John Kevin/iStock Editorial via Getty Images

The policy-induced everything bubble is imploding globally, as it must.

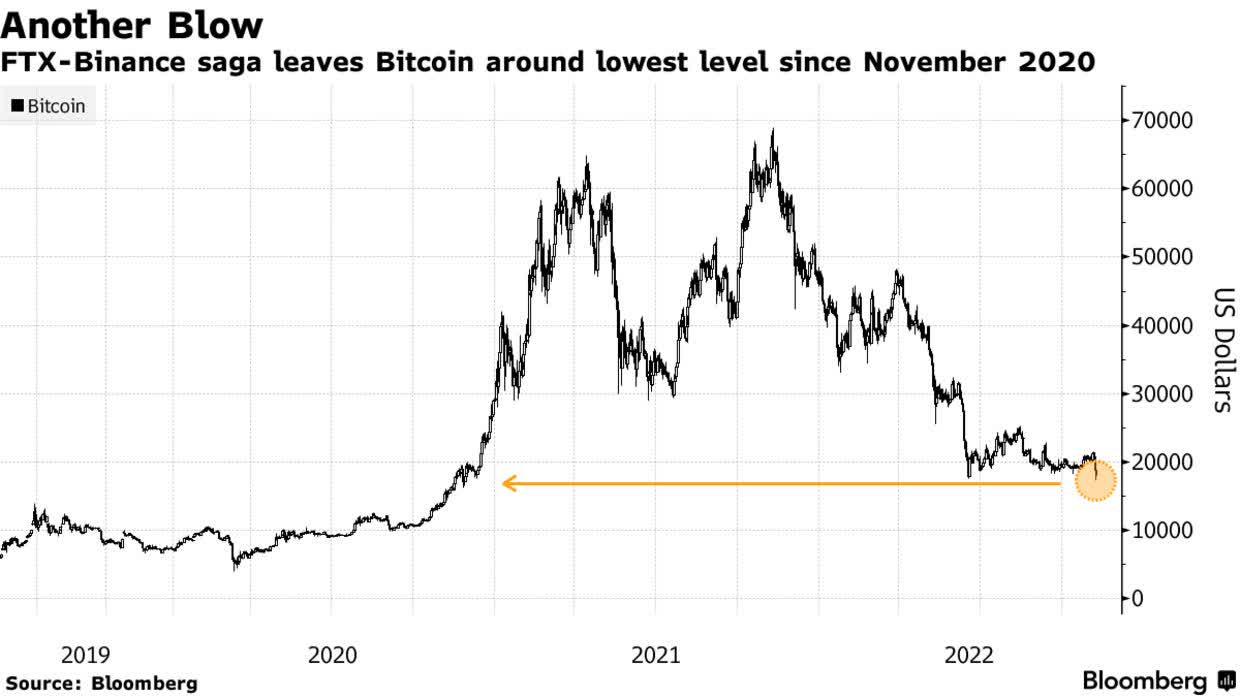

Overnight, we see contagion from highly levered Ponzi schemes in the crypto space as liquidity evaporates and panic justifiably spreads. Many naked emperors will be exposed here. Grandaddy Bitcoin (shown below) has tumbled to the lowest price since November 2020. See. Crypto markets tumble to a 2-year low on FTX contagion concern.

The fact that pension funds have allocated significant member capital to this madness reveals a dereliction of duty and the speculative madness that was. A quote of the day goes to Marc Weinstein of Mechanism Capital Ventures:

“I think if this bear market has proven anything, it’s that the emperor has no clothes. Even seasoned institutional investors can get swept away investing in hot deals at unreasonable valuations in a bull market.”

At the same time, the meltdown in real estate is just getting started. One area of increasing strife and mounting new supply for longer-term rental and sale emanates from the short-term rental sector.

Years of historically low interest rates emboldened many to buy homes for the sole purpose of short-term rentals on Airbnb and other sites. Of the 1.2 million Airbnb (ABNB) listings in the US, 62% have been added since 2020, according to short-term rental analytics firm AirDNA. The number of available Airbnb listings grew to 1.38 million in August 2022, up from about 1.07 million year-over-year, according to AirDNA.This buying pressure helped to drive bubble pricing into 2022. See Business Insider: Airbnb hosts worry about an Airbnb bust.

From March 2020 through March 2022, some 40% of purchases in Canada and the US were bought as second homes for ‘investment,’ occasional use and/or short-term rental.

Meanwhile, problems with inattentive landlords and disruptive tenants have prompted municipalities to increasingly ban or restrict short-term rentals. Next came the year-to-date leap in utility and mortgage rates, with bookings in retreat amid a consumer-led downturn. A perfect shitstorm.

A recent Wealthion discussion illuminates trends unfolding in the US. The setup in Canada is arguably worse.

Disclosure: No positions

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment