LordRunar/iStock via Getty Images

Co-produced with Treading Softly

It’s been famously said that everyone worships something. Whether that be in a spiritual sense, some form of deity, or something tangible. Some like to worship at the feet of the “almighty dollar.”

In ancient Greece, they openly worshiped a pantheon of gods. All of them had skills and powers different from one another and focused on specific aspects of daily life or the economy as a whole.

Apollo was the god of the sun, his job is pretty self-explanatory.

Ares was the god of war, again it seems pretty straightforward.

Recently, we got to see the earning releases of two very popular companies for income investors – we buy for income and ride out price movements as they come and go. These firms carry Greek god names while providing us with a great stream of income.

So, I am buying the Greek gods of income to bring their unique skills and abilities to my portfolio. In the end, they’ll enable me to keep getting excellent income month after month.

Let’s climb Mount Olympus together.

Pick #1: ARCC – Yield 10%

Ares Capital Corp. (ARCC) reported a very strong quarter and telegraphed that they expect these returns to continue with a hefty 11.6% dividend increase to $0.48/quarter. The market is surprised, but it really shouldn’t be. ARCC borrows at fixed rates and lends at floating rates. If there is a better business model in a rising-rate environment, we can’t think of one.

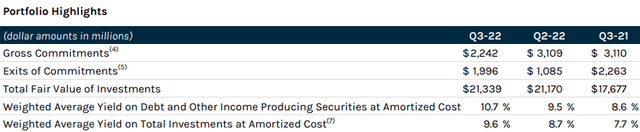

You can see how ARCC’s yield on investments has risen over the past year. From 7.7% to 9.6%. (Source: ARCC Q3 Presentation.)

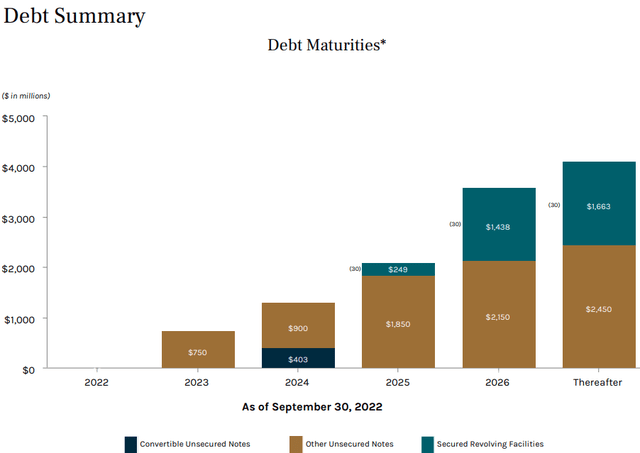

Meanwhile, their debt is fixed-rate, and they don’t have much maturing for several years.

This provides a very long runway where rising interest rates contribute directly to the bottom line. We saw that in Q3 earnings, and we’ll see more in Q4 as interest rates continue to rise.

The risk for ARCC is “credit” risk. Lending money at high rates is great, but it doesn’t mean much if the borrowers can’t pay. Many in the market have probably assumed that with the economy slowing, default risk would be increasing.

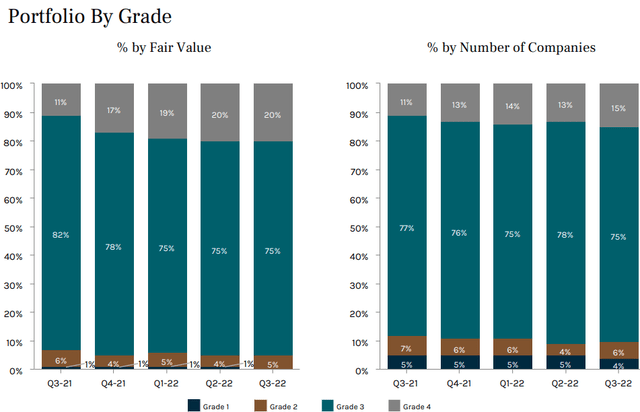

ARCC grades their portfolio on a 1-4 scale. 1 being the worst, meaning they do not expect to recover the full principal, and 4, meaning that the borrower is outperforming the expectations and assumptions made in underwriting. All loans start at a “3,” meaning that the company is performing within expectations.

Note that ARCC’s credit quality improved over the quarter, with Grade 4 growing while Grades 1 & 2 remained about the same. This likely surprises a lot of people. However, we need to keep in mind that inflation might decrease the buying power of earnings, but it makes paying down debt easier. GDP was negative in Q2 after adjusting for inflation. Before adjusting for inflation, growth was high.

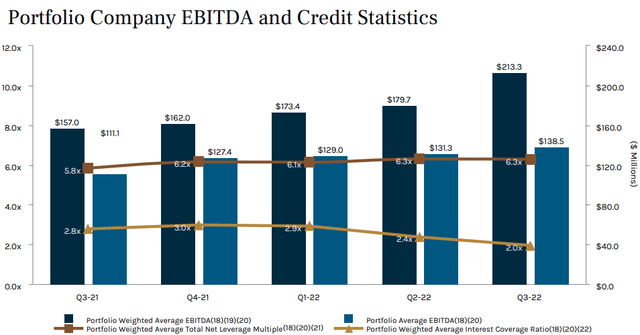

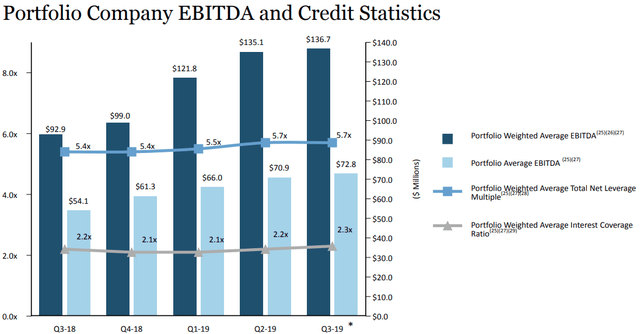

In general, companies are seeing higher revenues and higher EBITDA in gross amounts. This makes it easier for them to repay their debt. We can see this happening in ARCC’s portfolio. EBITDA is rising.

Interest coverage has declined to 2.0x. which looks low compared to where it was last year but is actually close to average for ARCC’s history. Here is a look at the same slide from Q3 2019.

Our thesis with ARCC and other debt investments has been that companies are relatively well-prepared for difficult times. Balance sheets are stronger than average thanks to the defensive moves during COVID, and many borrowers focused on refinancing fixed-rate debt at historically-low interest rates. Therefore, even as interest rates rise and the economy slows, default rates will remain low relative to historical experience.

This thesis is playing out with ARCC and other credit-sensitive investments. Their prices have been beaten up over market fears, and they are an excellent opportunity to get high yields. Prices are down, but dividends are rising!

Pick #2: ARI – Yield 12.4%

Apollo Commercial Real Estate Finance, Inc. (ARI) stunned the market. What did they do? Well, exactly what management said would happen. They said that rising rates would be good for their earnings. They guided that they would not cover the dividend in the first half but would in the second half.

Never be surprised by what the market is surprised at. ARI reported what objectively is an “ok” earnings report. They had $0.37 in distributable earnings, covering their $0.35 dividend by 106%. That’s good. It isn’t great. It certainly isn’t a number that has you thinking a dividend hike is imminent.

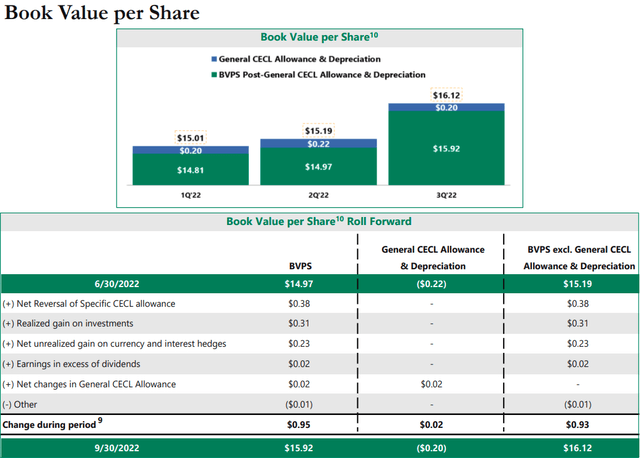

Book value climbed up for the quarter as ARI realized a gain on a previously impaired investment from which they received the deed in lieu of foreclosure and then sold. ARI also reversed a CECL (current expected credit loss) allowance as a property that was in default entered into a sale contract. This is an example of why commercial mortgages are attractive. Even when a borrower defaults, there is value in the real estate that ARI can extract. With an average loan to value of 60%, the value of the property can decline a lot and ARI can still get full recovery.

So why is ARI up nearly 20% today? The price was ridiculously low to start with. We’ve discussed this before, about how the market is irrational, and it is like your crazy neighbors shouting random numbers at you to buy your house. In the short run, the market is a voting machine, and the only requirement to vote is having money in a brokerage account. In the long run, it is a weighing machine. Earnings matter.

At HDO, we constantly preach about filtering out the noise of the voters. Focus on the fundamentals. Is the business making more money? Is the dividend safe? Is it getting safer?

Well, ARI told us today that the business is making more money, that the dividend is safe, and that it is getting safer. As a result, the voters in the market have realized just how wrong they are, and the price is rocketing up.

The lesson to be learned from ARI is that when the market is selling something off, don’t assume that it is “right.” Don’t assume that something is “wrong.” Focus on the fundamentals of the business. Take the time to understand the business and the dynamics driving it. Rising interest rates are fantastic for commercial mREITs. They own floating-rate loans! Yet the market has sold them off out of fear.

Just thank the market, buy when prices are low, and collect dividends.

Shutterstock

Conclusion

While you may not be worshipping at the feet of the sun god or the god of war, the associated religious beliefs have faded into the review mirror of history. We do still see their names as parts of large companies or institutions.

For me, ARI and ARCC are both big providers of regular and recurring income in my portfolio. They both presented strong earnings, and the outlook for both remains positive and strong according to my analysis.

What does this mean? Will I be decorating my garden walkways with the Grecian art of Apollo and Ares? Probably not. I will, instead, be cashing the dividend checks I receive from firms that carry their names.

You can too, by buying shares in the Greek gods of income! Then your retirement can enter a new phase of ease and relaxation. Less stressing over when to sell shares, more enjoyment of getting cash handed to you for doing nothing more than being a passive owner of a large company.

Retirement should be a time when your active work is done and your passive income provides you with what you need to have ends meet and beyond.

That’s the beauty of income investing, even the Greeks would agree with that.

Be the first to comment