ryasick

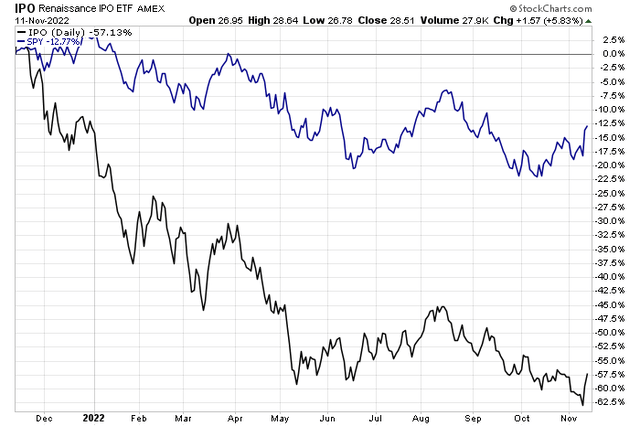

IPOs and leveraged credit are sketchy parts of the investable universe today. One fund has bucked the bearish trend, though. Is now a good time to add big yield to your portfolio? Let’s dive into one new closed-end fund that could be worth an allocation.

IPOs Weak Year-on-Year

According to Bank of America Global Research, NYSE:BXSL which commenced investing in 2018, is a specialty finance company, regulated as a BDC under the Investment Company Act of 1940, as amended, that invests in debt and equity of middle market commercial enterprises. BXSL’s objective is to generate current income with the potential for capital appreciation for distribution to shareholders as dividends. The company principally underwrites floating rate credit structures at the upper end of the capital structure. BXSL reported a strong earnings report last Thursday.

The New York-based $3.8 billion market cap Capital Markets industry stock within the Financials sector trades at a low 9.4 trailing 12-month price-to-earnings ratio and pays a 9.1% dividend yield, according to The Wall Street Journal. The closed-end fund features a 10.0% annual total net return since inception, according to the fund website and is 97.9% invested in first-lien senior secured notes. The total fund net asset value is $9.7 billion at the current fair market value estimate.

The fund company has upside potential from its strong origination platform and a portfolio generally oriented towards late-cycle activities. A reasonable fee structure is also aligned with shareholder interests, but its limited history still warrants some trepidation and uncertainty looking ahead. It remains to be seen how the fund performs should the economy worsen.

Looking back, BXSL paid two dividends in Q3: a core dividend of $0.60 and a special dividend of $0.20 versus a total payout of $0.73 in the previous quarter. There’s the potential for larger dividends this quarter. The current portfolio yield is near 9% and the board of directors approved a $262 million stock buyback plan which has been completed. More repurchase plans are expected, too.

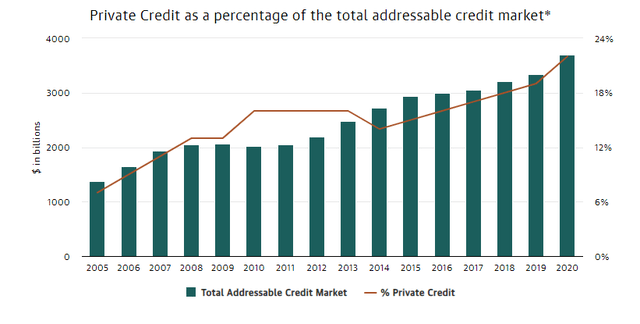

BSXL won both the 2021 Private Debt Investor BDC Manager of the Year, Americas award and the Global Fund Manager of the Year award as demand for private credit continues to grow. Blackstone reports that private credit as a percentage of the total addressable credit market is now up to 22% as of the end of 2020 at nearly $3.7 trillion. The fund aims to enhance revenue, optimize costs, and leverage its managers’ expertise in niches such as cybersecurity, ESG, and healthcare.

A Growing Global Private Credit Market

Blackstone Secured Lending Fund

The portfolio composition is diversified, which I like to see in this market environment. BXSL reports that the makeup of the fund is 15% in Software, but also significantly weighted in other defensive areas of the private credit market. As a result, its NAV has steadied in recent months while other tech-heavy funds have faltered. With liquidity of $1.1 billion, above the level from Q2, and no maturity waterfall until the middle of next year, the funding mix is conservative right now which I like to see amid tight financial conditions.

BXSL Portfolio Exposure

Blackstone Secured Lending Fund

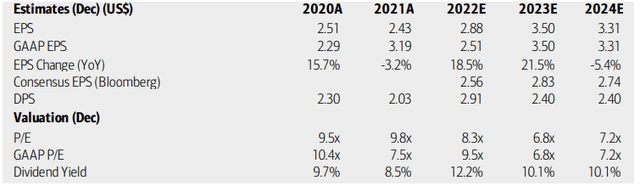

On valuation, analysts at BofA see the fund’s earnings growing sharply this year and next before turning down in 2024. Dividends might be extraordinary this year, though. Still, positive operating earnings and share buybacks should keep BXSL’s operating and GAAP P/Es at low levels while its yield remains high based on its portfolio. Overall, I like the valuation with its moderate-risk-level portfolio. The fund also generally benefits from rising and/or high interest rates.

BXSL: Earnings, Valuation, Dividend Yield Forecasts

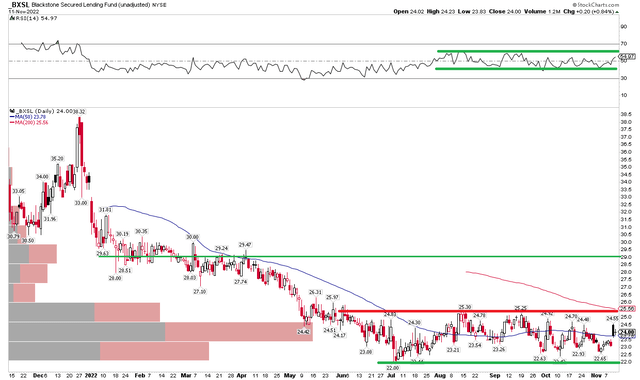

The Technical Take

Many investors might solely focus on BXSL’s portfolio and yield, but it’s also critical to pay attention to price action to identify key trends so as not to get caught on the wrong side of key moves. I see a trading range right now along with consolidation in the RSI momentum indicator.

Should shares breakout above about $25.50, I see upside potential to near $29 based on a measured move price target triggered bits its $3.50 range. Also, be sure to watch for a breakout or breakdown in the RSI as a possible harbinger of future price action. Overall, I would like to see this stabilization in BXSL but would prefer a breakout to take place before getting aggressively long.

BXSL: Shares Finding Support, Eyeing a Breakout

The Bottom Line

I like BXSL’s high yield and portfolio mix right now. The chart, while not as bullish as the fundamental case, looks decent with upside potential. Long-term investors can own this one while swing traders have key price levels to monitor.

Be the first to comment