nikkytok/iStock via Getty Images

In the two quarters since posting results, Stratasys (NASDAQ:SSYS) lost almost one-fifth of its value. The manufacturer of 3D printers lost money in the final quarter of the year. In the first quarter, Stratasys reported two cents in earnings per share, albeit on a non-GAAP measure. JPMorgan reacted positively to the last quarter by upgrading the stock and setting a $23 price target.

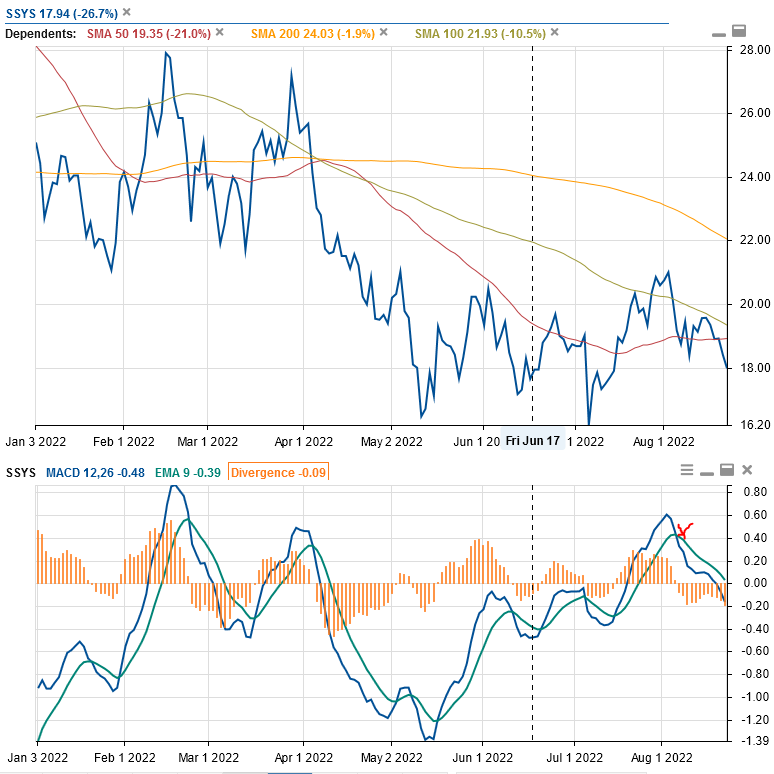

In the last week, the stock market started a reversal. This followed a prolonged rally that began in June 2022. Just when it looked like shares would break out above $20, SSYS stock closed below $18 on August 22, 2022. What did investors not like about the company’s most recent results?

Full Year Guidance Cut in Second-Quarter 2022 Report

Stratasys posted revenue growing by 13.3% year-on-year to $166.6 million. However, it cut its full-year revenue guidance from $675 million to $685 million. This is a drop from its previous range of $685 million to $695 million. The small cut is a result of unfavorable currency exchange rates that will hurt Q3 and Q4.

The company ended the quarter with $441.5 million in cash and equivalents. It has no debt. Unlike recent companies burning too much cash, Stratasys has ample cash. It is unlikely to issue debt or dilute shareholders.

In its reconciliation of GAAP to non-GAAP guidance, the company excluded a small stock-based compensation expense of $33 million to $35 million. In addition, intangible assets amortization expenses will cost up to $38 million for the year. This reconciles to a non-GAAP diluted EPS of 14 to 19 cents, compared to a GAAP loss of $1.04 to $1.17 a share.

Opportunity

Chief Executive Officer Yoav Zeif said that the company has doubled the total addressable market. This revenue growth will support its full-year guidance. Double-digit growth in the next few years will come from scaling the business. It will manage operating expenses to support expanding operating margins. For example, in Q2, net product sales increased by around $16 million while operating expenses increased by around $5 million.

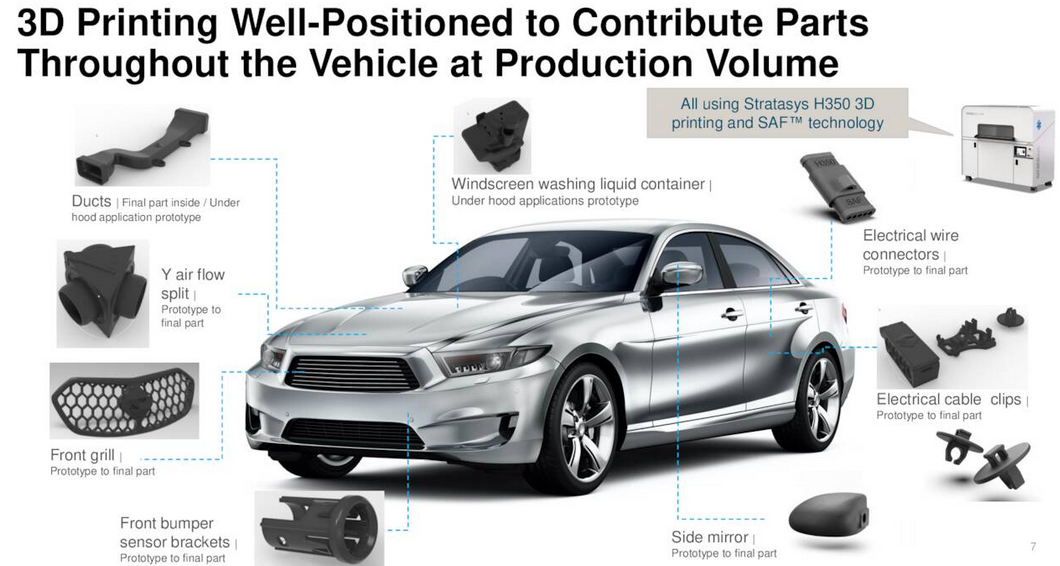

CEO Zeif expects revenue will surpass $700 million. It is depending on its innovation in polymer technologies to win customers. The company highlighted the many parts in vehicles and printed from Stratasys H350 3D printing and SAF technology:

Stratasys Q2/2022 Presentation

Source: Stratasys Q2/2022 Presentation

In software and services, Stratasys has a five-year plan to grow the business. Along the way, it will achieve profitability within three years.

Investors seeking exposure to the automotive parts sector may consider Magna (MGA). BorgWarner (BWA) is also a compelling auto parts and equipment investment:

SSYS Stock Score (SA Premium)

Aptiv (APTV) trades at a D- grade in valuation. Investors are paying a premium, betting on Aptiv’s next-generation autonomous driving system. Although APTV stock scores a B- on growth, passengers rated Aptiv self-driving experience a perfect 5-out-of-5 stars.

Stratasys is not a pure-play automotive parts supplier. It serves other industries, including the healthcare industry. The firm introduced a new, unique RadioMatrix material. This enables 3D printed models to display on X-rays and CT scans (per slide 8).

Makerbot Acquisition Update

CEO Zeif said the company is waiting for the Makerbot deal to close. Its quarterly report benefits from the exclusion of those results. The timing of the deal close will have an impact on results. Shareholders should expect higher margin figures for the rest of the year in the absence of Makerbot.

Risks in Stratasys

Investors buying Stratasys today are speculating that revenue will exceed costs within three years. The firm may not win supply deals if it does not realize its total addressable market potential. Customers must switch from prototyping Stratasys machines with limited use cases. It needs to validate the role of Stratasys machines in real-world production.

Additive 3D printing consumes many raw materials. Inflation is increasing costs. This might hurt demand. Stratasys raised prices in Q2/2021 to mitigate the costs of logistics inflation. This should limit the impact of cost headwinds that customers face.

After SSYS stock broke down below $20 earlier this month, the moving average convergence divergence line crossed over:

Stockrover.com

Chart from StockRover

The faster-moving blue line crossing the green line is a bearish signal. The stock risks re-testing the $16.20 low.

Your Takeaway

Stratasys is not a high-flying technology stock. Profitability from the 3D printing business eludes it for now. After the stock pulled back from the $20 range, investors may consider holding the stock from here.

Be the first to comment