Darren415

Introduction

When last discussing HF Sinclair (NYSE:DINO) who enjoyed a strong share price rally earlier in 2022, my previous article warned the easy money was made and as such, shareholders should consider exiting whilst the market was still supportive. After seeing their share price plunge around 20% in recent weeks, this was quite well-timed and when looking ahead into 2023, it seems their share price is likely to come under further downward pressure as this big spender dramatically ramps up their capital expenditure, despite a potential recession looming on the horizon.

Coverage Summary & Ratings

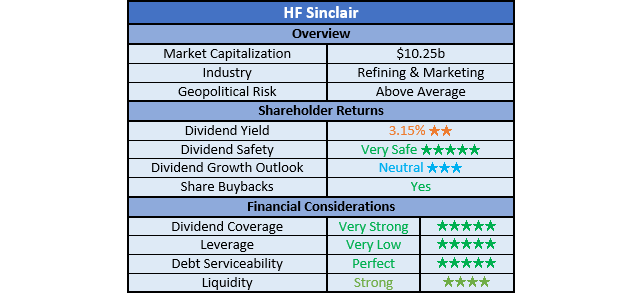

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

Author

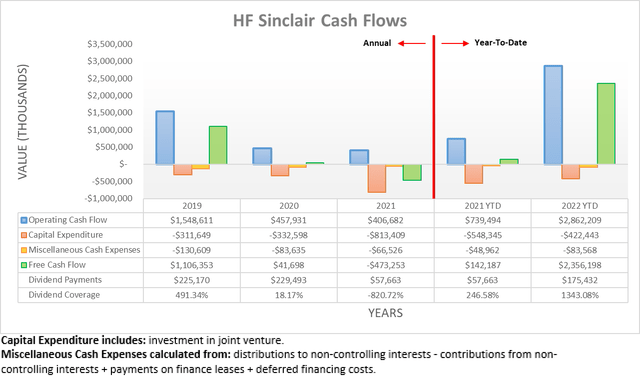

After enjoying a massive cash windfall during the second quarter of 2022, the good times kept rolling during the third quarter with their operating cash flow for the first nine months now landing at a never-before-seen $2.862b. This represents another large increase versus their previous result of $1.989b during the first half and unsurprisingly, this is also well above the $739.5m they generated one year prior during the first nine months of 2021.

Author

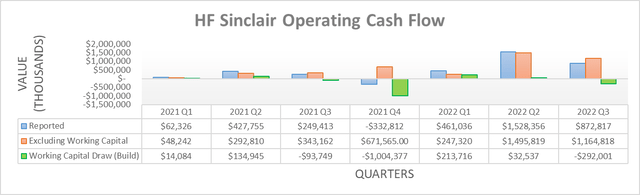

Even though not as profitable as the second quarter of 2022, their results during the third quarter still saw their reported operating cash flow at $872.8m, which historically speaking, remains a massive cash windfall. Although, this was weighed down by a large $292m working capital build that if excluded, sees their underlying operating cash flow at $1.165b and therefore well above anything apart from the second quarter that saw an equivalent result of $1.496b. Even in the face of this headwind, they still generated $737.6m of free cash flow during the third quarter, largely thanks to their continued low capital expenditure.

When looking ahead into 2023, it seems this massive cash windfall will come to end with their operating conditions almost certain to weaken as the economy slows or possibly, enters a recession as widely discussed within the market. To this point, gasoline and diesel prices have started normalizing after their cripplingly high prices earlier in the year as demand already suffers, despite the United States technically not currently enduring a recession. Obviously, the inherent volatility in the refinery industry makes it difficult to predict their free cash flow even when the economy is not expected to weaken, although one known aspect is their capital expenditure.

If looking at their recently released guidance for 2023, they forecast capital expenditure of $1.045b at the midpoint when including their midstream subsidiary, Holly Energy Partners (HEP), which is apt since its financial performance is consolidated within their financial statements. This is dramatically higher year-on-year versus 2022, as the latter only saw $422.4m during the first nine months, which annualizes to a mere $563m.

Admittedly, their operating cash flow is obviously known due to their inherent volatility but to provide a basis point, we can utilize their mid-cycle guidance as discussed within my previous analysis. When looking back at this guidance, they forecast free cash flow of $1.509b but importantly, this utilized depreciation and amortization of $590m that served as a middle-of-the-road proxy for capital expenditure. If their capital expenditure guidance for 2023 that is $455m higher is subtracted, it brings their estimated free cash flow down to circa $1b, assuming they see mid-cycle operating conditions.

Even though this free cash flow would still amount to a near double-digit free cash flow yield given their current market capitalization of approximately $10.25b, it could easily come in lower. The assumption of mid-cycle operating conditions is optimistic in my eyes, especially given the widely known risk of a recession on the horizon that in theory, should further hurt refined product demand and thus prices.

Whilst the upcoming European ban on Russian refined products in early 2023 could help prices in the short-term, I suspect the rerouting of trade to countries such as China and India will negate its impact as the year progresses. As a result, this sees no discernable upside catalysts to drive their share price higher during 2023 compared to 2022, especially as their lower earnings hinder the appeal of their shares. Plus, even if they meet this optimistic free cash flow estimation during 2023, their share price is still likely to see further downward pressure, as subsequently discussed.

Author

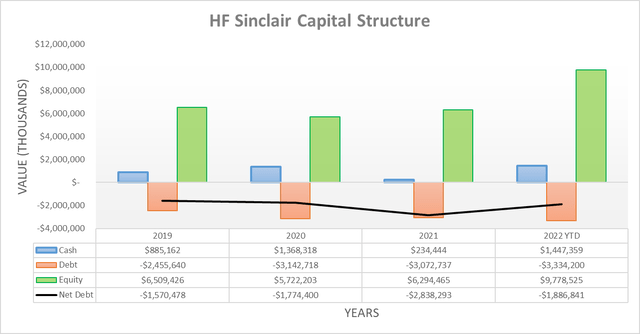

Despite their massive cash windfall continuing throughout the third quarter of 2022, surprisingly, their net debt still climbed modestly higher to $1.887b versus where it ended the second quarter at $1.646b. This increase of $241m was a result of their share buybacks hitting a staggering $866.2m during the third quarter on top of their accompanying dividend payments of $85.3m, which consumed more than the entirety of their free cash flow of $737.6m with the remaining immaterial difference stemming from minor acquisitions and so forth.

Importantly, these share buybacks also saw their outstanding share count drop to 201,676,537 from 220,508,896 across these same two points in time, which represents a decrease of 8.54% for merely one quarter. Admittedly, if not for their working capital build of $292m, their net debt would have still decreased slightly during the third quarter and thus in theory, this modest increase could revert lower during the fourth quarter if they see this build reverse into a draw. Regardless, their net debt remains significantly lower than its previous level of $2.838b at the end of 2021, thanks to their massive cash windfall.

When looking ahead into 2023, this recent brisk pace of share buybacks should slow significantly due to the weakening economy and their dramatically higher capital expenditure draining their free cash flow. Apart from lower earnings hindering the appeal of their shares, the loss of buying support via share buybacks will also see their share price under further downward pressure.

To quantify this dynamic, circling back to the previously discussed free cash flow estimation of circa $1b for 2023 assuming mid-cycle operating conditions, it would only leave circa $700m once subtracting their dividend payments. Whilst this could in theory repurchase around 7% of their outstanding shares at their current market capitalization, they only intend to direct half of their free cash flow towards shareholders, as per the commentary from management included below.

“And as we have demonstrated in the past in periods of strong cash flow generations, our priority is to return capital. And just to quantify this a little more specifically, we’ve called out the 50% payout ratio for the long term. Now, with respect to how much is dividend versus how much is share buyback, that’s just a matter of debate and what flavor it comes, but our commitment is to remain focused on this robust shareholder return.”

-HF Sinclair Q3 2022 Conference Call.

Since half of $1b is obviously $500m and circa $300m will be utilized for dividend payments, it only leaves circa $200m for share buybacks during 2023, thereby merely repurchasing around 2% of their outstanding share count at their current market capitalization. It should also be remembered this was assuming mid-cycle operating conditions that in my eyes, makes for an optimistic assumption given the risks of a recession on the horizon and thus if operating conditions fall lower, their share buybacks may cease, which would place even greater downward pressure on their share price. Ultimately only time will tell how their financial performance and thus share price perform during 2023, although right now, it is difficult to see their share price surpassing the levels seen during 2022, especially with there being no discernable upside catalysts on the horizon.

Since their net debt is only modestly higher and may revert lower again during this present quarter, it would be redundant to reassess their leverage or debt serviceability in detail, especially as the outlook for 2023 was the primary focus of this analysis. Likewise the same can also be said for their liquidity because their cash balance remains a formidable $1.447b following the third quarter of 2022, despite being modestly lower versus where it ended the second quarter at $1.702b.

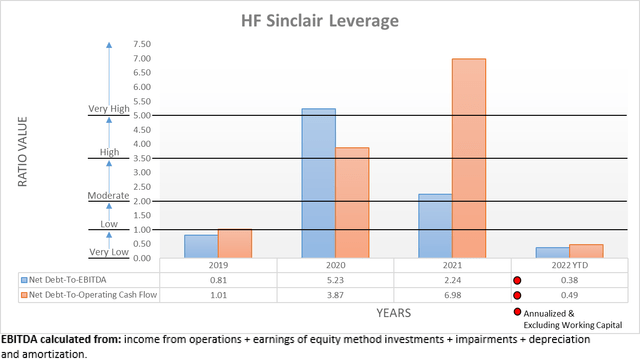

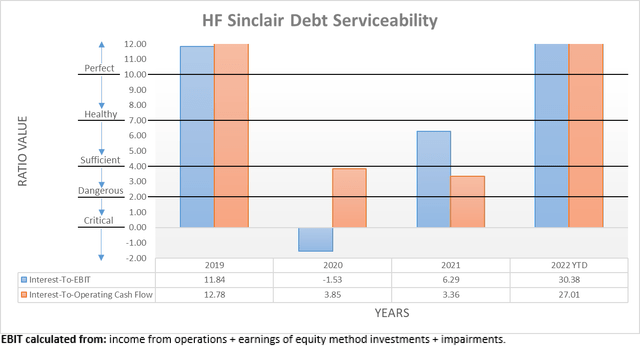

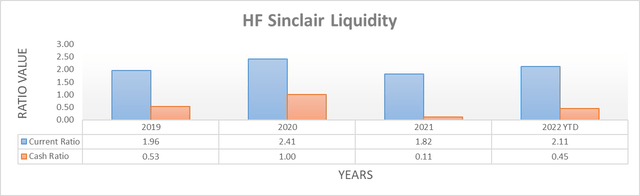

The three relevant graphs are still included below to provide context for any new readers, which unsurprisingly, once again sees their leverage within the very low territory given their net debt-to-EBITDA of 0.38 and net debt-to-operating cash flow of 0.49, which are easily beneath the applicable threshold of 1.00. As would be expected, their debt serviceability is also perfect with their interest coverage at 30.38 when compared against their EBIT or 27.01 when compared against their operating cash flow. Elsewhere, their formidable cash balance continues to underpin their strong liquidity as they sport a current ratio of 2.11 and a cash ratio of 0.45. If interested in further details regarding these topics, please refer to my previously linked article.

Author

Author

Author

Conclusion

It seems their record-setting financial performance during 2022 will end during 2023 as the economy weakens, especially with gasoline and diesel prices already normalizing, which should not come as a surprise given that booming operating conditions cannot last forever. Although, their accompanying forecast for dramatically higher capital expenditure will drain their free cash flow and thus in turn, it stands to see their share buybacks slow significantly, or possibly cease. The loss of this buying support will place further downward pressure on their share price, especially with no discernable upside catalysts on the horizon. Despite their share price already plunging during recent weeks, I nevertheless still believe that maintaining my hold rating is appropriate in light of this outlook.

Notes: Unless specified otherwise, all figures in this article were taken from HF Sinclair’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment