Stavklem

Homebuilders Rankings

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on August 10th.

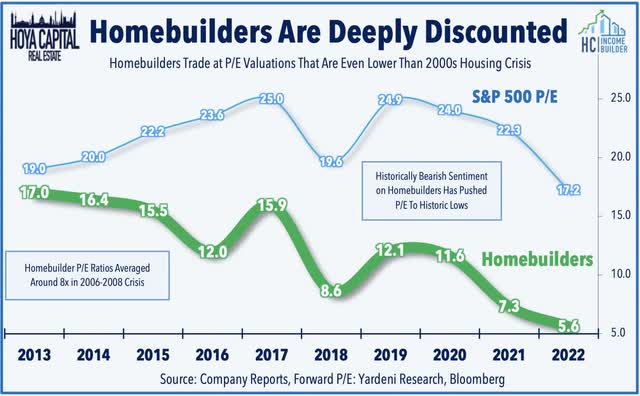

Those looking for a deep value “contrarian play” need not look much further than the homebuilders, which are perhaps the most unloved industry group across the entire equity market. Many of the same pundits that predicted a housing market “COVID-collapse” early in the pandemic have reemerged this year as a historic surge in mortgage rates rapidly turned the housing market from red-hot to icy-cold – but the recent retreat in rates has revived some activity and calls into question this bearish narrative. While homebuilders are not out of the woods yet given the ongoing uncertainty over the path of inflation – which ultimately dictates the path of mortgage rates – we believe that the risk-reward for the homebuilding sector is now skewed heavily to the upside. In the Hoya Capital Homebuilder Index, we track the 15 largest homebuilders, which account for roughly $100 billion in market value.

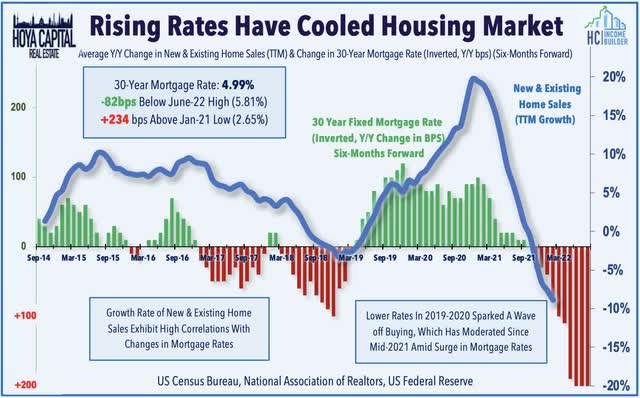

Rates, rates, rates. While changes in mortgage rates don’t change the underlying long-term supply/demand fundamentals, they sure do have an impact on short-term demand trends – a theme that we’ve seen both on the upside and downside over the past several years – and a dynamic that we identified as the major potential risk factor for the homebuilders. After bottoming in early 2021 at 2.65% and remaining below 3% as recently as this past November, the 30 Year Fixed Mortgage Rate soared to above 6% in the subsequent seven months – the most significant surge in mortgage rates in at least four decades and roughly double the “velocity” of previous jumps in mortgage rates. Naturally, with a significant segment of the market suddenly priced out of the market at those rates, housing market activity cooled dramatically during this period with essentially all of the major monthly housing reports showing a considerable contraction early this year.

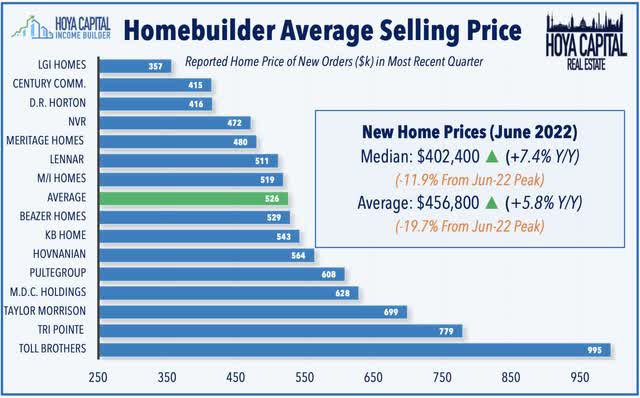

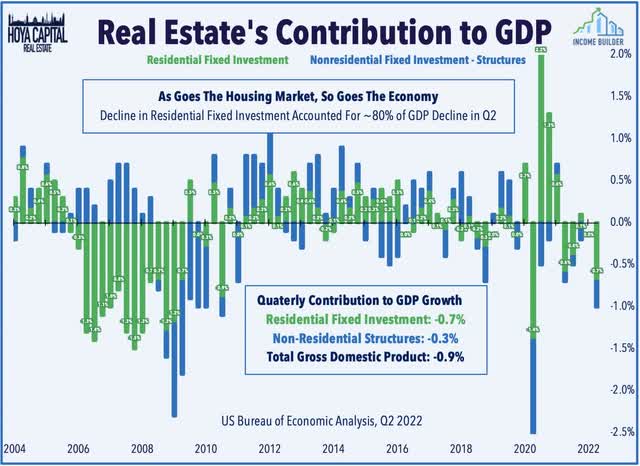

As goes the U.S. housing industry, so goes the U.S. economy. The sharp cooldown in housing market activity in the first half of the year had substantial ramifications for broader economic growth – and in fact, essentially single-handled pulled the U.S. into a technical recession in early 2022. Reversing its role from early in the pandemic as a key source of offsetting strength amid broader weakness, residential fixed investment was responsible for about 80% of the GDP decline in Q2 – contributing -0.7% of the -0.9% decline. While the notoriously lagging Home Price indices are still showing home price appreciation of nearly 20%, more real-time indicators of price growth show that price appreciation has been near-zero or even negative since peaking early in the summer. New Home Prices have dipped 19.8% since their peak in April – according to Census Bureau data – which has brought its year-over-year increase to 5.8% – below the rate of nominal GDP growth.

Given these circumstances, the deeply-discounted homebuilder valuations appeared to be justified assuming that mortgage rates had continued their extraordinary surge seen in early 2022, a surge that rapidly turned the housing market from red-hot to icy-cold and dragged homebuilders lower by 25-35% this year. Instead, mortgage rates have pulled back sharply from nearly 6% back down to the high-4% range as slowing global growth – and potentially deeply recessionary conditions in Europe and Asia – have cooled inflation rates in the United States. Mortgage rates in the 4%-range, if sustained, would promote a return of a more “normal” housing market of GDP-like home price appreciation and more balanced inventory levels. The headlines will remain ugly for at least several more quarters as home price appreciation stalls – and even turns negative in some previously red-hot markets – but this short-term pain is necessary to avoid a speculative bubble that was beginning to build.

Deeper Dive: Homebuilder Fundamentals

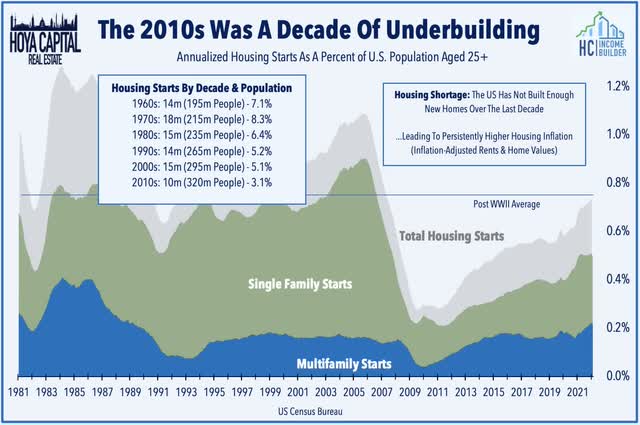

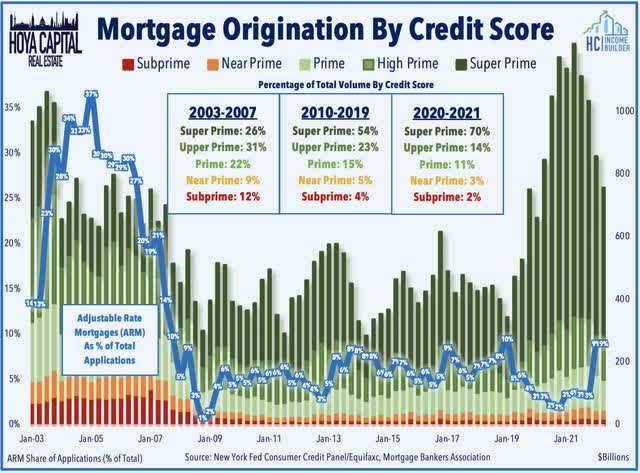

After being slammed at the outset of the pandemic on fears that a coronavirus-induced recession would inflame a repeat of the Great Financial Crisis for the U.S. housing sector, publicly-traded homebuilders delivered historically strong operating performance beginning in late 2020 with momentum continuing into mid-2022 ahead of the rate-driven cooldown. Even before the added pandemic-driven tailwinds, the 2020s were already poised to be a robust decade for the housing industry. New home construction has seen a slow, grinding recovery since plunging during the prior recession – a period in which roughly half of privately-held homebuilding firms in the United States went out of business. By nearly every metric, the US has been significantly under-building homes – particularly single-family homes – over the last decade, and the record-low inventory levels of both new and existing homes seen throughout the pandemic were clearly symptomatic of a significant housing shortage.

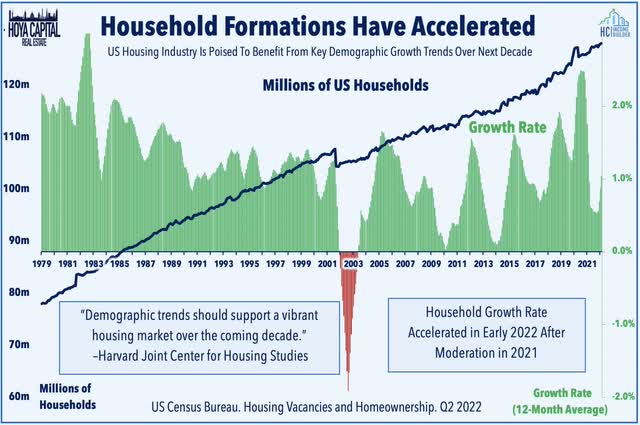

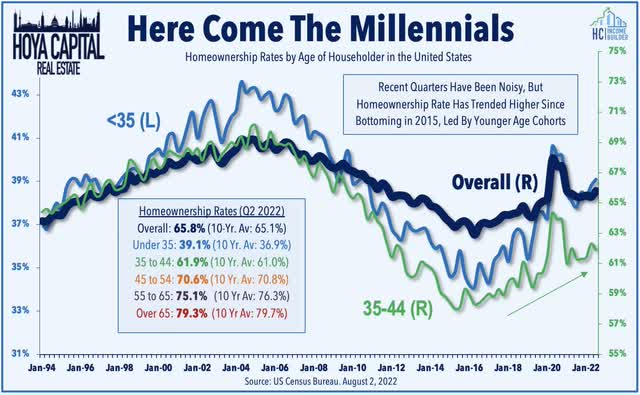

Meanwhile, this underbuilding came ahead a decade in which the largest generation in American history – the millennials – are entering the housing markets in full force, peaking around 2028. Harvard University’s Joint Center for Housing Studies (JCHS) projects that annual household growth through 2028 will average 1.2 million households per year, which is 20% higher than the prior five-year average. As JCHS points out, over the next 10 years, the population in key demographic groups will swell – particularly in the critical 35-45-year-old associated with incremental single-family housing demand. The largest of this cohort – those born between 1989 and 1993 – are just now on the cusp of entering this prime first-time homebuying age. Some more recent developments have also been particularly positive for the housing demand outlook as the U.S. birth rate accelerated in 2021 for the first time in nearly a decade while foreign immigration into the U.S. has accelerated rather dramatically under the Biden Administration at a 141,000-per-month rate since November 2020 according to data from the Bureau of Labor Statistics.

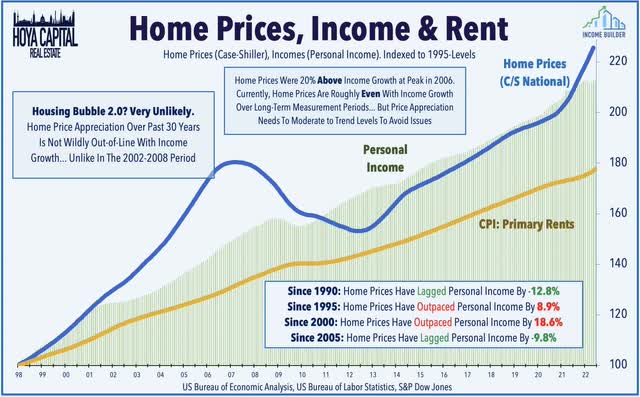

Robust growth in household formations – combined with the lingering housing shortage – kept the “pedal to the metal” for home price appreciation from 2020 through mid-2022. Case Shiller National Home Price Index data – which lags real-time market conditions by 3-6 months – showed that home values soared 19.8% year-over-year in its latest May report but, as noted above, more real-time indicators show a significant moderation in home price appreciation since late Spring. The cooldown in home price appreciation is welcome and critically necessary to avoid a speculative bubble that was beginning to build – and the longer-term pain that would result from a period of significantly negative national home price appreciation. This cooldown came just-in-time to avoid these issues, in our view, as home prices aren’t wildly out-of-line with personal income growth over long-term measurement periods – the metric that is most fundamentally correlated with home values.

Rental markets were a brief reprieve from cost-pressures, but soaring rental rates combined with moderating home prices have started to close the ‘Buy vs. Rent’ value gap which has been skewing heavily towards renting as the “better-value” in recent months resulting from the surge in mortgage rates. In its most recent rent report, Zumper reported that rent growth reaccelerated in July to an 11.3% year-over-year rate after showing some signs of moderation in the prior two months. Data from Zillow (Z) shows that annual rent growth has remained around 15% throughout 2022 with 50 of the top 60 markets seeing rent growth in excess of 10% in its most recent June report. Consistent with recent data from Yardi Matrix, Apartment List reported last week that while rents are rising more slowly than they did in 2021, the pace is still double that of pre-pandemic years.

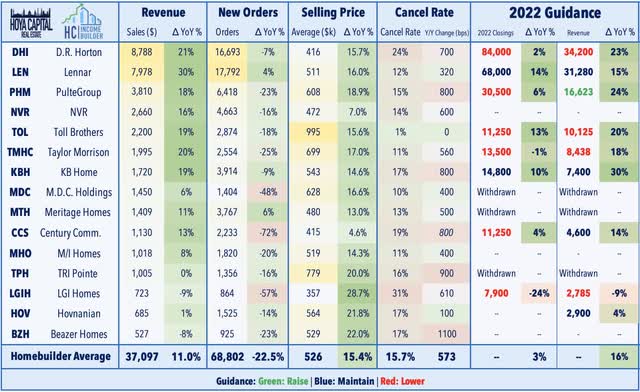

All things considered, earnings reports from homebuilders were surprisingly solid in the second quarter with builders exhibiting few signs of the type of distress that would be suggested by their historically discounted valuations. While order growth has declined significantly from the historic levels seen in the prior year, builders continue to work through a substantial backlog of ordered homes that helped to sustain double-digit revenue growth into the second quarter. Cancellation rates, however, jumped in the second quarter to levels that are roughly back to historic averages in the 15-20% range, but most builders remained quite upbeat on the longer-term outlook. Notably, five builders maintained or increased their full-year revenue-growth target this past quarter including a revenue target boost from PulteGroup (PHM). Among the eight builders that provide guidance, revenue growth is still expected to average 16% this year.

Because builders were already operating above maximum build capacity and sitting on historically large backlogs, the 20% pullback in new orders is not as concerning as it would otherwise appear. Builders still report nearly 150,000 units in their backlog – more than 10% higher than the prior year. Despite the supply chain headwinds and double-digit cost inflation, homebuilder profit margins have climbed to record highs as builders have been able to more-than-offset cost pressures through higher sales prices. Recent earnings reports have shown continued positive momentum for the industry despite the supply chain headwinds and cooling home prices. Homebuilder gross margins climbed to 27.8% in Q2 – up more than 400 basis points from last year – while net margins climbed to 18.9% to record-highs – up 440 from last year.

Homebuilder Valuations and Dividends

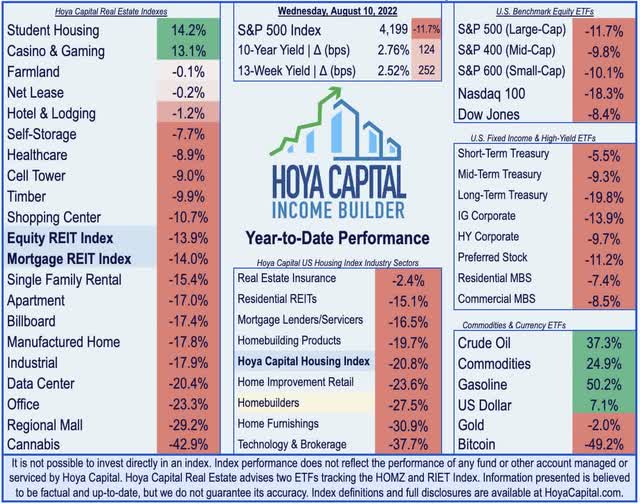

After plunging more than 50% during the depths of the pandemic in March and April 2020, homebuilders have delivered a robust rebound over the subsequent 18 months and extended their streak of outperformance over both the Equity REIT ETF (VNQ) and the S&P 500 ETF (SPY) to three-straight years in 2021 with total return of nearly 50%. The selling pressure returned in the first-half of 2022 amid the surge in mortgage rates and the resulting housing industry contraction, sending the homebuilder segment of the Housing 100 Index lower by nearly 40% at the June lows before recovering in the subsequent six weeks to trim their year-to-date declines to roughly 28%.

