Portra

Investment Thesis

I previously covered HNI Corporation (NYSE:HNI) in August. While I highlighted the risk in the company’s residential end market at that time, I was a bit more optimistic about the company’s commercial/workplace business as benefits from the economy reopening and work from office resuming were expected to offset some of the impacts of the economic slowdown. However, things have become incrementally worse and HNI is experiencing weakness in demand for its products in both housing and workplace business. The company’s order rate has started to decline since the third quarter of FY22. The elevated backlog levels in the Residential Building Products segment should benefit the company’s fourth-quarter revenue. However, this is expected to normalize by early FY23 impacting the volume growth in FY23. The Workplace Furnishings segment should be impacted in the fourth quarter and beyond due to the weakness in demand. The volume deleveraging in both segments should impact margins in FY23, partially offset by positive pricing, improvements in the supply chain, stabilization in commodity costs, and an improved product mix. The valuation based on the FY23 consensus EPS estimate is in line with the historical five-year average forward P/E of 16.72x. While I like the company’s long-term prospects, near-term headwinds and valuations keep me on the sidelines.

HNI Revenue Outlook

In the third quarter of FY22, the sales in the Residential Building Products segment improved by 15.5% Y/Y due to the growth in new construction and remodel retrofit channels as well as the acquisition of the Residential Building Products companies in 2021 and 2022. The new construction business was stronger than R&R due to the higher builder backlogs. The sales in the Workplace Furnishings segment decreased by 4.6% Y/Y due to the impact of the sale of the Lamex business in July 2022 as part of its restructuring program.

The orders in the Residential Building Products segment declined 6% Y/Y in Q3 FY22 due to the slowdown in the housing market. Higher mortgage rates are negatively impacting affordability, which is pressuring both new construction activity and the repair and remodeling (R&R) industry. The orders from the new construction market were higher than R&R due to the strength in builder backlogs. The backlog remains elevated due to the strong demand in the housing industry over the past few quarters. This elevated backlog, along with the pricing actions, should benefit the segment’s revenue in Q4 FY22. The backlog is expected to normalize in early FY23, i.e., January or February. After that, the lower order volumes due to the softening housing industry should start reflecting in the segment’s revenue in FY23, and the growth rate should be in line with the new construction and R&R end markets.

The Workplace Furnishings segment, which contributes ~60% to the company’s total revenue, is also facing headwinds as the outlook for corporate profits is softening. This is leading to cautious spending by corporations. The orders from large contract customers in major markets have moderated. HNI is continuously working with its large customers to understand their objectives related to furniture applications. However, this has resulted in more complicated sales processes as its customers are iterating multiple possibilities and taking longer to reach a decision. The smaller transactional activity that is sold through national dealers and wholesalers is also weakening as they react quickly to macroeconomic uncertainty. Unlike these two markets, the company is experiencing good demand from midmarket customers. The demand is driven by back-to-office trends, where offices are operated either by traditional in-person or hybrid work models. However, the strength in this market alone is not enough to offset the headwinds in the other two markets. The revenue growth in the Workplace Furnishings segment should be impacted due to the weakening end markets.

I still believe the long-term trends for the Residential Building Products segment remain strong due to the lower housing inventory and shifting demographic trends. Additionally, HNI is also working on strategic initiatives such as investing to create product awareness, leveraging its distribution model, better connecting with its customers, and doing acquisitions. However, it will take some years for these initiatives to benefit revenues, and there is not much visibility yet on the extent of benefit from these initiatives.

