AntonioGuillem/iStock via Getty Images

Introduction

Altice USA, Inc. (NYSE:ATUS) stock has bounced back 17% in the last two days (November 10-11), after losing 29% on the day of its Q3 2022 results (November 2) two weeks ago. We see the rebound as the result of the broader rally after positive U.S. inflation data, with ATUS stock moving much more than the market because of its highly levered nature.

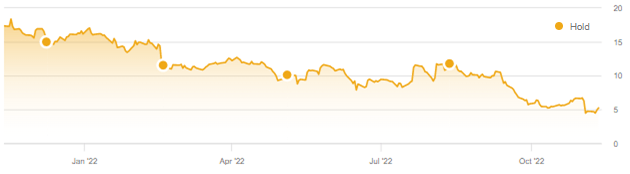

ATUS stock has lost 71% since we downgraded our rating to Hold one year ago, halving again since our most recent update after Q2 results in August. We were right to urge investors to avoid the stock:

|

Librarian Capital ATUS Rating vs. Share Price (Last 1 Year)  Source: Seeking Alpha (12-Nov-22). |

Q3 results showed ATUS’s operational performance has not improved. Revenues fell 4.3% and EBITDA fell 12.7% year-on-year. Broadband subscriber losses were worse than in Q2, with higher churn explicitly blamed on Telco competition, in contrast to its larger peers Charter (CHTR) and Comcast (CMCSA). Fiber passings are being added at an accelerated pace, but penetration remains poor. The new CEO has so far not indicated any change in strategy. Free Cash Flow has fallen by two thirds year-to-date, and Net Debt / EBITDA has risen to 6.0x. Net debt stood at $24.0bn while market capitalization was just $2.37bn. There was no update on the Suddenlink sale process.

ATUS looks superficially cheap but is too high-risk and speculative. We reiterate our Hold rating. Avoid.

Altice USA Downgrade Recap

Our downgrade was based on concerns around the fundamentals in ATUS’ business:

- Competition in ATUS markets is already intensifying

- ATUS’ offering may be fundamentally uncompetitive

- EBITDA and FCF will likely decline

- Management’s turnaround initiatives may not be successful

We believe these problems are specific to ATUS, owing to poor management, including past excessive cost cuts and bad strategic choices. In particular, we believe ATUS’ singular focus on fiber is misguided, because speed is only one of the areas on which broadband providers compete; we prefer the strategy at Charter and Comcast, where they also target related offerings such as hardware and mobile, and softer factors such as service quality and automation.

ATUS has been in a turnaround since last September, after the abrupt exit of its COO and a warning of further broadband subscriber losses. Management’s strategy to improve performance has been to accelerate its Fiber-To-The-Home (“FTTH”) roll-out, relaunch its Mobile offering and rebuild its retail outlets and door-to-door salesforce. A sale process for its Suddenlink business was reported in the press in July and later confirmed by management. A new CEO has been hired from Comcast and took up his role in October.

At the UBS conference in December 2021, then CEO and now executive chairman Dexter Goei had expected a low-single-digit decline in revenues and a mid-single-digit decline in EBITDA in 2022, but results have so far been worse.

Q3 results showed ATUS’s operational performance has not improved.

Altice USA Q3 Results Headlines

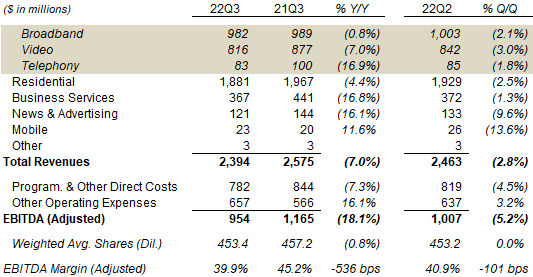

In Q3 2022, as reported, ATUS revenues fell 7.0% and EBITDA fell 18.1% on a year-on-year basis, and fell 2.8% and 5.2% respectively on a sequential basis:

|

ATUS P&L Headlines (Q3 2022 vs. Prior Periods)  Source: ATUS results release (Q3 2022). |

Reported figures include termination fees on the Air Strand contract in Business Services in the prior year. These totalled approximately $75m in Q3 2021 and $120m in the full year. Excluding Air Strand, revenues fell 4.3% and EBITDA fell 12.7% on a year-on-year basis (while sequential decline rates were the same).

