Tea Nagode/iStock via Getty Images

When we last covered Newtek Business Services Corp. (NASDAQ:NEWT), we highlighted that the valuation compression remained on track and the stock had a little bit more to go before it became attractive. Specifically we said,

Unfortunately, we are seeing way too many quality bargains here. Whether we look among regional banks or among BDCs, we are finding better deals than NEWT. None of them come with the current uncertainty of NEWT’s transition either. We are hence maintaining this at a neutral/hold rating. We anticipate giving this a buy rating in the $17 price range.

Source: Valuation Compression On Track

The stock hit $17.50 at the last close and we decided to see if we were at that point where we can upgrade this former high-flying Business Development Company.

Dividend Stream Continues, For Now

The third quarter had the much anticipated dividend cut that we were talking about when we previously covered the stock. 2021 was an extraordinary year boosted by government assisted loans and we finally saw the tapering of that feed into NEWT’s dividends.

Barry Sloane, President, Chairman and CEO commented:

We are pleased to announce the declaration of our third quarter dividend of $0.65 per share, which is payable on September 30, 2022 to shareholders of record as of September 20, 2022. With a little over four months remaining in 2022, we remain confident in our previously forecasted full year 2022 dividend guidance in the range of $2.40 per share to $2.90 per share.

Source: Seeking Alpha

The current yield even at that low end of $2.40, remains fantastic, exceeding 14%, but of course that is slated to change next year as it moves off a BDC model.

Valuation

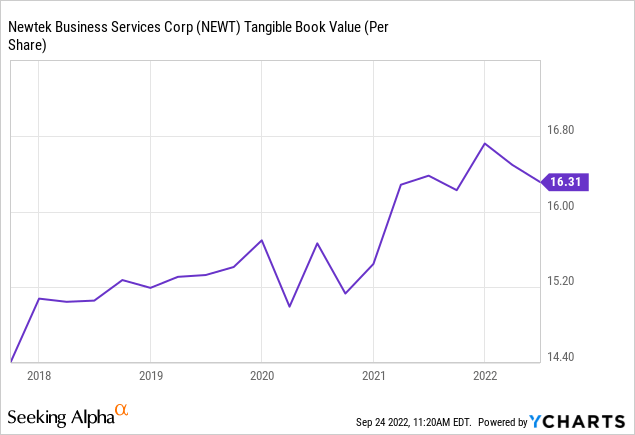

Our main gripe with NEWT, like with most companies we write a negative piece, was the valuation. It is not that we did not want to own NEWT, we just did not want to own it at twice tangible book value. In A Good Point To Exit we wrote that NEWT did not deserve such a premium valuation as most of its income for 2021 was non-reoccurring. Hence at $31, the stock appeared insanely overvalued. One surprise for us here was that the drop-off in net income was far less steep in 2022 than we initially hinted at. NEWT’s base business, ex-PPP, is performing better. Analysts are also seeing NEWT earning as much as $3.00 next year. You do have to take their estimates with loads of skepticism because they are generally quite hesitant to price in a slowdown, let alone an actual recession. Here, the confusion is even higher as the BDC to bank holding model is quite new for them. Nonetheless, anywhere in that ballpark makes NEWT cheap.

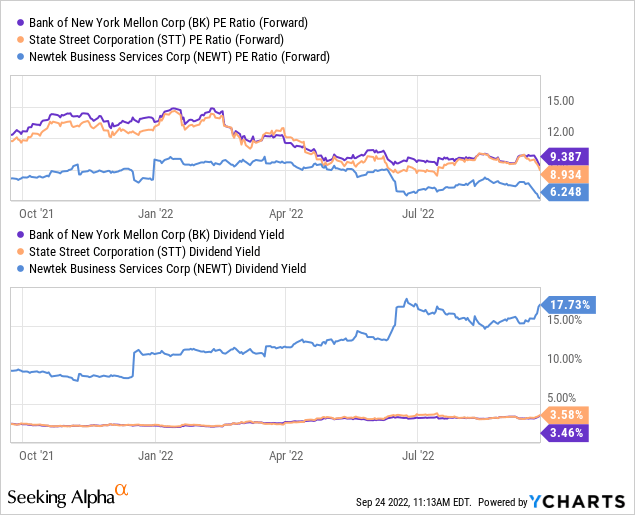

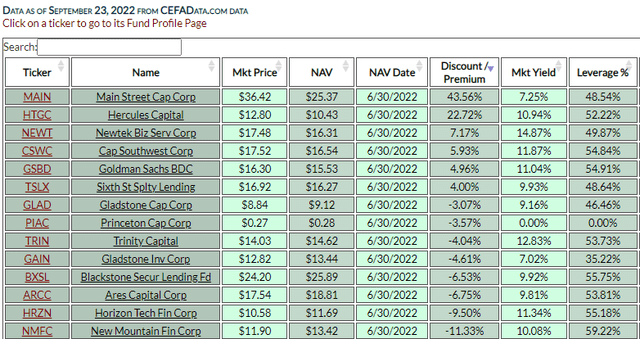

Relative to BDCs though, NEWT has maintained its expensive nature. That is, its stock has dropped but so has everyone else’s stock price. Back in October 2021, NEWT was the second most expensive stock, trailing only Main Street Capital (MAIN). Today, it has moved to a close third, edging out Capital Southwest (CSWC).

So while valuation has become attractive, plenty of other BDCs offer good deals and the certainty of dividends. This is one reason that we would not go ape over the deal that is presented today.

Finally, in the banking sphere, there are many great deals as well. NEWT’s bank holding status likely provides it with a lower cost of funds without getting too much into credit risk. Both The Bank of New York Mellon Corporation (BK) and State Street Corporation (STT) provide such a lower risk model for investors. The two are of course extremely large compared to NEWT and are likely to draw institutional investors with ease. NEWT is far cheaper though, whether we look at forward P/E ratios or the current dividend yield.

Verdict

NEWT is attractive here and we see good things on a longer-term outlook. One key aspect that is missing is the certainty of a proper investor return framework. Obviously, NEWT chose this route away from BDC as it felt it was the best way to grow. We disagreed with the logic at the time as NEWT could have issued a lot of common equity above tangible book value as an alternative. They also likely had not envisioned the drastic changes in interest rates since then. With perfect hindsight, this is not the way they would have gone. Now that we are here, investors crave a dividend policy and a capital return framework that puts their mind at ease. They will likely get that soon as the conversion is approved. NEWT will likely have the best success if it puts majority of the earnings towards the dividend and use a small amount for growth. That will draw dollars from both sides (BDCs and banking stocks). A poor capital return policy (say $1.00 in dividends) would likely erode confidence further and in that case, we can easily see it trade at 0.8X tangible book value, or closer to $13.00.

While we were tempted to upgrade this, we see too many better stocks here today and hence on a relative basis are still keeping this at neutral/hold.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment