Brandon Bell

I have been covering the takeover of Spirit Airlines (NYSE:SAVE) by Frontier Airlines (NASDAQ:ULCC) since the early days and saw how JetBlue (NASDAQ:JBLU) became a party interested in acquiring Spirit Airlines as well. A vote on the transaction with Frontier Airlines was postponed several times. As I discuss in this report, both airlines have sweetened the deal several times to win the hearts and shares of current shareholders but there can only be one winner.

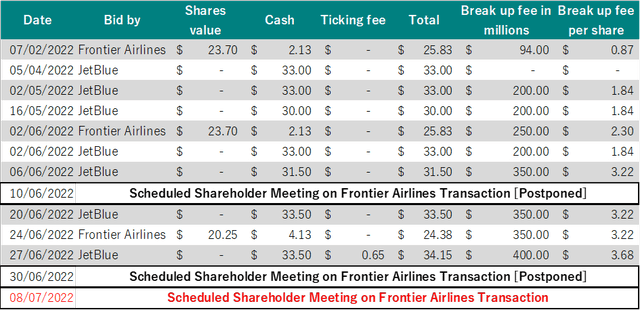

Offers for Spirit Airlines – Revisiting the Timeline

Timeline offers for Spirit Airlines (The Aerospace Forum)

The timeline shows that it has mostly been JetBlue that has tried to make its offer more compelling. As there have been significant doubts on regulatory approval for a combination of JetBlue and Spirit Airlines, the airline sweetened its offer by increasing the reverse termination fee. This also was driven by doubts on how serious JetBlue is to acquire Spirit Airlines. So, the increasing fee mostly serves as a message of JetBlue to shareholders and Spirit Airlines management that it’s serious about pursuing a combination with the low-cost carrier.

Frontier Airlines followed up with a lousy increase of the break-up fee but did nothing with its June 2 improved bid to sweeten the deal for shareholders of Spirit Airlines. When JetBlue further increased the reverse break-up fee, Spirit Airlines postponed the shareholder meeting. Postponing a shareholder meeting obviously gives management the time to study the new bid, but it also reduces the chances of the transaction with Frontier Airlines not being approved by shareholders. Topping the reverse break-up fee already sparked a postponement on the vote for the acquisition by Frontier. And as Spirit Airlines continued backing a combination with Frontier Airlines, JetBlue started to put more effort into gaining shareholder support by promising a $1.50 pre-payment, but this was later topped by a $2.22 per share pre-payment offer from Frontier Airlines and a questionable cash bump. A JetBlue response that led to the June 30 vote being postponed saw a hike in the reverse termination fee to $400 million, a ticking fee applied that adds $0.65 per share to the total consideration and a pre-payment of $2.50 plus a monthly pre-payment with a maximum of $1.80. That brings the total pre-payment to $4.30, topping the Frontier Airlines cash consideration.

Pros and Cons for Both

I think both combinations have regulatory risk. There’s a sentiment that this risk is bigger with JetBlue than it is with Frontier Airlines and that might be true, but JetBlue has shown more willingness to make things happen with a reverse break-up fee that is higher than Frontier’s and willingness to divest in key markets such as New York and Boston to gain regulatory approval. One big argument from a business perspective against a combination with JetBlue is the difference in the business model that would make an integration of Spirit Airlines into the JetBlue brand highly complex and with JetBlue currently facing some issues with operating its own schedule to the extent it previously forecast one could wonder whether the airline should pursue a combination at all.

The JetBlue offer feels like an airline desperately trying to protect its key markets by acquiring an eroding power while going all-in as fears for JetBlue has risen that it might be left out in a new round of consolidation weakening the airline’s competitive strength.

That, however, does not discount the simple fact that measured by dollar value the JetBlue offer is superior. There’s a total consideration of $34.15, which is all cash while Frontier Airlines’ total consideration is dependent on the stock prices of Frontier Airlines, and we have seen in a matter of months that the Frontier Airlines share prices did depreciate while its bump to the cash consideration did not offset that reduction in share prices. The result is that while the JetBlue offer has been increased by 3.5% assuming a full duration for a transaction decision, the Frontier Airlines offer reduced by 6%.

The continued support for a combination with Frontier Airlines did not motivate Frontier to even try to make a compelling offer, and one can wonder whether Spirit Airlines really protected shareholder interests as much as possible. Opposing an offer that tops the Frontier Airlines offer by a third really should make one wonder whether Spirit Airlines management has really attempted to get the highest value for its shareholders. Frontier Airlines and Spirit Airlines touted a potential share price value of $50 per share for the combined company, but I already discussed that projection in a previous report, and I’m doubtful on that share price being realized even more so when we consider the trajectory of Frontier Airlines share prices.

The way shareholders should vote is really simple. With doubts on the regulatory approval but also the future share price value of Frontier Airlines, vote for the bid that has the highest pre-payment. Frontier Airlines’ current pre-payment offer is $2.22 per share compared to $2.50 from JetBlue plus a $1.80 per share ticking fee. So, in terms of pre-payment, pre-payment plus ticking fee and total consideration the JetBlue offer is more compelling.

Conclusion

Considering share price risk and regulatory hurdles, investors should be focused on the highest pre-payment offer because that’s one of the parts that’s most certain. I do have doubts on JetBlue’s ability to finance this transaction and in some way after succeeding to spoil the vote for the Frontier Airlines transaction it could just pay $400 million and that would be the price the airline would pay to prevent a strong competing power. So, even the pre-payment is not a full guarantee as the exact clauses on the reverse break-up are not known.

However, assuming that JetBlue is serious about acquiring Spirit Airlines shareholders should vote against a Frontier Airlines offer for the following reasons:

- The pre-payment from JetBlue tops the pre-payment from Frontier Airlines.

- The total pre-payment from JetBlue including ticking fee exceeds the cash part of the bid from Frontier Airlines.

- JetBlue offers cash apart from the pre-payment whereas Frontier Airlines offers shares with no guarantee on future share price levels.

- The Frontier Airlines offer consists of $20.25 worth of shares at the time of writing while JetBlue’s offer without pre-payments totals $29.85.

Vote against a combination with Frontier Airlines if you like cash. In the event of new offers coming in, weigh the cash consideration of the offer and vote for the higher cash pre-payment.

Be the first to comment