconi Project to produce battery grade nickel sulphate, cobalt sulphate and scandium oxide.

- Ardea Resources is evaluating its massive 4,200 sq. km tenements for lithium & rare earths potential, in addition to nickel, cobalt and gold.

- Commencement of OZ Minerals-Havilah strategic alliance drilling.

- Aeon Metals AEM survey identifies new near surface targets at Walford, 14 km long, near-surface, highly conductive structure identified. Amy West drilling delivers exceptional copper and cobalt results.

- Global Energy Metals enters binding agreement to sell its majority interest in the Werner Lake Cobalt Project to High-Tech Metals Ltd.

- Giga Metals Measured plus indicated resources at Turnagain increase by 42% to 1.52 billion tonnes. Contained nickel increases by 35% to 7.0 billion pounds.

- TMC – NORI and Allseas lift over 3,000 tonnes of polymetallic nodules to surface from planet’s largest deposit of battery metals.

As usual all comments are welcome.

Be the first to comment