Morsa Images/DigitalVision via Getty Images

Initiating Coverage

Topgolf Callaway Brands Corp. (NYSE:MODG) is an investment that can be of interest to investors who are looking for growth in an unconventional category. We believe that the company is attractive due to its strong financial performance and guidance, and our thesis relies on a couple of secular tailwinds that will increase the golf market demographic. Along with a reasonable forward P/E valuation with ample room for upside, we believe that Topgolf Callaway Brands is an attractive investment today.

Company Overview

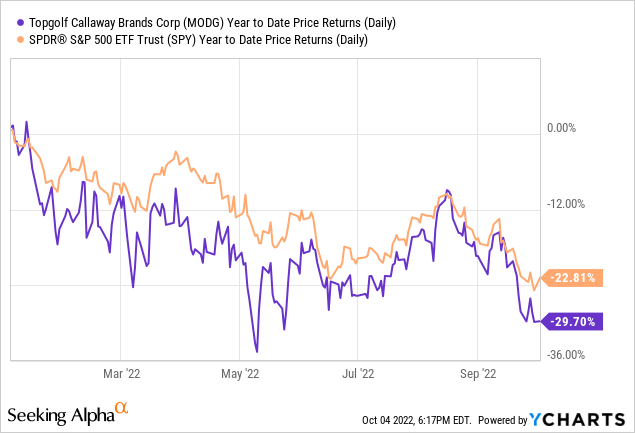

Topgolf Callaway Brands Corp. is a tech-enabled golf company delivering leading golf equipment, apparel and entertainment, with a portfolio of global brands including Topgolf, Callaway Golf, TravisMathew, Toptracer, Odyssey, OGIO, Jack Wolfskin, and World Golf Tour. In its current form, the company is a golf conglomerate with business lines in apparel, golf technology, video games, and entertainment. In the past, the company has gone through a series of acquisitions and mergers, most recently a merger with Topgolf in May 2021. Year-to-date, the company has slightly underperformed the market as the company had a stock return of -29.70% compared to S&P 500’s return of -22.81%.

Commentary on Merger

The merger between Callaway Golf Company and Topgolf International, Inc. has been an interesting merger between golf-related businesses that serve different purposes. Callaway focused primarily on golf equipment and apparel, and Topgolf was a golf-related entertainment company. Since the merger completed in May 2021, we believe the newly formed company is much more diversified through different verticals, and we think that the company is fundamentally more sound together than if the companies were to be separate. Now, this conglomerate of a business has business segments in not only clothing and golf equipment, but now in entertainment, technology, and video games. As golf adoption increases, Topgolf Callaway Brands Corp. is well poised to benefit from increased entertainment spend, apparel spend, and greater adoption of golf technology.

Strong Performance and Guidance

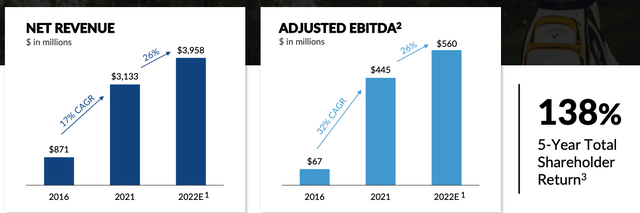

Topgolf Callaway Brands Corp. has a strong history of shareholder value generation, mostly in the form of growth. From 2016 to 2021, the company’s revenue CAGR was an impressive 17% with an Adjusted EBITDA CAGR of 32% in the same time frame. Using 2022 estimates, the company projects a strong 26% YoY revenue and Adjusted EBITDA growth. We believe that the strong growth across top line and bottom line metrics is the increased popularity of golf and increasing adoption of golf technology, such as Topgolf’s tech-filled games.

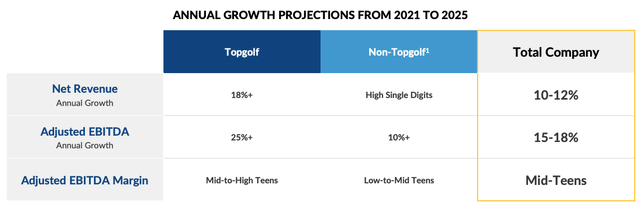

The company also has ambitious but achievable growth targets until the year 2025, in which the company projects double-digit CAGR in net revenue and Adjusted EBITDA. As seen below, Topgolf is expected to provide bulk of the growth, and we believe this makes sense given the increasing popularity of the brand and growth potential still left in the segment. Meanwhile, Non-Top Golf segments which comprise mostly of equipment and apparel are expected to still show solid growth in the next few years.

Secular Tailwinds in Golf

We believe the rise of LIV and the increasing competition between LIV and PGA will bring about secular tailwinds for the golf industry. The competition will likely galvanize the once stagnant sport, by bringing new players, sponsors, and innovations that will increase the sport popularity and therefore increase the market potential. We believe that Topgolf Callaway Brands Corp. can take advantage of such tailwinds by having more opportunities to market their products and have a higher consumer base willing to purchase golf equipment and apparel along with dabble in golf entertainment such as Topgolf. Furthermore, Netflix (NFLX) is planning for a PGA Tour documentary series, and we believe this could provide another catalyst for interest in the sport. Just as F1 racing gained many new fans across the globe due to a riveting Netflix series, we believe the PGA Tour documentaries could potentially have the same impact and usher in a new generation of golfers.

Valuation

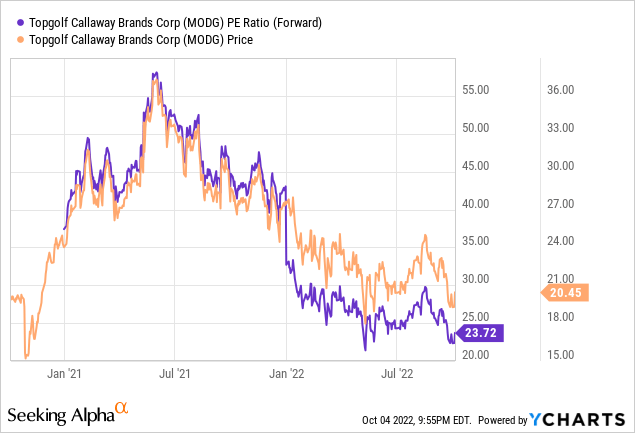

The valuation of Topgolf Callaway Brands is cheap on historical levels as the company now only trades at around ~23x forward P/E. With mid-teen growth projected out by management and other secular tailwinds, we believe the valuation is attractive for long-term investors. The average forward P/E in the last two years was around 30x and we believe that would be a reasonable valuation given current market conditions and price support from a substantial $100 million buyback program. That represents a ~30% upside from current levels.

Risk to Thesis

As golf is a leisure activity, the main risk to Topgolf Callaway Brands is a severe recession that dampens consumer spending and hurts consumers’ willingness to spend on expensive apparel, equipment, or golf-related entertainment. Though the threat of a recession is real, we believe that the company is well-diversified through different brands and has different levers to maintain its financial performance. Furthermore, with $178 million in cash on the balance sheet and a strong operating cash flow of $137 million, we believe the company is well prepared against major liquidity risks in the event of a downturn.

Conclusion

Overall, we remain optimistic on Topgolf Callaway Brands and its business prospects. The company has a strong history of financial growth, and we believe that there are many tailwinds to help meet the company’s own short-term growth targets and potentially provide an additional boost to the stock price. The valuation remains low on a historical level and we believe there’s a lot of upside to be had if the company were to trade back at its historical forward P/E valuation levels.

Be the first to comment