MarsBars

Putting together an income portfolio is much like putting together a sports team, with some holdings fulfilling the mundane blocking and tackling by providing a high yield, while high dividend growth names hold long-term strategic importance.

Most investors have heard of the 4% rule when it comes to retirement planning. With many retirees may put their nest egg in the S&P 500 (SPY), fulfilling this rule would require selling a part of their principal every year, especially considering that SPY currently yields just 1.56%.

This simply won’t work for investors who don’t like to sell their holdings. For one thing, the market is unpredictable and it would eat into long-term gains if one were to sell in a down market.

This brings me to Physicians Realty Trust (NYSE:DOC), which by no means is a fast growing REIT. However, at a 6.5% dividend yield, it doesn’t have to be. This article highlights why investors who seek high current income ought to give DOC a look.

Why DOC?

Physicians Realty Trust is a self-managed REIT that’s primarily focused on acquiring and developing medical office buildings leased to physicians, hospitals, and healthcare systems. It derives 97% of its cash NOI from MOBs, and at present, owns a portfolio of 290 properties that are 95% leased.

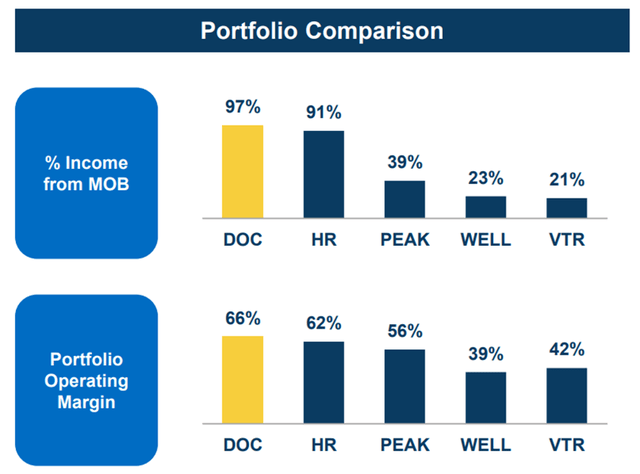

Medical office buildings are arguably the highest quality asset class in healthcare, and didn’t see the negative effects on the magnitude that senior housing assets saw in 2020. Notably, DOC has portfolio concentration in MOBs compared to peers and its properties enjoy some of the highest margins, as shown below. DOC’s portfolio quality is driven by its high percentage of properties that are on-campus or affiliated with health systems, which stands at 89%.

DOC Portfolio Comparison (Investor Presentation)

Meanwhile, DOC reported third quarter revenue growth of 14% YoY to $131.5 million, and its MOBs saw same-store cash net operating income growth of 1.1% YoY. DOC has also been active in portfolio recycling, completing $102 million of investments, including the funding of previous construction loan commitments, while disposing of $116 million worth of 3 properties in Great Falls Montana, realizing a net gain on sale of $54 million.

Plus, DOC maintains a strong BBB rated balance sheet with a net debt to EBITDA ratio of 5.6x and no material debt refinancing until 2025. DOC’s dividend is also well-covered by an 88% payout ratio, based on Q3 FFO per share of $0.26.

Also encouraging, DOC is seeing stronger than historical average leasing spreads of 6.2% during Q3, on the back of impressive 8% leasing spreads in the second quarter. This, combined with annual rent escalators could drive bottom line growth down the line, and these attributes were noted during the recent conference call:

The consecutive quarters of strong releasing spreads above the historical 2% to 3% is a direct result of the mission critical nature of our assets and the enhanced value of our portfolio during a rapidly rising replacement costs. Importantly, we’ve achieved these results without sacrificing retention, without excessive concessions, and not discounting annual rent escalators. In total, tenant improvement and incentive packages totaled to $0.61 per square foot per year on renewals, while we achieved an 81% retention rate and a 3.1% average annual rent escalator across our 251,000 square feet of leasing activity in the consolidated portfolio during the quarter.

My biggest complaint around DOC is the lack of FFO per share growth over the years. This is due in part to the competitive asset class in which DOC invests, resulting in low cap rates. This, combined with an insufficiently high share price leads to marginally accretive equity raises, which is combined with debt to purchase properties at low cap rates (compared to other healthcare asset types).

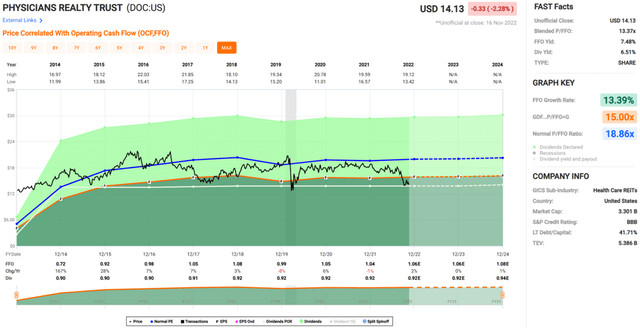

However, recent trends in strong lease spreads could change that picture, and the stock is attractive priced at $14.17 with a blended P/FFO of 13.4, sitting well below its normal P/FFO of 18.9. Investors, meanwhile, get paid a handsome and well-covered 6.5% dividend yield that’s backed by a strong balance sheet and some of the strongest assets in the healthcare segment.

DOC Valuation (FAST Graphs)

Investor Takeaway

Physicians Realty Trust is a safe and attractive play in the healthcare space, with one of the highest quality portfolios in the sector. It has proven resilient to pandemic related headwinds, and its properties have enjoyed rising lease spreads well above historical averages.

Investors also get rewarded handsomely with a 6.5% dividend yield that’s well-covered by FFO. As such, those looking to fulfill their 4% drawdown rate from a safe play in the healthcare segment with a high dividend yield ought to give DOC a hard look.

Be the first to comment