teppakorn tongboonto/iStock via Getty Images

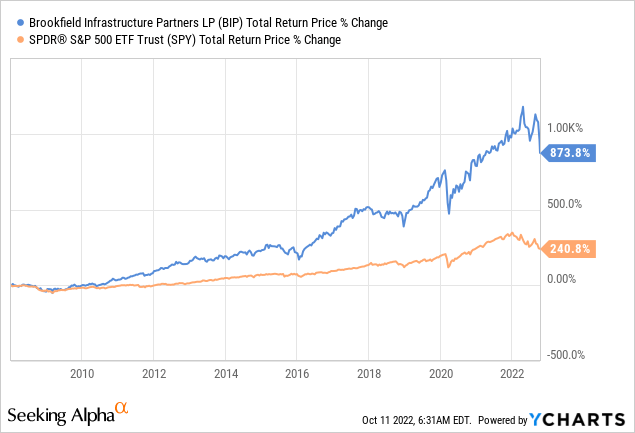

Brookfield Infrastructure (NYSE:BIPC)(NYSE:BIP) recently hosted its Investor Day, and we found it interesting enough that we decided to share highlights from the event. One of the reasons why it is worth following Brookfield Infrastructure is that it has an excellent track record of outperforming the market. As can be seen below, the margin of outperformance to the S&P500 is quite significant, and we believe there is a high probability that it will continue to beat the market going forward.

The underlying source of this outperformance is their simple strategy of acquiring high-quality infrastructure assets on a value basis, enhancing the assets through improved operations, and selling/recycling mature assets that have been de-risked and where operational improvements have been completed. This strategy combined with excellent management has resulted in a stable and well-diversified business with highly visible growth. This year looks like it will be another year of record financial results, with 2022 YTD FFO per unit increasing by 11% y/y. The company is also forecasting above-target growth for 2023, with an expected $3.00+ FFO/Unit.

Besides record financial performance, 2022 has been an active year for asset rotation and new acquisitions. So far four asset sales have been secured, and there are three in progress. Brookfield Infrastructure has also made five new investments for ~$2.8 billion. These new investments include AusNet, HomeServe, and Deutsche Funkturm (DFMG). AusNet is an Australian energy delivery services business, owning and operating more than $11 billion of electricity and gas network assets. HomeServe is a British multinational home emergency repairs and improvements business. Deutsche Funkturm is Deutsche Telekom’s antenna telecommunications towers business.

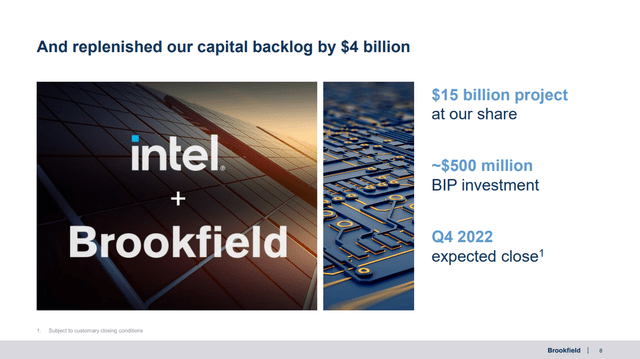

Another important investment that was recently announced is the joint venture the company is establishing with Intel to re-shore semiconductor manufacturing. This is a massive investment where the company will be investing up to $15 billion for a 49% stake, with BIP’s equity investment at ~$500 million. The company expects that the re-shoring trend will lead to other large-scale corporate initiatives similar to this one.

Brookfield Infrastructure Investor Presentation

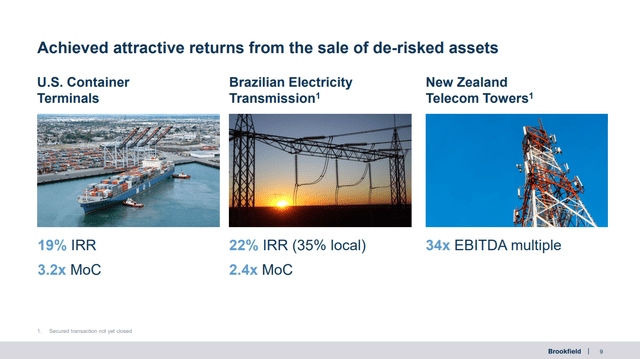

Probably the most interesting slide for Brookfield Infrastructure investors is the one where the company shows the impressive returns it has generated in some of the sales of de-risked assets.

