John M Lund Photography Inc/DigitalVision via Getty Images

Micron (NASDAQ:NASDAQ:MU) manufactures semiconductor memory devices. These devices are commodity-like and as such MU’s ASP, revenues, gross margin “GM”, profitability and cash flow are subject to the supply demand balance in the market. The demand for memory devices is declining rapidly as a result of macroeconomic headwinds. In this article, I will share my thesis that the headwinds are getting stronger and hence demand decline will accelerate. In addition, I believe that the stock market will decline further as a result of these same headwinds, dragging MU’s share price down by at least 20% from current levels.

FiQ2023 guidance is horrible

MU reported its F4Q2022 results on September 29. Results were in-line with downside guidance provided in an 8K filing on August 8. The shocker was a downside guidance for F1Q2023, with QoQ revenue down 36% and GM down 1450 bps at the mid-point. MU guided to a small operating loss and a large negative FCF of over $1.5 billion.

Yet its shares did not trade down on September 30. I believe that investors are buying into management’s outlook where they “expect strong revenue growth in the second half of fiscal 2023 as bit demand rebounds following substantial improvement in customer inventories”.

At least one analyst, Mr. Timothy Arcuri of UBS, probed at the basis of management’s optimism by asking management for their expectation of the behavior of their cloud customers, which represent the strongest segment, that might drive this 2H rebound. Unfortunately, management did not provide any substance in their answer. My guess is that management did survey of customers’ expected consumption, purchases and inventory level and modeled a strong 2H rebound. I have followed this MU management for many years. In the last downturn, management had provided similar optimistic outlook for demand rebound that was subsequently proven to be too optimistic. Hence, I believe investors should take this optimistic outlook with a large grain of salt.

Macro headwinds are strengthening

My expectation is that given the current highly volatile macroeconomic environment, no one really knows for sure what the medium-term demand for memory looks like. We are in an unprecedented period of time with multiple macroeconomic and geopolitical headwinds buffeting the worldwide economies. Inflation is running at levels that we have not seen in almost 40 years. The Federal Reserve is increasing interest rate rapidly and is resolved to increase rates until inflationary pressure shows signs of easing to the targeted 2% level. The US dollar is appreciating against most currencies around the world, causing most Central Banks around to world to raise interest rate. The higher rates are sending many countries into a recession. In the U.S., the Leading Economic Indicator “LEI” has been down six months in a row. Historically, such a decline in the LEI has always led to a recession. Hence, it is likely that the U.S. economy will go into a recession, if we are not already in one.

The war in Ukraine and the subsequent sanctions against Russia have resulted in a spike in energy prices in European countries. The high cost of energy has practically shut down energy-intensive industries in Europe, such as companies in the chemical, metal and fertilizer industries. The high cost of energy has also shut down many small businesses as they were unable to pass on the cost of energy to their customers. The European energy crisis is causing the cost of energy to increase significantly in Asia as well, as Asian countries are now competing with European countries for the limited LNG capacity.

Meanwhile, China’s economy is growing well below the government’s target as a result of several factors: strict lockdown to prevent the spread of COVID, a decline in its property value as China works to unwind its over-leveraged real estate sector, and a cautious consumer as a result of decline in China’s real estate market value and stock market.

These macroeconomic and geopolitical headwinds are unlikely to resolve in the next 6 months and very likely cause most countries to go into a recession. Hence, it seems highly unlikely that MU’s market will rebound strongly in 6 months’ time. At best, I expect the memory demand will tread water at a much lower level for a while longer, resulting in an L-shaped demand profile.

Micron’s markets are in a melt down

For the last several quarters, MU’s consumer electronics markets (smart phones and consumer PCs) have been declining rapidly while enterprise and auto/industrial have been holding up. F4Q results showed that with the exception of auto/industrial, all markets are in rapid decline. Even in auto, MU guided to a F1Q2023 decline QoQ. The memory market meltdown led to a guidance of F1Q2023 revenues down 36% QoQ!

This is not surprising. When enterprises face a potential recession, they all have the same playbook – preserve cash. They do that by cancelling or deferring purchase orders, liquidating inventory, cutting capex and expenses. All these actions have direct impact on MU’s revenues.

As of August 5, companies in the S&P500 reported an earnings growth of 6.7% for 2Q, the lowest since Q4 2020. For 3Q, FactSet expects that S&P500 companies will report an earnings growth of 2.9%. But if we exclude energy companies from the data set, 3Q earnings growth for the rest of the S&P500 companies is expected to decline by 3.4%.

I expect that S&P500 earnings to continue to deteriorate for 4Q and 1Q as the recession takes hold. As a result, MU’s customers will likely take more aggressive actions to preserve cash as they see their revenues and earnings decline. Given the confluence of all the macro and geopolitical headwinds mentioned earlier, it is my assessment that we are already in a recession, and this recession will be similar in depth and in duration as those seen in the 70’s and 80’s. As such, that is why I believe that MU’s expectation of a rebound in F2H2023 is too optimistic.

Micron is executing its down-cycle playbook

Like a ship caught in a hurricane, you do what you can to survive so you can fight another day. In such a strong headwind environment, preservation of cash is job number one. MU is working to preserve cash by cutting capex, reducing the utilization of its manufacturing capacity and reducing working capital requirement. It continues to invest in its technology and new product development. This is the typical playbook for a down-cycle.

The long cycle time for manufacturing, however, is causing MU’s inventory to balloon as demand drops rapidly. MU ended F4Q2022 with 139 days of supply. Management expects that inventory will balloon to over 150 days of supply by the end of F1Q2023. MU will likely have to cut prices aggressively to move its inventory and to maintain market share which will severely impact GM. I believe we are seeing that already in its F1Q guidance with GM guidance down 1450 bps.

Despite all these efforts to preserve cash, MU expects to have a negative FCF of over $1.5 billion. In FY2022, MU spent about $2.4 billion repurchasing shares at an average price of around $67 per share. To preserve cash, it is unlikely that MU will purchase a material number of shares even though their shares are trading at around $50, significantly below $67.

Micron’s share price will likely decline further

Given my outlook for the depth and the duration of the coming recession, I expect MU’s price to continue to decline from here. It is possible that we may have intervals of bear market rally, but those are opportunities to add to my shorts.

In my previous articles on MU published on July 4 and May 3, readers have suggested that a low P/E ratio (current TTM P/E is 6.5) and the book value (currently at $45.5) would provide support. Based on SA’s data, the forward P/E ratio of MU is currently at 101 with a forward EPS of $0.49. Hence, the forward P/E may not provide much support.

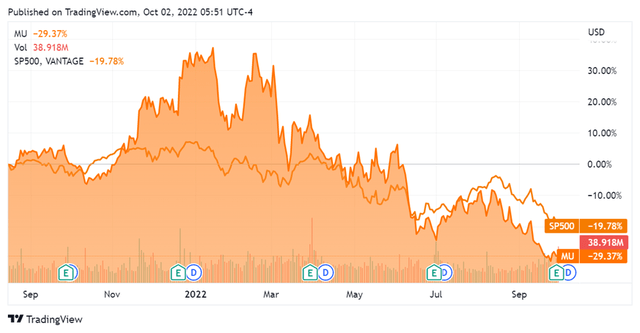

Some analysts have posited that the S&P500 may decline to 3000 (from a recent value of 3585) in a recession. That is another 16.3% lower from the current level. What would MU’s shares fare should the S&P500 fall another 16.3%? With a beta of 1.3, I would expect MU’s share to decline by around 21.2%. That would take MU’s shares below $40. Figure 1 provides a visual of the high beta value of MU as its shares rose more than the S&P500 in an up market and declined more than the same index in a down market.

Figure 1: MU share performance vs S&P500. (SA data base)

History has shown that when investors capitulate, book value or other such valuation metrics may not provide any solid support. When capitulation happens, it may be an excellent time to buy MU shares. Meanwhile, I remain short and may add to my shorts in a bear market valley.

My Gross Margin and macro indicators are not flashing buy signals

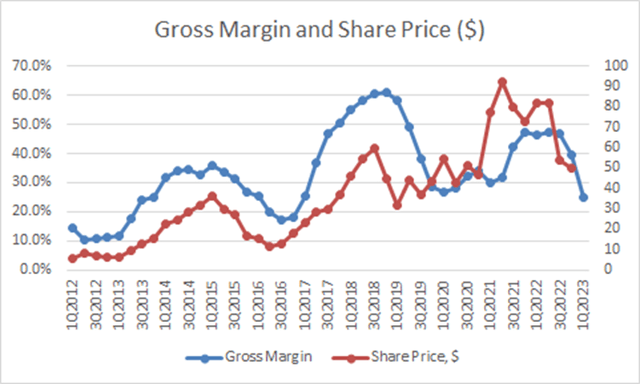

I have always advocated that MU’s gross margin (GM) provides an excellent indicator for the turning of its business. Currently, the GM indicator is on a rapid decline. I would consider buying only when the GM rate of decline inflects. The GM indicator is shown in Figure 2. Figure 2 shows that GM’s rate of decline is accelerating and hence is not showing a buy signal.

Figure 2: MU’s GM and share price trend. (Arthur’s work based on company releases and SA data base)

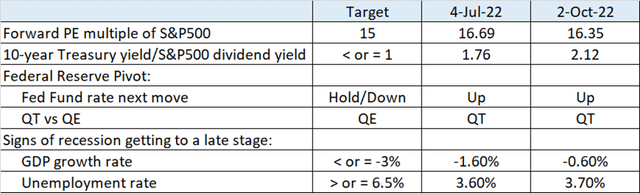

Since MU’s business and its share price are greatly impacted by the macro headwinds, I proposed in my July 4 article to use a set of macro indicators to assess an inflection in MU’s business. The indicators and their current values are shown in Figure 3. The data in Figure 3 show that the macro indicators are not showing a buy signal either.

Figure 3: Macro indicators not giving buy signals yet. (David Rosenberg)

MU is a great company and I look forward to owning it again one day. It is in a cyclical business and hence one has to trade it accordingly. I believe that the likely short- to medium-term trajectory for its share price is down. Hence, I will wait patiently and watch my indicators. Meanwhile, I have been short since earlier this year and may add to my position should the market and MU shares rally.

Takeaway

The macroeconomic headwinds are accelerating and MU’s markets have rolled over and are in steep decline. MU has guided for a large QoQ revenue decline, a loss and a large negative FCF for its F1Q2023. Management expects their market to rebound strongly in F2H2023. However, given the strong macro headwinds, my expectation is that it will take longer for demand to rebound. With most companies in a cash preservation mode during a recession, and with MU fighting to preserve its market share and cash, its GM and profitability will likely be down beyond F1H2023. With a recession, my expectation is that MU shares will go down more than 20% from here. I will stay short and watch my indicators for future buying opportunities.

Be the first to comment