ATUS’s revenue performance in Q3 was disappointing across the board. Broadband revenues fell 0.8% year-on-year (discussed further below), while Video and Telephony revenues continued their larger, structural declines. Business Services revenues were flat excluding Air Strand. News & Advertising revenues were down 16.1% year-on-year, despite an election year this year, which management attributed to some political campaigns being weighted more to Q4, “a couple of” large non-political campaigns in the prior-year quarter, and macro-driven ad market weakness. Mobile revenues grew 11.6% year-on-year, compared to 31% at Comcast and 40% at Charter; management indicated they had “discontinued some of our service promotions” in Q3.

Year-to-date, as reported, ATUS revenues fell 3.8% and EBITDA fell 11.7% on a year-on-year basis; excluding Air Strand ($84m of revenues, assumed to be 100%-margin) in the prior-year, revenues fell 2.8% and EBITDA fell 9.4%:

|

ATUS P&L Headlines (Q3 YTD 2022 vs. Prior Periods)  Source: ATUS results release (Q3 2022). |

ATUS’ also had disappointing broadband customer numbers.

Altice USA Broadband Losses Continuing

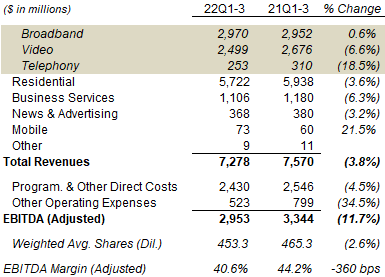

ATUS lost 43k of broadband subscribers in Q3, worse than Q2’s 40k loss:

|

ATUS Customer Numbers (Q3 2022 vs. Prior Periods)  Source: ATUS results release (Q3 2022). |

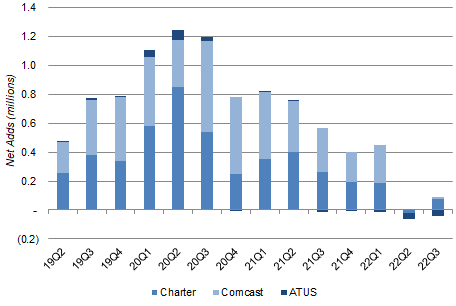

ATUS’ sequentially worse broadband net loss was in contrast to Charter and Comcast, which both saw Q3 rebounds from Q2 net losses (that were attributed to seasonality, specifically college students exiting for the summer):

|

Broadband Net Adds –ATUS vs. Charter & Comcast (Since Q2 2019)  Source: Company filings. |

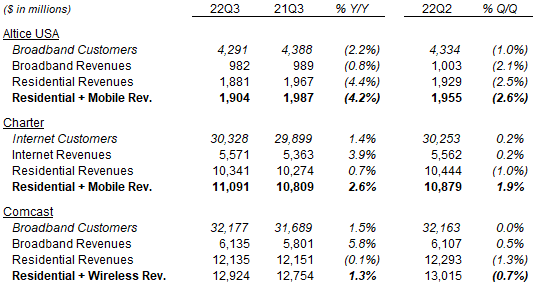

ATUS’ revenue declines were also in contrast to Charter and Comcast, both of which grew Broadband revenues year-on-year and sequentially in Q3. The implied year-on-year growth in broadband Average Revenue Per User at ATUS was just 1.5%, compared to 2.4% at Charter and 4.2% at Comcast:

|

Cable Residential Broadband & Mobile Growth (Q3 2022 vs. Prior Periods)  Source: Company filings. NB. Figures include SMBs. Mobile revenues include device sales. Charter lost 59k Internet customers in Q2 2022 in a transition between federal subsidy programs. |

In addition, whereas Charter and Comcast attributed their lower recent growth primarily to lower gross adds market-wide and described their broadband subscriber churn as remaining at historically low levels, ATUS acknowledged it was suffering from higher churn and explicitly blamed this on Telco competition. As current chairman and former CEO Dexter Goei explained on the Q3 earnings call:

“While we typically see seasonal return to school benefits in Q3 when comparing to Q2, we’re still experiencing higher competition in parts of our footprint … We’re seeing effects from FWA (Fixed Wireless Access) that’s been out there, fiber over-builders primarily in the West, but we do obviously have Frontier (FYBR) who’s grown in the East in a small part of our footprint in Connecticut …

On the East side we have lower gross out activity and, on the West side, higher churn activity than we have seen historically …

We’re seeing higher churn activity primarily in markets where we’re seeing increased competition on fiber side, on fiber overbuilders, whether that be AT&T (T) or some of the smaller players out there”

Goei also confirmed that ATUS has lost subscribers in both the East and West on a year-to-date basis.

The figures and comments quoted above support our view that many of ATUS’ problems are specific to the company and the result of past management decisions.

Fiber Roll-Out Accelerating But Not Helping

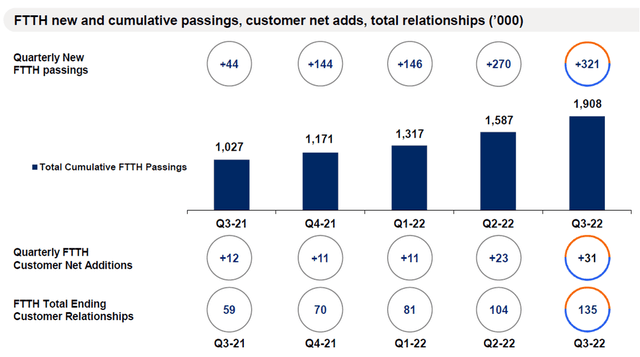

Fiber passings are being added at an accelerated pace, but penetration remained poor.

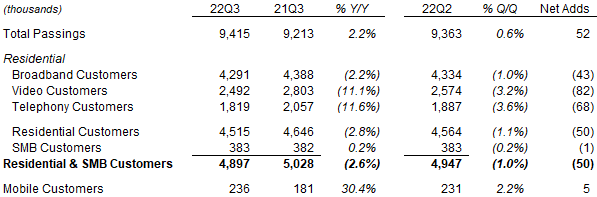

ATUS added 321k Fiber-To-The-Home (“FTTH”) passings in Q3, a new record, taking total FTTH passings to 1.91m (out of total passings of 9.42m). However, FTTH subscriber net adds were just 31k, and total FTTH customers only reached 135k, or 7% of FTTH passings:

|

ATUS Fiber Passings, Penetration & Customer Count (Last 5 Quarters)  Source: ATUS results presentation (Q3 2022). |

Our view is that speed is just one of several areas on which customer choose their broadband products, and ATUS customer statistics support this view. 42% of ATUS customers remain at speeds of 200 Mbps or lower, likely by choice because 1 Gbps speeds have been available on 92% of ATUS’ footprint (including 100% of its Optimum footprint) since Q3 2020; the penetration of 1 Gbps products was just 19%. And, as one analyst pointed out on the call, ATUS was losing customers to Fixed Wireless products which were materially slower than even ATUS’ non-fiber broadband.

We view ATUS’ accelerating fiber roll-out as at best irrelevant, and potentially damaging given some of the installation and service quality issues previously described, as well as its impact on ATUS’ cashflows and balance sheet.

ATUS’ Free Cash Flow Has Collapsed

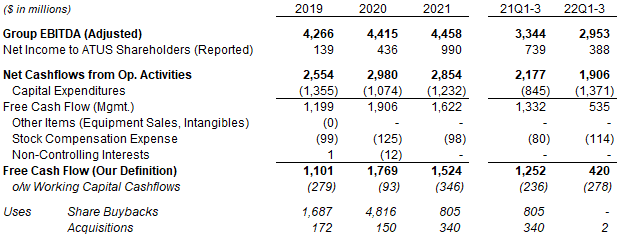

ATUS’ Free Cash Flow (“FCF”) has fallen by 60% year-to-date, to just $535m (on management definition); on our definition, which also subtracts share-based compensation costs, year-to-date FCF is down 66% to just $420m:

|

ATUS EBITDA & Cashflows (Since 2019)  Source: ATUS company filings. |

Q3 FCF as defined by management was just $136m, annualizing to $544m.

Of the $832m decline in year-to-date FCF (on our definition), $526m was due to higher Capital Expenditures, $271m was due to lower operating cashflows (primarily from lower profits), and $34m was due to share-based compensation. Year-to-date FTTH CapEx was $483m, compared to $124m in Q1-3 2021, having been accelerated in Q2.

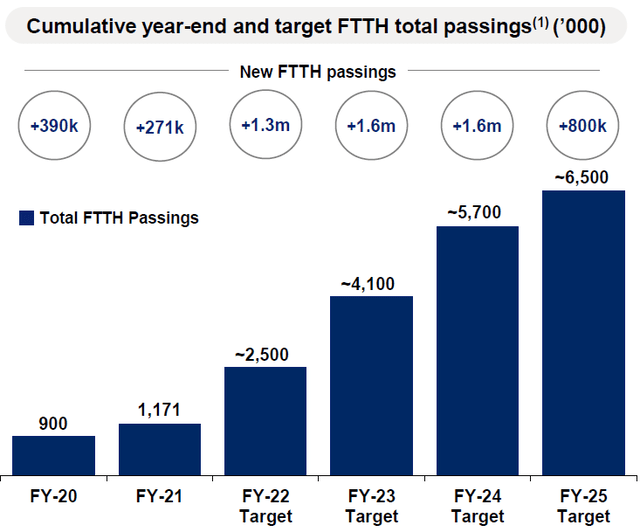

Management continues to guide to $1.7-1.8bn of cash CapEx in 2022, approximately $0.5bn higher than in 2021. CapEx should eventually fall back after the current FTTH initiative has been completed, but this is not expected until “after a couple of years”. (ATUS targets approximately 6.5m of FTTH passings by 2025 year-end.)

|

ATUS FTTH Passings (Target vs. History)  Source: ATUS results presentation (Q3 2022). |

We believe ATUS’ FTTH strategy is misguided but do not expect major changes. New CEO Dennis Mathew, asked by an analyst for his opinion given his experience at Comcast with a non-fiber approach, indicated more of the same:

“I’m really a big believer that fiber is the best technology that exists today. So that’s a hallmark of the Altice strategy that I’m actually very optimistic about. And as I look ahead, I think we need to focus on disciplined execution and customer experience”

ATUS Net Debt Now At 6x EBITDA

ATUS’ Net Debt / EBITDA has risen to 6.0x, a potentially unsustainable level.

Consolidated Net Debt was $24.0bn at Q4 2022, down $62m sequentially and $597m year-on-year. ATUS has suspended buybacks after Q3 2021 and now uses all FCF to pay down debt. However, with FCF at a $0.5bn run-rate, this would only reduce Net Debt by about 2% annually unless EBITDA starts growing again.

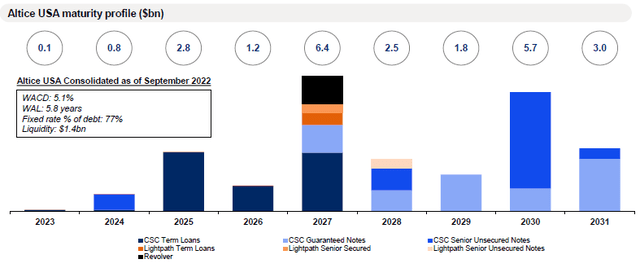

Refinancing may become a risk in either 2024 or 2025. Only $0.1bn of debt is maturing in 2023, but $0.8bn will mature in 2024 and $2.8bn in 2025, more than ATUS’ current FCF. Refinancing may be expensive (compared to current weighted average cost of debt of only 5.1%), given ATUS’ higher risk and higher market interest rates, and the effects will be felt relatively quickly as the average life of current ATUS debt is only 5.8 years:

|

ATUS Debt Maturity Profile (2023-31)  Source: ATUS results presentation (Q3 2022). |

Compared to the $24.0bn Net debt, ATUS’ market capitalization is just $2.37bn.

No Update on Suddenlink Sale Process

Management declined to comment on the sale process for its Suddenlink process, ongoing since at least July, except confirming (as we predicted in our past article) that a partial sale is being actively considered:

“We had some inquiries along pieces of it as opposed to the whole thing across multiple players. And so we were being responsive that way to a piecemeal versus a whole company solution.”

ATUS may need cash proceeds from disposals to pay down its debt. A partial sale would raise less than a complete sale, and would be negative from that perspective. In addition, both AT&T and T-Mobile (TMUS) have reportedly hired investment bankers to explore raising external capital to fund construction of fiber broadband networks, which could reduce investor appetite for ATUS’ assets.

A sale on Suddenlink is far from certain, and may not produce the benefits that some investors hope for.

ATUS is Too Speculative

ATUS shares may seem superficially attractive given its valuation. With shares at $5.22, the market capitalization is just $2.37bn, seemingly offering a 20%+ FCF Yield compared to run-rate Free Cash Flow of about $0.5bn.

However, with Net Debt at $24.0bn and 6.0x last-twelve-month EBITDA, the equity value can fluctuate wildly even with small changes in operational performance. Because less than 10% of ATUS’ Enterprise Value is in its equity, a hypothetical 5% EBITDA decline would, assuming EV / EBITDA remains unchanged, wipe out more than half of the value of the equity. ATUS shares falling 29% after Q3 2022 results on November 2 was an example of this dynamic.

Against this, we have no great confidence that ATUS operations will improve or even stabilize. ATUS’ position is much weaker than that of Charter and Comcast, and we believe it is still paying for past management errors. Broadband subscriber losses are continuing, Telco competitors are taking share, and the FTTH roll-out is not helping.

We reiterate our Hold rating on Altice USA stock. Avoid.

Be the first to comment