porcorex

I’m tempted to buy undervalued tech stocks in today’s market, but dividend stocks are simply too appealing. That’s because there’s no telling what the market will do in the short-term, and it takes a certain level of patience to hold onto an unrealized loss that doesn’t pay you anything. This brings me to Sixth Street Specialty Lending (NYSE:TSLX), which remains undervalued and just announced a dividend raise. In this article, I highlight what makes TSLX a gift for dividend investors.

Why TSLX?

Sixth Street Specialty Lending is a BDC that invests in the U.S. middle market space, primarily through senior secured loans, and equity investments in portfolio companies. It targets companies with $10 to $250 million in annual EBITDA. Notably, TSLX benefits from its affiliation with its external advisor, Sixth Street, a global investment firm with over $50 billion in AUM. This robust management platform gives TSLX valuable line of sight and deal sourcing opportunities that it would not otherwise have.

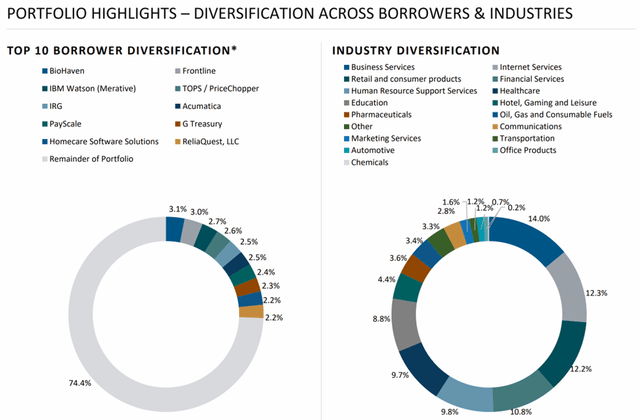

At present, it holds a diversified portfolio across 75 investments with an average investment size of $37 million, and its largest investment represents just 3.1% of the total portfolio. TSLX also maintains a conservative profile, with the vast majority of its investments (90%) being first-lien secured debt and just 1% being second-lien debt (also considered to be safe). Less than 1% of the portfolio is in the form of riskier mezzanine debt and 6% is in equity investments, giving TSLX NAV upside and capital gains potential.

The portfolio remains well positioned, with higher exposure to defensive industries with recurring revenue streams. As shown below, business, internet, and financial services make up the top 3 industries, with consumer products and HR services rounding out the top 5, which comprise half of the portfolio’s fair value.

TSLX Portfolio Mix (Investor Presentation)

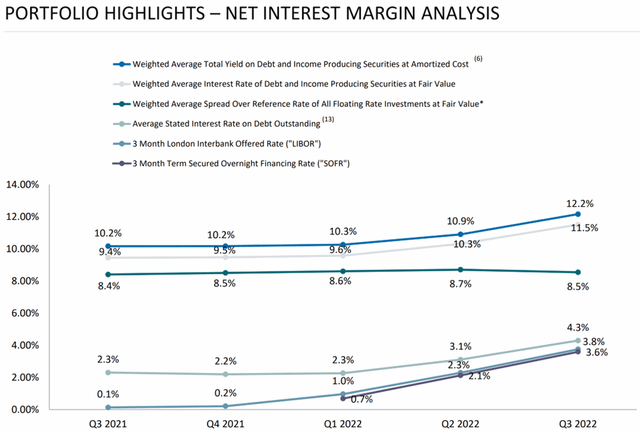

Meanwhile, TSLX is benefiting from rising rates, as 98.9% of its debt investments are floating rate. As shown below, TSLX’s weighted average yield on debt has soared along with rising interest rates since the start of the year, from 10.2% to 12.2% as of the end of the third quarter.

TSLX Portfolio Yield (Investor Presentation)

Also encouraging, TSLX’s NAV per share actually increased by $0.09 sequentially to $16.36, despite a tumultuous time for both public and private market valuations. NII per share came in at $0.47, which more than covers TSLX’s recent 7.1% dividend raise to $0.45 per share. This is also supported by a respectable BBB- rated balance sheet, with a debt to equity ratio of 1.17x, sitting well below the 2.0x statutory limit.

Risks to TSLXL include general economic weakness, which could pressure borrowers’ abilities to repay. In addition, high interest rates could pressure consumer demand and thereby impact the financial health of the borrowers.

Nonetheless, TSLX exercises prudent underwriting standards, and its borrowers currently have a weighted average 1.9x coverage over financial covenants per credit agreement. TSLX’s direct sourcing model (versus syndicated loans) also comes with distinct advantages, as it has effective voting control on 89% of debt investments, helping to ensure that TSLX retains some form of decision making capacity.

TSLX also has plenty of firepower to expand the portfolio, as it currently has $846 million of undrawn capacity. Another inherent advantage to TSLX is the reputation that it’s built with its investors. Since IPO in 2011, a $14.71 per share investment in TSLX is now worth $36.42 based on current NAV per share and cumulative regular and special dividends.

This sterling reputation has resulted in TSLX trading at a 12% premium to NAV, based on the current price of $18.30, thereby enabling accretive equity raises that are beneficial to existing shareholders. While some investors may not want to invest in a BDC at a premium to NAV, it’s worth reminding that investments should be based on earnings power rather than book value, and well-run BDCs that have demonstratable performance are worth paying a premium for.

Investor Takeaway

TSLX is a well-managed BDC that’s well positioned to weather market volatility and generate solid returns for investors. At the current price of $18.30, TSLX pays a covered 9.8% yield while trading at a meaningful premium to NAV, reflecting the efficiency of its platform. With a strong portfolio, diversified funding sources, and plenty of room to grow, TSLX is a great pick for income-seeking investors looking for exposure to the broad credit market.

Be the first to comment