mysticenergy

The crude oil market has experienced significant volatility over recent months. WTI crude crashed nearly 40% from its ~$122 high in June to ~$77 last month. Oil has since reversed to its range high of $87, rising over 12% in just a week as OPEC+ agreed to a sizeable 2Mbd production cut. The extent to which this change will impact the market is debatable, as OPEC+ produced around 3.5Mbd below its target over the summer. As such, the quota cut will not lower global production, but will still deter a rise in production. Nevertheless, OPEC’s willingness to take aggressive measures, despite immense backlash from Washington, indicates a desire to keep crude oil prices high.

In reaction to the change, White House officials have asked the US Energy Department to analyze the potential impacts of oil and gas export bans and are mulling extending the Strategic Petroleum Reserve “SPR” release. Of course, banning oil and gas exports will likely be untenable given Europe’s increased dependence on US energy products, particularly considering the Nord Stream pipeline attack. A continuation of the SPR release is an option, but its storage levels are so low that doing so would exacerbate national security and emergency preparedness risks.

The Department of Energy’s current plan is to end the SPR release at the end of October, effectively bringing around 1Mbd off commercial markets. There is speculation that the administration would quickly seek to refill the SPR, but the Energy Department quashed that claim. Regardless, the global and US oil markets are in a slight shortage today, and that deficit is likely to grow over the coming months unless global demand declines significantly. I believe this change will likely cause oil prices to rise back over $100 per barrel, if not higher, as there are no signs of continued supply growth in North America.

Given the recent rise in crude oil, now may be one of the last opportunities for investors to look toward oil producer stocks to take advantage of the potential rebound in oil prices. Many exploration and producer stocks are trading at much lower valuations today than they were months ago. Even more, a rise in oil prices represents a significant risk to the stock market because higher prices would slow the economy and increase inflation, making the Federal Reserve unable to stimulate the economy effectively. To me, this makes oil stocks a surprisingly powerful means of hedging against key market risks. Given the state of the US dollar, international oil companies such as Canadian Natural Resources (NYSE:CNQ) may be the best way to take advantage of the trend.

The Economic Case For Crude Oil

Like most oil companies, Canadian Natural Resources’ stock price is almost entirely dependent on the price of crude oil and, to a lesser extent, natural gas. The company’s unique fundamentals (valuation, management, etc.) are essential from a long-term standpoint, but CNQ’s value will fluctuate primarily with energy prices in the short term. Accordingly, I believe it is an excellent time to take a closer look at the crude oil market to judge its economic outlook better.

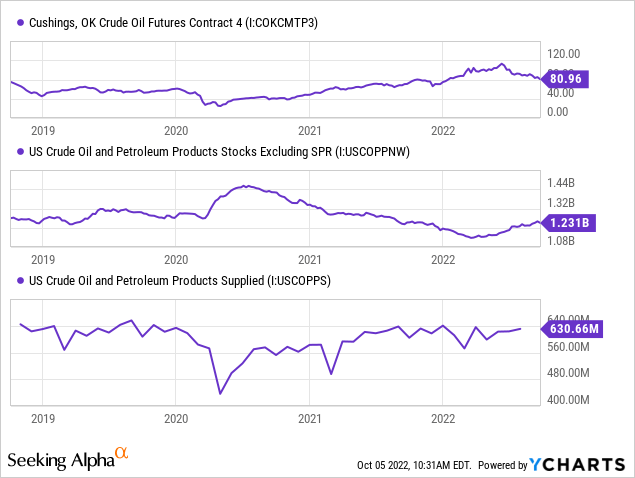

The price of crude oil is very closely correlated to US commercial oil stocks, that is, total US oil inventories excluding those in the SPR. That figure was falling quickly from 2020 to earlier this year, causing oil to rise, but it has increased since May, causing oil to decline. Many speculators and analysts have stated that oil has declined due to a drop in demand. While it is true that China’s “zero COVID” policy lowered its demand, Chinese demand is expected to rise over the coming weeks and months as its measures ease. That said, US oil demand has remained strong, as indicated by inventory data. See below:

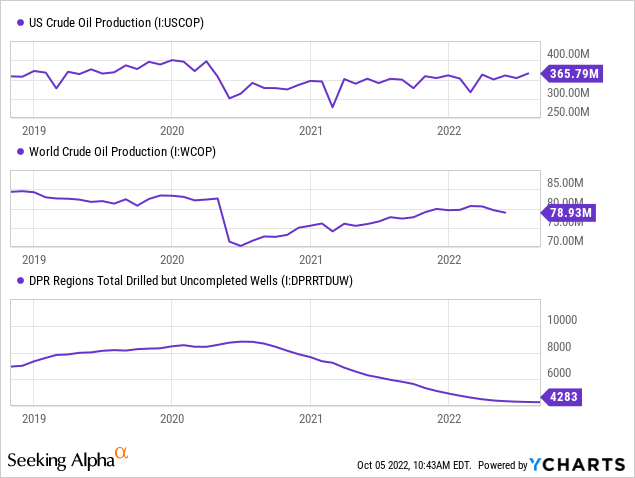

From a commercial standpoint, oil is in a very slight glut with rising inventories, though US demand is near peak levels. This was a significant change from its position earlier this year when the market was in a massive deficit. Despite this, there has been no increase in global oil production, and there are indications of an impending decline. US production has not returned to pre-2020 levels, while the world’s production rebound may have ended. Further, US oil output growth has depended mainly on completing previously “drilled but uncompleted” or “DUC” wells instead of new drilling. The inventory of “DUC” wells has declined dramatically, meaning the US must increase drilling for production to continue to rise. While “DUC” data is not available globally, I suspect a similar circumstance exists in most oil-producing regions, hence the decline in world oil production. See below:

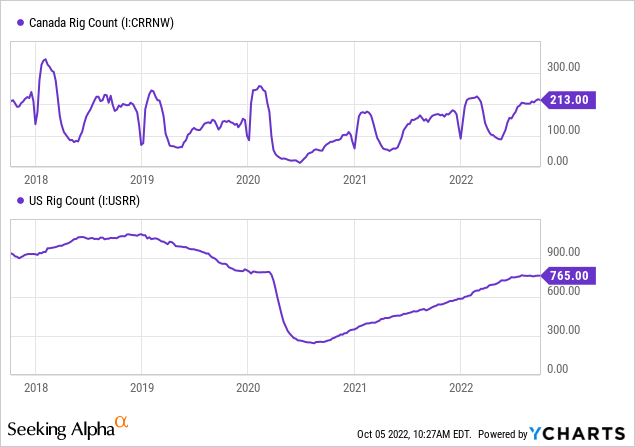

The US and Canada have increased drilling activity during most of 2021 and 2022. However, rig count levels remain generally below those of 2018-2019. Further, rig count growth has stagnated over the past six weeks in the US and Canada, meaning North American oil production may decline soon as newly completed wells experience significant first-year output declines. See below:

For most US (and likely Canadian) producers, the oil price must be above $50-$70 per barrel for new wells to be profitable. That data was taken from a survey in March of this year and may be based on 2021 financial data and estimates. Oil production costs are rising quickly amid significant labor shortages in the sector and increased material costs, energy expenses, interest expenses, etc. Accordingly, many North American producers may seek to reduce drilling activity if oil is near or below $80 per barrel. OPEC appears to see the same floor as suggested by its recent historically significant quota cuts.

In my view, this situation virtually guarantees the global and North American crude oil output will decline over the coming months, simultaneously with the expected end of the SPR release. Total US oil stocks, including those in the SPR, have declined consistently throughout the year and are at a 15-year low. To me, that fact, combined with the reversal in world oil output, strongly indicates a considerable impending rise in the price of crude oil.

Value Potential In Canadian Natural Resources

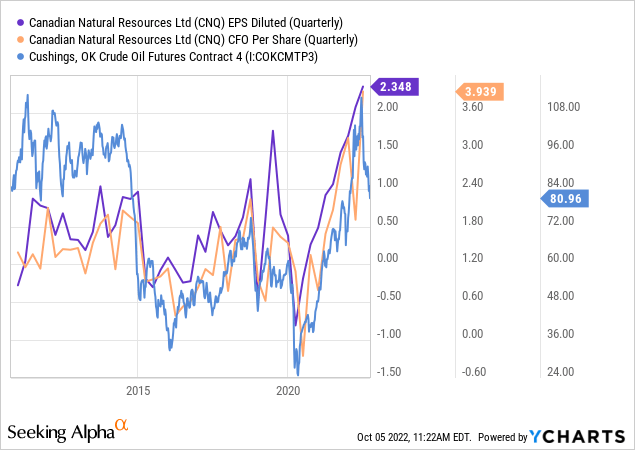

Canadian Natural Resources is one of Canada’s largest and most developed oil and natural gas companies. In 2021, just over 90% of its sales came from crude oil and NGLs, with only a small portion generated from natural gas. At today’s prices, I am very bullish on crude oil but remain moderately bearish on North American natural gas so that the company may fare better than those with more significant natural gas sales. The company’s CFO per share and EPS are tightly correlated to the price of crude oil. Over the past decade, its EPS has turned negative when crude oil passes below $60, though its cash flows only appear to require an oil price of ~$40. See below:

Canadian Natural Resources is likely to see a significant decline in its Q3 earnings, given the drop in oil prices. Historically, its quarterly EPS had tended to $1-$1.5 when crude oil averaged ~$80-$90 per barrel, while its CFO per share has averaged around $2.5-$3 at today’s oil prices. The company’s consensus EPS target for the last quarter is ~$2.15. In my view, that estimate may be a bit too high, given the significant decline in crude oil prices and the potential rise in production costs. Of course, North American natural gas prices were very high last quarter, but given its relatively low natural gas output, I doubt this factor greatly benefited the firm’s bottom line.