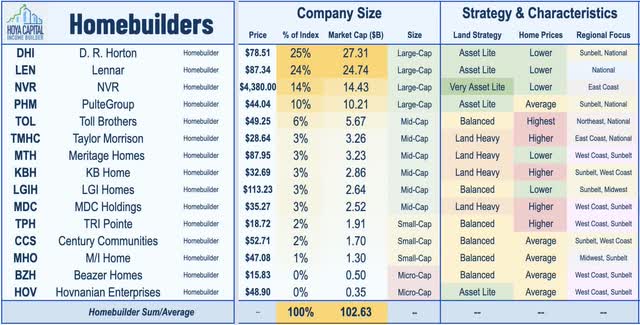

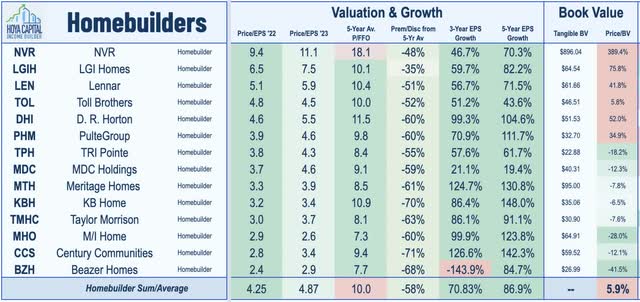

Homebuilders have delivered EPS growth of over 40% per year over the past five years, nearly triple the 15% annual EPS growth by S&P 500 components during that time. Remarkably, despite this strong historical earnings growth and a consensus forecast calling for double-digit earnings growth in 2022, homebuilders trade at some of the lowest P/E multiples across any equity sector. Within the sector, we note that investors generally award relative premiums to the large-cap builders like D.R. Horton (DHI) and Lennar (LEN), as well as to builders with more “land-lite” options-heavy strategies including NVR (NVR).

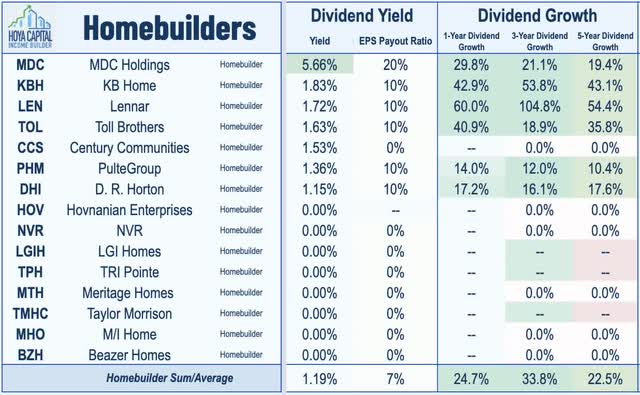

Homebuilders are not typically known for their dividends – instead plowing back essentially all retained earnings back into land acquisitions and other channels of growth. That said, seven builders do indeed pay a dividend, led by M.D.C. Holdings (MDC) which pays a roughly 5.66% yield. All six of these homebuilders have raised their dividends at least once since the start of the pandemic including a 50% increase from Lennar this year. Notably, the builders that do pay a dividend have achieved dividend growth of over 30% over the past three years, far outpacing the S&P 500 dividend growth rate of roughly 7% during that time.

Deeper Dive: Homebuilding Economics

Taking a step back, the US single-family homebuilding sector is a cyclical, competitive, and fragmented industry, while also being one of the slowest sectors to recover from the Great Financial Crisis. Homebuilding can be broken down into two distinct businesses, each with different risk/return characteristics: 1) Land Development; and 2) Home Construction. Historically, homebuilders have been overweight in the land development business, but large public builders have increased their use of land options, offloading the land development responsibilities onto residential lot development companies, allowing these builders to focus on construction and reduce balance sheet risk.

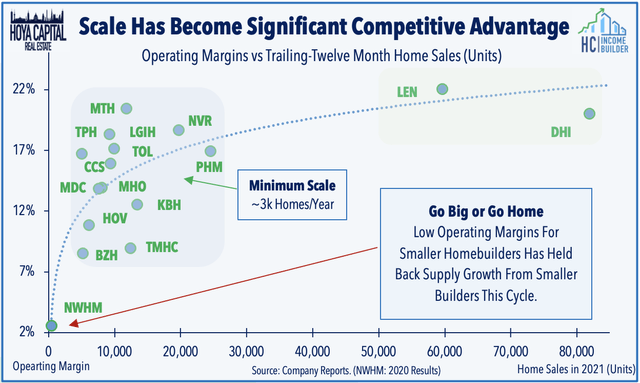

Consistent with the “Go Big or Go Home” thesis, home building is a high-operating-leverage business with relatively low margins, so size and scale are a critical competitive advantage for these large homebuilders. Even within our index, which only includes the largest builders in America, this critical importance of operating with a “minimum scale” becomes abundantly clear. Following the profitability trendline, it becomes apparent why smaller, private homebuilders have become an increasingly rare breed in recent years and why we haven’t seen – and likely won’t see – the uncontrolled building “boom” that wreaked havoc in the prior housing cycle. The smallest builder in the index, New Home Company – which was acquired by Apollo in 2021 – reported operating margins of under 3% in full-year 2020.

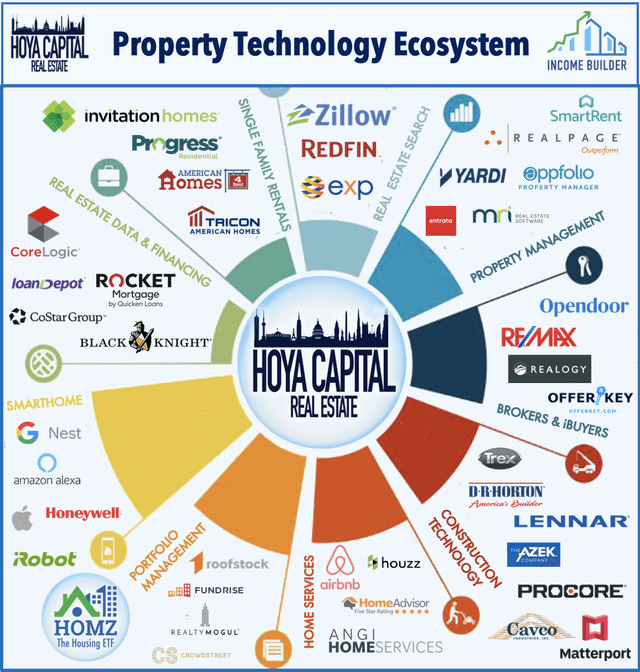

Hoya Capital Another major theme within the sector over the last several years has been the outperformance from builders focused on the lower-priced entry-level segment with strong demand coming from older millennials and from institutional rental operators including single-family rental REITs, which we discussed in a recent piece: Single Family Rentals: PropTech Revolution. Consistent with our view that the “institutionalization” of the single-family housing sector is a trend in the early innings, we expect built-to-rent buyers including American Homes 4 Rent (AMH), Invitation Homes (INVH), and Tricon Residential (TCN) to increasingly favor new home construction over existing home acquisitions – largely through partnerships with homebuilders – to fuel portfolio growth. Hoya Capital

As discussed above, there are roughly 20 million more U.S. households now than there were at the start of 2000 and we believe that the household formation rate will see continued gradual increases over the next five years as the millennial generation enters prime first-time homebuying age. The recent gains in the homeownership rate have been driven by a continued rise in the household formation rate among younger cohorts, which sent vacancy rates of both owned and rented housing units to multi-decade lows. We forecast a continued steady uptick in the homeownership rate over the next decade as millennials enter the housing markets in full force over the next ten years.

Finally, you can’t discuss the housing sector without mentioning the enormous impact of real estate technology in fueling the future growth of the sector over the next decade. The “prop-tech” industry includes data and technology companies including Zillow, Black Knight (BKI), CoStar (CSGP), and Redfin (RDFN), as well as tech-focused brokerage firms like Realogy (RLGY) and RE/MAX (NYSE:RMAX), all of which have helped to streamline the buying, selling, and renting process of housing properties. The availability of technologies like virtual house tours and the increased adoption of digital relationships between renters/homebuyers and landlords/brokers have proven to be especially critical amid the pandemic disruptions.

Takeaway: Short-Term Pain, Long-Term Gain

Those looking for a deep value “contrarian play” need not look much further than the homebuilders, which are perhaps the most unloved industry group across the entire equity market. These discounted valuations may have been justified if mortgage rates had continued their extraordinary surge seen in early 2022, a surge that rapidly turned the housing market from red-hot to icy-cold and dragged homebuilders lower by 25-35% this year. Instead, mortgage rates have pulled back sharply from nearly 6% back down to the high-4% range. While not out of the woods yet given the ongoing uncertainty over the path of inflation – which ultimately dictates the path of mortgage rates – we believe that the risk-reward for the homebuilding sector is now skewed heavily to the upside.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment