NiseriN

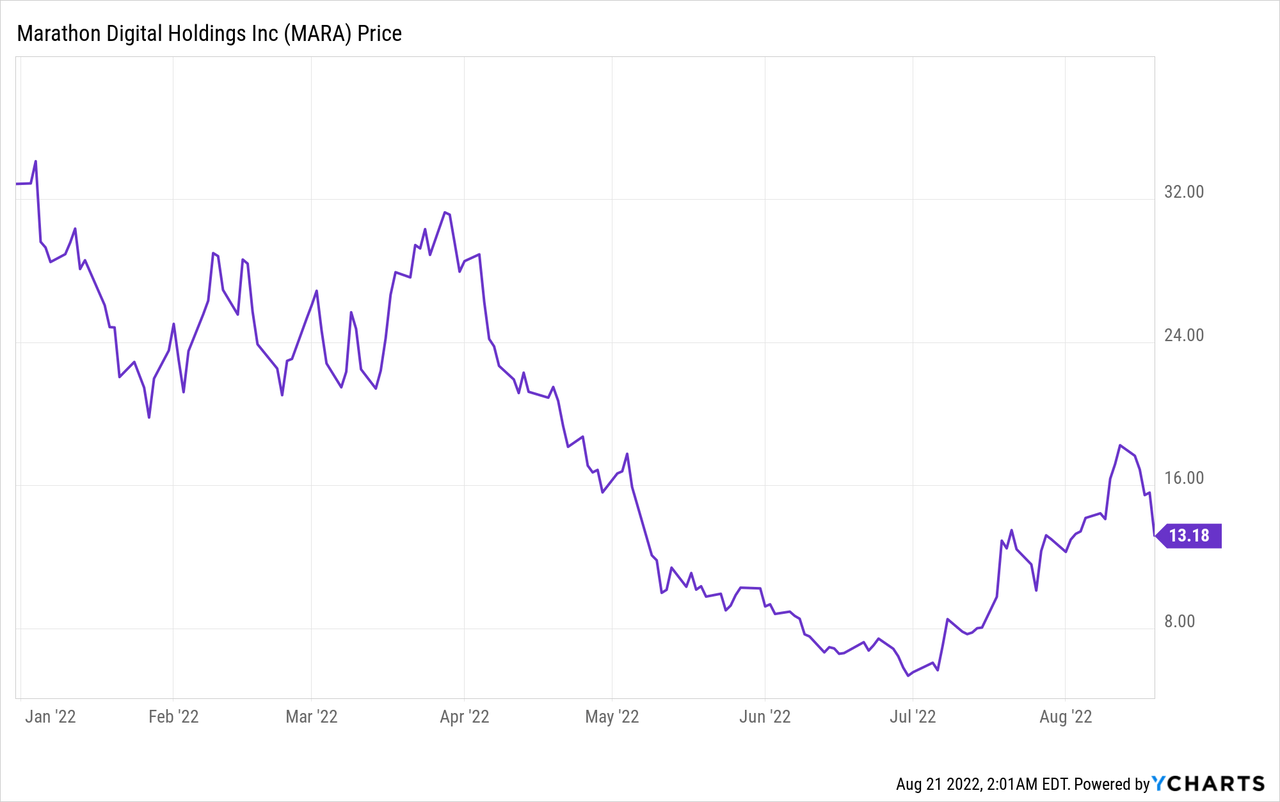

After Bitcoin recently crashed, I decided to move some funds into my favorite crypto mining stock, Marathon Digital Holdings (NASDAQ:MARA).

Bitcoin sold off recently due to rate hike fears after investors received the July 2022 Fed minutes notes.

I’m extremely bullish on Bitcoin & blockchain technology in the long run and don’t mind picking up MARA stock at a discount.

While most BTC miners have sold off their Bitcoin to keep the lights on, I was impressed by Marathon’s die-hard HODL strategy in the company’s most recent Q2 quarterly report.

In this article, I’ll provide a thorough update on Marathon Digital’s business and give several reasons why I bought back into Marathon Digital stock.

Q2 Business Update

My MARA stock article talked extensively about why the 2024 Bitcoin halving is such an important event. Now, I want to shift gears and cover how Marathon is doing after reading their latest Q2 2022 quarterly report.

The company suffered a massive drop in Bitcoin production due to the Montana mining facility shut down in July. A massive storm struck the town of Hardin, Montana on June 11th and caused 75% of Marathon’s miner to go offline. The company lost nearly 30,000 miners for several weeks, which severely impacted its total mining production in Q2 2022.

Q2 Bitcoin production was 707 BTC (Up 8% YoY) while Bitcoin’s price dropped 57% during the same period. It was a rough quarter for all crypto stocks as Bitcoin plummeted after the Terra Luna collapse.

Total revenue hit $24.9 million and the company recorded a net loss of $191.6 million (-$1.75 per share). Impairment expenses of $207.3 million made up the bulk of Marathon’s losses due to failing Bitcoin prices.

The good news is Marathon Digital held 10,127 BTC on its balance sheet at the end of July 31st, 2022 and broke the 10k BTC milestone for the first time ever.

Total number of miners installed reached 49,000 at the end of Q2 but the company maintains its goal of nearly 200,000 miners installed by early 2023.

Marathon Digital moved all of its miners from Hardin, Montana to North Texas after signing a 254 MW agreement with Applied Blockchain (APLD).

Additionally, the Company continues to expect its mining operations to be 100% carbon neutral by the end of 2022.

The company has $120.7 million in cash on its balance sheet as of Q2 2022.

Why I’m More Bullish on Marathon Digital

After BlackRock signed a deal with Coinbase (COIN) to buy Bitcoin for its clients, I knew that many institutional investors will finally accept Bitcoin as “real money” for the first time ever.

This event alone is a huge bullish indicator for crypto stocks because BlackRock wants to buy Bitcoin while prices are down.

Marathon Digital has more Bitcoin than any other North American crypto miner and just relocated its facilities away from Hardin, Montana to North Texas and North Dakota.

BTC Held by Top Publicly-Traded Crypto Miners

| Company | BTC Holdings as of July 2022 |

| Marathon Digital (MARA) | 10,127 |

| Hut 8 (HUT) | 7,736 |

| Riot Blockchain (RIOT) | 6,696 |

| HIVE (HIVE) | 3,091 |

| Core Scientific (CORZ) | 1,205 |

Source: Author, with data from company filings

Texas is a crypto-friendly state that will help the company scale BTC production.

Whenever I’m investing in a new and emerging sector, I look for the best company that can scale and grow its revenues over time.

Marathon’s 10,127 BTC holdings have a current market value of ~$212 million and could be handy if the company wants to sell some to scale its operations.

The company used several different methods to raise cash during Q2, including a $161 million sale of common stock and new $100 million loan.

Marathon is an asset-light company with around $14 million in quarterly capital expenditures and plans to spend around $150 million to $175 million to deliver and deploy its remaining miners.

Risk Factors

This is a dark period for crypto companies and Marathon could fall victim to several risk factors such as:

- Falling Bitcoin prices that increase impairment expenses and delay mining expansion.

- Issuance of more common shares to fund operations, which will dilute shareholders.

- Increased energy costs due to the Russia-Ukraine war that will increase capital expenditures.

- Another potential storm or natural disaster that suspends mining production at either the North Texas or North Dakota facilities.

It’s not a guarantee that all publicly-traded crypto miners will survive until the next Bitcoin halving in 2024. Marathon has enough cash and Bitcoin on its balance sheet to stay in business.

The biggest risk in my opinion is falling Bitcoin prices that would send crypto investors running for the exits.

MARA stock was trading as low as $6 in June 2022 and could trend downwards if Bitcoin remains bearish.

I personally buy MARA stock whenever it dips below $15 or under $2 billion in market cap.

Conclusion

YOLO stocks have taken a beating recently, so now it’s time to invest in crypto stocks. The best time to buy any stock is when nobody wants to own it and I don’t think things could get much worse for the crypto industry.

There are dozens of publicly-traded crypto miner stocks right now but most of them have awful balance sheets or relatively small BTC holdings.

Marathon is the “Alpha” for the group with over 10,000 BTC and counting. That’s why I loaded up on MARA stock during the recent market selloff and will add more as we head into next year.

Be the first to comment