I believe Canadian Natural Resources will likely have an annual EPS of around $6, or $1.5 quarterly, at today’s energy prices. This estimate is slightly below that of most analysts, but would still give CNQ a low forward “P/E” ratio of ~9X. Of course, if crude oil rises above $100 per barrel, as I strongly suspect, its annualized EPS would likely be closer to $8-$10, giving it a very attractive “P/E” of 5.3X to 6.6X today. Indeed, given today’s oil price dynamics, I would not be surprised to see crude rise above its June highs over the next twelve months – mainly if economic demand does not decline dramatically.

Canadian Natural Resources is cheap compared to peers, with a TTM “P/E” of 7.15X compared to a peer (harmonic) average of 10.5X (using PXD, EOG, DVN, HES, and FANG) as peers, making it among the cheapest North American large-cap oil stocks. CNQ’s “P/E” is 21% below the entire sector median, while its “EV/EBITDA” is 45% below the sector median. The company has a debt-to-equity of 36%, which is nearly the same as most of its peers, though with a slightly lower quick ratio of 0.60X, indicating minor liquidity risk in the event of a substantial decline in crude oil prices. Overall, I believe this data suggests CNQ is trading at a roughly 20% to 30% discount compared to its peers.

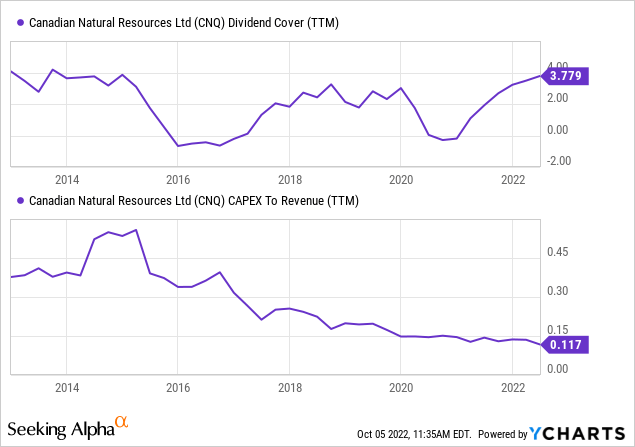

CNQ’s low valuation may be that it is a Canadian firm, and many Canadian stocks trade at lower valuations than US stocks. The stock has also experienced a great deal of volatility in recent months, causing its valuation to decline too far, too fast. In my view, this factor is particularly surprising, considering CNQ has a 4.1% yield that is well above most US peers. While the company has marginally raised its CapEx budget, its capital investments are so low, and its dividend cover is so high that it could dramatically increase its dividend. See below:

Like most North American oil producers, Canadian Natural Resources appears to be reaching a state of maturity. The company no longer focuses on rapidly growing output through CapEx, but on becoming more efficient and driving more significant free cash flows. Combined with the impending end to SPR withdrawals and a potentially big decline in global oil output, the firm may soon be selling at even higher prices.

The Bottom Line

Overall, I am bullish on CNQ and believe it is undervalued by 20-30%, even with crude oil at today’s relatively low levels. My top-down assessment of crude oil suggests the company’s profits may rise dramatically over the coming months, meaning the stock could increase past its June high of $62. The Canadian dollar has declined by nearly 5% against the USD over the past two months – its most significant decline since 2020. Since much of its operations are situated in Canada, CNQ also has a partial hedge against the rising US dollar since its costs decline in US dollar terms as the CAD/USD exchange rate falls.

In my view, US investors would benefit from CNQ not only due to its low valuation and the positive outlook for crude, but also as a means of currency diversification. Even more, the potential for a US oil export ban increases regulatory risks for US oil producers. While Canada has its own energy-centric regulatory risk factors, an export ban is unlikely, considering the nation’s large oil net exports. Indeed, Canadian Natural Resources would likely benefit from a US export ban as Europe would become highly dependent on Canadian oil without US supplies.

An extension to the US SPR withdrawal is perhaps the most significant risk factor for CNQ and virtually all energy stocks, second to a large decline in economic demand. Investors should be mindful of these risk factors, as they are not necessarily unlikely. That said, OPEC’s willingness to defend oil prices partially mitigates these risks; at the very least, creating an “OPEC put” price floor of around $80 per barrel. CNQ is not a low-risk stock, but given its low valuation and that attractive outlook for oil, I believe it is a solid long-term investment with considerable short-term potential.

Be the first to comment