Dilok Klaisataporn

LyondellBasell Industries N.V. (NYSE:LYB) is a chemical company that also refines crude oil into gasoline and distillates. At High Yield Investor, we have already had one successful iteration of buying and selling the stock. As we wrote back on May 20th:

…the stock has generated tremendous returns since we bought it, even as the broader market (SPY) has sold off over that span. As a result, LYB now trades near our fair value estimate. It offers a decent, but unimpressive, 4% dividend yield, even as other high-yielding opportunities are looking more attractive than ever. We, therefore, decided to sell our LYB shares at a price of $111.43 to lock in very strong 30% total returns in less than half a year (77.76% annualized total returns). We recycled the capital elsewhere into opportunities trading at deep discounts to our fair value estimate and offering yields well in excess of LYB’s 4%.

Shortly after, LYB pulled back sharply, and we decided to buy back in. Our thesis was that it is a leader in its industry that generates cash flow from a diverse range of sources, it has a freshly deleveraged investment grade balance sheet, a significant cash flow yield, and a commitment to paying an attractive and growing dividend to shareholders alongside opportunistic share buybacks.

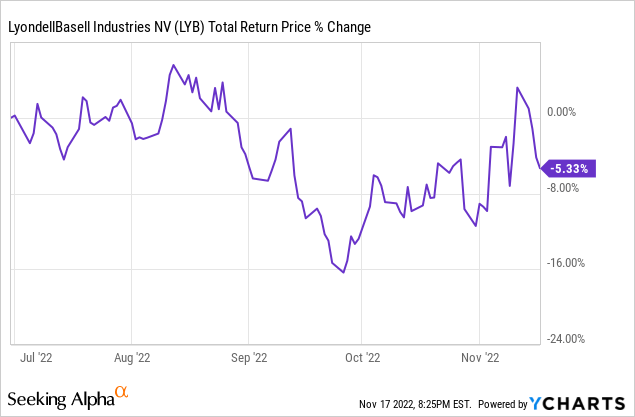

Since buying back in, the stock has declined some, but remains roughly in the same range of when we bought it:

However, the business itself has run into stiff headwinds. As management highlighted on its latest earnings call:

During the third quarter, as you would expect, our team remains very focused on cash generation while navigating the well-known, very challenging environment. LyondellBasell’s business portfolio faced headwinds from rising costs and weaker demand at the same time…

Our results reflect margin compression across all segments due to rising costs and weaker global demand. Our olefins and polyolefins businesses faced persistently high and volatile energy cost, coupled with lower demand, particularly in Europe and China. While our oxyfuel business and refining segment continue to earn margins above historical averages and demand for fuels remained strong, results were sequentially lower following peak margins in the second quarter of 2022.

Higher cost for energy, raw materials, labor and transportation negatively impacted our Advanced Polymer Solutions segment. Across our European assets, September year-to-date energy costs are $1.8 billion higher than the same period in 2020. During the quarter, we recognized $84 million in cost related to the exit from our refining business. We expect to incur a similar amount for refining exit costs during each of the next five quarters.

While the headwinds are real – prompting us to reduce our fair value estimate for the stock – we remain bullish on LYB for three big reasons.

#1. Well-Positioned For Recession

While it is true that LYB is suffering from a combination of reduced demand and increased costs, the company is still in pretty good shape for weathering a recession.

First and foremost, its balance sheet is in excellent condition. Thanks to a strong focus on deleveraging in recent years, its debt maturity calendar is well-laddered, and the company recently received a credit rating upgrade to BBB (with a stable outlook) from S&P. On top of that, it has $1.5 billion in cash and short-term investments and $5.3 billion in total liquidity, giving it plenty of flexibility to respond opportunistically to market dislocations while also weathering particularly challenging periods.

On top of that, despite the serious headwinds, the company remains very profitable, and declines are expected to begin decelerating moving forward. On the Q3 earnings call, management reported the following:

Earnings were $1.96 per share. EBITDA was $1.2 billion…we delivered an impressive $1.4 billion of cash from operating activities…we are seeing some relief in both feedstocks and energy costs. And I would say, broadly, it feels like we’re kind of finding maybe a bottom.

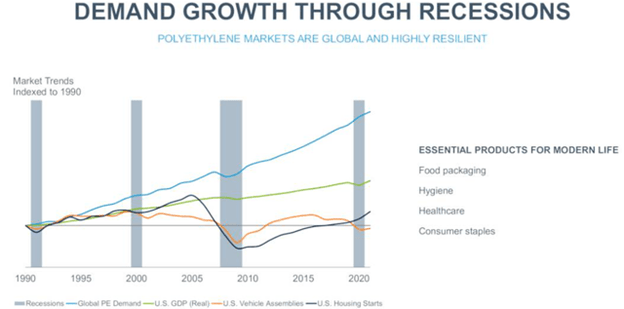

Even as the economy increasingly appears headed for a recession, LYB feels confident that its business should weather challenges better than others, as Polyethylene demand has proven to be more recession resistant than what is experienced for many other sectors that are generally considered to be more defensive:

Polyethylene Demand (LyondellBasell)

#2. Strong Long-Term Growth Potential

In addition, LYB’s long-term growth outlook remains intact. One of the reasons for this is simply that the company is able to deploy capital at high rates of return. As management stated on the earnings call:

Despite significant headwinds our company generated a 19% return on invested capital over the past 12 months.

On top of that, LYB is keenly focused on improving operating efficiencies. As management laid out during the Q3 earnings call:

LyondellBasell has a well-earned reputation as a cost leader in our industry. But after 12 years with a singular focus on managing costs, a significant number of untapped value opportunities have accumulated. We believe this untapped value can be unlocked with modest incremental investments in resources. Our value enhancement program utilizes a proven stage gate methodology to identify, implement and track progress on hundreds of initiatives across the company.

Over 2,000 IDs have been generated, and we have validated more than 1,500 initiatives to date. But we’re just getting started. We organized value opportunities into three categories: manufacturing and operational excellence, procurement and supply chain and commercial excellence. We have confidence that our value enhancement program is capable of achieving an estimated $750 million of annual recurring EBITDA improvement by the end of 2025.

If successful, this effort should drive 11.3% accretion by itself relative to 2022’s expected EBITDA generation within just three years. This growth will be on top of general economic growth, any additional acquisitions or organic growth investments, and of course share repurchases.

#3. Very Attractive Value Proposition

Last, but not least, we remain very bullish on LYB due to the attractive value proposition in the current share price along with what management describes as a “secure steadily growing dividend” that currently offers a 5.8% forward dividend yield, which is well above the historical average of 4.3%.

The trailing twelve-month P/E ratio is 6.4x, well below the ten-year average of 10.5x, as is the TTM EV/EBITDA ratio of 5.3x compared to the ten-year average of 7.3x. The forward price to free cash flow ratio is also very attractive at 10.5x, compared to the ten-year average of 14.0x.

Analysts expect the dividend to grow at a ~5.5% CAGR through 2026, which combines with the current 5.8% dividend yield and considerable multiple expansion potential to offer investors a mid-teen total return CAGR moving forward. When combined with the relatively low long-term downside risk given the strong balance sheet and business model, LYB’s risk-reward is very attractive at the moment.

Investor Takeaway

LYB is definitely facing some pretty stiff headwinds right now. However, its balance sheet remains rock solid, and its dividend is well-covered by cash flows. Long-term, the company continues to have a promising dividend growth outlook and its valuation combined with its current yield imply that the total return profile is very promising.

While it is hard to know exactly when the stock will begin moving higher given that the macroeconomic environment remains very uncertain, it seems highly likely that LYB will deliver market-crushing total returns over the long-term. We remain bullish and long alongside other attractive high yield opportunities in our International Portfolio as a result and will continue to provide regular in-depth coverage of the stock at High Yield Investor.

Be the first to comment