Brookfield Infrastructure Investor Presentation

Financials

We have to give management a lot of credit for taking advantage of historically low interest rates in the last few years. This has positioned the company well to withstand rising rates in the short to medium term. Upcoming maturities are in-line with current levels, and therefore rising interest rates are expected to have an immaterial impact on near- to medium-term financial performance. The company has a 13-year corporate debt duration, 7-year non-recourse debt duration, and ~ 90% of debt is fixed-rate.

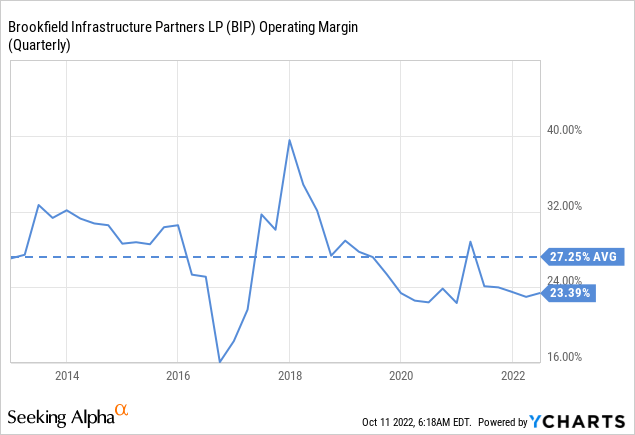

In general, we can see that the company has high-quality assets when looking at its very robust operating margin, which has remained above 20% for most of the last decade.

Balance Sheet

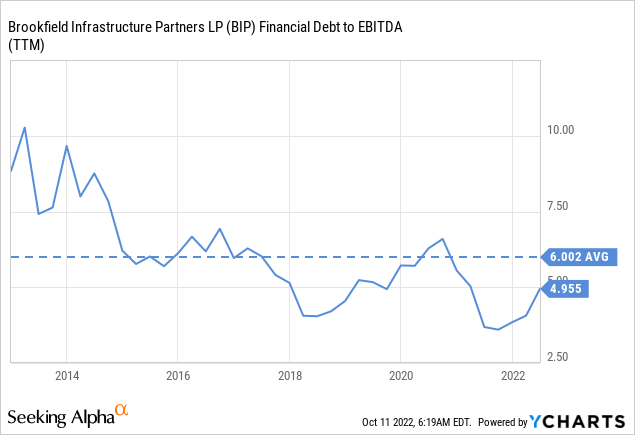

BIP currently has a strong balance sheet that should permit significant more investments. It has corporate liquidity of ~$3 billion, it has an investment grade BBB+ credit rating, and its dividend payout ratio is less than 70%. The financial debt to EBITDA is also quite manageable, and lower than its historical average for the last ten years.

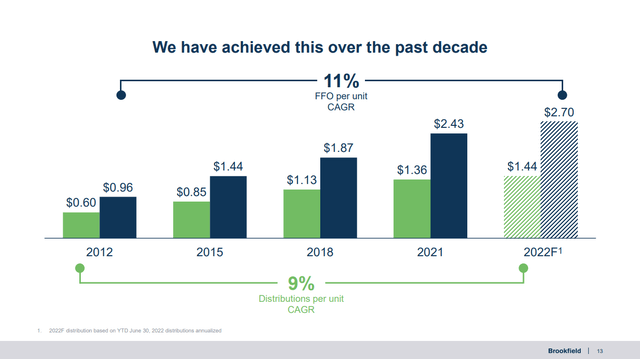

Brookfield Infrastructure’s Historical Results

The company was happy to remind investors of the outstanding results it has delivered over the previous decade. With funds from operation per unit growing 11% CAGR, and the distributions per unit increasing with a 9% CAGR. Based on management’s commentary they seem very confident they can keep this level of results going for still several more years.

Brookfield Infrastructure Investor Presentation

Operating Leverage

The company shared that it is not only through new investments and asset recycling that they expect to keep growth going but also through margin improvements.

Management explained that the company’s fixed-cost structure provides significant operating leverage to enhance margins in two ways. One is through increasing utilization on existing networks, the other is adding capacity through capital expansion projects.

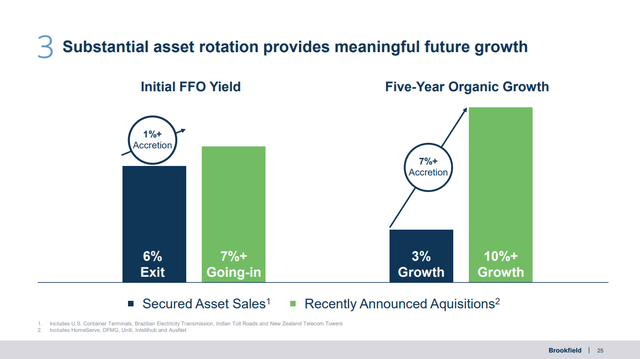

Asset Rotation & New Investments

To illustrate the benefits of their asset rotation strategy, management showed that the initial funds from operations yield is ~1% higher than that of the assets they sold. More importantly, the new investments have a much higher expected growth rate of 10%+ compared to ~3% growth for the disposed assets. This made it very clear how the asset rotation strategy drives per unit FFO growth.

Brookfield Infrastructure Investor Presentation

BIP expects a lot of new investment opportunities to come from three main global trends that they have identified. These are digitalization, decarbonization, and deglobalization. It is estimated that $1 trillion will be required over the next five years to upgrade data infrastructure globally. These include fiber networks, wireless infrastructure, and data centers. One such example is the previously mentioned telecom towers business, which has a large-scale portfolio of ~36,000 towers. BIP’s equity investment in this opportunity is estimated to be ~$600 million. Examples provided for decarbonization include Inter Pipeline, which is a business with significant emissions focused on carbon reduction or elimination. Another example was Enercare, one of North America’s largest home and commercial services and energy solutions companies.

Brookfield Infrastructure Investor Presentation

Valuation

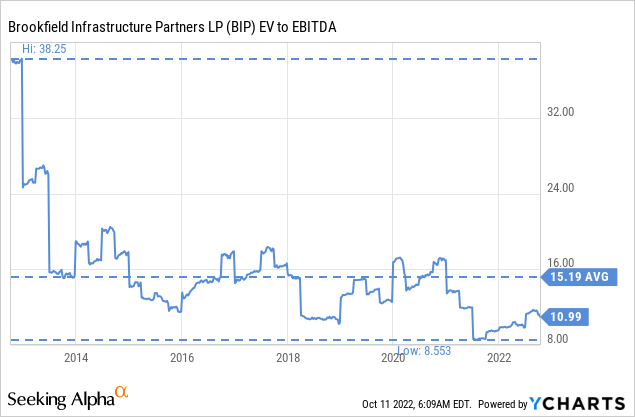

Even though we currently find the company about fairly valued, we believe it can still be an interesting investment given its inflation-resistant characteristics. The EV/EBITDA multiple is currently below its historical average, but it is important to remember that the mix of businesses owned by BIP is constantly changing.

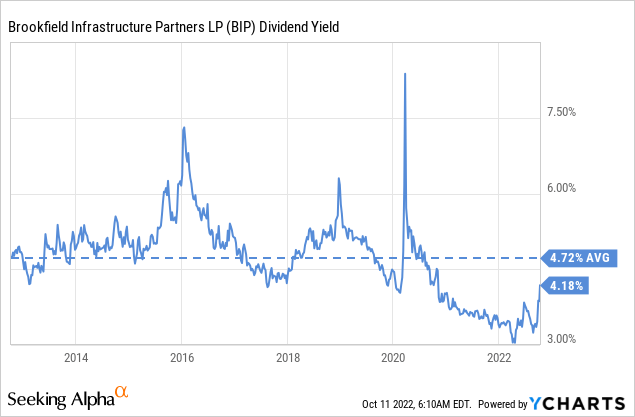

Judging by the dividend yield the company appears less attractive at current prices, with a yield that is a little below the ten-year average.

Risks

The main risk we see with Brookfield Infrastructure is that due to the nature of the investments it makes, they are usually accompanied by significant leverage. While we see the current leverage as manageable, and the company prepared itself well to face interest rate increases, it is a risk worth considering, nonetheless. Other than that we consider BIP to be a below-average risk investment, with most of its assets having relatively little obsolescence risk, and considered part of the backbone of the economy.

Conclusion

Brookfield Infrastructure made a compelling case during their most recent investor day that the company is well positioned to continue outperforming. It took advantage of the low interest rate period to refinance a lot of its debt, has been successfully implementing its asset rotation strategy, and has the balance sheet and opportunity pipeline to continue making attractive investments in the future. We find shares fairly valued at the moment, and expect that the company will prove inflation resistant given the nature of its assets.

Be the first to comment