Flashpop/DigitalVision via Getty Images

It’s like we’re all in a nightclub and the lights just came on.

-Airbnb CEO Brian Chesky, on the 2022 tech downturn.

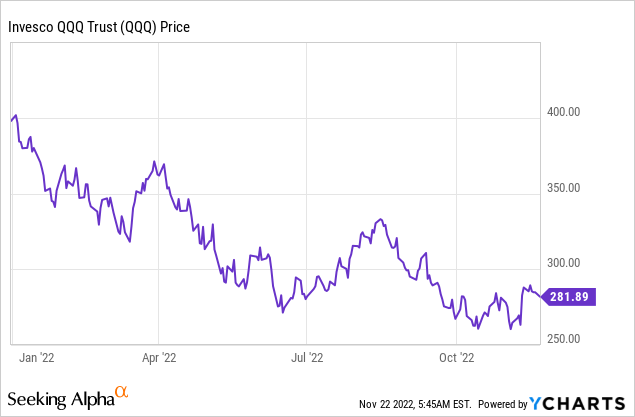

With the end of zero rate Fed policy and quantitative easing, markets have been rocked by the cold grasp of reality in 2022. Tech companies suddenly find themselves in the uncomfortable position of having to turn a profit. Airbnb (ABNB) CEO Brian Chesky laid out the facts in a recent interview with CNN. The Nasdaq (QQQ) has been wrecked this year, down roughly 30% even after the powerful rally off the October lows on hopes of a Fed pivot and/or economic soft landing. For its part, Airbnb has willingly made the transition from growth at all costs to focusing on profit. But many of its cash-hungry peers will be too late. As a general rule, any company that has liabilities exceeding assets and negative net income will not be in business in 12-18 months. Companies that lose money but have stronger balance sheets will have time to transition, but it will be painful.

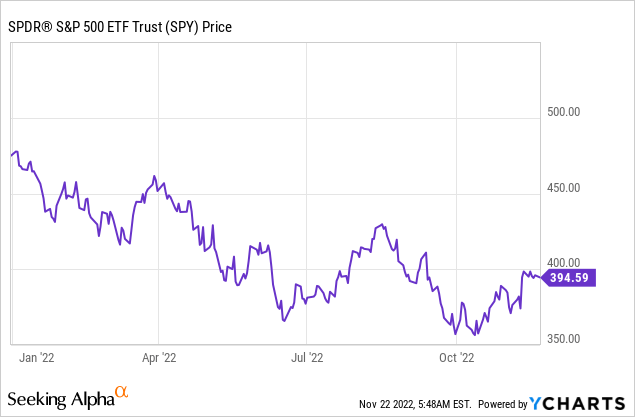

Chesky compared the current situation in tech and crypto to a nightclub, but I think that actually may be too generous. Judging by the behavior of many in the tech and crypto worlds, the situation is more like junior prom–and when the lights came on it turned out they were dancing with the quarterback’s girlfriend. As liquidity continues to drain from the system from QT and government borrowing, I would expect more fraud, waste, and malinvestment bubbles to the surface. In the words of Buffett, it’s only when the tide goes out that we see who has been swimming naked. The S&P 500 (SPY) has held up better than the Nasdaq this year, only falling by 17.5% from the peak as of my writing this.

Part of this is due to recent investor delusions of a return to QE and 0% rates, but the main reason is that earnings have held up reasonably well. And the main reason that earnings have held up is that consumers refuse to slow down their spending, even as prices rise faster than incomes. This is despite weak economic fundamentals that have worsened over the past few months. However, as we’ll get into in a bit, the wheels seem to be turning behind the scenes, highlighting the need for caution from investors here.

Is The American Consumer Actually Rock-Solid?

US retail sales rose 1.3% in October (0.9% excluding gasoline and autos). These are huge numbers. This is a really interesting contradiction here– wages rose about 0.4% for the month but core spending rose 0.9%. It’s one of the most thematic trends of 2022 in that every month incomes rise a little in nominal terms but spending rises a lot (i.e. the standard of living falls). Consumers, sick and tired of COVID lockdowns are now engaging in “revenge spending,” paying big prices for airline tickets, fashion, cars, and live entertainment. The New York Times coined this the “YOLO economy“. Consumers don’t mind spending more than they earn in light of the tight labor market and there are widespread beliefs that the government will step in with helicopter money if the economy slows.

This says a lot about whether the Fed’s battle to stop inflation will be a quick victory or a long and hard-fought battle. Retail earnings help paint the picture. Upper-middle-class linchpin Target (TGT) badly missing on earnings and lowering guidance for the holiday quarter. On the other hand, Walmart (WMT) blew out earnings– my guess is that roaring inflation turned a lot of Target customers into Walmart customers. And maybe some Walmart customers turn into Dollar General (DG) customers as well.

How can people collectively outspend their incomes month after month? Well, they either spend on credit or spend down savings. We’re seeing both. Personal savings rates are down to 3.1%, a level last seen in 2007 before the recession started. This collective number is actually insane in light of the fact that most Americans own their homes and were able to refinance during the pandemic at rates of 3% or lower.

Credit card balances just soared 19% in a mere 3 months. On the travel front, TSA checkpoint counts show that travel is running slightly under 2019 levels after running significantly less since the pandemic. Because consumers are still fairly cash-rich, credit card delinquencies probably aren’t a red flag yet. One possible “yellow flag” is that 90-day delinquencies are now above pre-pandemic levels. This is something to monitor going forward. US unemployment is near all-time lows at 3.7% but generally rises to 6% or higher in recessionary periods.

A sustained rise in the rate of unemployment could break the YOLO mentality and push savings rates back toward their historical average from current ultra-low levels. So far unemployment seems to be held in check– for example, if you get laid off as a software engineer from Meta (META), you’ve got a job in the electric car division of major automakers within a week. Big companies freezing hiring is likely to be a years-long process that will affect unemployment rates, but now there is a backlog of positions that are likely to be filled which will slow the rise of unemployment.

The YOLO Economy Is The Fed’s Inflation Nightmare

In a perfect world, wages rise in line with productivity and more than prices. This means profits go up over time, prices are more or less stable, and everyone is happy. In the YOLO economy, prices rise faster than wages, and people borrow money to cover the difference, driving prices up even more. The Fed is trying to deal with this by raising interest rates. The idea– if you have $10,000 in the bank, you’re welcome to spend it now, but if you are willing to wait a year and collect interest in the meantime, you can have $10,500. However, with most banks still paying 0% interest after 14 years of interest rates near zero, all of this profit is simply going to banks in most cases. Therefore, consumers are still incentivized to spend as if rates are at 0% because rates are at 0% for most consumers. It’s very easy to avoid this problem by buying t-bills, using Treasury Direct, or even shopping for CDs. But most people can’t be bothered to take 5 minutes to earn interest on their accounts, so the banks earn billions in profit. The upshot here– buy stock in banks like Bank of America (BAC). BofA CEO Brian Moynihan is a big bull on stocks, while JP Morgan CEO Jamie Dimon is much more bearish. However, if we learn one thing from history it’s not to listen to bank CEOs about where the economy is going (cough, 2008, cough).

The Fed’s job is complicated here. Consumers have a cash hoard from the pandemic and they’ll spend it until it’s gone. At the same time, market participants don’t believe the Fed is actually going to follow through on its plans despite public opinion being strongly in favor of stopping inflation. I’ve touched on this before, but it’s common for people to believe that the Fed will resort to money printing and QE, but it’s much less common for people to have a favorable opinion of them doing so. We saw this crazy rally in July with stocks soaring nearly 18% on hopes the Fed wasn’t serious about stopping inflation, and now we have a smaller rally of about 11% along the same lines. And investor appetites for risk directly affect the level of prices, making the market this weird reflexive game where the more people bet on a Fed pivot, the less likely a Fed pivot becomes. Hence the need for more rate hikes to stop the YOLO economy from creating an economic crash down the road.

For example, the dollar is down about 7% against a trade-weighted index since the latest pivot mania began in October. With $3.4 trillion in imports in 2021, consumer prices based on current levels of imports should rise about 1% over the next year compared with the baseline. Thus, the Fed is likely to be forced to keep rates higher for longer to put downward pressure on prices. Fed minutes come out tomorrow, and I wouldn’t be surprised in the least to see a hawkish tilt in light of the market’s defiance of the Fed.

The Cleveland Fed’s CPI Nowcast is projecting 0.5% month-over-month inflation for November, this number seems about right, especially considering how risk assets have rallied and the dollar has sunk in the last few weeks. This is way above target. In the end, the solution is simple for the Fed– if at first they don’t succeed, jack up rates higher. In that case, if you hold some cash you win, if you hold stocks you lose. Also notable is the surge in coronavirus cases in China. There are offsetting effects here. Lockdowns decrease demand but also decrease supply, so US consumers may enjoy cheaper gasoline but more shortages of other goods, like earlier in the pandemic. On balance, the lack of response to rising rates makes some sense, but the Fed can overcome by being less surgical with rate hikes and shocking the market. Whether this happens is an open question and depends on how long inflation takes to come down.

Do Current Stock Valuations Make Sense?

Stocks are a fair amount overvalued here.

After the manic relief rally from the October lows, the S&P 500 trades at a little over 18x earnings, on the high end of their historical average of 15-18x. As long as earnings are sustainable, this would be fine for investors. However, there is a lot of evidence that current levels of spending and corporate profits are not sustainable, and thus that profits will not remain at nosebleed levels. To this point, 18x earnings is egregiously high for interest rates at 5% or more in 2023. Think of it this way– you can get the same return parking your money in cash that you can buy buying shares in businesses. Bonds are mispriced as well, but not as badly as stocks.

As such, now is a good time to review stocks that you’re willing to sell and/or look to reduce risk. There’s an old approximation called the rule of 20 that says the multiple on stocks plus the inflation rate should equal 20– under that rule we should be at 12x earnings, which is like S&P 2500. Is this too extreme? Possibly, but it’s one way of showing that prices for stocks in general are too high compared with economic reality. If you must buy stocks, I’d avoid the “nightclub” segment of the market and look to buy small caps (IJR) where you get much better long-term compensation. I’ve previously pegged a fair value for the S&P 500 at 3200-3300 for a host of reasons from demographics to the business cycle to government debt loads.

If all you did was own the S&P 500 for the last 5 years, you’d be up 52% plus dividends. Even with stocks down off their crazy 2022 highs, investors have the opportunity to preserve some real gains in wealth and cover their downside as the business cycle turns. After 14 years of zero interest rate policy government support for zombie companies, the downside is likely to be worse than a typical garden-variety bear market.

Key Takeaways

- The broad stock market is not offering very much compensation for investors over the rate of cash. To this point, stocks are still overvalued relative to a 5% or higher rate on cash, and nothing has improved on this front over the last few months.

- Core inflation is projected to rise by 0.5% month over month for November. If the numbers come in as expected, it shows that the Fed has a ways to go to bring down inflation and that stocks are priced too optimistically.

- Consumers are spending plenty of money, but their real wages are not keeping up. It’s a matter of time before something has to give on this front.

- The startup/tech/crypto bust is likely to give more twists and turns, and more fraud, waste, and malinvestment are likely to be exposed in the coming months. A lot of companies are swimming naked, and I wouldn’t be surprised if several of the top 100 companies in America go out of business as a result of management fraud and/or malfeasance, similar to the early 2000s.

- Pivot mania 2.0 is likely to end the same way as the first round in July, with new lows for stocks and new highs for Treasury yields as assets correct to historical valuations.

- You can make money by picking the right businesses to invest in, but the amount of money-losing dead wood that has built up over the past 14 years is incredible. It’s essential to avoid junk companies in your portfolio if you want to stand a chance at profiting over the next couple of years.

Be the first to comment