Margin Outlook

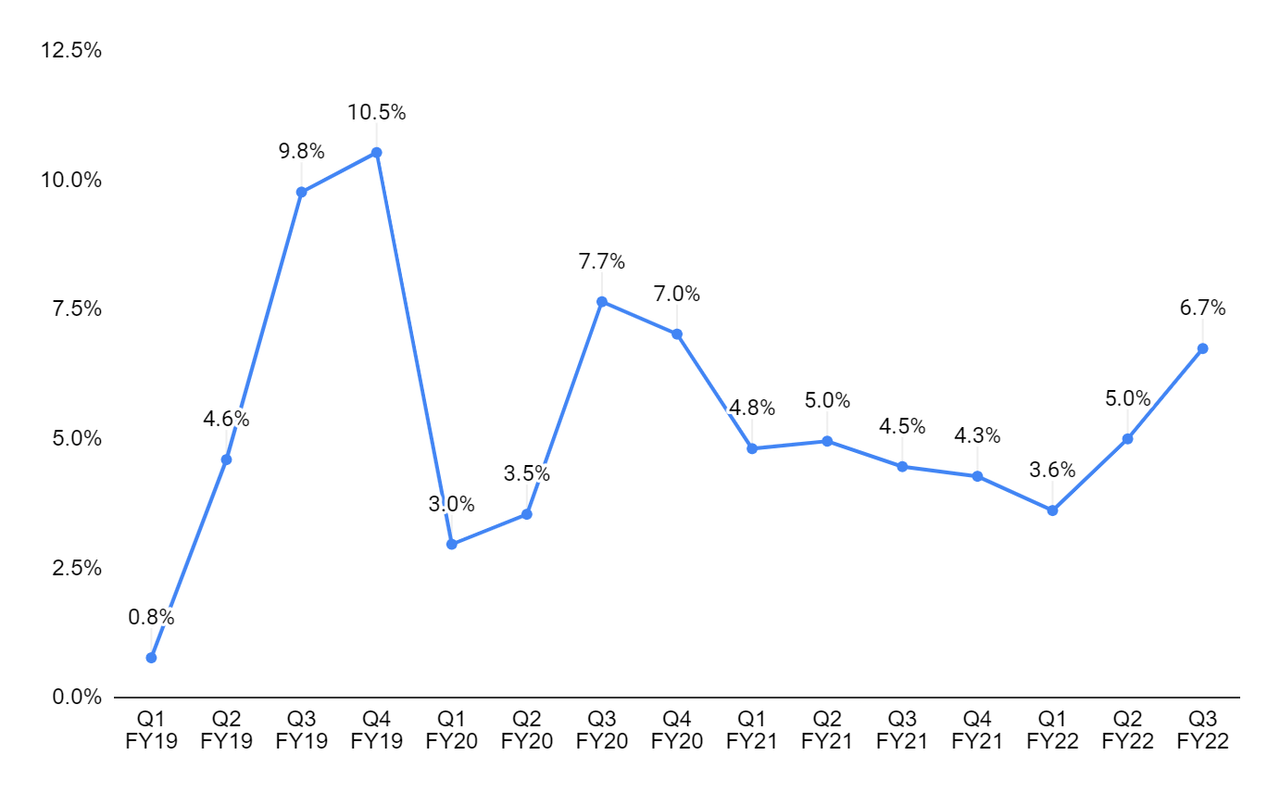

Despite the softening demand environment, HNI was able to generate solid Y/Y margin expansion in Q3 FY22. The gross margin in the quarter improved by 170 bps Y/Y to 35% whereas the adjusted operating margin improved by 230 bps Y/Y to 6.7% due to favorable price cost and product mix. The adjusted operating margin in the Workplace Furnishings segment improved by 150 bps Y/Y to 2.5% due to favorable price costs and benefits from restructuring actions that led to an improved product mix. The adjusted operating margin in the Residential Building Products segment improved 46 bps Y/Y to 17.7% due to positive pricing.

HNI’s adjusted operating margin (Company data, GS Analytics Research)

Looking forward, in the near to medium term, the company’s margin should be under pressure given the volume deleverage in both segments. This should be partially offset by positive pricing, improvements in the supply chain, stabilization in commodity costs, and an improved product mix. Given the weakening demand environment in FY23, the company has initiated a corporate-wide cost reduction plan for long-term profitability. When these actions are fully implemented, management is expecting permanent savings of ~$30 mn on an annual basis. While I believe these cost reduction initiatives will help the margins in the long term, I don’t think they will be able to offset the impact of volume deleveraging in the short to medium term.

Valuation & Conclusion

The stock is currently trading at 16.60x FY23 consensus EPS estimate of $1.65, which is near its five-year average forward P/E of 16.72x. The company’s revenue should be impacted in the near to medium term due to the slowdown in the new construction, and R&R end markets, as well as softness in its workplace business. Due to the volume deleveraging, the margins should also be impacted in FY23, partially offset by positive pricing, improvements in the supply chain, stabilization in commodity costs, and an improved product mix. While I believe the company can do well in the long term, given the near-term headwinds and a valuation that is in line with the historical average, I believe it is best to wait for the revenue decline to bottom before taking a long position. Hence, I have a neutral rating on the stock.

Be the first to comment