Drazen Zigic/iStock via Getty Images

Sometimes, investing can require great patience and the ability to be wrong for an extended period of time. If you can’t exercise these traits, it might be best to put your money in an index fund and play it safe. One company where patience has yet to pay off, but that I believe will, is Daseke (NASDAQ:NASDAQ:DSKE). This company, which operates as a specialty trucking and logistics firm that focuses on providing flatbed and specialized freight services throughout North America, has had a rough year so far. Shares are currently down almost double what the market is down and investors fear that the state of the economy could prove damaging to the enterprise. While it is probable that the firm will suffer some from a fundamental perspective, shares look too cheap to make sense at this moment. When coupled with a recent move management made aimed at capitalizing on the company’s low share price, I do think the firm warrants a ‘strong buy’ rating right now.

A rough ride

Back in late December of 2021, I wrote an article that took a rather bullish stance on Daseke. In that article, I acknowledged management’s hard work that was aimed at creating value for the company’s shareholders. I did also say that performance at that time had been rather mixed but that the outlook for the company was mostly positive. My overall conclusion about the company was that the firm would be subjected to volatility because of the company’s small size and based on its historical financial performance leading up to that point. But at the same time, I felt as though investors who didn’t mind that volatility might find it a very attractive prospect, leading me to rate it a ‘buy’. Since then, things have not gone precisely as planned. While the S&P 500 has generated a loss of 22.9%, shares of Daseke are down by 43.1%.

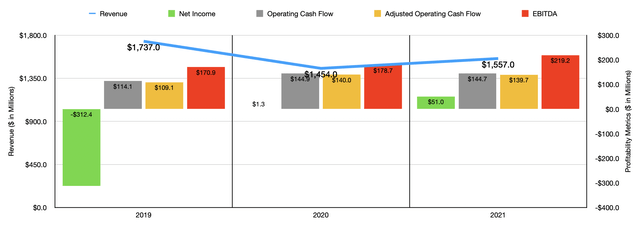

Author – SEC EDGAR Data

Based on this return disparity alone, you might think that the fundamental performance of the company has been awful. But that couldn’t be further from the truth. To start with, we should touch on how the firm ended its 2021 fiscal year. After all, when I last wrote about the company, we only had data covering through the third quarter of last year. During 2021, sales for the firm came in at $1.56 billion. While this is still lower than the $1.74 billion generated in 2019, it was 7.1% above the $1.45 billion in revenue the company generated in 2020. This increase in sales came even as the largest portion of the company’s revenue, the revenue associated with its company freight operations, dropped by 7%. Owner-operator freight revenue, meanwhile, grew by 19%, while brokerage revenue jumped by 14.8%. It is also true that fuel surcharge revenue shot up by 36.9%. But even without fuel surcharges factored in at all, revenue still would have been up by 4.9% year over year.

Interestingly, this increase in sales came even as miles traveled by the company decreased in 2021 compared to 2020. Company miles dropped by 11.5%, while even owner-operator miles declined by 4.4%. The company suffered from the exit of Aveda, which impacted sales to the tune of $51.7 million. What really helped the company, then, was the rate per mile, which grew from $2.45 to $2.75. At first glance, this much of an increase may not seem to be material for the company. But based on the number of miles engaged in during 2021, that disparity alone would have added $121.65 million in revenue to the company’s top line.

With revenue rising, profits also improved. Net income rose from $1.3 million in 2020 to $51 million in 2021. Of course, we should also pay attention to other profitability metrics. Consider operating cash flow. During the year, this metric totaled $144.7 million. That’s actually down slightly from the $144.9 million generated in 2020. Even if we adjust for changes in working capital, the metric would have dipped from $140 million to $139.7 million. EBITDA also worsened, falling from $223.1 million to $219.2 million.

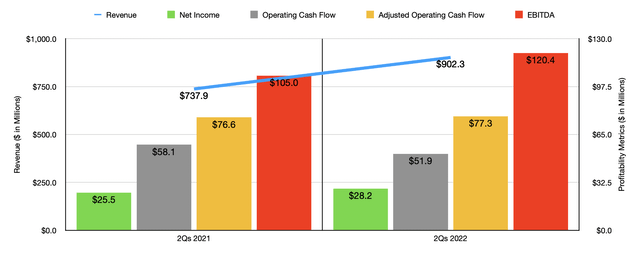

Author – SEC EDGAR Data

Admittedly, the weakness in 2021 from a cash flow perspective may have impacted the market’s perception of the company. However, that data should have been more than offset by positive results so far in 2022. Revenue in the first half of the year came in strong at $902.3 million. That represents an increase of 22.3% over the $737.9 million generated the same time one year earlier. From a peer percentage perspective, fuel surcharges were once again a big driver of growth here, with revenue up 90.3%. But even if we remove fuel surcharges altogether, we would have seen revenue rise by 16.1% year over year. Company freight revenue grew by 4.9%, while owner-operator freight revenue jumped by 14.3%. The company benefited from a 47.7% rise in brokerage revenue and by a 32.3% increase in logistics revenue. Interestingly, total miles traveled by the company continued to decline, dropping from 209 million to 194 million. But the rate per mile jumped from $2.60 to $3.05, pushing revenue per tractor up from $111,100 to $127,700.

The rise in revenue brought with it improved profitability. Net income in the first half of the 2022 fiscal year totaled $28.2 million. This is higher than the $25.5 million reported one year earlier. Operating cash flow did fall, dropping from $58.1 million to $51.9 million. But if we adjust for changes in working capital, it would have risen from $76.6 million to $77.3 million. Over that same window of time, we also saw EBITDA improve, climbing from $105 million to $120.4 million.

When it comes to the 2022 fiscal year as a whole, management said that revenue should rise by between 12% and 15%. At the midpoint, this would translate to sales of $1.77 billion. The company is also forecasting an increase in EBITDA between 5% and 10%. At the midpoint, that would imply a reading of $235.6 million. No guidance was given when it came to other profitability metrics. But if we assume that they will increase at the same rate that EBITDA should, then we should anticipate net income of $54.8 million and adjusted operating cash flow of $150.2 million.

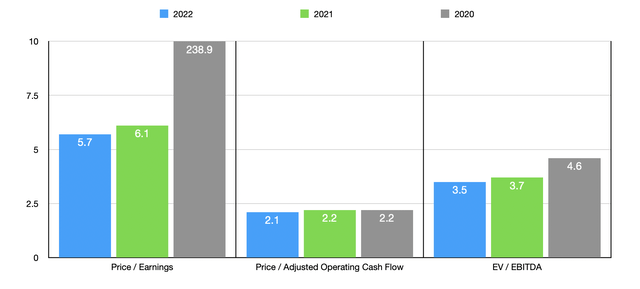

Author – SEC EDGAR Data

These figures give us a forward price to earnings multiple of 5.7, a forward price to adjusted operating cash flow multiple of 2.1, and a forward EV to EBITDA multiple of 3.5. Even if financial results revert back to what we saw in 2021, these multiples would still be low at 6.1, 2.2, and 3.7, respectively. To take this a step further, a return back to what we saw in 2020 would still see shares trading on the cheap from a cash flow perspective. The price to adjusted operating cash flow multiple would be 2.2, while the EV to EBITDA multiple would come in at 4.6. And for the operating cash flow angle, this is after taking out $4.96 million associated with distributions that are paid out to preferred shareholders. The only way in which shares look pricey is from a price-to-earnings perspective. Due to the company’s weak bottom line results that year, the price-to-earnings multiple would be 238.9. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, the four companies with positive results were trading at multiples of between 7.4 and 15. In this case, Daseke was the cheapest of the group. Using the price to operating cash flow approach, the range was between 2 and 62.9. And using the EV to EBITDA approach, the range was between 3.4 and 7.5. In both of these cases, one of the five prospects was cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Daseke | 6.1 | 2.2 | 3.7 |

|

P.A.M. Transportation Services (PTSI) |

10.6 | 8.0 | 5.8 |

| ArcBest Corporation (ARCB) | 15.0 | 9.9 | 7.5 |

| Yellow Corporation (YELL) | N/A | 62.9 | 5.2 |

| Ryder System (R) | 8.6 | 2.0 | 4.0 |

| Covenant Logistics Group (CVLG) | 7.4 | 6.1 | 3.4 |

Takeaway

Based on all the data provided, I do think that shares of Daseke are unrealistically cheap at this time. They are cheap on an absolute basis and relative to similar firms. Even as financial performance weakens, it would have to weaken a lot in order for the company to be trading at fair value. This paints for me a very bullish picture. It also helps that management, on September 30th, announced that they were planning to buy back up to $40 million worth of shares over time. That announcement alone helped to push shares up by 10.6% on that day. It seems as though other market participants are starting to recognize how much additional value the company could create for its investors in the long haul if they do indeed buy back a sizable portion of stock. All things considered, I do believe that a ‘strong buy’ makes sense at this time, reflecting my belief that the company should significantly outperform the broader market for the foreseeable future.

Be the first to comment