Ultima_Gaina

This pullback is not over yet, as stocks sank to start the holiday-shortened week on two economic reports that painted very different pictures of the U.S. economy. One shows an economy in recession, while the other shows an economy rebounding from the summer slowdown and gaining strength into the fall. Therefore, there were talking points for both bulls and bears to make their respective cases for and against risk assets. Yet the bears have the floor at the moment, as the negative momentum in stock prices over the past three weeks is testing the will of those who see brighter skies ahead.

Finviz

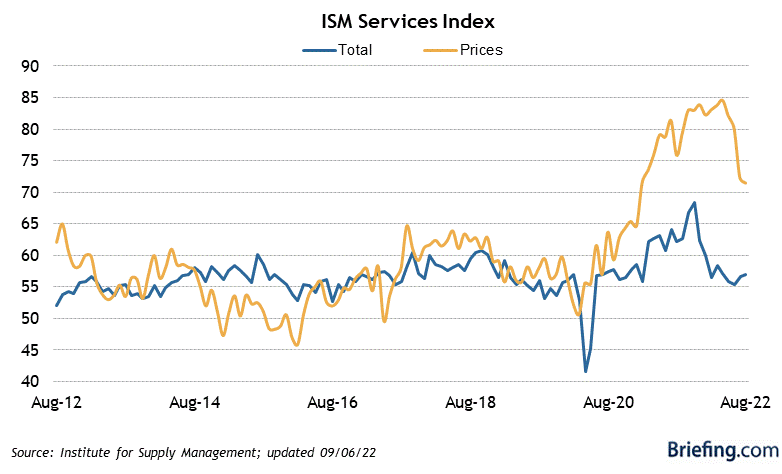

Yesterday’s ISM (Institute for Supply Management) Services index came in better than expected for August, rising to 56.9 and affirming that the economy is not in recession. Levels above 50 signal expansion, while levels below indicate contraction. The most encouraging aspect of this report is that the new orders and business activity sub-indexes rose above 60 to their highest levels for 2022. At the same time, the supplier deliveries sub-index fell to its lowest level since before the pandemic, reflecting continued improvement in the global supply chain. Most importantly, the prices paid sub-index continues to decline. Prices are still rising but the rate of increase is decelerating rapidly. This report has the best of both worlds. The economy is growing at a modest pace, while supply chains improve and price increases moderate.

Briefing.com

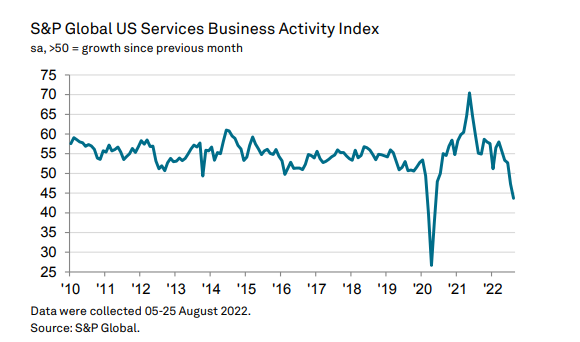

The S&P Global Services index tells a different story, falling further into contraction in August with a reading of 43.7. While prices paid based on input costs and output charges eased further, new orders fell in this survey. The business activity sub-index also declined. These results reflect an economy that will soon be in recession if it isn’t already.

S&P Global

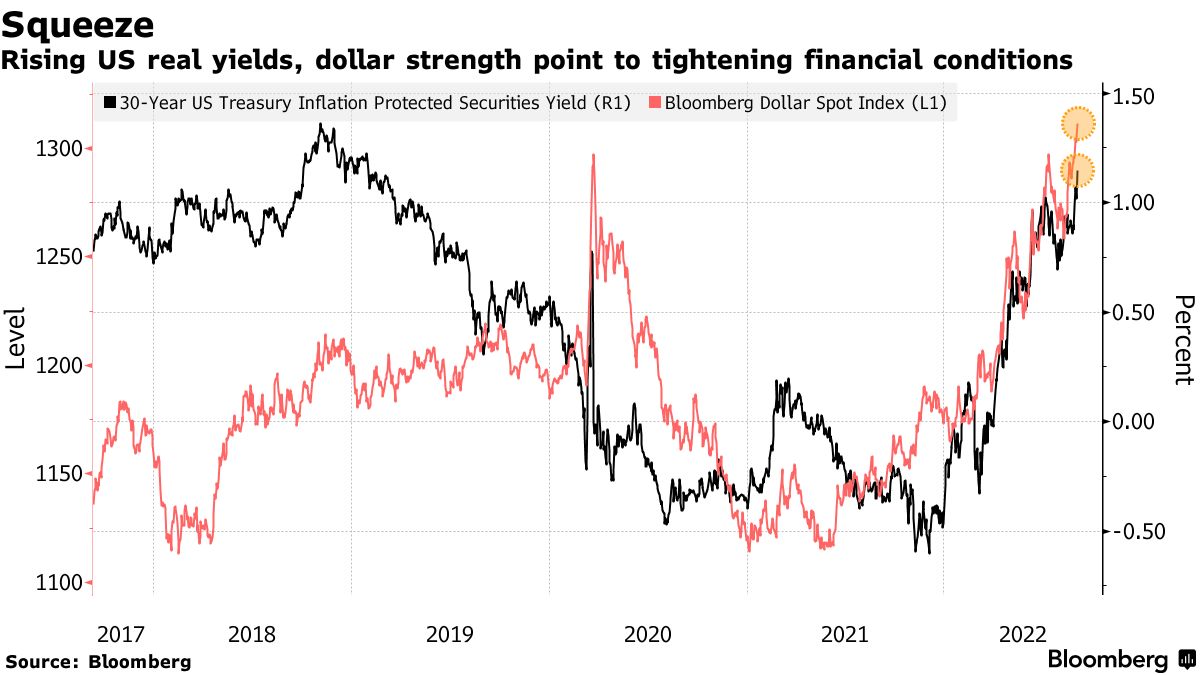

I think the sharp contrast in survey results is due to different industry weightings for respondents. The ISM survey has a much longer history than the one from S&P Global, which is why it tends to carry more weight among Wall Street pros. Regardless, it appears that the market interpreted all news as bad news in both reports. The strength in the ISM report resulted in a rise in interest rates, as the probability of a larger increase in the Fed funds rate at the Fed’s next meeting rose. That also led to a stronger dollar, tightening financial conditions. The fear of recession also intensified from S&P Global’s survey. The decline in prices in both surveys was clearly ignored.

Bloomberg

I am not allowing short-term gyrations in the stock market, regardless of how volatile, to dictate my outlook for the economy. The expansion looks to be intact, as consumers continue to shift spending from goods to services. The next inflation reading should show continued progress in price declines. The S&P 500 has pulled back 10% after rallying 17% off its June low. We have transitioned from overbought to near oversold very rapidly. I remain optimistic about the remainder of the year.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment