Karen Poghosyan

If we didn’t have the war in Ukraine and natural gas was flowing freely into Europe, the euro probably would not be as low as it is today. In addition to the blown-up Nord Stream pipelines, there are other gas flows that can be interrupted, plus there is the unpredictable weather that affects gas demand. Also, the war seems to be escalating, with the famous Crimean Bridge being blown up right after Vladimir Putin’s 70th birthday. Combined with the ongoing Ukrainian counteroffensive, this indicates a major escalation.

EURUSD (StockCharts.com)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Until the war is over and energy markets have normalized, it is hard to put a floor on the euro, as the situation can deteriorate rather quickly. Recently, the euro has been as low as 95 cents, but after launching 23 years ago, it has been as low as 83 cents. I would put the odds for the euro trading below 90 cents at even in the next three to six months, as a further escalation of the Ukrainian conflict now seems likely.

It is hard to hike rates in a deteriorating economy, which is what the ECB and BOE are doing. The Fed has an easier job rationalizing its rate hikes as the U.S. economy is not deteriorating yet, based on recent economic indicators. Still, further rate hikes by the Fed and aggressive QT will put more upside pressure on the dollar and more downside pressure on the euro. On a trade-weighted basis, the dollar is at an all-time high. I think it is overvalued, but until the Fed is done and the war ends, it can get more overvalued.

The Junk Bond Market Does Not Show Much Stress (Yet)

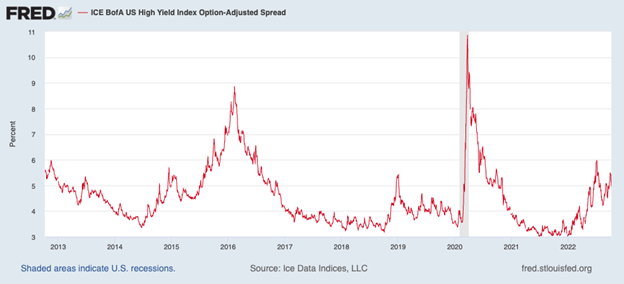

“Inside 400” (basis points) is a term in credit spreads that indicates a strong economy and healthy junk bond market. At 495 last week, the spread between Treasuries and the high-yield index is elevated, but not nearly as bad as what we saw in early 2016 (not to mention during the COVID crash). I think the Powell Fed wants this spread to Treasuries to go higher, as it would be consistent with a slower economy.

ICE BofA US High Yield Index Option-Adjusted Spread (St. Louis Fed)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

How high can these credit spreads go? That is hard to say ahead of time, as they are contingent on future policy decisions by the Fed. If the Fed pivots right before the November election, it is possible that those credit spreads might stop expanding. The trouble is that the Fed has given no indications of pivoting.

I am afraid that the Fed is compounding its mistakes by being too easy in 2021 and too tight in 2022, for fear that they are behind the curve on inflation. If they are hell-bent on the side of caution, they are likely to overdo it on the monetary tightening, causing a further expansion of junk bond spreads. If the Fed pauses now, I think they will see inflation trending lower in the next six months, as many indicators are suggesting, but for some bizarre reason, the Fed seems to be fixated on backward-looking data.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment