photovs

At the moment, school bus manufacturer Blue Bird (NASDAQ:NASDAQ:BLBD) looks like a disaster. The fundamentals are ugly and the year-to-date performance has disappointed. On its face, BLBD looks like an easy avoid — and maybe even an easy short.

For fiscal 2022 (ending September), Blue Bird is guiding for Adjusted EBITDA of $5 to $15 million, and free cash flow of negative $35 million to $45 million. Yet the company’s net debt sits at $187 million, and its enterprise value around $570 million.

Even that guidance can’t necessarily be trusted: Blue Bird has cut its outlook after each of the last two quarters, including the Q3 release in August. In the context of the fundamentals and the results, the fact that BLBD is threatening an all-time low seems to make some sense.

But it’s precisely that appearance that creates an opportunity here — even after the big bounce of the past five weeks. Blue Bird’s fundamentals and results are ugly not because the company is executing poorly, losing share, and/or seeing a long-term change in its market opportunity. Rather, the problems are external — and significant.

In other words, it’s not the ugly fundamentals that underpin an easy short case; rather, those fundamentals obscure an attractive bull case. That’s even more true at the lows.

The Case Against Blue Bird Stock

Even ignoring the fundamentals over the past few quarters, there’s a reasonable case for caution here. Over the long-term, Blue Bird does have an opportunity from the growth of electric school buses and other lower-emissions models (including propane-fueled models).

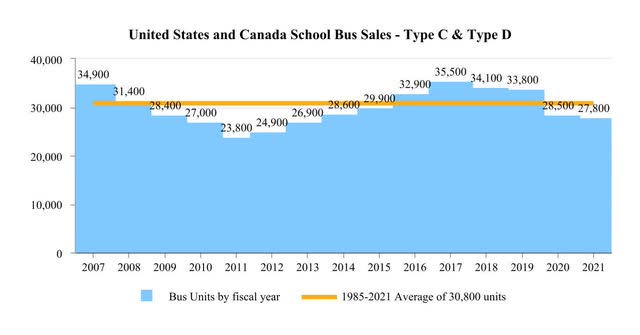

But unlike newer EV manufacturers, the company isn’t gaining an incremental edge from that new opportunity. For three decades now, US school bus unit sales have averaged about 31,000 annually:

BLBD 10-K

That figure doesn’t change much simply because engines do. As sales of EV and propane models grow, there should be a corresponding decline in ICE (internal combustion engine) buses. This seems a key fact that the market missed in sending BLBD to $28 in early 2021, a time when EV optimism was at its highest. (I’ve argued previously that the boom and bust surrounding the SPAC merger that became Lucid Group (LCID) was the key catalyst in reversing that optimism.)

And so the skeptical argument toward BLBD at the lows is that, yes, the company is going to see alternative-fuel growth. But, overall, its unit sales are largely capped by North American demand. That demand hasn’t changed — and over time isn’t likely to change, at least much. And so owning BLBD and its ugly fundamentals is hardly a value play.

Everything Is Going Wrong

It’s a reasonable argument, and the market did overshoot last year in seeing Blue Bird as part of the EV revolution. But it’s also an argument that misses a number of key points.

The most notable is that for Blue Bird, in recent quarters essentially everything has gone wrong. Lingering impacts of the pandemic continue to affect demand from school boards, who until recently had far more short-term issues to deal with than replacing bus fleets.

The supply chain continues to be an absolute mess. Coming into the year, Blue Bird was seeing shortages in over 25 parts per bus, according to the Q4 conference call. Pressures have reduced somewhat, but still remain: a shortage of chips for the EV program hit Q3 results and contributed to the lowered guidance for the year.

And of course, the parts that Blue Bird can get are more expensive. So is labor. Yet, in the interest of long-term comity, Blue Bird agreed to fill orders at lower, previously agreed-upon prices before instituting an increase. Per the Q3 call, prices have increased some 25% to account for those soaring input costs.

The good news is that in coming quarters, the fundamentals no doubt are going to get better. The supply chain is improving, Blue Bird is in better shape in terms of labor, and pricing will help margins starting in Q4.

And while customers likely aren’t thrilled about paying ~25% more for buses, there likely isn’t much choice. The North American bus market is essentially an oligopoly among three competitors, and there’s little evidence that Traton’s (OTCPK:TRATF) IC Bus business or Daimler Truck’s (OTCPK:DTRUY) Thomas Built Buses have taken market share or have avoided inflationary pressure.

Meanwhile, reduced spending during the height of the pandemic and the supply chain problems this year likely produce pent-up demand in CY23 and CY24. So should help from the federal government, including the recently-announced doubling of rebates for clean buses as part of a $5 billion program.

And while those programs don’t necessarily increase the overall number of buses sold long-term, they do provide an edge for Blue Bird, which has greater market share in EV and propane models than in legacy ICE buses.

All told, on the top and bottom line, there should be tailwinds on the way.

How Do You Value BLBD?

At the end of Q4, assuming the lower (ie, more negative) end of the guided free cash flow ($35 to $45 million) and including ~$20 million in pension expense, BLBD should have net debt of around $192 million. Fully-diluted market cap at $8.66 is $282 million, suggesting an enterprise value of $474 million.

That’s roughly 6x FY19 Adjusted EBITDA, even adding back current stock-based compensation. FY19 was a strong year, admittedly — Blue Bird’s most profitable in more than a decade — but higher market share in clean buses and government help suggest the company should be able to get back to those levels at some point. Even 8x FY19 EBITDA of $77 million gets the stock to $13, roughly 50% upside from here, even ignoring potential debt reduction as the company returns to positive free cash flow (presumably in FY23).

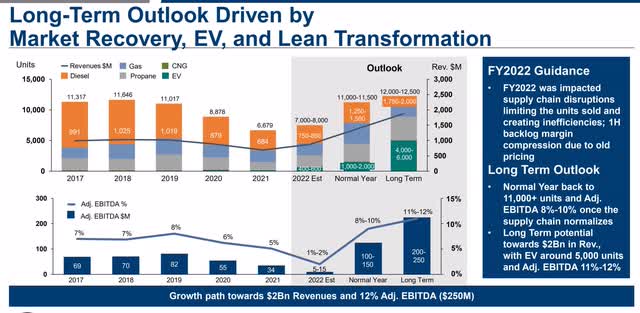

But that valuation hardly seems like a ceiling. Blue Bird itself sees a path to much bigger returns:

Blue Bird presentation, September 2022

Notably, the company’s outlook in terms of units is not that far above 2017-2019 levels. It appears to include a reasonably static level of long-term market demand, along with incremental share gains from clean models. (Blue Bird also plans to move into the so-called “repower” market, retrofitting existing ICE buses with cleaner engines, as well as supplying chassis for delivery and recreational vehicles.)

The guided 11-12% EBITDA margins, up from 7-8% in pre-pandemic times, seem like a stretch goal. But even falling short — mid-cycle performance in the range of $1.5 billion in revenue and EBITDA margins of 8% — still suggests big gains in BLBD. That rough model suggests ~$120 million in annual EBITDA. A 9x multiple (that too in line with pre-pandemic levels) along with debt repayment suggests a path toward $30.

To be sure, valuing a stock (or owning a stock) based on management projections is a dangerous strategy. But, directionally speaking, those projections should have some credibility.

Blue Bird is saying that everything is going wrong at the moment. That’s clearly the case; shortages are impacting nearly every vehicle manufacturer out there. Government support is real. There’s no reason to believe that demand is impaired long-term. Margin targets may be overstated (as they often are), but margins on clean energy models should be higher (as is the case in other vehicle classes). If Blue Bird falls short of its targets, again, there’s still room for substantial upside.

Admittedly, I’ve been wrong so far: my position in BLBD is underwater even after buying near pandemic lows. But this still seems a long-term story largely obscured by short-term challenges. The sell-off of late, in particular, doesn’t seem to make a ton of sense given that macroeconomic worries should be a modest benefit in terms of input costs and labor.

At the very least, performance should normalize as the environment does — and there’s a scenario in which BLBD absolutely soars at some point in the next few years. Combine price increases, government support, and stable wage and input costs, and this is a stock that can pretty easily clear $20. That kind of upside seems worth the risk — particularly with BLBD stock at the lows.

Be the first to comment