M. Suhail

Since its founding in 1976, The Home Depot (NYSE:HD) has grown to be one of the most reliable companies in the United States, selling everything one might need for home improvement, construction, renovations and more.

While the company’s fundamentals and overall performance is unquestioned, there may be an issue with its debt load as we head into an environment where we may see interest rates go higher and stay there for a while – prompting the company’s interest expense to hurt the company’s EPS growth.

Let’s dive in.

Home Depot Is Doing Fine

When it comes to the company’s fundamentals and neutral long-term prospects, it’s as solid as it gets.

The company is projected to grow earnings per share at between 3% and 7% over the next decade, with sales growth by 2% to 3% over the same period. This puts the company just ahead of where overall US GDP is projected to be at over the same time period and in-line with where most companies will be.

On top of that, they pay a dividend yielding 2.75%, which currently stands at a roughly 45% payout ratio, a highly sustainable point with the company’s solid top and bottom line growth projections.

Beyond that decade, the prospects of automation should clear some of the company’s manufacturing, processing and warehouse operations, which should help increase their margins to overcome the inflation we’re expected to see over the next decade.

So What’s The Potential Issue?

The potential issue for Home Depot is their debt load, which ballooned from under $10 billion back at the end of 2013 to almost $37 billion as of their latest financial report.

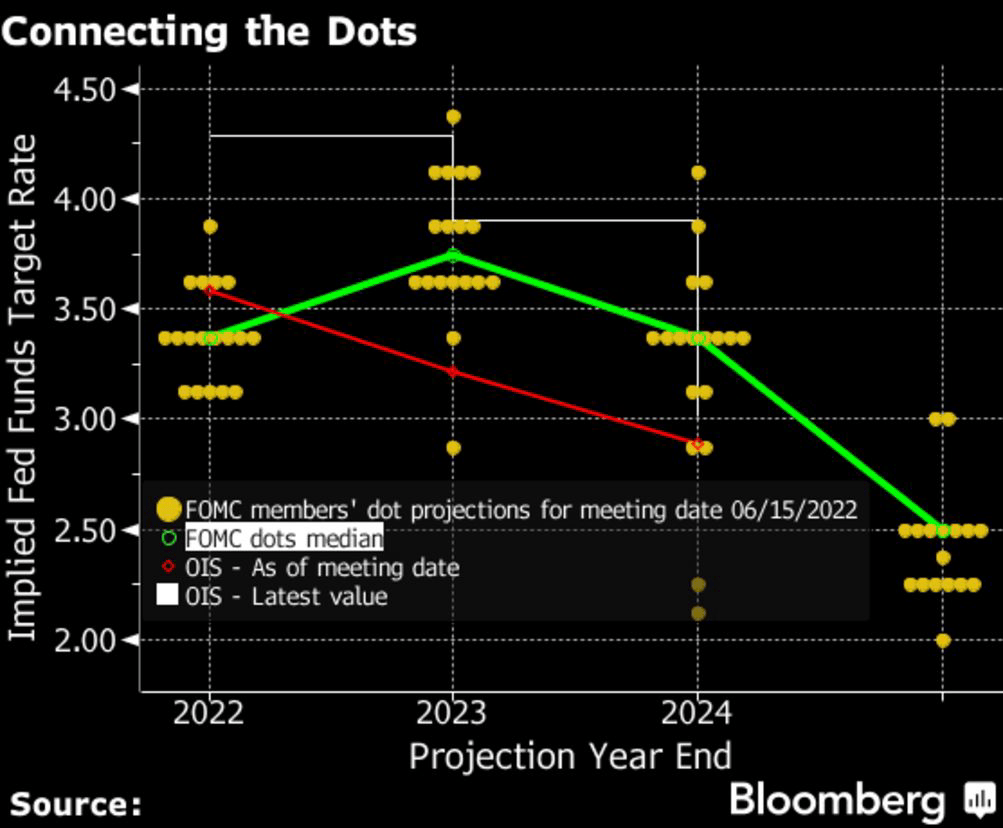

With revenues of $155 billion annually and operating income of over $24 billion per year, this amount of debt shouldn’t be all that bad overall, as the company can handle this debt in a neutral environment. However, with interest rates heading up to over 4%, with an expected further rise in the coming months and a dot plot which projects rates to remain over 2.5% for quite some time, the company can face an increasing interest expense bill.

Fed Dot Plot – Bloomberg (Bloomberg Terminal)

This has resulted in Home Depot’s interest expense increasing over the past few quarters and I expect it to continue at a faster rate than they boost debt.

I expect that the company will pay around $1.6 billion in interest expense for the year, which I believe will rise by ~15% in the year after to $1.8 billion.

While this doesn’t seem to be much at all for a company which rakes in about $24 billion each year in operating income, it does matter at a time where the US and global economies are expecting some form of slowdown or recession.

What If? A Conservative Estimation

In theory, having a higher debt load in a neutral or growing economy doesn’t mean all that much as long as you can service that debt without hurting your operational efficiency. Home Depot is certainly in that category.

But with several high profile economist projecting some form of a recession in the coming quarters – the company is actually one of the more vulnerable ones to a recession type event.

This is because home improvement is a luxury, in most cases, and in case of a recession – you have both more people who become unemployed and cannot afford to do these home renovations, as well as people who rely on several jobs to make their annual income losing one of them or reducing their hours, resulting in lower wages and lower spending power.

Overall, if the company was not increasing their debt load and paying more in interest expense, weathering a recession shouldn’t be an issue. They are still likely to maintain a significant percentage of their current sales and they do have over $1.2 billion in cash and equivalents which they can use as needed.

But with an increased debt load, the company’s leverage increases and they face tougher multiples as fair value, and while a recession should lead to lower interest rates, it’s unclear how fast the federal reserve will act. This means, I believe, that we may see a year or two with still-high interest rates.

There’s Something Else: Market Share Loss?

While companies like Home Depot and Lowe’s (LOW), its main major competitor, are going to continue to dominate the industry, I see trouble brewing over the next 2-3 years beyond the aforementioned debt load and interest rate risk – market share.

According to industry research, the home improvement market is expected to grow at a CAGR of about 4.6% through 2025. With Home Depot’s revenue growth projected at just 2% to 3% over that time period – I believe it’s indicative of a loss of market share.

While Lowe’s is projected to report even lower growth than Home Depot, it may be the mom-and-pop hardware stores in smaller towns, as well as companies like Amazon (AMZN) offering an avenue for much smaller outfits to sell their products and enjoy the Prime free shipping and the likes.

If you add this to the overall thesis and assume that while the company will remain stable on paper, that it can lead to some market share loss – it adds to the risk portfolio of the company by raising the question of ‘can it get it back?’.

So What Does This Mean?

While this by no means indicates that the company will report significant declines which will place it in long-term trouble, I do think that since it used the previously-low interest rates to load up on debt, that HD is highly likely to underperform the broader market in the case of an economic downturn.

Since I do expect an economic downturn to take effect in the coming quarters, I believe that Home Depot is highly likely to underperform other companies and the broader market and have therefore turned neutral on the company’s 2-3 year prospects.

Be the first to comment