dszc/E+ via Getty Images

Co-produced with Treading Softly.

The fall and winter months mean one thing for many – longer nights and shorter days.

The sun sets earlier and the sun rises later.

With colder weather, many of us are spending more time indoors dreaming of warmer weather. This leads to a natural spike in various commodity prices and consumption. Why? All that heat and light has to be generated somehow!

In colonial times, large wood-burning fireplaces were common in homes. They provided light and warmth to the whole household. Kerosene lanterns and candles abound. Every home was a massive fire hazard from a modern perspective.

Fast forward in time – coal, heating oils, and natural gas quickly took over roles that fireplaces often held – sources of heat and sources of power to generate electricity to produce light. In essence, we outsourced our light and heat to be generated elsewhere and imported into our home via power lines.

As I’ve said previously and will likely say countless more times, I like to find sources of income from the “essentials” of life. Having a home warm enough to live in is essential. Most of us like to keep it warmer than the bare essential level, and since we can afford it, that isn’t a problem.

I encourage you to turn up the heat. I make money from every cubic foot of natural gas that you use, regardless of the price it is trading hands for.

Let’s explore how I do just that.

Pick #1: EPD – Yield 8%

Enterprise Products Partners L.P. (EPD) is an MLP with over 50,000 miles of NGL, crude oil, natural gas, petrochemicals, and refined products pipelines. EPD has set itself apart from peers as a blue-chip MLP by providing investors with a distribution that has been hiked every year since 1998.

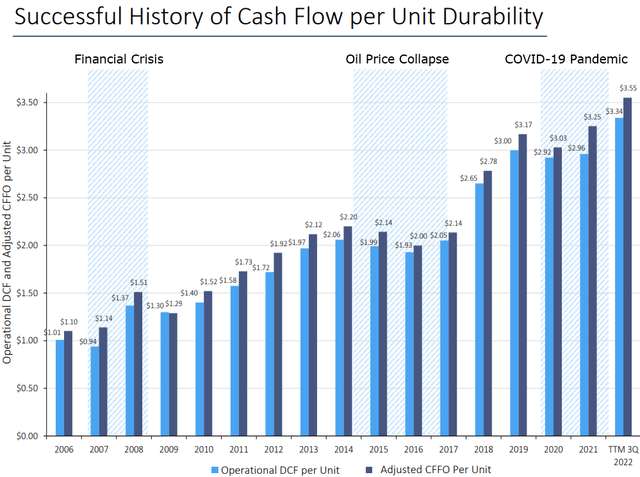

This impressive feat has been achieved despite significant volatility. Energy prices tend to be volatile all the time, but the 2010s was an especially brutal decade. Through the mid-2010s, oil and energy accounted for an elevated number of bankruptcies. Many publicly traded companies filed for bankruptcy, dividends were cut, and shareholders were diluted. This difficulty stemmed from the collapse of commodity prices from 2014-2016, putting significant strain on the sector.

While others were struggling, EPD managed to have durable cash flow. Source.

EPD Investor Presentation – Nov 2022

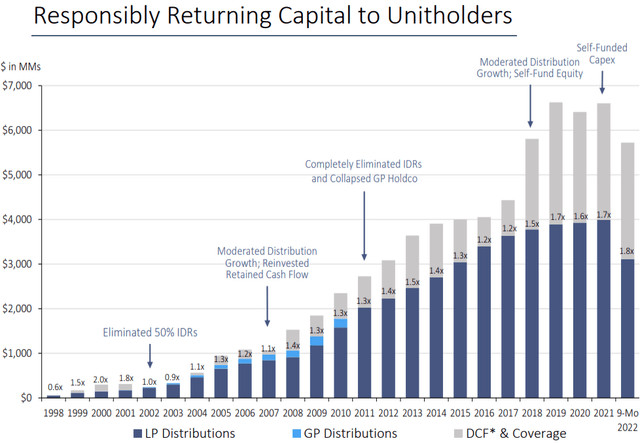

What is the secret to EPD’s success? It has been conservative. EPD has hiked the distribution yearly, but it has grown even faster. It reinvested the excess undistributed cash flow and allowed it to build up. As cash flow after distribution rose, EPD reached the point where it no longer needed to raise capital by issuing equity. Last year, EPD fully self-funded CAPEX without needing debt or equity.

EPD Investor Presentation – Nov 2022

In short, EPD has followed the Income Method. It passed along great income but held back a little for reinvestment and future income growth.

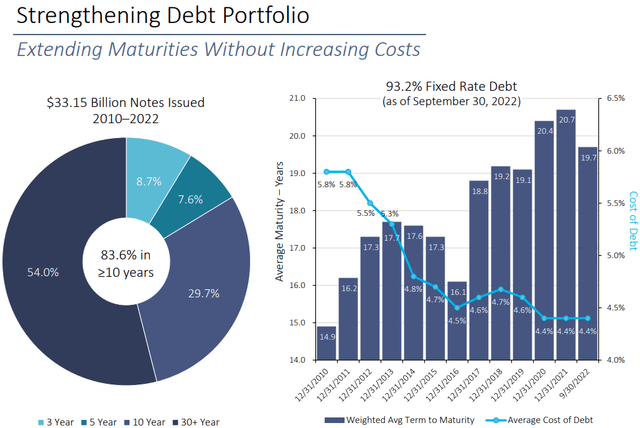

Through the tumult, EPD maintained a strong balance sheet, currently rated BBB+. EPD utilizes very long-term maturities. EPD’s weighted average maturity is nearly 20 years!

EPD Investor Presentation – Nov 2022

With only 8.7% of EPD’s debt maturing in the next three years and material FCF after distributions, rising interest rates are not a big deal for its balance sheet.

EPD has a stable balance sheet, enough cash flow to fully fund all cap-ex without needing new debt or issuing equity, and is covering its distribution by 1.8x DCF, this all adds up to stability and safety. EPD is in a position to navigate any macro-environment, which provides a lot of comfort in a sector that is known for sudden twists and turns.

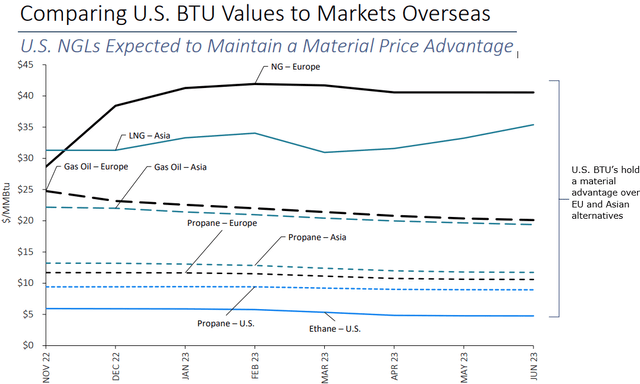

EPD is an MLP we are happy to hold through a crisis, we are even happier to hold it when fundamentals are very strong. Europe is in an energy crisis creating a huge pricing advantage for U.S. NGLs.

EPD Investor Presentation – Nov 2022

COVID was significantly disruptive of the energy markets as reductions in capital expenditures, and the sudden rebound in demand has created imbalances in supply and demand in favor of suppliers.

Perhaps it is because so many were burned by the commodity crash caused in part by the shale rush in the U.S., perhaps it is governments publicly proclaiming a preference for “green” energy, likely it is a combination of several dynamics, but we are not seeing a huge spike in supply. Commodity prices have come down from their recent peaks but remain much higher than they have averaged over the past decade. This is not something that will change quickly. The “commodity supercycle” has started, and prices will remain high for many years.

EPD has been a safe and reliable income investment through the tough times of the 2010s. Now we can enjoy holding it through the boom times for energy!

Note: EPD issues a Schedule K-1 at tax time.

Pick #2: AM – Yield 8.5%

Antero Midstream Corporation (AM) is an MLP that has Antero Resources Corporation (AR) as its sole customer. Having one customer is both a benefit and a risk. The risk is obvious: AM’s future is tied for better or worse to AR’s future. The benefit is that keeping an eye on one customer is much easier.

AR produces natural gas and NGLs and has been benefiting significantly from higher prices. Since Q4 2019, AR has reduced its debt by $2.6 billion and only has $1.17 billion in debt still outstanding. This substantial reduction in debt led to a rating upgrade to Ba1 from Moody’s in May. AR is a substantially lower risk and more conservative business partner for AM today than it was in 2019.

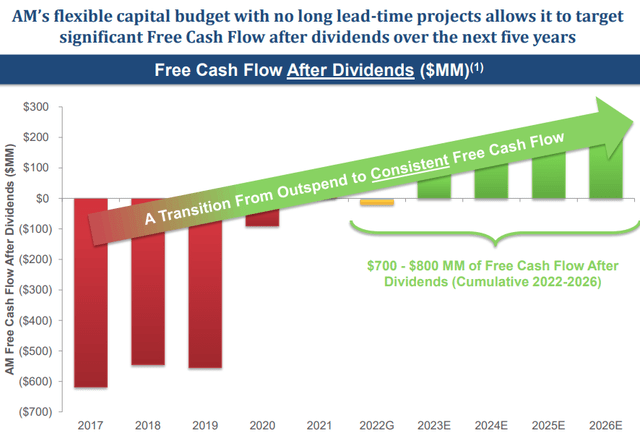

Meanwhile, AM has worked hard to improve its own financial position. Last quarter, AM had $30 million in FCF (free cash flow) after dividends and capital expenditures.

AM had an ambitious goal: To fund all capital expenditures from FCF fully and still have positive FCF after dividends. It is finally achieving that goal in the second half of this year. Source.

Very few MLPs can achieve FCF after dividends and cap-ex, this provides investors with a lot of confidence and stability, knowing that AM doesn’t have to access the capital markets to fund growth.

AM is benefiting from the fiscal discipline of AR and the growing strength of its own balance sheet. With natural gas prices likely to remain elevated for the foreseeable future, we want to maintain exposure to NG. AM is a great option, with the additional side benefit that it is structured as a corporation and sends out a 1099 at tax time. That makes it the perfect choice for investors who want exposure to NG but also want to avoid a K-1.

Conclusion

With AM and EPD, I enjoy exposure to Natural gas demand without having to worry about the variable nature of its price. As more natural gas is used in the United States and globally, the more AM and EPD will be essential to move it from point A to point B.

I am a consumer of natural gas as well. My local utility burns it to generate electricity and it provides heat to various appliances in my home – not to mention my natural gas fireplace.

So when I start a fire in that fireplace, I am reminded of my holdings in AM and EPD. They may have been integral in moving that fuel from the ground to my home, and if not for my home specifically, they are for countless others.

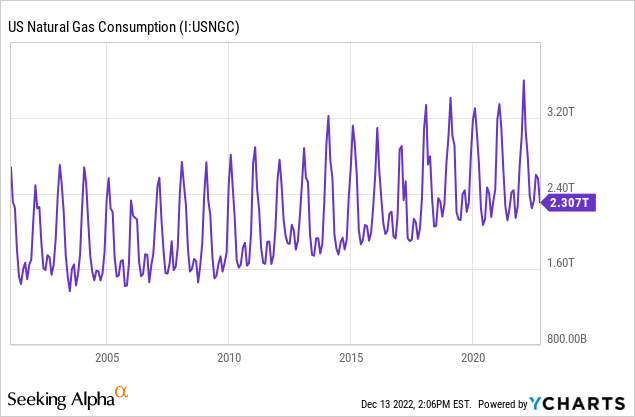

Natural gas usage is not going away, it is actually increasing in demand!

So this winter, I can turn up the heat, or strike a match to light a fire, all while knowing that my holdings in AM and EPD will continue to provide my portfolio with excellent quarterly income. Income that I can use to pay more than just my gas bill.

As the nights are long and days are short in winter, consider getting exposure to natural gas via these income generators and you too will soon find yourself encouraging others to crank up the heat in their homes.

Be the first to comment